Technology

Research and development including product review of FLSmidth…

Published

14 years agoon

By

admin

Being at the forefront of technological advancement since 1882, FLSmidth today offers complete solutions and process improvements in order to reduce cost of ownership, say Bjarne Moltke Hansen, Group Exec. VP, MD & CEO, Country Head – FLSmidth India.

FLSmidth supplies cement plants and technology to cement producers. How does the company keep pace with the latest trends and developments in cement plants and technology?

Research and development including product review of FLSmidth is all about exploring and developing new solutions, products, processes and technologies. We do this in cooperation with our customers, and get feedback from our customer services or via input from the comprehensive knowledge and experience we get from the operation and maintenance contracts we do on cement plants. Through research, we assist our business to find medium and long-term solutions to support our customers and to address key industry strategic concerns. Research allows us to glean knowledge of the basic principles and understand what is happening. We follow the trends in the marketplace and, through research, do our best to get ahead of the competition in the market. Development primarily used to be focused on products; but today we have turned our attention to complete solutions and process improvements which all reduces the total cost of ownership.

How do FLSmidth’s environmental solutions help companies control air pollution?The cement industry counts for about five per cent of the global carbon dioxide (CO2) emissions, which naturally creates demand for reductions. Furthermore, energy consumption is one of the largest costs of running a cement plant. If energy consumption is reduced, both costs and emission of CO2 will also be reduced. As a worldwide leading provider of sustainable technologies we offer engineered solutions that minimize gaseous and particulate emissions and ensure that specific emission requirements are continuously met.For example, our fabric filters and electrostatic precipitators can reduce the dust emission level as low as less than 5 mg/Nm3. A low level of NOx in emissions can be achieved because of our low NOx ILC calciner and our low NOx DUOFLEXTM burner in the burning process. Further reduction of NOx is also possible with our Selective Non-Catalytic Reduction (SNCR) solution. The D-SOx???system, exclusively developed by FLSmidth, is a proven and simple method that provides an SO2 emissions reduction in the range of 25-30 per cent, without addition of reagents.Other solutions we provide include FLS-GSA gas suspension absorber for a high level of SO2, HCl and mercury removal, hydrated lime injection system to reduce SO2 emission, and FLSmidth’s patent-pending mercury roaster system to reduce mercury emissions. Recently we have introduced a new air pollution control solution called CataMaxTM due to our rigorous R&D efforts to go below the requirements of the USA NESHAP regulations. Additionally, we offer a range of services to help maintain, improve and operate air pollution control equipment more efficiently.During 2010, global growth partnership company, Frost & Sullivan acknowledged FLSmidth’s contribution to emissions control, for its commitment and innovative approach to increase the efficiency of its air pollution control equipment in order to reduce emissions from cement and minerals plants. What kind of equipments and projects does the company supply to cement manufacturers for utilizing alternative fuels and reducing fuel costs? In addition to reducing the usage of fossil fuels and reducing fuel costs, adopting alternative fuels technology in cement plants provides a safe alternative to conventional disposal of waste in dedicated waste incinerators or in landfills, thus reducing environmental burden.In the Indian cement industry, many types of alternative fuels are applied, ranging from hazardous to non-hazardous and they may be in the liquid or solid state. Of these alternative fuels, solid state fuels presently account for the largest part, and in particular, agro-waste and biomass accounts for the most significant alternative fuel energy contributors.In FLSmidth, we develop and supply specific equipment and/or complete projects, giving cement producers the ability to use alternative fuel in pyro processing installations. Our service covers everything from consultancy to complete solutions.Some specific products developed for the purpose of utilizing alternative fuels are:HOTDISC Reactor: The HOTDISC is a safe, simple and effective combustion device integrated with the pre-heater and calciner for utilising alternative fuels. It has proven to be the best available technology for substituting calciner fuel with coarse alternative fuels. The HOTDISC combustion device provides the flexibility to burn all kinds of solid waste in sizes upto 1.2 metres in diameter, from sludge or grains to huge whole truck tyres. This eliminates the need for expensive shredding of lumpy waste material. In India, we are supplying the HOTDISC reactor to Vasavadatta Cement.DUOFLEX Burner: The DUOFLEX burner fires rotary kilns with pulverised coal or coke, oil, natural gas or any mixture of these fuels. The burner can be fitted with extra pipes for secondary fuels such as plastic chips, wood chips, sewage sludge etc. In India, for MyHome Cement, we have incorporated a burner to fire pharmaceutical liquid waste into the main burner.Pfister TRW-S/D + ProsCon: We have developed the Pfister TRW-S/D for accurately dosing any alternative fuels, whether extremely light or heavy, fine or coarse products or even potentially explosive bulk materials such as FLUFF, RDF, sewage sludge, plastics, wood chips or animal meal. FLSmidth KOCH Live Bottom Hopper is a robust and flexible system for receiving and extracting bulk waste fuels. It is suitable for both front end loaders and truck tipplers.What kind of after-sales services does the company presently offer to cement companies? In what way do these services enhance the productivity of cement companies?

We consider after-sales service as an important part of our business. We provide a whole range of services that include basic spare parts, providing plant optimization services, providing upgrade solutions, and even complete outsourcing solutions of operation and maintenance of cement plants.Many cement plants in India have enhanced their productivity and reduced their energy costs through our optimization and upgrade solutions. We conduct thorough audits and provide customized solutions.Which were the major cement projects and services executed by FLSmidth in India? What has been FLSmidth’s experience in execution of cement projects in India?

We have been executing major projects in India since 1904, when we supplied our first rotary kiln in India. Some of our recent major projects are:??13000 tpd project for Associated Cement Company in Wadi, Karnataka (2007) ??10,000 TPD project for ABG Cement Ltd in Kutch, Gujarat (2008) ??10,000 TPD project for Jaypee Group in Andhra Pradesh (2007) ??7,000 TPD Project for Associated Cement Company in Chanda, India ??6,000 TPD project for Jaiprakash Associates Ltd, in kutch, Gujarat (2010) ??6,000 TPD project for Chettinad Cement in Gulbarga, Karnataka (2010) ??5,500 TPD project for Zuari Cement, Yerraguntala, Andhrapradesh (2007) ??5000 TPD Project for Heidelberg Cement, Damoh (2010)FLSmidth has very positive experience about our Indian projects. The industry has a high knowledge levels. As a result, Indian cement projects are completed quicker in general, and Indian cement plants operate at a much higher productivity compared to global standards.What innovations have been pioneered by FLSmidth for the cement industry? What is the R&D spending of FLSmidth globally?

FLSmidth has been in the forefront on technological advancement in cement industry right from its inception in 1882. As early as 1890, FLSmidth introduced Shofer vertical shaft kiln that consumed 1/3rd of fuel used by an ordinary kiln at that time. We also introduced tube mills that were far better at crushing hard clinker than previous technology in 1893. In 1925, we introduced Symmetro gear for tube mills, the first such central gear unit in the industry. More recently in 1998, we introduced the SF Cross bar cooler that revolutionized clinker coolers in the way they were designed and operated, while reducing the fuel consumption in the cement plant. In 2001, we launched our HOTDISC reactor to burn big size waste fuels such as full automobile tyres. In 2011, FLSmidth’s R&D costs totalled USD 50 million.What is your view about the prospects of the cement companies in general and the cement plant and equipments industry in particular in India?

After China, India is the largest cement producer in the world with a total installed capacity of 310 mtpa. Southern region dominates the industry with 35 per cent business space and the demand for the product has grown by 9.4 per cent over the last decade time. India has 107 integrated cement plants and 37 grinding units and the largest producer is Holcim, through investments in Ambuja Cement and ACC. Though the last two years are somewhat sluggish, government’s continuous thrust on infrastructure improvement and strong demand for construction and housing sector has been the keen grown drivers of the industry. Housing contributes 60 per cent of the demand for cement, where the growing infrastructure demand foresees to support the growth in cement demand by 8-9 per cent in the coming years. The per capita consumption of cement in India is 220 kg annually, which is the lowest among BRIC countries. Hence there is potential for high growth in India.The overall driver for sales in FLSmidth’s cement business is the level of new global contracted kiln capacity, linked closely to local or regional demand/supply imbalances for cement. This is particularly relevant in key markets as India where FLSmidth has a strong presence, and where cement consumption is rising fast on the back of strong economic growth and rural demand.What is your growth strategy for the Indian market? Do you see FLSmidth emerging as the market leader in its businesses in India? If yes, when?

We definitely consider ourselves as market leaders in India today within supply of cement plants and customer services where we hold a market share of 50 – 60 per cent based on kiln capacity. Our strategy in India will focus on being even closer to the customers via increasing the customer service business and also catering to the requirements of EPC (engineering procurement and construction – turnkey) projects in the cement industryWhat are the future plans of FLSmidth in India?We have been in India for more than 100 years and our strategy is to continue to strengthen the position. Today we are 4000 very skilled employees in India in various locations and we will proceed to develop our people. People are key and our most valuable resource. We have done several acquisitions over the last years and we will continue to do this going forward together with new greenfield workshops to make sure we have both high quality and are competitive. Half of our employees work on international projects which is also a stabilizing factor e.g. when India like now has a growth pause. What steps are needed to be taken by the Indian government to make the cement plants and equipments industry more profitable and competitive?

Two topics are important here, namely, infrastructure and power. A huge country in a high growth pace needs a very well working infrastructure – this goes for harbours, airports, railways, roads, houses etc. If infrastructure is in place, transport is easier and mobility will start increasing plus new industries will be attracted. Secondly, the country lacks electrical power, which again is needed for not only the cement industry but for all industries. Finally, access to raw materials and permits for new cement plants are crucial for the dynamic in this fantastic industry.

You may like

Concrete

Redefining Efficiency with Digitalisation

Published

2 weeks agoon

February 20, 2026By

admin

Professor Procyon Mukherjee discusses how as the cement industry accelerates its shift towards digitalisation, data-driven technologies are becoming the mainstay of sustainability and control across the value chain.

The cement industry, long perceived as traditional and resistant to change, is undergoing a profound transformation driven by digital technologies. As global infrastructure demand grows alongside increasing pressure to decarbonise and improve productivity, cement manufacturers are adopting data-centric tools to enhance performance across the value chain. Nowhere is this shift more impactful than in grinding, which is the energy-intensive final stage of cement production, and in the materials that make grinding more efficient: grinding media and grinding aids.

The imperative for digitalisation

Cement production accounts for roughly 7 per cent to 8 per cent of global CO2 emissions, largely due to the energy intensity of clinker production and grinding processes. Digital solutions, such as AI-driven process controls and digital twins, are helping plants improve stability, cut fuel use and reduce emissions while maintaining consistent product quality. In one deployment alongside ABB’s process controls at a Heidelberg plant in Czechia, AI tools cut fuel use by 4 per cent and emissions by 2 per cent, while also improving operational stability.

Digitalisation in cement manufacturing encompasses a suite of technologies, broadly termed as Industrial Internet of Things (IIoT), AI and machine learning, predictive analytics, cloud-based platforms, advanced process control and digital twins, each playing a role in optimising various stages of production from quarrying to despatch.

Grinding: The crucible of efficiency and cost

Of all the stages in cement production, grinding is among the most energy-intensive, historically consuming large amounts of electricity and representing a significant portion of plant operating costs. As a result, optimising grinding operations has become central to digital transformation strategies.

Modern digital systems are transforming grinding mills from mechanical workhorses into intelligent, interconnected assets. Sensors throughout the mill measure parameters such as mill load, vibration, mill speed, particle size distribution, and power consumption. This real-time data, fed into machine learning and advanced process control (APC) systems, can dynamically adjust operating conditions to maintain optimal throughput and energy usage.

For example, advanced grinding systems now predict inefficient conditions, such as impending mill overload, by continuously analysing acoustic and vibration signatures. The system can then proactively adjust clinker feed rates and grinding media distribution to sustain optimal conditions, reducing energy consumption and improving consistency.

Digital twins: Seeing grinding in the virtual world

One of the most transformative digital tools applied in cement grinding is the digital twin, which a real-time virtual replica of physical equipment and processes. By integrating sensor data and

process models, digital twins enable engineers to simulate process variations and run ‘what-if’

scenarios without disrupting actual production. These simulations support decisions on variables such as grinding media charge, mill speed and classifier settings, allowing optimisation of energy use and product fineness.

Digital twins have been used to optimise kilns and grinding circuits in plants worldwide, reducing unplanned downtime and allowing predictive maintenance to extend the life of expensive grinding assets.

Grinding media and grinding aids in a digital era

While digital technologies improve control and prediction, materials science innovations in grinding media and grinding aids have become equally crucial for achieving performance gains.

Grinding media, which comprise the balls or cylinders inside mills, directly influence the efficiency of clinker comminution. Traditionally composed of high-chrome cast iron or forged steel, grinding media account for nearly a quarter of global grinding media consumption by application, with efficiency improvements translating directly to lower energy intensity.

Recent advancements include ceramic and hybrid media that combine hardness and toughness to reduce wear and energy losses. For example, manufacturers such as Sanxin New Materials in China and Tosoh Corporation in Japan have developed sub-nano and zirconia media with exceptional wear resistance. Other innovations include smart media embedded with sensors to monitor wear, temperature, and impact forces in real time, enabling predictive maintenance and optimal media replacement scheduling. These digitally-enabled media solutions can increase grinding efficiency by as much as 15 per cent.

Complementing grinding media are grinding aids, which are chemical additives that improve mill throughput and reduce energy consumption by altering the surface properties of particles, trapping air, and preventing re-agglomeration. Technology leaders like SIKA AG and GCP Applied Technologies have invested in tailored grinding aids compatible with AI-driven dosing platforms that automatically adjust additive concentrations based on real-time mill conditions. Trials in South America reported throughput improvements nearing 19 per cent when integrating such digital assistive dosing with process control systems.

The integration of grinding media data and digital dosing of grinding aids moves the mill closer to a self-optimising system, where AI not only predicts media wear or energy losses but prescribes optimal interventions through automated dosing and operational adjustments.

Global case studies in digital adoption

Several cement companies around the world exemplify digital transformation in practice.

Heidelberg Materials has deployed digital twin technologies across global plants, achieving up to 15 per cent increases in production efficiency and 20 per cent reductions in energy consumption by leveraging real-time analytics and predictive algorithms.

Holcim’s Siggenthal plant in Switzerland piloted AI controllers that autonomously adjusted kiln operations, boosting throughput while reducing specific energy consumption and emissions.

Cemex, through its AI and predictive maintenance initiatives, improved kiln availability and reduced maintenance costs by predicting failures before they occurred. Global efforts also include AI process optimisation initiatives to reduce energy consumption and environmental impact.

Challenges and the road ahead

Despite these advances, digitalisation in cement grinding faces challenges. Legacy equipment may lack sensor readiness, requiring retrofits and edge-cloud connectivity upgrades. Data governance and integration across plants and systems remains a barrier for many mid-tier producers. Yet, digital transformation statistics show momentum: more than half of cement companies have implemented IoT sensors for equipment monitoring, and digital twin adoption is growing rapidly as part of broader Industry 4.0 strategies.

Furthermore, as digital systems mature, they increasingly support sustainability goals: reduced energy use, optimised media consumption and lower greenhouse gas emissions. By embedding intelligence into grinding circuits and material inputs like grinding aids, cement manufacturers can strike a balance between efficiency and environmental stewardship.

Conclusion

Digitalisation is not merely an add-on to cement manufacturing. It is reshaping the competitive and sustainability landscape of an industry often perceived as inertia-bound. With grinding representing a nexus of energy intensity and cost, digital technologies from sensor networks and predictive analytics to digital twins offer new levers of control. When paired with innovations in grinding media and grinding aids, particularly those with embedded digital capabilities, plants can achieve unprecedented gains in efficiency, predictability and performance.

For global cement producers aiming to reduce costs and carbon footprints simultaneously, the future belongs to those who harness digital intelligence not just to monitor operations, but to optimise and evolve them continuously.

About the author:

Professor Procyon Mukherjee, ex-CPO Lafarge-Holcim India, ex-President Hindalco, ex-VP Supply Chain Novelis Europe, has been an industry leader in logistics, procurement, operations and supply chain management. His career spans 38 years starting from Philips, Alcan Inc (Indian Aluminum Company), Hindalco, Novelis and Holcim. He authored the book, ‘The Search for Value in Supply Chains’. He serves now as Visiting Professor in SP Jain Global, SIOM and as the Adjunct Professor at SBUP. He advises leading Global Firms including Consulting firms on SCM and Industrial Leadership and is a subject matter expert in aluminum and cement. An Alumnus of IIM Calcutta and Jadavpur University, he has completed the LH Senior Leadership Programme at IVEY Academy at Western University, Canada.

Concrete

Digital Pathways for Sustainable Manufacturing

Published

2 weeks agoon

February 20, 2026By

admin

Dr Y Chandri Naidu, Chief Technology Officer, Nextcem Consulting highlights how digital technologies are enabling Indian cement plants to improve efficiency, reduce emissions, and transition toward sustainable, low-carbon manufacturing.

Cement manufacturing is inherently resource- and energy-intensive due to high-temperature clinkerisation and extensive material handling and grinding operations. In India, where cement demand continues to grow in line with infrastructure development, producers must balance capacity expansion with sustainability commitments. Energy costs constitute a major share of operating expenditure, while process-related carbon dioxide emissions from limestone calcination remain unavoidable.

Traditional optimisation approaches, which are largely dependent on operator experience, static control logic and offline laboratory analysis, have reached their practical limits. This is especially evident when higher levels of alternative fuel and raw materials (AFR) are introduced or when raw material variability increases.

Digital technologies provide a systematic pathway to manage this complexity by enabling

real-time monitoring, predictive optimisation and integrated decision-making across cement manufacturing operations.

Digital cement manufacturing is enabled through a layered architecture integrating operational technology (OT) and information technology (IT). At the base are plant instrumentation, analysers, and automation systems, which generate continuous process data. This data is contextualised and analysed using advanced analytics and AI platforms, enabling predictive and prescriptive insights for operators and management.

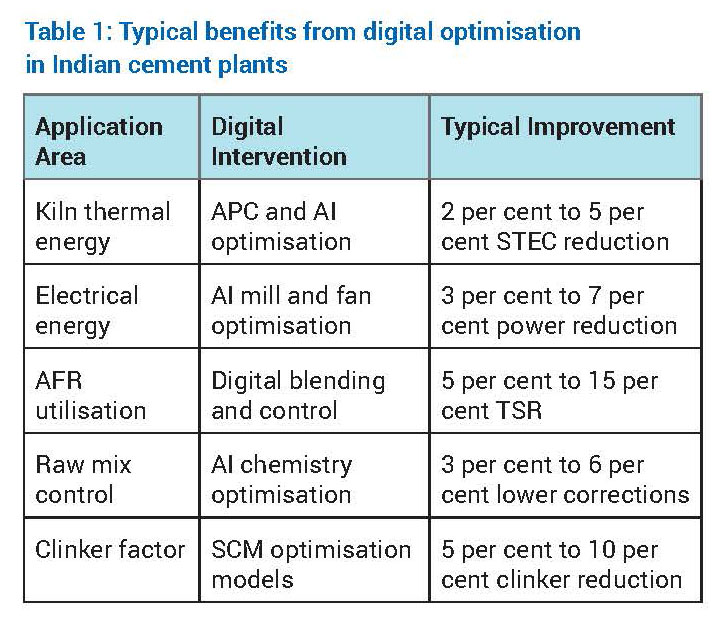

Digital optimisation of energy efficiency

- Thermal energy optimisation

The kiln and calciner system accounts for approximately 60 per cent to 65 per cent of total energy consumption in an integrated cement plant. Digital optimisation focuses on reducing specific thermal energy consumption (STEC) while maintaining clinker quality and operational stability.

Advanced Process Control (APC) stabilises critical parameters such as burning zone temperature, oxygen concentration, kiln feed rate and calciner residence time. By minimising process variability, APC reduces the need for conservative over-firing. Artificial intelligence further enhances optimisation by learning nonlinear relationships between raw mix chemistry, AFR characteristics, flame dynamics and heat consumption.

Digital twins of kiln systems allow engineers to simulate operational scenarios such as increased AFR substitution, altered burner momentum or changes in raw mix burnability without operational risk. Indian cement plants adopting these solutions typically report STEC reductions in the range of 2 per cent to 5 per cent. - Electrical energy optimisation

Electrical energy consumption in cement plants is dominated by grinding systems, fans and material transport equipment. Machine learning–based optimisation continuously adjusts mill parameters such as separator speed, grinding pressure and feed rate to minimise specific power consumption while maintaining product fineness.

Predictive maintenance analytics identify inefficiencies caused by wear, fouling or imbalance in fans and motors. Plants implementing plant-wide electrical energy optimisation typically achieve

3 per cent to 7 per cent reduction in specific power consumption, contributing to both cost savings and indirect CO2 reduction.

Digital enablement of AFR

AFR challenges in the Indian context: Indian cement plants increasingly utilise biomass, refuse-derived fuel (RDF), plastic waste and industrial by-products. However, variability in calorific value, moisture, particle size, chlorine and sulphur content introduces combustion instability, build-up formation and emission risks.

Digital AFR management: Digital platforms integrate real-time AFR quality data from online analysers with historical kiln performance data. Machine learning models predict combustion behaviour, flame stability and emission trends for different AFR combinations. Based on these predictions, fuel feed distribution, primary and secondary air ratios, and burner momentum are dynamically adjusted to ensure stable kiln operation. Digitally enabled AFR management in cement plants will result in increased thermal substitution rates by 5-15 percentage points, reduced fossil fuel dependency, and improved kiln stability.

Digital resource and raw material optimisation

Raw mix control: Raw material variability directly affects kiln operation and clinker quality. AI-driven raw mix optimisation systems continuously adjust feed proportions to maintain target chemical parameters such as Lime Saturation Factor (LSF), Silica Modulus (SM), and Alumina Modulus (AM). This reduces corrective material usage and improves kiln thermal efficiency.

Clinker factor reduction: Reducing clinker factor through supplementary cementitious materials (SCMs) such as fly ash, slag and calcined clay is a key decarbonisation lever. Digital models simulate blended cement performance, enabling optimisation of SCM proportions while maintaining strength and durability requirements.

Challenges and strategies for digital adoption

Key challenges in Indian cement plants include data quality limitations due to legacy instrumentation, resistance to algorithm-based decision-making, integration complexity across multiple OEM systems, and site-specific variability in raw materials and fuels.

Successful digital transformation requires strengthening the data foundation, prioritising high-impact use cases such as kiln APC and energy optimisation, adopting a human-in-the-loop approach, and deploying modular, scalable digital platforms with cybersecurity by design.

Future Outlook

Future digital cement plants will evolve toward autonomous optimisation, real-time carbon intensity tracking, and integration with emerging decarbonisation technologies such as carbon capture, utilisation and storage (CCUS). Digital platforms will also support ESG reporting and regulatory compliance.

Digital pathways offer a practical and scalable solution for sustainable cement manufacturing in India. By optimising energy consumption, enabling higher AFR substitution and improving resource efficiency, digital technologies deliver measurable environmental and economic benefits. With appropriate data infrastructure, organisational alignment and phased implementation, digital transformation will remain central to the Indian cement industry’s low-carbon transition.

About the author:

Dr Y Chandri Naidu is a cement industry professional with 30+ years of experience in process optimisation, quality control and quality assistance, energy conservation and sustainable manufacturing, across leading organisations including NCB, Ramco, Prism, Ultratech, HIL, NCL and Vedanta. He is known for guiding teams, developing innovative plant solutions and promoting environmentally responsible cement production. He is also passionate about mentoring professionals and advancing durable, resource efficient technologies for future of construction materials.

Concrete

Turning Downtime into Actionable Intelligence

Published

2 weeks agoon

February 19, 2026By

admin

Stoppage Insights instantly identifies root causes and maps their full operational impact.

In cement, mining and minerals processing operations, every unplanned stoppage equals lost production and reduced profitability. Yet identifying what caused a stoppage remains frustratingly complex. A single motor failure can trigger cascading interlocks and alarm floods, burying the root cause under layers of secondary events. Operators and maintenance teams waste valuable time tracing event chains when they should be solving problems. Until now.

Our latest innovation to our ECS Process Control Solution(1) eliminates this complexity. Stoppage Insights, available with the combined updates to our ECS/ControlCenter™ (ECS) software and ACESYS programming library, transforms stoppage events into clear, actionable intelligence. The system automatically identifies the root cause of every stoppage – whether triggered by alarms, interlocks, or operator actions – and maps all affected equipment. Operators can click any stopped motor’s faceplate to view what caused the shutdown instantly. The Stoppage UI provides a complete record of all stoppages with drill-down capabilities, replacing manual investigation with immediate answers.

Understanding root cause in Stoppage Insights

In Stoppage Insights, ‘root cause’ refers to the first alarm, interlock, or operator action detected by the control system. While this may not reveal the underlying mechanical, electrical or process failure that a maintenance team may later discover, it provides an actionable starting point for rapid troubleshooting and response. And this is where Stoppage Insights steps ahead of traditional first-out alarm systems (ISA 18.2). In this older type of system, the first alarm is identified in a group. This is useful, but limited, as it doesn’t show the complete cascade of events, distinguish between operator-initiated and alarm-triggered stoppages, or map downstream impacts. In contrast, Stoppage Insights provides complete transparency:

- Comprehensive capture: Records both regular operator stops and alarm-triggered shutdowns.

- Complete impact visibility: Maps all affected equipment automatically.

- Contextual clarity: Eliminates manual tracing through alarm floods, saving critical response time.

David Campain, Global Product Manager for Process Control Systems, says, “Stoppage Insights takes fault analysis to the next level. Operators and maintenance engineers no longer need to trace complex event chains. They see the root cause clearly and can respond quickly.”

Driving results

1.Driving results for operations teams

Stoppage Insights maximises clarity to minimise downtime, enabling operators to:

• Rapidly identify root causes to shorten recovery time.

• View initiating events and all affected units in one intuitive interface.

• Access complete records of both planned and unplanned stoppages

- Driving results for maintenance and reliability teams

Stoppage Insights helps prioritise work based on evidence, not guesswork:

• Access structured stoppage data for reliability programmes.

• Replace manual logging with automated, exportable records for CMMS, ERP or MES.(2)

• Identify recurring issues and target preventive maintenance effectively.

A future-proof and cybersecure foundation

Our Stoppage Insights feature is built on the latest (version 9) update to our ACESYS advanced programming library. This industry-leading solution lies at the heart of the ECS process control system. Its structured approach enables fast engineering and consistent control logic across hardware platforms from Siemens, Schneider, Rockwell, and others.

In addition to powering Stoppage Insights, ACESYS v9 positions the ECS system for open, interoperable architectures and future-proof automation. The same structured data used by Stoppage Insights supports AI-driven process control, providing the foundation for machine learning models and advanced analytics.

The latest releases also respond to the growing risk of cyberattacks on industrial operational technology (OT) infrastructure, delivering robust cybersecurity. The latest ECS software update (version 9.2) is certified to IEC 62443-4-1 international cybersecurity standards, protecting your process operations and reducing system vulnerability.

What’s available now and what’s coming next?

The ECS/ControlCenter 9.2 and ACESYS 9 updates, featuring Stoppage Insights, are available now for:

- Greenfield projects.

- ECS system upgrades.

- Brownfield replacement of competitor systems.

Stoppage Insights will also soon integrate with our ECS/UptimeGo downtime analysis software. Stoppage records, including root cause identification and affected equipment, will flow seamlessly into UptimeGo for advanced analytics, trending and long-term reliability reporting. This integration creates a complete ecosystem for managing and improving plant uptime.

(1) The ECS Process Control Solution for cement, mining and minerals processing combines proven control strategies with modern automation architecture to optimise plant performance, reduce downtime and support operational excellence.

(2) CMMS refers to computerised maintenance management systems; ERP, to enterprise resource planning; and MES to manufacturing execution systems.

World Cement Association Annual Conference 2026 in Bangkok

Assam Chief Minister Opens Star Cement Plant In Cachar

Adani Cement, NAREDCO Form Strategic Alliance

Walplast’s GypEx Range Secures GreenPro Certification

Smart Pumping for Rock Blasting

World Cement Association Annual Conference 2026 in Bangkok

Assam Chief Minister Opens Star Cement Plant In Cachar

Adani Cement, NAREDCO Form Strategic Alliance

Walplast’s GypEx Range Secures GreenPro Certification

Smart Pumping for Rock Blasting

Trending News

-

Economy & Market4 weeks ago

Economy & Market4 weeks agoBudget 2026–27 infra thrust and CCUS outlay to lift cement sector outlook

-

Economy & Market4 weeks ago

Economy & Market4 weeks agoFORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

-

Concrete1 month ago

Concrete1 month agoSteel: Shielded or Strengthened?

-

Concrete2 weeks ago

Concrete2 weeks agoRefractory demands in our kiln have changed