Technology

Technology can be used to enhance operational efficiency

Published

3 years agoon

By

admin

Pukhraj Sethiya, Chief Operating Office, ReVal Consulting, discusses the role of technology in making mining a more sustainable activity.

Tell us about the process of mining limestone. How does it impact the environment?

Any industry, whether it is related to it directly or not, depends on mining. Any manufacturing process requires raw materials, which can be mined or grown. The primary raw material used to make cement is limestone, and there does not appear to be a substitute anytime soon. Basically, limestone is a sedimentary rock composed of calcium carbonate or calcium magnesium carbonate that is found near to the surface, usually beneath a thin layer of soil and waste debris (overburden). Limestone is mined using open cast mining techniques since it is found around the surface. Mining limestone follows a regular procedure and is similar to opencast mining of other minerals. The process of extracting limestone begins with exploration, and is followed by resource estimation and modelling, the creation of a geological report and mining plan, obtaining all required government permits, such as environmental and forestry clearances. It culminates in the granting of a mining lease followed by extraction of limestone.

After receiving the necessary approvals, miners begin building the necessary infrastructure, including the access road, offices, homes and other structures. The development and deployment of the appropriate mining equipment, however, remains crucial. Following a box cut, the sequence of activities in normal production includes face preparation, drilling, blasting, excavation, loading and hauling of ore as well as infill drilling. In order to increase resources and determine the quality of the ore, miners do more parallel exploration.

Since the majority of limestone is locked up in cement plants, demand from these plants is what controls and influences limestone production. The typical technology used in Indian limestone mines is excavation using small diesel excavators with bucket sizes of 3-3.5 cum along with tipper trucks/dump trucks of 25-35 T, but the industry’s top players also use larger machinery with excavators that have bucket capacities of up to 10 cubic metres (Cu.m) and dump trucks that weigh 60-100 T. A small number of miners also used electric shovels and dumpers that match. Because limestone is so hard, surface miners—which are currently widely used in coal mining—are used less frequently in limestone mining.

We believe that by carefully designing the pit and implementing operational planning procedures that involve weekly and monthly planning and adherence to them, the entire fleet and mining process, which ultimately will lead to the cost of mining, can be optimised. The quality of the limestone plays a crucial role in the process of making cement.

As with any other surface mining activity, limestone mining involves breaking ground, therefore common environmental effects include tree removal, deforestation and dust production among others. However, there are steps that are done by the majority of mining firms to minimise environmental damage, such as planting new trees, tree transplantation (which has been adopted sometimes), water table monitoring, water management, reuse of water, etc. In our work with customers at ReVal Consulting, we strongly support the use of operational planning techniques to optimise fleet and cost while maintaining SOPs. The direct effect is on cost savings, while indirectly this improves long-term sustainability of operations and reserve protection by reducing carbon footprint and environmental impact.

Tell us about the equipment used for mining coal, limestone or other materials relevant for the cement industry?

Hydraulic excavators, wheel loaders, backhoe loaders, bulldozers, dump trucks, tippers, graders, rock breakers, vibratory compactors, cranes, fork lifts, dozers, off-highway dumpers (20T to 240T), drills, scrapers, motor graders, rope shovels, etc. are just a few examples of the machinery that falls under the category of mining equipment deployed for limestone mining. They carry out a range of tasks, including ground preparation, excavation, material haulage, dumping/laying in a specific way, material handling, haul road building, etc. Shovels, surface miners, dumpers and drills are the primary production tools used in opencast mining for hauling, drilling and excavating. While a wide variety of mining equipment with various capacities is being used in India, the most popular fleet is made up of hydraulic excavators with 3 to 10 Cu.m bucket capacities and dumpers with 35 to 100 T capacities. Surface miners are also frequently used in the mining of soft and thin seams in softer strata like coal and limestone (in a few locations, such as western Gujarat), which eliminates the need for blasting in coal and ultimately contributes to lowering greenhouse gas emissions.

In each product category, a small number of major firms dominate the mining equipment market. However, equipment from producers like Caterpillar, Komatsu, Kobelco, BEML, and Liebherr is widespread, and dump trucks from Caterpillar, Volvo, Sany, Scania, and other manufacturers are readily available in India.

What are the government guidelines to prevent environment pollution in the mining process?

The National Mineral Policy 2019 emphasised the importance of including environmental, economic and social factors as early in the decision-making process as possible to ensure that mining is economically viable, socially responsible and environmentally, technically and scientifically sound, makes the best use of mineral resources, and ensures sustainable post-closure land uses. All mining companies are required by law to submit an environmental management plan as part of their mining plans. This plan contains guidelines to prevent environmental pollution and addresses issues like the storage and use of topsoil, the storage of overburden and waste rock, the reclamation and rehabilitation of land, the control of surface subsidence, the prevention of ground vibrations and noise pollution, the release of toxic liquids, and the restoration of flora.

With the MMDR amendment in 2015, India’s mining industry was first given a statutory mandate for sustainable development. Subsequently, a District Mineral Foundation (DMF) was established to promote sustainable development of the area and the people impacted by mining. One of the most significant actions toward formalising benefit sharing in the Indian mining industry was the establishment of the DMF. To support mineral extraction and promote sustainable mining, the Act was further revised in 2020.

All things considered, environmental clearance and forest clearance establish project-specific requirements for environmental management and protection, which are approved by MoEFCC under the applicable laws relating to the environment, the forest, and water.

Tell about any other effort taken by your organisation to make mining sustainable.

Although we are a consultancy company and do not operate mines, we offer our clients advice on various ways to make mining more sustainable. As was already mentioned, we concentrate on giving our clients advice on how to pick out the best equipment and how to plan their days to minimise operational demands, which in turn reduces diesel consumption, costs, and the need for capital, improving value for all stakeholders – not just shareholders.

We offer our clients the following suggestions for initiatives to increase the sustainability of mining:

Optimising capital needed: We assist clients in reducing capital, which ultimately lowers costs as well as carbon footprint and environmental impact. This is accomplished by developing mining plans in a way to minimise equipment and capital requirement, which is made possible by selecting the best location for the dump, optimising the stripping ratio, cutting down on haulage distance, etc.

Technology selection: We assist clients in choosing technologies that will lower overall running costs and cut down on the quantity of equipment needed to produce emissions. We assist clients in comparing alternative technologies for sustainable operations, such as trucks versus conveyor systems, and alternative energy sources, such as diesel versus electricity equipment.

Planning and management of dumps: Our professionals have a wealth of knowledge regarding mining planning. By focusing on internal dumping to the greatest extent feasible, which eliminates the need for external land, we optimise the entire planning schedule to reduce haulage distance. By altering the mine design, mine direction, and haul road design, we aim to minimise external dumping of overburden and waste rock.

Maximise resource extraction: In order to minimise environmental impact, enhance cost economics, and provide greater value to clients, we concentrate on maximising the extraction of mineral resources through planning, design, and cost reduction.

What is the role of technology in making the process of mining pollution free or sustainable?

The environment will inevitably be impacted by the anticipated growth of the mining industry in ways such as deforestation, air and water pollution, damage to and loss of biodiversity, however technology and environmental management strategies can reduce these effects as shown below:

Reduce the Carbon Footprint of Mining: The reduction of the negative effects of mining on the environment is mostly due to technological advancement. The environmental impact of diesel usage is reduced by equipment with greater fuel efficiency. The use of alternative technology, such as electrical equipment and conveyors instead of dumpers for haulage, has reduced the environmental impact and pollution of mining.

Alternative Fuels: Diesel is a significant source of pollution in the mining industry. By converting to alternative fuels, such as biodiesel blending, electrical equipment, battery-operated trucks, etc., it is possible to decrease the use of diesel machinery and the consumption of diesel.

IT technology deployment: The mining industry offers a lot of potential for IT technology. Although the mining industry hasn’t fully embraced technology, even in its infancy, innovations like GPS-based navigation can assist cut down on unnecessary equipment movement. Technology can be used to enhance operational efficiency and compliance by managing activities carefully in accordance with the plan.

Air pollution: The businesses can install the most recent air pollution control framework and technology on their mining sites to check the quality of the air. Through installed control systems, routine dust and air emissions monitoring can be carried out. This procedure is essential because it enables the businesses to function in accordance with the current air quality regulations.

Traditional mining techniques like blasting and stacking produce more dust, which worsens the air quality. The eco-friendly surface miner technology, which has been shown to be a more environmentally friendly technique of mining, can be used to regulate this. Regularly monitoring ambient air quality further aids in taking prompt corrective action.

Recycling and treatment of water: Water is a valuable resource that has great social and environmental significance for communities and is a crucial component of the mining process. Effective water stewardship is crucial to preventing conflict. A thorough water management planning approach enables mining companies to control the effects of their operations on the availability of water, optimise water use, and safeguard the local population’s resource rights by proactively monitoring the effects of both water withdrawal and outflow. While zero discharge is the norm at the moment, there are few cases of mine water being processed to make it potable and even packaged and sold. Treatment of mine water is essential.

Waste Management: Almost 99 per cent of the waste produced at these sites is categorised as non-hazardous waste, with the remaining 1 per cent being hazardous waste. The waste generated at these sites typically takes the form of waste rock or waste soil. Transport of the hazardous waste off-site for treatment, reuse, or disposal. All waste produced is eliminated in accordance with waste management programmes and waste disposal rules. However, there are some instances when overburden has been used to make aggregate and sand that can be used for filling and construction purposes in order to lessen damage. Therefore, it is important to encourage these creative solutions and alternative uses whenever possible.

How do you envision mining and its contribution to the conservation of the environment in the near future?

As I had mentioned at the outset, we have two options: either mine or grow. Mining is therefore unavoidable. We can only shift our attention away from mining fossil fuels and toward mining the materials needed for other energy sources, such as renewable energy, energy efficiency, etc. All things considered, we cannot abandon the mining industry.

Focus will be needed on mining of minerals like aluminium, copper, cobalt, nickel, lithium, rare earths, etc. in order to transition to a renewable energy-based economy and to increase energy efficiency.

Therefore, even if mining is required, industry must first concentrate on increasing the effectiveness of resource utilisation, or maximising the recovery and productivity of mineral resources. Deploying technology, improving mine planning, operational planning, and the mining process to lower input requirements per unit, lower costs, and lower capital requirements is the second, easier-to-achieve goal. Thirdly, use technology to monitor environmental effects, including carbon emissions, water and air pollution, noise pollution, etc., and assess the results. The long-term direct and indirect benefits of such actions far surpass their immediate costs.

The entities that ‘plan the mine and mine the plan’ will ultimately succeed in the long run. When I say ‘plan the mine,’ I mean to do it with the best possible mine design and planning, the best technology and equipment selection, a strict operational plan and implementation without deviations for the best results, and a longer resource life by maximising recovery. ReVal is pleased to be connected with and assist our clients in achieving these goals.

-Kanika Mathur

Concrete

Redefining Efficiency with Digitalisation

Published

3 days agoon

February 20, 2026By

admin

Professor Procyon Mukherjee discusses how as the cement industry accelerates its shift towards digitalisation, data-driven technologies are becoming the mainstay of sustainability and control across the value chain.

The cement industry, long perceived as traditional and resistant to change, is undergoing a profound transformation driven by digital technologies. As global infrastructure demand grows alongside increasing pressure to decarbonise and improve productivity, cement manufacturers are adopting data-centric tools to enhance performance across the value chain. Nowhere is this shift more impactful than in grinding, which is the energy-intensive final stage of cement production, and in the materials that make grinding more efficient: grinding media and grinding aids.

The imperative for digitalisation

Cement production accounts for roughly 7 per cent to 8 per cent of global CO2 emissions, largely due to the energy intensity of clinker production and grinding processes. Digital solutions, such as AI-driven process controls and digital twins, are helping plants improve stability, cut fuel use and reduce emissions while maintaining consistent product quality. In one deployment alongside ABB’s process controls at a Heidelberg plant in Czechia, AI tools cut fuel use by 4 per cent and emissions by 2 per cent, while also improving operational stability.

Digitalisation in cement manufacturing encompasses a suite of technologies, broadly termed as Industrial Internet of Things (IIoT), AI and machine learning, predictive analytics, cloud-based platforms, advanced process control and digital twins, each playing a role in optimising various stages of production from quarrying to despatch.

Grinding: The crucible of efficiency and cost

Of all the stages in cement production, grinding is among the most energy-intensive, historically consuming large amounts of electricity and representing a significant portion of plant operating costs. As a result, optimising grinding operations has become central to digital transformation strategies.

Modern digital systems are transforming grinding mills from mechanical workhorses into intelligent, interconnected assets. Sensors throughout the mill measure parameters such as mill load, vibration, mill speed, particle size distribution, and power consumption. This real-time data, fed into machine learning and advanced process control (APC) systems, can dynamically adjust operating conditions to maintain optimal throughput and energy usage.

For example, advanced grinding systems now predict inefficient conditions, such as impending mill overload, by continuously analysing acoustic and vibration signatures. The system can then proactively adjust clinker feed rates and grinding media distribution to sustain optimal conditions, reducing energy consumption and improving consistency.

Digital twins: Seeing grinding in the virtual world

One of the most transformative digital tools applied in cement grinding is the digital twin, which a real-time virtual replica of physical equipment and processes. By integrating sensor data and

process models, digital twins enable engineers to simulate process variations and run ‘what-if’

scenarios without disrupting actual production. These simulations support decisions on variables such as grinding media charge, mill speed and classifier settings, allowing optimisation of energy use and product fineness.

Digital twins have been used to optimise kilns and grinding circuits in plants worldwide, reducing unplanned downtime and allowing predictive maintenance to extend the life of expensive grinding assets.

Grinding media and grinding aids in a digital era

While digital technologies improve control and prediction, materials science innovations in grinding media and grinding aids have become equally crucial for achieving performance gains.

Grinding media, which comprise the balls or cylinders inside mills, directly influence the efficiency of clinker comminution. Traditionally composed of high-chrome cast iron or forged steel, grinding media account for nearly a quarter of global grinding media consumption by application, with efficiency improvements translating directly to lower energy intensity.

Recent advancements include ceramic and hybrid media that combine hardness and toughness to reduce wear and energy losses. For example, manufacturers such as Sanxin New Materials in China and Tosoh Corporation in Japan have developed sub-nano and zirconia media with exceptional wear resistance. Other innovations include smart media embedded with sensors to monitor wear, temperature, and impact forces in real time, enabling predictive maintenance and optimal media replacement scheduling. These digitally-enabled media solutions can increase grinding efficiency by as much as 15 per cent.

Complementing grinding media are grinding aids, which are chemical additives that improve mill throughput and reduce energy consumption by altering the surface properties of particles, trapping air, and preventing re-agglomeration. Technology leaders like SIKA AG and GCP Applied Technologies have invested in tailored grinding aids compatible with AI-driven dosing platforms that automatically adjust additive concentrations based on real-time mill conditions. Trials in South America reported throughput improvements nearing 19 per cent when integrating such digital assistive dosing with process control systems.

The integration of grinding media data and digital dosing of grinding aids moves the mill closer to a self-optimising system, where AI not only predicts media wear or energy losses but prescribes optimal interventions through automated dosing and operational adjustments.

Global case studies in digital adoption

Several cement companies around the world exemplify digital transformation in practice.

Heidelberg Materials has deployed digital twin technologies across global plants, achieving up to 15 per cent increases in production efficiency and 20 per cent reductions in energy consumption by leveraging real-time analytics and predictive algorithms.

Holcim’s Siggenthal plant in Switzerland piloted AI controllers that autonomously adjusted kiln operations, boosting throughput while reducing specific energy consumption and emissions.

Cemex, through its AI and predictive maintenance initiatives, improved kiln availability and reduced maintenance costs by predicting failures before they occurred. Global efforts also include AI process optimisation initiatives to reduce energy consumption and environmental impact.

Challenges and the road ahead

Despite these advances, digitalisation in cement grinding faces challenges. Legacy equipment may lack sensor readiness, requiring retrofits and edge-cloud connectivity upgrades. Data governance and integration across plants and systems remains a barrier for many mid-tier producers. Yet, digital transformation statistics show momentum: more than half of cement companies have implemented IoT sensors for equipment monitoring, and digital twin adoption is growing rapidly as part of broader Industry 4.0 strategies.

Furthermore, as digital systems mature, they increasingly support sustainability goals: reduced energy use, optimised media consumption and lower greenhouse gas emissions. By embedding intelligence into grinding circuits and material inputs like grinding aids, cement manufacturers can strike a balance between efficiency and environmental stewardship.

Conclusion

Digitalisation is not merely an add-on to cement manufacturing. It is reshaping the competitive and sustainability landscape of an industry often perceived as inertia-bound. With grinding representing a nexus of energy intensity and cost, digital technologies from sensor networks and predictive analytics to digital twins offer new levers of control. When paired with innovations in grinding media and grinding aids, particularly those with embedded digital capabilities, plants can achieve unprecedented gains in efficiency, predictability and performance.

For global cement producers aiming to reduce costs and carbon footprints simultaneously, the future belongs to those who harness digital intelligence not just to monitor operations, but to optimise and evolve them continuously.

About the author:

Professor Procyon Mukherjee, ex-CPO Lafarge-Holcim India, ex-President Hindalco, ex-VP Supply Chain Novelis Europe, has been an industry leader in logistics, procurement, operations and supply chain management. His career spans 38 years starting from Philips, Alcan Inc (Indian Aluminum Company), Hindalco, Novelis and Holcim. He authored the book, ‘The Search for Value in Supply Chains’. He serves now as Visiting Professor in SP Jain Global, SIOM and as the Adjunct Professor at SBUP. He advises leading Global Firms including Consulting firms on SCM and Industrial Leadership and is a subject matter expert in aluminum and cement. An Alumnus of IIM Calcutta and Jadavpur University, he has completed the LH Senior Leadership Programme at IVEY Academy at Western University, Canada.

Concrete

Digital Pathways for Sustainable Manufacturing

Published

3 days agoon

February 20, 2026By

admin

Dr Y Chandri Naidu, Chief Technology Officer, Nextcem Consulting highlights how digital technologies are enabling Indian cement plants to improve efficiency, reduce emissions, and transition toward sustainable, low-carbon manufacturing.

Cement manufacturing is inherently resource- and energy-intensive due to high-temperature clinkerisation and extensive material handling and grinding operations. In India, where cement demand continues to grow in line with infrastructure development, producers must balance capacity expansion with sustainability commitments. Energy costs constitute a major share of operating expenditure, while process-related carbon dioxide emissions from limestone calcination remain unavoidable.

Traditional optimisation approaches, which are largely dependent on operator experience, static control logic and offline laboratory analysis, have reached their practical limits. This is especially evident when higher levels of alternative fuel and raw materials (AFR) are introduced or when raw material variability increases.

Digital technologies provide a systematic pathway to manage this complexity by enabling

real-time monitoring, predictive optimisation and integrated decision-making across cement manufacturing operations.

Digital cement manufacturing is enabled through a layered architecture integrating operational technology (OT) and information technology (IT). At the base are plant instrumentation, analysers, and automation systems, which generate continuous process data. This data is contextualised and analysed using advanced analytics and AI platforms, enabling predictive and prescriptive insights for operators and management.

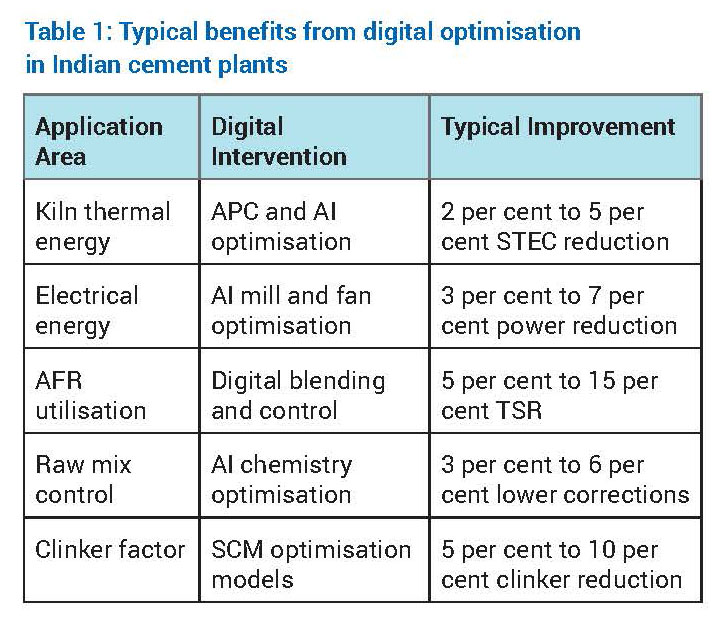

Digital optimisation of energy efficiency

- Thermal energy optimisation

The kiln and calciner system accounts for approximately 60 per cent to 65 per cent of total energy consumption in an integrated cement plant. Digital optimisation focuses on reducing specific thermal energy consumption (STEC) while maintaining clinker quality and operational stability.

Advanced Process Control (APC) stabilises critical parameters such as burning zone temperature, oxygen concentration, kiln feed rate and calciner residence time. By minimising process variability, APC reduces the need for conservative over-firing. Artificial intelligence further enhances optimisation by learning nonlinear relationships between raw mix chemistry, AFR characteristics, flame dynamics and heat consumption.

Digital twins of kiln systems allow engineers to simulate operational scenarios such as increased AFR substitution, altered burner momentum or changes in raw mix burnability without operational risk. Indian cement plants adopting these solutions typically report STEC reductions in the range of 2 per cent to 5 per cent. - Electrical energy optimisation

Electrical energy consumption in cement plants is dominated by grinding systems, fans and material transport equipment. Machine learning–based optimisation continuously adjusts mill parameters such as separator speed, grinding pressure and feed rate to minimise specific power consumption while maintaining product fineness.

Predictive maintenance analytics identify inefficiencies caused by wear, fouling or imbalance in fans and motors. Plants implementing plant-wide electrical energy optimisation typically achieve

3 per cent to 7 per cent reduction in specific power consumption, contributing to both cost savings and indirect CO2 reduction.

Digital enablement of AFR

AFR challenges in the Indian context: Indian cement plants increasingly utilise biomass, refuse-derived fuel (RDF), plastic waste and industrial by-products. However, variability in calorific value, moisture, particle size, chlorine and sulphur content introduces combustion instability, build-up formation and emission risks.

Digital AFR management: Digital platforms integrate real-time AFR quality data from online analysers with historical kiln performance data. Machine learning models predict combustion behaviour, flame stability and emission trends for different AFR combinations. Based on these predictions, fuel feed distribution, primary and secondary air ratios, and burner momentum are dynamically adjusted to ensure stable kiln operation. Digitally enabled AFR management in cement plants will result in increased thermal substitution rates by 5-15 percentage points, reduced fossil fuel dependency, and improved kiln stability.

Digital resource and raw material optimisation

Raw mix control: Raw material variability directly affects kiln operation and clinker quality. AI-driven raw mix optimisation systems continuously adjust feed proportions to maintain target chemical parameters such as Lime Saturation Factor (LSF), Silica Modulus (SM), and Alumina Modulus (AM). This reduces corrective material usage and improves kiln thermal efficiency.

Clinker factor reduction: Reducing clinker factor through supplementary cementitious materials (SCMs) such as fly ash, slag and calcined clay is a key decarbonisation lever. Digital models simulate blended cement performance, enabling optimisation of SCM proportions while maintaining strength and durability requirements.

Challenges and strategies for digital adoption

Key challenges in Indian cement plants include data quality limitations due to legacy instrumentation, resistance to algorithm-based decision-making, integration complexity across multiple OEM systems, and site-specific variability in raw materials and fuels.

Successful digital transformation requires strengthening the data foundation, prioritising high-impact use cases such as kiln APC and energy optimisation, adopting a human-in-the-loop approach, and deploying modular, scalable digital platforms with cybersecurity by design.

Future Outlook

Future digital cement plants will evolve toward autonomous optimisation, real-time carbon intensity tracking, and integration with emerging decarbonisation technologies such as carbon capture, utilisation and storage (CCUS). Digital platforms will also support ESG reporting and regulatory compliance.

Digital pathways offer a practical and scalable solution for sustainable cement manufacturing in India. By optimising energy consumption, enabling higher AFR substitution and improving resource efficiency, digital technologies deliver measurable environmental and economic benefits. With appropriate data infrastructure, organisational alignment and phased implementation, digital transformation will remain central to the Indian cement industry’s low-carbon transition.

About the author:

Dr Y Chandri Naidu is a cement industry professional with 30+ years of experience in process optimisation, quality control and quality assistance, energy conservation and sustainable manufacturing, across leading organisations including NCB, Ramco, Prism, Ultratech, HIL, NCL and Vedanta. He is known for guiding teams, developing innovative plant solutions and promoting environmentally responsible cement production. He is also passionate about mentoring professionals and advancing durable, resource efficient technologies for future of construction materials.

Concrete

Turning Downtime into Actionable Intelligence

Published

3 days agoon

February 19, 2026By

admin

Stoppage Insights instantly identifies root causes and maps their full operational impact.

In cement, mining and minerals processing operations, every unplanned stoppage equals lost production and reduced profitability. Yet identifying what caused a stoppage remains frustratingly complex. A single motor failure can trigger cascading interlocks and alarm floods, burying the root cause under layers of secondary events. Operators and maintenance teams waste valuable time tracing event chains when they should be solving problems. Until now.

Our latest innovation to our ECS Process Control Solution(1) eliminates this complexity. Stoppage Insights, available with the combined updates to our ECS/ControlCenter™ (ECS) software and ACESYS programming library, transforms stoppage events into clear, actionable intelligence. The system automatically identifies the root cause of every stoppage – whether triggered by alarms, interlocks, or operator actions – and maps all affected equipment. Operators can click any stopped motor’s faceplate to view what caused the shutdown instantly. The Stoppage UI provides a complete record of all stoppages with drill-down capabilities, replacing manual investigation with immediate answers.

Understanding root cause in Stoppage Insights

In Stoppage Insights, ‘root cause’ refers to the first alarm, interlock, or operator action detected by the control system. While this may not reveal the underlying mechanical, electrical or process failure that a maintenance team may later discover, it provides an actionable starting point for rapid troubleshooting and response. And this is where Stoppage Insights steps ahead of traditional first-out alarm systems (ISA 18.2). In this older type of system, the first alarm is identified in a group. This is useful, but limited, as it doesn’t show the complete cascade of events, distinguish between operator-initiated and alarm-triggered stoppages, or map downstream impacts. In contrast, Stoppage Insights provides complete transparency:

- Comprehensive capture: Records both regular operator stops and alarm-triggered shutdowns.

- Complete impact visibility: Maps all affected equipment automatically.

- Contextual clarity: Eliminates manual tracing through alarm floods, saving critical response time.

David Campain, Global Product Manager for Process Control Systems, says, “Stoppage Insights takes fault analysis to the next level. Operators and maintenance engineers no longer need to trace complex event chains. They see the root cause clearly and can respond quickly.”

Driving results

1.Driving results for operations teams

Stoppage Insights maximises clarity to minimise downtime, enabling operators to:

• Rapidly identify root causes to shorten recovery time.

• View initiating events and all affected units in one intuitive interface.

• Access complete records of both planned and unplanned stoppages

- Driving results for maintenance and reliability teams

Stoppage Insights helps prioritise work based on evidence, not guesswork:

• Access structured stoppage data for reliability programmes.

• Replace manual logging with automated, exportable records for CMMS, ERP or MES.(2)

• Identify recurring issues and target preventive maintenance effectively.

A future-proof and cybersecure foundation

Our Stoppage Insights feature is built on the latest (version 9) update to our ACESYS advanced programming library. This industry-leading solution lies at the heart of the ECS process control system. Its structured approach enables fast engineering and consistent control logic across hardware platforms from Siemens, Schneider, Rockwell, and others.

In addition to powering Stoppage Insights, ACESYS v9 positions the ECS system for open, interoperable architectures and future-proof automation. The same structured data used by Stoppage Insights supports AI-driven process control, providing the foundation for machine learning models and advanced analytics.

The latest releases also respond to the growing risk of cyberattacks on industrial operational technology (OT) infrastructure, delivering robust cybersecurity. The latest ECS software update (version 9.2) is certified to IEC 62443-4-1 international cybersecurity standards, protecting your process operations and reducing system vulnerability.

What’s available now and what’s coming next?

The ECS/ControlCenter 9.2 and ACESYS 9 updates, featuring Stoppage Insights, are available now for:

- Greenfield projects.

- ECS system upgrades.

- Brownfield replacement of competitor systems.

Stoppage Insights will also soon integrate with our ECS/UptimeGo downtime analysis software. Stoppage records, including root cause identification and affected equipment, will flow seamlessly into UptimeGo for advanced analytics, trending and long-term reliability reporting. This integration creates a complete ecosystem for managing and improving plant uptime.

(1) The ECS Process Control Solution for cement, mining and minerals processing combines proven control strategies with modern automation architecture to optimise plant performance, reduce downtime and support operational excellence.

(2) CMMS refers to computerised maintenance management systems; ERP, to enterprise resource planning; and MES to manufacturing execution systems.

Refractory demands in our kiln have changed

Digital supply chain visibility is critical

Redefining Efficiency with Digitalisation

Cement Additives for Improved Grinding Efficiency

Digital Pathways for Sustainable Manufacturing

Refractory demands in our kiln have changed

Digital supply chain visibility is critical

Redefining Efficiency with Digitalisation

Cement Additives for Improved Grinding Efficiency

Digital Pathways for Sustainable Manufacturing

Trending News

-

Concrete4 weeks ago

Concrete4 weeks agoAris Secures Rs 630 Million Concrete Supply Order

-

Concrete4 weeks ago

Concrete4 weeks agoNITI Aayog Unveils Decarbonisation Roadmaps

-

Concrete3 weeks ago

Concrete3 weeks agoJK Cement Commissions 3 MTPA Buxar Plant, Crosses 31 MTPA

-

Economy & Market3 weeks ago

Economy & Market3 weeks agoBudget 2026–27 infra thrust and CCUS outlay to lift cement sector outlook