Concrete

Fastest Growing Cement Companies in India

Published

12 months agoon

By

admin

India is the world’s second-largest cement producer, with over 7 per cent of global installed capacity. The installed cement capacity in India is 553 mtpa, with a production of 298 mtpa. Ready availability of raw materials for making cement, such as limestone and coal, is a key factor aiding the growth of the sector.

Capacity addition in the cement industry is estimated at 63-70 mt between FY25 and FY26, with approximately 33-35 mt expected in FY25 alone. This is driven by an increasing spend on housing and infrastructure activities. The capacity utilisation is expected to rise to 71 per cent in FY25 from 70 per cent in FY24, backed by higher cement volumes, driven by demands in roads, urban infrastructure and commercial real estate. India’s cement production was expected to reach 457 mt by FY25, a growth rate of 5 per cent per cent year on year.

The cement industry is mainly driven by the consequential number of construction activities with growing demand and a surging need for residential complexes for the urbanised population. Further, the construction of various infrastructure projects such as airports and roads, undertaken by the Government in recent times, propels the growth of the market.

Consumption of cement has also been growing consistently on the back of rising rural housing demand. Strong expansion of the industrial sector is one of the main demand drivers for the cement industry. As a result, there is a strong potential for an increase in long-term demand. Initiatives such as the development of 98 smart cities are expected to significantly boost the sector.

Massive modernisation and assimilation of state-of-the-art technology have made cement plants energy-efficient and environment-friendly. The cement industry contributes to environmental cleanliness by consuming hazardous waste like fly ash (around 30 mt) from thermal power plants and the entire 8 million tonne of granulated slag produced by steel manufacturing units. It uses alternate fuels and raw materials through advanced and environment-friendly technologies.

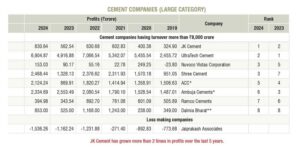

JSW Cement is the only company in the list to have achieved double digit year-on-year growth of 25 per cent outperforming its peers.

Sagar Cements (SCL) acquired Andhra Cements (ACL) in 2023 at a cost of Rs.922 crore, helping

it achieve capacity guidance of 10 million tonnes per annum (mtpa) before 2025.

Star Cements ranks as the second largest in profits with an impressive growth of 34 per cent.

NCL Industries has more than doubled its growth from 2023 to 2024, outperforming its competitors.

Fastest Growing Cement Companies – Large JK Cement

JK Cement’s operations commenced with commercial production at its flagship grey cement unit at Nimbahera, Rajasthan, in 1975. Today, it is one of India’s leading manufacturers of grey cement, with an installed capacity of 20 mtpa, and one of the world’s leading white cement manufacturers, with a total white cement capacity of 1.20 mtpa and wall putty capacity of 1.2 mtpa. Its vision is to be the preferred manufacturer of cement and cement-based products that partners in nation-building. It is India’s No. 1 white cement and wall putty company and has been at the forefront of the country’s cement industry, focusing on quality, innovation and sustainability with superior products and a strong brand name.

JK white cement is sold across 43 countries around the globe. The company has a strong international presence with two subsidiaries, JK Cement

Works Fujairah FZC and JK White Cement (Africa). Over four decades, it has partnered India’s multisectoral infrastructure needs on the strength of its product excellence, customer orientation and technology leadership.

The recent acquisition of Toshali Cement for Rs.900 million marks a significant expansion into the Eastern Indian market, adding 0.6 mtpa to its cement production capacity. Toshali Cement, based in Odisha, operates two key units: an integrated unit in Koraput with a clinker capacity of 0.33 mtpa and a grinding capacity of 0.2 mtpa, and a grinding unit in Cuttack with a capacity of 0.44 mtpa. Additionally, the acquisition includes a limestone mining license for which JK Cement will pay an extra `670 million. This strategic move strengthens its footprint in a region poised for growth owing to government infrastructure projects and housing initiatives.

The company reported net sales of Rs.105.6315 billion during the financial year ending 31 March 2024, compared to Rs.90.9391 billion the previous year. Notably, it recorded a PAT of Rs.8.3064 billion, a significant increase from the

Rs.5.2068 billion reported the previous year. This growth is reflected in an improved EPS of `107.5, up from `65.06 in the preceding financial year.

Ultra Tech Cement

Ultra Tech Cement is the cement flagship company of the Aditya Birla Group and the largest manufacturer of grey cement, RMC and white cement in India. It provides a range of products that caters to the needs of various aspects of construction, from foundation to finish, under five business verticals: Grey Cement, White Cement, Concrete, Building Products and Ultra Tech Building Solutions.

It is the only cement company globally (outside China) to have 100+ mtpa of cement manufacturing capacity in a single country. Its business operations span the UAE, Bahrain, Sri Lanka and India. It has a consolidated installed capacity of 132.45 mtpa and 23 manufacturing units, 28 grinding units, one clinkerisation unit and eight bulk packaging terminals. It is the third-largest cement producer in the world, excluding China.

In the white cement segment, Ultra Tech operates under the brand name Birla White. It has one white cement unit and three wall care putty units, with a current capacity of 1.98 mtpa. With 185+ RMC plants in 85+ cities, Ultra Tech is the largest manufacturer of concrete in India. A founding member of the Global Cement and Concrete Association (GCCA), it is a signatory to the GCCA Climate Ambition 2050 and has committed to the Net Zero Concrete Roadmap announced by GCCA. It is focused on accelerating the decarburisation of its operations.

The acquisition of a 1.1 mtpa grinding unit from India Cements for Rs.3.15 billion marks a strategic move to strengthen its market presence in Maharashtra. The unit, located in Parli, comes with a captive railway siding, enhancing logistics and operational efficiency. This acquisition is part of the company’s broader plan to expand capacity, as it also announced a Rs.5.04 billion investment to expand its Parli and Dhule units. With these expansions, it aims to cater to future growth in the region, aligning with its target to boost total capacity to nearly 200 mtpa by FY26.

Total revenue jumped 12 per cent to Rs.686.41 billion for FY2023-24, from Rs.612.37 billion in FY2022-23. Profit before tax was Rs.93.88 billion, compared to Rs.72.62 billion the previous year. Net profit

was Rs.69.05 billion, compared to Rs.49.51 billion for 2022-2023.

Shree Cement

Shree Cement is one of India’s top three cement producers, with operations spanning both the domestic and international markets. It is known for its range of cement products, including OPC, PPC and clinker. With a focus on efficiency and sustainability, it has positioned itself as one of the lowest-cost producers in the country. Its commitment to innovation is reflected in the diverse range of solutions it offers for construction, from housing to large-scale infrastructure projects.

The company operates across India and abroad, with a total production capacity of 50.4 mtpa. It has 12 integrated cement plants and multiple grinding units, making it one of the largest cement manufacturers in the country. Its reach extends to the UAE and its expansion plans are aligned with its goal of achieving 80 mtpa by 2030. Additionally, it has invested significantly in green energy, with a power generation capacity of 474 mw, including renewable energy sources such as solar and wind.

In FY2024, Shree Cement reported robust financial performance, with a revenue of Rs.205.2 billion, representing a 15 per cent increase from the previous year. Net income for FY2024 stood at Rs.24 billion, reflecting an impressive 89 per cent growth compared to FY2023. The profit margin also increased to

12 per cent, up from 7.1 per cent the previous year. These strong financial results were driven by increased operational efficiency and higher revenues from expanding operations.

Nuvoco Vistas Corporation

Nuvoco Vistas Corporation, a part of the Nirma Group, is one of India’s leading cement manufacturers, with a strong presence in the country’s building materials industry. With a total installed capacity of 25.0 MTPA, the company operates 11 cement plants, including integrated units, grinding units, and ready-mix concrete plants across key regions such as Chhattisgarh, Jharkhand, Rajasthan, Haryana, and West Bengal. As part of its long-term expansion strategy, Nuvoco plans to increase its total capacity to 31.0 MTPA by Q3 FY27 through strategic acquisitions and greenfield expansions.

Nuvoco focuses on sustainable and innovative cement solutions, offering a premium product portfolio, including Concreto, Duraguard, and Zero M (a low-carbon cement). The company is also a key player in the ready-mix concrete (RMX) market, operating 56 RMX plants nationwide. As part of its cost optimisation initiative (Project Bridge 2.0), the company continues to enhance operational efficiencies, focusing on reducing power and fuel costs while improving its distribution network.

As part of its growth strategy, Nuvoco is leveraging its recent Vadraj Cement acquisition, which will add 6.0 MTPA of cement capacity and 3.5 MTPA of clinker capacity, strengthening its position in Gujarat and Maharashtra. This acquisition will diversify its footprint across North and West India, making it the third-largest player in the Western market. The company also benefits from strong backward integration, with captive limestone mines, power generation capabilities, and a 50 MW renewable energy portfolio, including waste heat recovery systems (WHRS) and solar power.

For 9M FY25, Nuvoco Vistas reported a total revenue of Rs.73.3 billion, with an EBITDA of Rs.8.35 billion. Cement sales volume stood at 4.7 million tons in Q3 FY25, reflecting a 16% YoY growth. With a strong focus on capacity expansion, premiumisation, and sustainability, Nuvoco is well-positioned to capitalise on infrastructure demand and market growth, further strengthening its cost efficiency and brand leadership.

Fastest Growing Cement Companies – Medium

JSW Cement

Part of the diversified $ 23 billion JSW Group, JSW Cement is India’s leading green cement company with a current capacity of 19 mtpa and is on a mission to support the country’s growth in core economic sectors with speed and innovation, delivering the best-quality green cement to customers. Its vision is to build a self-reliant India by boosting infrastructure and the fast-growing economy through projects setting new benchmarks.

The company’s world-class facilities and technological advancements give it the firepower to keep expanding to newer geographies around the country and target new customer segments. It has manufacturing units in Vijayanagar, Karnataka; Nandyal, Andhra Pradesh; Salboni, West Bengal; Jajpur, Odisha; Dolvi, Maharashtra and Fujairah, UAE, among others. With a strong presence in 11 major states in India, it is expanding its footprint in the country and overseas by adding to its existing five active state-of-the-art manufacturing plants and three mines, and intends to increase its production capacity. It is targeting 25 mtpa production by 2023 and all its current business investments are driven to achieve this goal.

JSW Cement is present across the value chain of building materials comprising cement, concrete and construction chemicals. This gives it a unique advantage to cater to the diverse needs of the construction industry with premium, high-quality and eco-friendly products. Its subsidiary, Shiva Cement, is currently investing over `15 billion in a 1.36 mtpa clinker unit to be established in Sundergarh, Odisha. The project includes setting up a 1 mtpa grinding unit and associated facilities.

During FY2023-24, the company reported total income of `59.5189 billion, compared to `49.0114 billion in FY2022-23. PAT was reported at `2.2092 billion in FY2023-24, compared to `2.4975 billion the previous year.

Star Cement

Star Cement is the No. 1 cement brand in India’s Northeast and one of the fastest growing cement brands in West Bengal and Bihar. Its state-of-the-art cement plants bring together innovation and technology to provide high-quality cement, focusing on best-in-class sustainable construction. It has established itself as the most accredited brand in the region for providing high-quality cement and fair pricing.

The company has gained a prominent

position in the Indian construction industry for its premium quality cement, focusing on sustainable development, to meet today’s challenging building material needs and home-building aspirations of millions of customers, supported by pioneering marketing initiatives. It is powered by three cement plants located at Lumshnong in Meghalaya, Sonapur-Guwahati in Assam and Mohitnagar Jalpaiguri in West Bengal, making it one of the largest manufacturers of cement in eastern India. It is proud to have consistently earned recognition and top awards in the construction industry.

The company’s product range for construction includes OPC 43 and 53 grades, PPC and Portland slag cement (PSC). Anti-rust cement (ARC) is another marquee product in the value-added segment in line with evolving customer and construction needs. Known for competence and quality, these products are sought after by customers, engineers, dealers

and contractors.

Star Cement recorded a total revenue of Rs.29.11 billion in FY2023-24, compared to Rs.27.05 billion in FY2022-23. It reported an EBITDA of Rs.5.83 billion in FY2023-24, compared to Rs.5.2 billion the previous year. PAT stood at

Rs.2.95 billion, compared to Rs.2.48 billion in FY2022-23. Projected EPS is Rs.7.3 in FY 2023-24, compared to Rs.6.1 the previous year.

Orient Cement

Orient Cement is a prominent player in India’s cement industry, with a strong presence across key regions. It manufactures and markets high-quality cement under the brands Birla A1 Premium and Birla A1 Strong Crete. It operates three integrated cement plants and a grinding unit, catering to markets in Maharashtra, Telangana and Karnataka. With a strategic focus on sustainability, it is also making strides in reducing its carbon footprint and adopting cleaner energy sources.

In addition to domestic operations, the company has been exploring growth opportunities in new geographies, aiming to strengthen its market position across India. Its efforts towards product innovation and capacity expansion have helped it capture a larger market share in competitive regions. Its strategic investments in modernising manufacturing facilities are expected to improve operational efficiency and increase output. A customer-centric approach and strong distribution network have also played a key role in maintaining its competitive edge.

In FY2024, Orient Cement demonstrated steady financial performance, reporting a revenue of Rs.7.2058 billion for Q2, which marked a 17.11 per cent year-on-year increase. Net profit for the same period stood at Rs.246.3 million, a significant improvement compared to a loss of Rs.95 million in the previous year. This reflects its focus on cost management and operational efficiency. For Q3 FY24, revenue increased to Rs.7.5131 billion while net profit surged by 63.5 per cent to Rs.449.9 million.

JK Lakshmi Cement

JK Lakshmi Cement, a subsidiary of the JK Organisation, is a key player in the Indian cement industry, with an installed capacity of 16.5 MTPA. The company operates integrated cement plants in Rajasthan and Chhattisgarh, along with grinding units in Gujarat, Haryana, Odisha, and West Bengal. Its subsidiary, Udaipur Cement Works Ltd. (UCWL), contributes an additional 4.7 MTPA, enhancing its overall market presence.

JK Lakshmi is on track to achieve 30 MTPA capacity by 2030 through strategic greenfield and brownfield expansions.

The company offers a diversified product portfolio, including blended cement, ready-mix concrete (RMC), and autoclaved aerated concrete (AAC) blocks. It has also launched low-carbon and premium cement products, catering to growing sustainability demands. JK Lakshmi is investing heavily in renewable energy, with 48% of its power sourced from WHRS and solar. The company’s focus on cost leadership has enabled it to maintain one of the lowest cement production costs in the industry.

As part of its expansion strategy, JK Lakshmi Cement is developing additional grinding units in Surat (1.35 MTPA) and Prayagraj, Madhubani, and Patratu (3.4 MTPA combined). Additionally, it is expanding clinker capacity at its Durg plant (2.3 MTPA) and foraying into the North Eastern market with a clinker unit (1.0 MTPA) and a cement grinding unit (1.5 MTPA) in Assam. These projects will strengthen its market reach and logistics efficiencies, ensuring long-term growth and profitability.

For 9M FY25, JK Lakshmi Cement reported a total revenue of `42.95 billion, with an EBITDA of `5.44 billion. Despite volume pressures, the company remains focused on cost efficiency, premiumisation, and market expansion. Its Project Bridge 2.0 initiative is driving operational improvements, helping JK Lakshmi maintain its position as a cost-efficient and growth-driven cement producer in India.

Fastest Growing Cement Companies – Small

Udaipur Cement Works

Udaipur Cement Works (UCWL) is one of India’s leading cement manufacturers, with its roots in Udaipur, the city of lakes in Rajasthan. A subsidiary of JK Lakshmi Cement (JKLC), it is a manufacturer and supplier of cement and cementitious products with manufacturing facilities in Rajasthan. With an integrated cement manufacturing unit with an installed cement production capacity of 2.2 mtpa, it manufactures a range of cement, including PPC, OPC and clinker.

The company is relentlessly focused on product quality, customer satisfaction and innovation, which has helped push boundaries and tap the immense potential for development in the infrastructure and construction sectors in India. Its philosophy is based on sustainable growth and a developmental framework that works for a better and happier future. Working principles have been aligned to contribute to the nation’s commitment to meet the UN Sustainable Development Goals and it upholds the highest levels of system standards, such as the ISO Certification for Environment (14001), Occupational Health and Safety (45001), Energy (50001), and Quality Management (9001) systems. It has also inventoried its carbon and water footprint as per ISO 14064 – 1 and ISO 14046.

The company reported a total income of Rs.11.7436 billion during FY2023-24 compared to Rs.10.3226 billion in FY2022-23. It posted a PAT of Rs.628.8 million for FY 2023-24 as against Rs.351 million the previous year and EPS of Rs.1.25 compared to Rs.1.15.

On July 31, 2024, as part of its amalgamation plan, JK Lakshmi Cement Ltd’s board approved the merger of its three subsidiaries – Udaipur Cement Works Ltd, Hansdeep Industries & Trading Co and Hidrive Developers and Industries Pvt Ltd – with itself.

Shree Digvijay Cements

Shree Digvijay Cements is one of India’s pioneers in manufacturing cement, having started operations in 1944 in the coastal township of Digvijaygram (Sikka) in Jamnagar district,Gujarat. Since 2019, it is part of True North, formerly known as India Value Fund Advisers (IVFA). The company’s licensed capacity stands at 3 mtpa, housing a fully automatic modern cement plant which is ISO 9001, ISO 14001 and OHSAS 18000 certified.

The company is one of the key exporters of cement and cement clinker throughout the world, for which it received the Certificate of Honour of Export House from the President of India. It has a Gujarat-wide network of over 1,000 channel partners selling cement under the brand name Kamal Cement. In addition, it is among the earliest accredited companies awarded with the prestigious license from the American Petroleum Institute (API) for manufacturing oil well cement – API 10A Class G HSR cement. It has been a trendsetter in providing superior quality ordinary and special Portland cement. Its commitment to sustainable development and

high ethical standards in business dealings have been appreciated.

The company offers a unique combination of product quality and customer-tailored logistics solutions through a combination of road, railways and captive seaport that can harbour and handle 3,000 to 5,000 DWT vessels along the jetty. Safe anchorage for 5,000 to 35,000 DWT vessels is available 5 km from the port/wharf site. For safe anchorage of 50,000-100,000 DWT vessels, 20-25 m of water is available 10 km from the port site.

During FY 2023-24, the company reported net sales of 1.358 million tonne, up 7.8 per cent from 1.259 million tonne in FY2022-23. Total revenue was Rs.8.0097 billion, up 9.4 per cent from Rs.7.3192 billion in FY2022-23 and PAT was Rs.877.6 million, up 52 per cent compared to Rs.577.1 million the previous year.

NCL Industries

NCL Industries is a well-established player in the building materials sector, with diversified interests in cement, RMC, hydropower and cement particleboards. It operates under the Nagarjuna Cement brand and has expanded its footprint across multiple regions in India. Founded in 1980, it has steadily grown its production capacity and product offerings, contributing significantly to the infrastructure and construction sectors.

The company’s growth is driven by its continued investment in modernisation and expansion of its production facilities. This includes efforts to improve its production capabilities in cement and allied products. Additionally, it is committed to sustainability, with initiatives to enhance energy-efficiency in operations.

In FY2024, NCL Industries achieved substantial growth in both production and sales. Cement production during Q1 FY 2024 increased by 23 per cent year on year to 751,000 tonne, while sales volumes rose to 742,000 tonne during the same period. This growth reflects the company’s strategic focus on capacity expansion and operational efficiency. With a revenue of Rs.18.7 billion for FY2024, it has solidified its market position in India’s cement industry.

Sagar Cements

Sagar Cements, a key player in the Southern and Eastern Indian cement market, operates with a total installed cement capacity of 10.50 MTPA. The company has a strong presence across Telangana, Andhra Pradesh, Odisha, Maharashtra, and Madhya Pradesh, supported by integrated and grinding units in Mattampally, Bayyavaram, Gudipadu, and Jajpur. It is backed by AvH Resources India Pvt. Ltd. (a Belgian major) and Premji Invest, holding 19.64 per cent and 10.10 per cent equity stakes, respectively.

Sagar Cements continues to invest in sustainability and cost optimisation, with 102.96 MW of captive power capacity and an increasing share of green energy, including waste heat recovery systems (WHRS) and solar power plants. In January 2025, the company commissioned a 6 MW Solar Power Plant at its Gudipadu Unit, with plans for an additional 6 MW at Dachepalli. To reduce logistics costs and improve operational efficiencies, the company has also introduced electric vehicles (EVs) for raw material and cement transportation across key locations.

As part of its growth strategy, Sagar Cements is expanding its Dachepalli plant, increasing clinker capacity from 1.85 MTPA to 2.31 MTPA and cement capacity from 2.25 MTPA to 3.00 MTPA. This project is expected to be completed by FY26, with a total investment of Rs.4.70 billion. Additionally, the company is enhancing green energy infrastructure, with 9 MW WHRS at Dachepalli and 4.5 MW at Gudipadu, ensuring long-term sustainability.

For Q3 FY25, Sagar Cements reported a total revenue of Rs.5.64 billion, marking a 16 per cent YoY decline, with cement sales volume at 1.38 million tons. Operating EBITDA stood at Rs.0.38 billion, with an EBITDA margin of 7 per cent. The company continues to focus on cost optimisation, green energy transition, and capacity expansion, positioning itself for long-term growth and improved profitability in the Indian cement market.

KCP Cement

KCP Cement, a leading cement manufacturer in South India, operates with a total installed cement capacity of 4.3 MTPA across its plants in Macherla and Muktyala, Andhra Pradesh. The company produces Grade 53 Ordinary Portland Cement (OPC) and Portland Pozzolana Cement (PPC) under the brands KCP Cement and Shreshtaa. With a strong market presence in Andhra Pradesh and Tamil Nadu, KCP Cement caters to a wide customer base, including infrastructure developers, real estate companies, and retail buyers.

The company is committed to sustainable manufacturing, with a focus on waste heat recovery, solar, wind, and hydel power to reduce its carbon footprint. KCP Cement continues to invest in energy efficiency, aiming to lower production costs and environmental impact. Apart from cement, KCP operates in heavy engineering, sugar, and hospitality, ensuring a diversified revenue base. The company is also optimising its logistics and distribution network, expanding its fleet and improving supply chain efficiency to enhance operational effectiveness.

As part of its growth strategy, KCP Cement is leveraging its engineering expertise to strengthen its market position. The company is focused on cost efficiency, product diversification, and capacity expansion to improve profitability. Additionally, ongoing investments in alternative fuels and resource efficiency are expected to drive long-term sustainability and competitiveness.

For 9M FY25, KCP Cement reported a total revenue of Rs.10.31 billion, with an EBITDA loss of Rs.0.64 billion. The company’s total expenses stood at Rs.1,068.63 crore, reflecting operational challenges. Despite short-term pressures, KCP remains committed to capacity expansion, operational improvements, and strategic investments to solidify its presence in the South Indian cement market.

Concrete

Refractory demands in our kiln have changed

Published

3 days agoon

February 20, 2026By

admin

Radha Singh, Senior Manager (P&Q), Shree Digvijay Cement, points out why performance, predictability and life-cycle value now matter more than routine replacement in cement kilns.

As Indian cement plants push for higher throughput, increased alternative fuel usage and tighter shutdown cycles, refractory performance in kilns and pyro-processing systems is under growing pressure. In this interview, Radha Singh, Senior Manager (P&Q), Shree Digvijay Cement, shares how refractory demands have evolved on the ground and how smarter digital monitoring is improving kiln stability, uptime and clinker quality.

How have refractory demands changed in your kiln and pyro-processing line over the last five years?

Over the last five years, refractory demands in our kiln and pyro line have changed. Earlier, the focus was mostly on standard grades and routine shutdown-based replacement. But now, because of higher production loads, more alternative fuels and raw materials (AFR) usage and greater temperature variation, the expectation from refractory has increased.

In our own case, the current kiln refractory has already completed around 1.5 years, which itself shows how much more we now rely on materials that can handle thermal shock, alkali attack and coating fluctuations. We have moved towards more stable, high-performance linings so that we don’t have to enter the kiln frequently for repairs.

Overall, the shift has been from just ‘installation and run’ to selecting refractories that give longer life, better coating behaviour and more predictable performance under tougher operating conditions.

What are the biggest refractory challenges in the preheater, calciner and cooler zones?

• Preheater: Coating instability, chloride/sulphur cycles and brick erosion.

• Calciner: AFR firing, thermal shock and alkali infiltration.

• Cooler: Severe abrasion, red-river formation and mechanical stress on linings.

Overall, the biggest challenge is maintaining lining stability under highly variable operating conditions.

How do you evaluate and select refractory partners for long-term performance?

In real plant conditions, we don’t select a refractory partner just by looking at price. First, we see their past performance in similar kilns and whether their material has actually survived our operating conditions. We also check how strong their technical support is during shutdowns, because installation quality matters as much as the material itself.

Another key point is how quickly they respond during breakdowns or hot spots. A good partner should be available on short notice. We also look at their failure analysis capability, whether they can explain why a lining failed and suggest improvements.

On top of this, we review the life they delivered in the last few campaigns, their supply reliability and their willingness to offer plant-specific custom solutions instead of generic grades. Only a partner who supports us throughout the life cycle, which includes selection, installation, monitoring and post-failure analysis, fits our long-term requirement.

Can you share a recent example where better refractory selection improved uptime or clinker quality?

Recently, we upgraded to a high-abrasion basic brick at the kiln outlet. Earlier we had frequent chipping and coating loss. With the new lining, thermal stability improved and the coating became much more stable. As a result, our shutdown interval increased and clinker quality remained more consistent. It had a direct impact on our uptime.

How is increased AFR use affecting refractory behaviour?

Increased AFR use is definitely putting more stress on the refractory. The biggest issue we see daily is the rise in chlorine, alkalis and volatiles, which directly attack the lining, especially in the calciner and kiln inlet. AFR firing is also not as stable as conventional fuel, so we face frequent temperature fluctuations, which cause more thermal shock and small cracks in the lining.

Another real problem is coating instability. Some days the coating builds too fast, other days it suddenly drops, and both conditions impact refractory life. We also notice more dust circulation and buildup inside the calciner whenever the AFR mix changes, which again increases erosion.

Because of these practical issues, we have started relying more on alkali-resistant, low-porosity and better thermal shock–resistant materials to handle the additional stress coming from AFR.

What role does digital monitoring or thermal profiling play in your refractory strategy?

Digital tools like kiln shell scanners, IR imaging and thermal profiling help us detect weakening areas much earlier. This reduces unplanned shutdowns, helps identify hotspots accurately and allows us to replace only the critical sections. Overall, our maintenance has shifted from reactive to predictive, improving lining life significantly.

How do you balance cost, durability and installation speed during refractory shutdowns?

We focus on three points:

• Material quality that suits our thermal profile and chemistry.

• Installation speed, in fast turnarounds, we prefer monolithic.

• Life-cycle cost—the cheapest material is not the most economical. We look at durability, future downtime and total cost of ownership.

This balance ensures reliable performance without unnecessary expenditure.

What refractory or pyro-processing innovations could transform Indian cement operations?

Some promising developments include:

• High-performance, low-porosity and nano-bonded refractories

• Precast modular linings to drastically reduce shutdown time

• AI-driven kiln thermal analytics

• Advanced coating management solutions

• More AFR-compatible refractory mixes

These innovations can significantly improve kiln stability, efficiency and maintenance planning across the industry.

Concrete

Digital supply chain visibility is critical

Published

3 days agoon

February 20, 2026By

admin

MSR Kali Prasad, Chief Digital and Information Officer, Shree Cement, discusses how data, discipline and scale are turning Industry 4.0 into everyday business reality.

Over the past five years, digitalisation in Indian cement manufacturing has moved decisively beyond experimentation. Today, it is a strategic lever for cost control, operational resilience and sustainability. In this interview, MSR Kali Prasad, Chief Digital and Information Officer, Shree Cement, explains how integrated digital foundations, advanced analytics and real-time visibility are helping deliver measurable business outcomes.

How has digitalisation moved from pilot projects to core strategy in Indian cement manufacturing over the past five years?

Digitalisation in Indian cement has evolved from isolated pilot initiatives into a core business strategy because outcomes are now measurable, repeatable and scalable. The key shift has been the move away from standalone solutions toward an integrated digital foundation built on standardised processes, governed data and enterprise platforms that can be deployed consistently across plants and functions.

At Shree Cement, this transition has been very pragmatic. The early phase focused on visibility through dashboards, reporting, and digitisation of critical workflows. Over time, this has progressed into enterprise-level analytics and decision support across manufacturing and the supply chain,

with clear outcomes in cost optimisation, margin protection and revenue improvement through enhanced customer experience.

Equally important, digital is no longer the responsibility of a single function. It is embedded into day-to-day operations across planning, production, maintenance, despatch and customer servicing, supported by enterprise systems, Industrial Internet of Things (IIoT) data platforms, and a structured approach to change management.

Which digital interventions are delivering the highest ROI across mining, production and logistics today?

In a capital- and cost-intensive sector like cement, the highest returns come from digital interventions that directly reduce unit costs or unlock latent capacity without significant capex.

Supply chain and planning (advanced analytics): Tools for demand forecasting, S&OP, network optimisation and scheduling deliver strong returns by lowering logistics costs, improving service levels, and aligning production with demand in a fragmented and regionally diverse market.

Mining (fleet and productivity analytics): Data-led mine planning, fleet analytics, despatch discipline, and idle-time reduction improve fuel efficiency and equipment utilisation, generating meaningful savings in a cost-heavy operation.

Manufacturing (APC and process analytics): Advanced Process Control, mill optimisation, and variability reduction improve thermal and electrical efficiency, stabilise quality and reduce rework and unplanned stoppages.

Customer experience and revenue enablement (digital platforms): Dealer and retailer apps, order visibility and digitally enabled technical services improve ease of doing business and responsiveness. We are also empowering channel partners with transparent, real-time information on schemes, including eligibility, utilisation status and actionable recommendations, which improves channel satisfaction and market execution while supporting revenue growth.

Overall, while Artificial Intelligence (AI) and IIoT are powerful enablers, it is advanced analytics anchored in strong processes that typically delivers the fastest and most reliable ROI.

How is real-time data helping plants shift from reactive maintenance to predictive and prescriptive operations?

Real-time and near real-time data is driving a more proactive and disciplined maintenance culture, beginning with visibility and progressively moving toward prediction and prescription.

At Shree Cement, we have implemented a robust SAP Plant Maintenance framework to standardise maintenance workflows. This is complemented by IIoT-driven condition monitoring, ensuring consistent capture of equipment health indicators such as vibration, temperature, load, operating patterns and alarms.

Real-time visibility enables early detection of abnormal conditions, allowing teams to intervene before failures occur. As data quality improves and failure histories become structured, predictive models can anticipate likely failure modes and recommend timely interventions, improving MTBF and reducing downtime. Over time, these insights will evolve into prescriptive actions, including spares readiness, maintenance scheduling, and operating parameter adjustments, enabling reliability optimisation with minimal disruption.

A critical success factor is adoption. Predictive insights deliver value only when they are embedded into daily workflows, roles and accountability structures. Without this, they remain insights without action.

In a cost-sensitive market like India, how do cement companies balance digital investment with price competitiveness?

In India’s intensely competitive cement market, digital investments must be tightly linked to tangible business outcomes, particularly cost reduction, service improvement, and faster decision-making.

This balance is achieved by prioritising high-impact use cases such as planning efficiency, logistics optimisation, asset reliability, and process stability, all of which typically deliver quick payback. Equally important is building scalable and governed digital foundations that reduce the marginal cost of rolling out new use cases across plants.

Digitally enabled order management, live despatch visibility, and channel partner platforms also improve customer centricity while controlling cost-to-serve, allowing service levels to improve without proportionate increases in headcount or overheads.

In essence, the most effective digital investments do not add cost. They protect margins by reducing variability, improving planning accuracy, and strengthening execution discipline.

How is digitalisation enabling measurable reductions in energy consumption, emissions, and overall carbon footprint?

Digitalisation plays a pivotal role in improving energy efficiency, reducing emissions and lowering overall carbon intensity.

Real-time monitoring and analytics enable near real-time tracking of energy consumption and critical operating parameters, allowing inefficiencies to be identified quickly and corrective actions to be implemented. Centralised data consolidation across plants enables benchmarking, accelerates best-practice adoption, and drives consistent improvements in energy performance.

Improved asset reliability through predictive maintenance reduces unplanned downtime and process instability, directly lowering energy losses. Digital platforms also support more effective planning and control of renewable energy sources and waste heat recovery systems, reducing dependence on fossil fuels.

Most importantly, digitalisation enables sustainability progress to be tracked with greater accuracy and consistency, supporting long-term ESG commitments.

What role does digital supply chain visibility play in managing demand volatility and regional market dynamics in India?

Digital supply chain visibility is critical in India, where demand is highly regional, seasonality is pronounced, and logistics constraints can shift rapidly.

At Shree Cement, planning operates across multiple horizons. Annual planning focuses on capacity, network footprint and medium-term demand. Monthly S&OP aligns demand, production and logistics, while daily scheduling drives execution-level decisions on despatch, sourcing and prioritisation.

As digital maturity increases, this structure is being augmented by central command-and-control capabilities that manage exceptions such as plant constraints, demand spikes, route disruptions and order prioritisation. Planning is also shifting from aggregated averages to granular, cost-to-serve and exception-based decision-making, improving responsiveness, lowering logistics costs and strengthening service reliability.

How prepared is the current workforce for Industry 4.0, and what reskilling strategies are proving most effective?

Workforce preparedness for Industry 4.0 is improving, though the primary challenge lies in scaling capabilities consistently across diverse roles.

The most effective approach is to define capability requirements by role and tailor enablement accordingly. Senior leadership focuses on digital literacy for governance, investment prioritisation, and value tracking. Middle management is enabled to use analytics for execution discipline and adoption. Frontline sales and service teams benefit from

mobile-first tools and KPI-driven workflows, while shop-floor and plant teams focus on data-driven operations, APC usage, maintenance discipline, safety and quality routines.

Personalised, role-based learning paths, supported by on-ground champions and a clear articulation of practical benefits, drive adoption far more effectively than generic training programmes.

Which emerging digital technologies will fundamentally reshape cement manufacturing in the next decade?

AI and GenAI are expected to have the most significant impact, particularly when combined with connected operations and disciplined processes.

Key technologies likely to reshape the sector include GenAI and agentic AI for faster root-cause analysis, knowledge access, and standardisation of best practices; industrial foundation models that learn patterns across large sensor datasets; digital twins that allow simulation of process changes before implementation; and increasingly autonomous control systems that integrate sensors, AI, and APC to maintain stability with minimal manual intervention.

Over time, this will enable more centralised monitoring and management of plant operations, supported by strong processes, training and capability-building.

Concrete

Redefining Efficiency with Digitalisation

Published

3 days agoon

February 20, 2026By

admin

Professor Procyon Mukherjee discusses how as the cement industry accelerates its shift towards digitalisation, data-driven technologies are becoming the mainstay of sustainability and control across the value chain.

The cement industry, long perceived as traditional and resistant to change, is undergoing a profound transformation driven by digital technologies. As global infrastructure demand grows alongside increasing pressure to decarbonise and improve productivity, cement manufacturers are adopting data-centric tools to enhance performance across the value chain. Nowhere is this shift more impactful than in grinding, which is the energy-intensive final stage of cement production, and in the materials that make grinding more efficient: grinding media and grinding aids.

The imperative for digitalisation

Cement production accounts for roughly 7 per cent to 8 per cent of global CO2 emissions, largely due to the energy intensity of clinker production and grinding processes. Digital solutions, such as AI-driven process controls and digital twins, are helping plants improve stability, cut fuel use and reduce emissions while maintaining consistent product quality. In one deployment alongside ABB’s process controls at a Heidelberg plant in Czechia, AI tools cut fuel use by 4 per cent and emissions by 2 per cent, while also improving operational stability.

Digitalisation in cement manufacturing encompasses a suite of technologies, broadly termed as Industrial Internet of Things (IIoT), AI and machine learning, predictive analytics, cloud-based platforms, advanced process control and digital twins, each playing a role in optimising various stages of production from quarrying to despatch.

Grinding: The crucible of efficiency and cost

Of all the stages in cement production, grinding is among the most energy-intensive, historically consuming large amounts of electricity and representing a significant portion of plant operating costs. As a result, optimising grinding operations has become central to digital transformation strategies.

Modern digital systems are transforming grinding mills from mechanical workhorses into intelligent, interconnected assets. Sensors throughout the mill measure parameters such as mill load, vibration, mill speed, particle size distribution, and power consumption. This real-time data, fed into machine learning and advanced process control (APC) systems, can dynamically adjust operating conditions to maintain optimal throughput and energy usage.

For example, advanced grinding systems now predict inefficient conditions, such as impending mill overload, by continuously analysing acoustic and vibration signatures. The system can then proactively adjust clinker feed rates and grinding media distribution to sustain optimal conditions, reducing energy consumption and improving consistency.

Digital twins: Seeing grinding in the virtual world

One of the most transformative digital tools applied in cement grinding is the digital twin, which a real-time virtual replica of physical equipment and processes. By integrating sensor data and

process models, digital twins enable engineers to simulate process variations and run ‘what-if’

scenarios without disrupting actual production. These simulations support decisions on variables such as grinding media charge, mill speed and classifier settings, allowing optimisation of energy use and product fineness.

Digital twins have been used to optimise kilns and grinding circuits in plants worldwide, reducing unplanned downtime and allowing predictive maintenance to extend the life of expensive grinding assets.

Grinding media and grinding aids in a digital era

While digital technologies improve control and prediction, materials science innovations in grinding media and grinding aids have become equally crucial for achieving performance gains.

Grinding media, which comprise the balls or cylinders inside mills, directly influence the efficiency of clinker comminution. Traditionally composed of high-chrome cast iron or forged steel, grinding media account for nearly a quarter of global grinding media consumption by application, with efficiency improvements translating directly to lower energy intensity.

Recent advancements include ceramic and hybrid media that combine hardness and toughness to reduce wear and energy losses. For example, manufacturers such as Sanxin New Materials in China and Tosoh Corporation in Japan have developed sub-nano and zirconia media with exceptional wear resistance. Other innovations include smart media embedded with sensors to monitor wear, temperature, and impact forces in real time, enabling predictive maintenance and optimal media replacement scheduling. These digitally-enabled media solutions can increase grinding efficiency by as much as 15 per cent.

Complementing grinding media are grinding aids, which are chemical additives that improve mill throughput and reduce energy consumption by altering the surface properties of particles, trapping air, and preventing re-agglomeration. Technology leaders like SIKA AG and GCP Applied Technologies have invested in tailored grinding aids compatible with AI-driven dosing platforms that automatically adjust additive concentrations based on real-time mill conditions. Trials in South America reported throughput improvements nearing 19 per cent when integrating such digital assistive dosing with process control systems.

The integration of grinding media data and digital dosing of grinding aids moves the mill closer to a self-optimising system, where AI not only predicts media wear or energy losses but prescribes optimal interventions through automated dosing and operational adjustments.

Global case studies in digital adoption

Several cement companies around the world exemplify digital transformation in practice.

Heidelberg Materials has deployed digital twin technologies across global plants, achieving up to 15 per cent increases in production efficiency and 20 per cent reductions in energy consumption by leveraging real-time analytics and predictive algorithms.

Holcim’s Siggenthal plant in Switzerland piloted AI controllers that autonomously adjusted kiln operations, boosting throughput while reducing specific energy consumption and emissions.

Cemex, through its AI and predictive maintenance initiatives, improved kiln availability and reduced maintenance costs by predicting failures before they occurred. Global efforts also include AI process optimisation initiatives to reduce energy consumption and environmental impact.

Challenges and the road ahead

Despite these advances, digitalisation in cement grinding faces challenges. Legacy equipment may lack sensor readiness, requiring retrofits and edge-cloud connectivity upgrades. Data governance and integration across plants and systems remains a barrier for many mid-tier producers. Yet, digital transformation statistics show momentum: more than half of cement companies have implemented IoT sensors for equipment monitoring, and digital twin adoption is growing rapidly as part of broader Industry 4.0 strategies.

Furthermore, as digital systems mature, they increasingly support sustainability goals: reduced energy use, optimised media consumption and lower greenhouse gas emissions. By embedding intelligence into grinding circuits and material inputs like grinding aids, cement manufacturers can strike a balance between efficiency and environmental stewardship.

Conclusion

Digitalisation is not merely an add-on to cement manufacturing. It is reshaping the competitive and sustainability landscape of an industry often perceived as inertia-bound. With grinding representing a nexus of energy intensity and cost, digital technologies from sensor networks and predictive analytics to digital twins offer new levers of control. When paired with innovations in grinding media and grinding aids, particularly those with embedded digital capabilities, plants can achieve unprecedented gains in efficiency, predictability and performance.

For global cement producers aiming to reduce costs and carbon footprints simultaneously, the future belongs to those who harness digital intelligence not just to monitor operations, but to optimise and evolve them continuously.

About the author:

Professor Procyon Mukherjee, ex-CPO Lafarge-Holcim India, ex-President Hindalco, ex-VP Supply Chain Novelis Europe, has been an industry leader in logistics, procurement, operations and supply chain management. His career spans 38 years starting from Philips, Alcan Inc (Indian Aluminum Company), Hindalco, Novelis and Holcim. He authored the book, ‘The Search for Value in Supply Chains’. He serves now as Visiting Professor in SP Jain Global, SIOM and as the Adjunct Professor at SBUP. He advises leading Global Firms including Consulting firms on SCM and Industrial Leadership and is a subject matter expert in aluminum and cement. An Alumnus of IIM Calcutta and Jadavpur University, he has completed the LH Senior Leadership Programme at IVEY Academy at Western University, Canada.

Refractory demands in our kiln have changed

Digital supply chain visibility is critical

Redefining Efficiency with Digitalisation

Cement Additives for Improved Grinding Efficiency

Digital Pathways for Sustainable Manufacturing

Refractory demands in our kiln have changed

Digital supply chain visibility is critical

Redefining Efficiency with Digitalisation

Cement Additives for Improved Grinding Efficiency

Digital Pathways for Sustainable Manufacturing

Trending News

-

Concrete4 weeks ago

Concrete4 weeks agoAris Secures Rs 630 Million Concrete Supply Order

-

Concrete4 weeks ago

Concrete4 weeks agoNITI Aayog Unveils Decarbonisation Roadmaps

-

Concrete3 weeks ago

Concrete3 weeks agoJK Cement Commissions 3 MTPA Buxar Plant, Crosses 31 MTPA

-

Economy & Market3 weeks ago

Economy & Market3 weeks agoBudget 2026–27 infra thrust and CCUS outlay to lift cement sector outlook