Economy & Market

We ensure sustainability throughout our operations

Published

2 years agoon

By

admin

Ganesh W Jirkuntwar, Senior Executive Director and National Manufacturing Head, Dalmia Cement (Bharat), discusses the transformative shift of the cement industry towards greener practices. Going green aligns with global climate goals and presents opportunities for enhanced competitiveness and environmental stewardship.

What is the current sentiment in the cement industry about going green?

Cement, a key component of concrete, is a major contributor to CO2 emissions. Studies show that the cement industry’s worldwide yearly production of 4.2 billion tonnes contributes about 7 per cent of worldwide carbon dioxide yearly emissions. Since the pandemic, India and the world are now pushing harder than ever to meet climate goals. Moreover, for India, the need and importance to cut down on emissions is double; to target climate change and to reduce the current dangerous levels of air pollution.

The usage and demand for cement are only going to increase due to the burgeoning population and the need for housing and infrastructure. India, along with the world, needs to fast-track the journey to zero-carbon. Consumers are also becoming increasingly aware of the environmental impact of the products they use and are seeking more sustainable and eco-friendly options. By going green, cement companies can meet this demand, gaining a competitive edge in the market and establishing themselves as environmentally conscious businesses.

In the cement industry, the problems of emissions lies in the manufacturing of cement. The energy used to heat the kilns that produce the clinker and the chemical processes that convert limestone into calcium oxide are the major causes of these emissions. However, the Indian cement sector has been at the forefront in responding to climate change. Many large cement companies have done huge emission reductions by using supplementary cementitious materials, improving energy efficiency, substituting fossil fuels with alternative fuels, using waste heat to generate electricity, and scientifically trying new production techniques and process improvements.

Technologies like Waste Heat Recovery (WHR) power generation systems, reducing or ceasing the use of fossil fuels, using solar energy, as well as converting current fossil-fuel-based facilities into renewable biomass fuel-based units, are being used by various companies to reduce the emissions during cement production. As the need for energy is paramount in the cement industry, the solution to its emission issues lies in finding renewable electricity that can produce clean, safe, affordable, and infinite energy. Across the globe and in India, companies are in the process of changing their manufacturing techniques to transition to clean energy and reduce their carbon footprint.

Tell us about the key alternative raw materials used for the manufacturing of green cement?

Green cement, which boasts a lower carbon footprint compared to traditional cement, is made using supplementary cementitious materials (SCMs). Below are some of SCMs, which are typically used in green cement production.

Fly ash: It is a byproduct of coal-fired power plants and contains silica and alumina, which are great for making green cement.

Ground granulated blast furnace slag (GGBS): This is a byproduct of the steel industry. When ground into a fine powder, it can replace traditional materials in cement production and significantly reduce carbon emissions.

Calcined clay: This clay type is heated to high temperatures to enhance its reactivity. It can replace traditional raw materials in green cement production.

These materials help in reduction of clinker, with a very high carbon footprint in cement production and hence reduce the carbon footprint of cement.

How does the use of alternative fuels impact the productivity and efficiency of the manufacturing process?

The use of alternative fuels in cement manufacturing processes has several benefits. It significantly reduces dependency on fossil fuel, which is highly polluting and reduces greenhouse gas emissions, hence a great lever for lowering carbon footprint. Alternative fuels like biomass, municipal wastes and industrial byproducts are being used as a substitute to fossil fuels such as coal, petroleum coke etc. Uses of alternative fuel helps in lowering cost of production as well as help maintain cleanliness of the environment.

However, usage of alternative fuels comes with its set of challenges impacting productivity and efficiency in the manufacturing process. The lower calorific values of alternative fuels compared to fossil fuels impacts the heat balance of the cement kiln. Hence to ensure the correct temperature profile is maintained during the entire process, cement plants need to optimise fuel mix and make operational adjustments of the kiln. Also, careful considerations need to be taken during selection of alternative fuels, ensuring compatibility with the manufacturing process, else it can impact the quality of the clinker and the final product.

Quality and availability of alternative fuels are also vital. As waste and by-products are sourced from other industries, reliable supply chains and strict quality control measures are required to ensure standard quality and availability. There are also additional challenges like health and safety risks to workers handling storage of the alternative fuels and meeting regulatory compliances and standards in terms of use of alternative fuels.

To mitigate these challenges, the cement industry will need to adopt diverse strategies like research and investments in advanced technologies for optimal use of alternate fuels, partnership with other industries for reliable availability and collaboration with regulatory bodies for monitoring compliances.

Tell us about the cement blends or products from your organisation that are lower in their carbon content.

We offer cement blends that are designed to have lower carbon content. Blended cements are made by mixing two or more materials, with at least one being a cementitious material like Portland cement, fly ash, ground granulated blast furnace slag (GGBS), silica fume or limestone. In India, we manufacture several types of blended cements, including:

Portland Pozzolana Cement (PPC): This blend includes Clinker and pozzolanic materials such as fly ash. Known for its strength and durability, PPC is commonly used in construction projects like dams, bridges, and high-rise buildings.

Portland Slag Cement (PSC): PSC combines Clinker with GGBS, a by-product of the iron and steel industry. PSC offers high strength, low heat of hydration, and resistance to sulfate and chloride attacks, making it ideal for marine and coastal structures. Dalmia Bharat is the largest manufacturer of PSC in India, known for its lowest carbon footprint.

Composite Cement: This blend includes OPC/Clinker along with other cementitious materials like fly ash or GGBS, as well as additives such as limestone or silica fume. It’s commonly used when high durability and strength are needed in construction projects.

Our blended cement is available under the brand names Dalmia INFRAPRO and Dalmia INFRAGREEN, among others, covering various categories mentioned above. We also offer other brands such as Dalmia DSP and Konark Cement.

Tell us about your Net Zero Goals. How much have you achieved so far?

We were the first cement company in the world to commit to a net zero and carbon-negative roadmap in 2018 setting an ambitious precedent. By embracing a circular economy model, we focused on recycling materials, reusing resources, and adopting alternative raw materials and fuels in our production cycle. This strategy has allowed the company to avoid a substantial 8.6 million tonnes of CO2 emissions annually, with a targeted reduction to 15 million tones per year by 2027. We have established around 72 MW of waste heat-based power generation capacity, contributing 20 per cent of our total power needs. This shift to waste-fueled power not only enhances overall efficiency but also facilitates a clean energy transition away from fossil fuels. We are 14 times water-positive and were among the first to pioneer alternative fuels in cement kilns. We also commenced our transition to electrical vehicles by joining the EV100 initiative, becoming the first to join the triplet of RE100, EP100 and EV100 globally. We have also been integrating circularity into our products and processes and have become a plastic waste recycling positive company.

Currently, the company boasts one of the lowest net carbon footprints in the global cement industry at 456 CO2 emission-Kg/tonne.

How do you incorporate sustainability in your cement manufacturing process?

As a company we strongly believe in the business philosophy ‘Clean and Green is Profitable and Sustainable’. We ensure sustainability throughout our operations through several key approaches.

- Use of alternative raw materials like fly ash and slag in the manufacturing process which helps to reduce emissions and lowers carbon footprint. This has enabled us to reduce the use of natural resources.

- Implementation of sustainable mining practices to minimise environmental impact like minimising water usage, use of eco-friendly mining techniques, restoring mined lands and protection of biodiversity in that region.

- Use of water conservation techniques like recycling and reusing water to reduce water usage through optimal processes. Eg. Using rainwater harvesting to reduce dependency on freshwater resources.

- Controlling air emissions through upgraded technology, alternative fuels, and systematic monitoring of emissions with our plants and surrounding areas. To manage ‘fugitive’ emissions, we have also implemented measures like enclosed conveyors, installation of dust collection systems and regular equipment maintenance to prevent leaks. We also train our employees to identify and report any air quality issues.

- Beyond environmental concerns, we also deeply focus on health and safety, people management and community engagement, promoting sustainable measures across our operations.

Can incorporation of automation and technology further the green initiative of the cement industry?

Use of advanced technologies and automation systems can help cement manufacturers become more sustainable by reducing energy consumption, increasing efficiency and minimising waste generation.

One of the key benefits is optimisation of cement manufacturing process is decrease in energy consumption and limited greenhouse gas emissions. For example, automated kiln control systems can help maintain precise temperature and pressure conditions, allowing for efficient fuel burning and reduced emissions.

Advanced technologies like artificial intelligence and machine learning, can assist in real-time monitoring and identifying any inadequacies or areas of improvement, helping manufacturers to optimise their operations and reduce waste and emissions.

Using sensors and data analytics for predictive maintenance of equipment allows for timely repairs and replacements. This approach can help minimise unexpected breakdowns and reduce related maintenance costs.

Additionally, digital solutions can track and report sustainability metrics, allowing cement manufacturers to monitor their environmental performance.

Overall, use of automation and technology can increase efficiency, reduce downtime and boost productivity whilst minimising environmental impact.

What are the major challenges in reducing the carbon content of cement manufacturing?

There are several key challenges:

Emissions from raw material: One of the key challenges is the emissions associated with calcination of raw materials – limestone. It accounts for almost 60 per cent of the CO2 emissions in the cement sector. Unlike other industries where emissions mainly come from burning fossil fuels, this is a challenging issue for cement production, as there are no simple alternatives available yet.

High energy requirement: Cement production requires very high temperatures, typically achieved through the combustion of fossil fuels such as coal, oil, and natural gas. This reliance on fossil fuels makes it hard to switch to cleaner energy sources, complicating efforts to reduce emissions.

High technology costs: Many decarbonisation technologies, such as carbon capture and storage (CCS), are capital-intensive and require large investments. This high cost can be a significant barrier, especially for smaller cement manufacturers.

Regulatory and policy support: The cement industry needs government driven regulatory frameworks and policies that support the adoption of low-carbon technologies. However, establishing effective policies and regulations that encourage decarbonisation while ensuring competitiveness and addressing potential trade-offs is a challenge for policymakers.

Lack of financial incentives: Decarbonising cement production requires substantial investments in new technologies, equipment, and infrastructure. But limited financial incentives and regulatory frameworks for promoting low-carbon cement can inhibit the adoption of sustainable practices.

Addressing these challenges requires a multi-pronged approach, including technological innovation, supportive policies, financial incentives and collaboration among governments, industry stakeholders and research institutions. Continuous research and development are also crucial to find and scale up effective decarbonisation technologies for the cement sector.

How do you measure the impact of your green cement on the environment?

Measuring the impact of green cement on the environment and society involves a comprehensive approach considering its entire life cycle. Several steps are taken to gauge this impact:

Environmental Impact Assessment (EIA): An EIA is conducted to evaluate how Cement production affects the environment. This includes assessing material extraction, manufacturing processes, energy and water usage, and the product’s

carbon footprint.

Social Impact Assessment (SIA): SIA evaluates how Cement production influences local communities, such as job opportunities and community development. Stakeholder engagement and local knowledge play a crucial role in

this assessment.

Life Cycle Assessment (LCA): LCA measures the overall environmental impact of Cement, from extraction to disposal. Identifying areas for improvement helps minimise environmental harm.

Environmental reporting: Regular reporting on environmental performance and progress toward sustainability goals ensures transparency. This includes data on carbon emissions, water usage, and waste generation, aiding stakeholders in staying informed.

Stakeholder engagement: Engaging with stakeholders helps understand their concerns and perspectives. This collaboration identifies opportunities for improvement and ensures sustainability strategies align with stakeholder expectations.

- –Kanika Mathur

Concrete

Our strategy is to establish reliable local partnerships

Published

16 hours agoon

February 19, 2026By

admin

Jean-Jacques Bois, President, Nanolike, discusses how real-time data is reshaping cement delivery planning and fleet performance.

As cement producers look to extract efficiency gains beyond the plant gate, real-time visibility and data-driven logistics are becoming critical levers of competitiveness. In this interview with Jean-Jacques Bois, President, Nanolike, we discover how the company is helping cement brands optimise delivery planning by digitally connecting RMC silos, improving fleet utilisation and reducing overall logistics costs.

How does SiloConnect enable cement plants to optimise delivery planning and logistics in real time?

In simple terms, SiloConnect is a solution developed to help cement suppliers optimise their logistics by connecting RMC silos in real time, ensuring that the right cement is delivered at the right time and to the right location. The core objective is to provide real-time visibility of silo levels at RMC plants, allowing cement producers to better plan deliveries.

SiloConnect connects all the silos of RMC plants in real time and transmits this data remotely to the logistics teams of cement suppliers. With this information, they can decide when to dispatch trucks, how to prioritise customers, and how to optimise fleet utilisation. The biggest savings we see today are in logistics efficiency. Our customers are able to sell and ship more cement using the same fleet. This is achieved by increasing truck rotation, optimising delivery routes, and ultimately delivering the same volumes at a lower overall logistics cost.

Additionally, SiloConnect is designed as an open platform. It offers multiple connectors that allow data to be transmitted directly to third-party ERP systems. For example, it can integrate seamlessly with SAP or other major ERP platforms, enabling automatic order creation whenever replenishment is required.

How does your non-exclusive sensor design perform in the dusty, high-temperature, and harsh operating conditions typical of cement plants?

Harsh operating conditions such as high temperatures, heavy dust, extreme cold in some regions, and even heavy rainfall are all factored into the product design. These environmental challenges are considered from the very beginning of the development process.

Today, we have thousands of sensors operating reliably across a wide range of geographies, from northern Canada to Latin America, as well as in regions with heavy rainfall and extremely high temperatures, such as southern Europe. This extensive field experience demonstrates that, by design, the SiloConnect solution is highly robust and well-suited for demanding cement plant environments.

Have you initiated any pilot projects in India, and what outcomes do you expect from them?

We are at the very early stages of introducing SiloConnect in India. Recently, we installed our

first sensor at an RMC plant in collaboration with FDC Concrete, marking our initial entry into the Indian market.

In parallel, we are in discussions with a leading cement producer in India to potentially launch a pilot project within the next three months. The goal of these pilots is to demonstrate real-time visibility, logistics optimisation and measurable efficiency gains, paving the way for broader adoption across the industry.

What are your long-term plans and strategic approach for working with Indian cement manufacturers?

For India, our strategy is to establish strong and reliable local partnerships, which will allow us to scale the technology effectively. We believe that on-site service, local presence, and customer support are critical to delivering long-term value to cement producers.

Ideally, our plan is to establish an Indian entity within the next 24 months. This will enable us to serve customers more closely, provide faster support and contribute meaningfully to the digital transformation of logistics and supply chain management in the Indian cement industry.

Economy & Market

Power Build’s Core Gear Series

Published

16 hours agoon

February 19, 2026By

admin

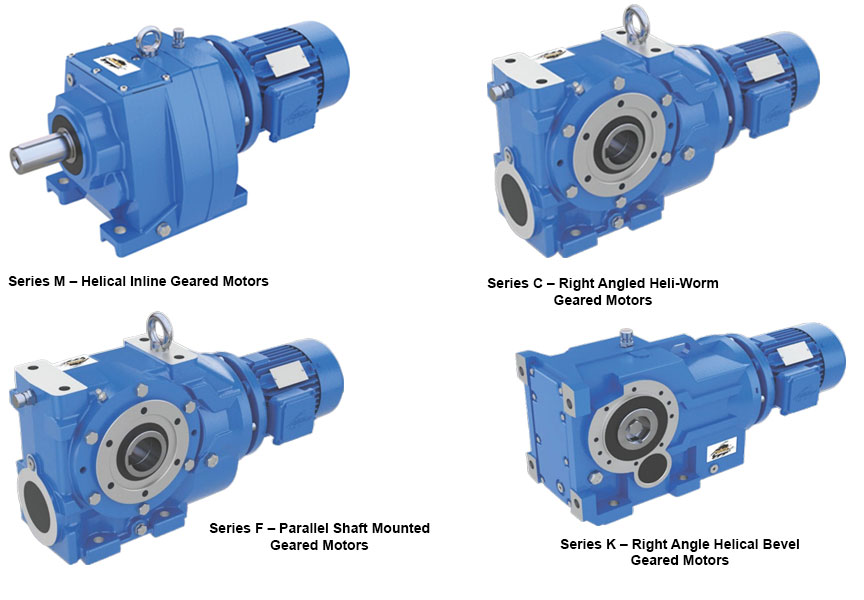

A deep dive into Core Gear Series of products M, C, F and K, by Power Build, and how they represent precision in motion.

At the heart of every high-performance industrial system lies the need for robust, reliable, and efficient power transmission. Power Build answers this need with its flagship geared motor series: M, C, F and K. Each series is meticulously engineered to serve specific operational demands while maintaining the universal promise of durability, efficiency, and performance.

Series M – Helical Inline Geared Motors

Compact and powerful, the Series M delivers exceptional drive solutions for a broad range of applications. With power handling up to 160kW and torque capacity reaching 20,000 Nm, it is the trusted solution for industries requiring quiet operation, high efficiency, and space-saving design. Series M is available with multiple mounting and motor options, making it a versatile choice for manufacturers and OEMs globally.

Series C – Right Angled Heli-Worm Geared Motors

Combining the benefits of helical and worm gearing, the Series C is designed for right-angled power transmission. With gear ratios of up to 16,000:1 and torque capacities of up to 10,000 Nm, this series is optimal for applications demanding precision in compact spaces. Industries looking for a smooth, low-noise operation with maximum torque efficiency rely on Series C for dependable performance.

Series F – Parallel Shaft Mounted Geared Motors

Built for endurance in the most demanding environments, Series F is widely adopted in steel plants, hoists, cranes and heavy-duty conveyors. Offering torque up to 10,000 Nm and high gear ratios up to 20,000:1, this product features an integral torque arm and diverse output configurations to meet industry-specific challenges head-on.

Series K – Right Angle Helical Bevel Geared Motors

For industries seeking high efficiency and torque-heavy performance, Series K is the answer. This right-angled geared motor series delivers torque up to 50,000 Nm, making it a preferred choice in core infrastructure sectors such as cement, power, mining and material handling. Its flexibility in mounting and broad motor options offer engineers the freedom in design and reliability in execution.

Together, these four series reflect Power Build’s commitment to excellence in mechanical power transmission. From compact inline designs to robust right-angle drives, each geared motor is a result of decades of engineering innovation, customer-focused design and field-tested reliability. Whether the requirement is speed control, torque multiplication or space efficiency, Radicon’s Series M, C, F and K stand as trusted powerhouses for global industries.

http://www.powerbuild.in

Call: +919727719344

Concrete

Compliance and growth go hand in h and

Published

16 hours agoon

February 19, 2026By

admin

Pankaj Kejriwal, Whole Time Director and COO, Star Cement, on driving efficiency today and designing sustainability for tomorrow.

In an era where the cement industry is under growing pressure to decarbonise while scaling capacity, Star Cement is charting a pragmatic yet forward-looking path. In this conversation, Pankaj Kejriwal, Whole Time Director and COO, Star Cement, shares how the company is leveraging waste heat recovery, alternative fuels, low-carbon products and clean energy innovations to balance operational efficiency with long-term sustainability.

How has your Lumshnong plant implemented the 24.8 MW Waste Heat Recovery System (WHRS), and what impact has it had on thermal substitution and energy costs?

Earlier, the cost of coal in the Northeast was quite reasonable, but over the past few years, global price increases have also impacted the region. We implemented the WHRS project about five years ago, and it has resulted in significant savings by reducing our overall power costs.

That is why we first installed WHRS in our older kilns, and now it has also been incorporated into our new projects. Going forward, WHRS will be essential for any cement plant. We are also working on utilising the waste gases exiting the WHRS, which are still at around 100 degrees Celsius. To harness this residual heat, we are exploring systems based on the Organic Rankine Cycle, which will allow us to extract additional power from the same process.

With the launch of Star Smart Building Solutions and AAC blocks, how are you positioning yourself in the low-carbon construction materials segment?

We are actively working on low-carbon cement products and are currently evaluating LC3 cement. The introduction of autoclaved aerated concrete (AAC) blocks provided us with an effective entry into the consumer-facing segment of the industry. Since we already share a strong dealer network across products, this segment fits well into our overall strategy.

This move is clearly supporting our transition towards products with lower carbon intensity and aligns with our broader sustainability roadmap.

With a diverse product portfolio, what are the key USPs that enable you to support India’s ongoing infrastructure projects across sectors?

Cement requirements vary depending on application. There is OPC, PPC and PSC cement, and each serves different infrastructure needs. We manufacture blended cements as well, which allows us to supply products according to specific project requirements.

For instance, hydroelectric projects, including those with NHPC, have their own technical norms, which we are able to meet. From individual home builders to road infrastructure, dam projects, and regions with heavy monsoon exposure, where weather-shield cement is required, we are equipped to serve all segments. Our ability to tailor cement solutions across diverse climatic and infrastructure conditions is a key strength.

How are you managing biomass usage, circularity, and waste reduction across

your operations?

The Northeast has been fortunate in terms of biomass availability, particularly bamboo. Earlier, much of this bamboo was supplied to paper plants, but many of those facilities have since shut down. As a result, large quantities of bamboo biomass are now available, which we utilise in our thermal power plants, achieving a Thermal Substitution Rate (TSR) of nearly 60 per cent.

We have also started using bamboo as a fuel in our cement kilns, where the TSR is currently around 10 per cent to 12 per cent and is expected to increase further. From a circularity perspective, we extensively use fly ash, which allows us to reuse a major industrial waste product. Additionally, waste generated from HDPE bags is now being processed through our alternative fuel and raw material (AFR) systems. These initiatives collectively support our circular economy objectives.

As Star Cement expands, what are the key logistical and raw material challenges you face in scaling operations?

Fly ash availability in the Northeast is a constraint, as there are no major thermal power plants in the region. We currently source fly ash from Bihar and West Bengal, which adds significant logistics costs. However, supportive railway policies have helped us manage this challenge effectively.

Beyond the Northeast, we are also expanding into other regions, including the western region, to cater to northern markets. We have secured limestone mines through auctions and are now in the process of identifying and securing other critical raw material resources to support this expansion.

With increasing carbon regulations alongside capacity expansion, how do you balance compliance while sustaining growth?

Compliance and growth go hand in hand for us. On the product side, we are working on LC3 cement and other low-carbon formulations. Within our existing product portfolio, we are optimising operations by increasing the use of green fuels and improving energy efficiency to reduce our carbon footprint.

We are also optimising thermal energy consumption and reducing electrical power usage. Notably, we are the first cement company in the Northeast to deploy EV tippers at scale for limestone transportation from mines to plants. Additionally, we have installed belt conveyors for limestone transfer, which further reduces emissions. All these initiatives together help us achieve regulatory compliance while supporting expansion.

Looking ahead to 2030 and 2050, what are the key innovation and sustainability priorities for Star Cement?

Across the cement industry, carbon capture is emerging as a major focus area, and we are also planning to work actively in this space. In parallel, we see strong potential in green hydrogen and are investing in solar power plants to support this transition.

With the rapid adoption of solar energy, power costs have reduced dramatically – from 10–12 per unit to around2.5 per unit. This reduction will enable the production of green hydrogen at scale. Once available, green hydrogen can be used for electricity generation, to power EV fleets, and even as a fuel in cement kilns.

Burning green hydrogen produces only water and oxygen, eliminating carbon emissions from that part of the process. While process-related CO2 emissions from limestone calcination remain a challenge, carbon capture technologies will help address this. Ultimately, while becoming a carbon-negative industry is challenging, it is a goal we must continue to work towards.

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence

FORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence