Concrete

The Great Indian Disruption

Published

3 years agoon

By

admin

From witnessing the entry of the Adani Group directly at No 2 position to dealing with margin compression, hike in commodity and fuel prices and decline in net profits, the Indian cement industry is living the aftermath of a big disruption.

It all started in the year 2020. As the Covid-19 pandemic hit the world, the cement industry felt its devastating effects, too. That was the beginning of the disruption. Two years later, the Indian cement industry experienced a paradigm shift with the entry of the Adani Group and the exit of Holcim. The current scenario involves the economic changes that are likely to have a long-term impact on the industry. Let us look at the great Indian disruption of the cement industry.

The Recap

According to reports, the Adani Group had been planning to enter the cement industry for some time and it had also formed a subsidiary called Adani Cement Industries Ltd in June 2021. The company was apparently planning to build an integrated plant in Kutch, Gujarat, and grinding units in Dahej, Gujarat, and Raigad, Maharashtra. It also won limestone blocks in Andhra Pradesh, Gujarat, and Rajasthan by bidding process.

The sudden entry by Adani through aggressive bidding changed the industry gesture. As soon as Holcim announced its exit from the Indian market, a brutal bidding war took place to acquire its assets, and at the end of it, the assets were acquired by the Adani Group. This is India’s largest M&A transaction in the infrastructure and materials sector.

Billionaire Gautam Adani’s entry into the cement industry with the acquisition of Holcim-listed cement assets in India, namely ACC and Ambuja Cement, for an amount of just less than $10 billion may lead to unification in the industry as large players may try to gain smaller marginal players. In a speech at an event to mark the completion of the acquisition, the Adani Group Founder and Chairman said the ports-to-energy has in a single stroke become the second largest manufacturer in the country only behind UltraTech cement. A few days after the acquisition of ACC and Ambuja Cement, Adani announced his plans to double the existing cement manufacturing capacity of 70 million tonnes per year within the next five years, putting it close to market leader UltraTech Cement, and becoming the most profitable manufacturer in India till 2030, which will definitely benefit the cement industry.

With the cement sector historically growing at 1.1 per cent to 2 per cent higher than the GDP Adani expects the cement sector to grow to 8 per cent to 10 per cent. Gautam Adani’s acquisition of cement giants Ambuja and ACC from Holcim has set off a rally in both stocks adding a sufficient amount to investors’ wealth. As per analysts, ACC and Ambuja Cement will benefit from Adani’s acquisition by acquiring 63.1 per cent of Ambuja Cement along with related assets. With the government’s push to build infrastructure in India cement demand is likely to stay strong with ACC and Ambuja to benefit in the long run, the analysts added. According to Adani, Ambuja Cement and ACC operations are energy intensive, and when combined with Adani’s renewable power generation capabilities these operations

can gain a great benefit that is a must for the Indian industry.

The entry of Adani, which renovated the boards of ACC and Ambuja Cement to reflect the largest takeover in India’s infrastructure sector, would infuse Rs 20,000 crore in Ambuja Cement through preferential allotment of shares, which will further strengthen Ambuja’s balance sheet and fulfill the capital requirements for economic development, further additions and investments in technology. This investment reveals Adani’s commitment to the cement sector and an attempt to completely transform the cement sector. With Ambuja and ACC in its fold, the Adani group will now have nine listed companies in the stock market.

Adani’s foray into the cement industry is the tip of the iceberg. The larger picture involves the exponentially growing infrastructure sector in the country. Here’s how Adani’s presence has made a difference to other players and market dynamics, and is likely to continue:

- Solidifying and unifying the company’s operations in real estate and infrastructure

- Backward integration of its assets in other heavy industries such as coal and power

- With the combined capacities of Ambuja and ACC, Adani commands the second highest cement manufacturing capacity of 70 million tonnes

- Mandatory open offers in both the companies led to their respective share prices spiking up

- Clearly Adani will aim for the No. 1 position, and that will have the company scouting for mergers and acquisitions.

- Adding to its existing capacity is another important way in which the company will try to increase cement production.

The Real Twist

The real estate market faced the repercussions of the pandemic at a maximum. Today, as the necessary corrections have been done, we are looking at changing trends, which are having a direct impact on the demand for cement.

Shraddha Kedia-Agarwal, Director, Transcon Developers, said, “In the post-Covid world, there is a shift in demand for sea-facing homes with large open spaces like balconies, terraces, courtyards, gardens, and parks in the vicinity. Work-from-home and the hybrid work culture have changed the pattern for most home buyers in the post-Covid era. Owning a home is no more a matter of investment preference, but a necessity, given the boost that a luxury residence has come to lodge in the wider perspective of the work-life choices. The latest trends of customer preferences have shifted from premium real estate to a more sophisticated approach, buyers who want to get a lifestyle that can flawlessly include the work-from-home notion, while not giving up on the lavishness and comforts of luxury living. These trends are expected to continue in 2023 as well.”

She also pointed out that with RERA ensuring transparency and laws allowing 100 per cent FDI in construction, Indian real estate is witnessing sharp investment infusions from NRIs. The new class of ultra-rich people is on a buying spree of luxury homes in global cities like Mumbai, Bangalore, etc. The Indian markets are proving their grit and potential, it is now time for investors to decide if they want to benefit from India’s future potential.

“With the rise in cement cost and other building material costs, the same will eventually be carried forward to the buyer. This is a basic entrepreneurial rule. New launches will be expensive. In their initial stages, they may be at a 10 to 20 per cent lower cost, but I am foreseeing a rise in real estate price of about 18 to 20 per cent in the near future,” says Ketan Patel, Director, Akshar Group.

Pointing out the change in consumer behaviour, he said that when the price of projects increase, there is a setback of 10 to 15 per cent in the overall sales funnel. “What we have observed over the years is that the number of enquiries go down when there is an increase in price. However, the customer who is looking to buy a house or property or upgrade does come through and convert as a customer.”

The Big Picture

The objective of the Adani Group behind this takeover is to move beyond its central business of power plants, ports, and coal mine operations and expand into new fields such as airports, data centres, and digital services. Entering the cement industry is, no doubt, a part of that plan.

With so many companies moving their manufacturing operations to India, the country’s status as a preferred manufacturing destination has become firm, and with Adani’s entry, both of these will together lead to a multiplier effect on jobs and income, higher productivity, cost-effectiveness, and higher consumption. With the entry of Adani into cement considering additional capacities in western and eastern regions in the last three-quarters Adani aims that he should be able to grow at a rate faster than the industry and outperform other competitors.

In October 2021, Prime Minister Narendra Modi launched the PM Gati Shakti- National Master Plan (NMP) for multiple modes of connectivity. Gati Shakti will drive synergy to create an outstanding, seamless transport network in India. The Gati Shakti Scheme will give a much-needed advantage to infrastructure development and handling across India which will bring economic growth and will boost the cement industry. The plans to expand highways and create new cargo terminals under the PM Gati Shakti – National Master Plan will not only boost the competitiveness of the Indian industry by lowering the cost of transportation but also lead to better connectivity between production centers and consumption markets, both domestic and global. With this Master Plan, Adani Group will benefit from the economies of scale for its infrastructure business. This will raise the demand for cement in the future.

Holcim, in a statement, had said, “The corresponding offer share prices of Rs 385 for Ambuja Cement and Rs 2,300 for ACC Cement express into cash proceeds of CHF 6.4 billion for Holcim.” As per analysts, the deal is positive from a long-term perspective as it will help them in bringing down costs, and trim debts, which will lead to better margins and high returns. The deal also highlights the growing supremacy of Indian companies to complete the last transactions with foreign players and help Adani Group increase its global impression and would also help in the backward alliance as the company is constructing airports and other infrastructure projects. This will also help the sector to turn the weaker demands that have hurt the sector so far towards the sector.

The takeover of the Holcim Group’s stake in Ambuja Cement and ACC Ltd is an opportunity to attain decarbonisation of the cement sector for India to attain targets of reducing the carbon intensity of the Indian economy to below 45 per cent by 2030 and almost nil by 2070.

The Adani Group is willing to judge all opportunities present there and will consider one that is strategically correct and available at a reasonable valuation. While with the takeover of the Holcim stake in ACC Ltd. and Ambuja Cement is an opportunity for Adani to position breakthrough technologies and raise its standards in the cement sector globally. But it is sure that Adani’s entry will affect the competition and soon Adani will fit in the hard-to-abate cement in their green dream.

The Cost Impact

The cement industry has so far not been able to improve cement prices to the required extent to pass on an increase in input energy costs.

Jatin Shah, Chief Technical Officer and Managing Director, TDD, Colliers India, “Cement price as per last report has risen by about 9 per cent in October 2022 compared to March 2022. Other components like steel, aluminium, copper, etc, which are significant contributors also remain volatile. The construction cost has gone up due to various factors like labour cost and cost of transport coupled with material price volatility. This remains a concern for the developer, contractors and will continue to impact the industry.”

He advises developers to keep an eye on the fluctuating prices. He says, “Volatile market leads to hedging of prices. We recommend the developers to remain watchful for bulk procurement and approach projects with Just in time approach, tweak contracts to bring in more materials linked to basic prices and take contractors into confidence.”

In an earlier statement from Colliers India, Ramesh Nair, Chief Executive Officer, India and Managing Director, Market Development, Asia, Colliers, commented, “Costs of key construction materials are likely to remain volatile for next few months due to uncertainties created by geo-political issues, persistent lockdowns in China and a probable global recession. Prices of key construction materials will hinge on multiple factors including global economic situation, inflation rates and supply constraints. Therefore, developers are likely to push new launches till the input prices further decline, as any further surge in the cost of construction materials would impact the timely delivery of ongoing projects and disrupt their cash flows resulting in increase in housing prices.”

Speaking about the immediate effect of the rising costs, Vinit Tiwari, Chief Sales Officer, Nuvoco Vistas Corp Ltd, says, “ Consolidation has resulted in an organised market, and processes will be streamlined as a result. We anticipate that competition will become more intense in the future as more companies enter the market with expanded capacity, but at Nuvoco, we are focusing on our key competencies: quality, innovation, and value for money. We are advancing our core competency of offering premium products while maintaining our core values. As part of our efforts, we are strengthening our supply chain and digitising the purchasing process.”

The Price Factor

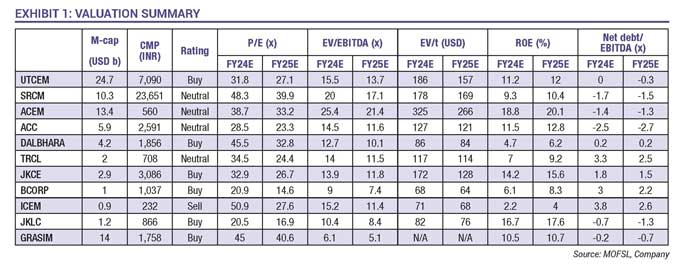

- A report by Motilal Oswal titled ‘Cement: Demand Recovery Seen but Price Volatility Continues’, the following points have been elucidated about the recovering demand for cement.

- Cement demand has recovered in the last few weeks largely driven by government infrastructure projects, while trade demand has remained muted. We expect 7 per cent demand growth YoY in 3QFY23, aided by the low base of last year. Our discussions with industry participants indicate that YTD volume growth in the non-trade segment (15 per cent YoY growth) is better than the trade segment (3-4 per cent YoY growth).

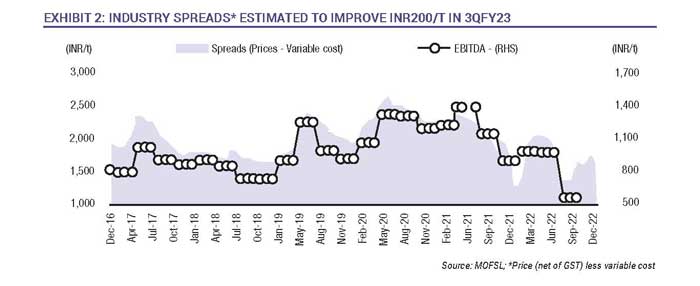

- Post 2QFY23, while the Eastern region has witnessed a consistent price improvement, the Northern and Central regions have yet to see a sustained price improvement. The pan-India average price seems to be up 2-3 per cent QoQ in 3QFY23.

- Volatility continues in coal/petcoke prices, with petcoke prices falling in Nov/Dec ’22 and coal prices increasing in the last few weeks. We expect an average energy cost reduction of Rs 50-70/t in 3QFY23 and INR100/t in 4QFY23.

- Average spreads (cement price net of GST- variable costs) for the industry is expected to improve by Rs 200/t QoQ (v/s INR300/t estimated earlier), given the rollback of price hikes announced in Nov ’22.

Demand recovers from mid-Nov ’22, east and south outperforming

- After demand weakness due to the festive season in Oct ’22, cement demand recovered from mid-Nov ’22, and we believe that volumes grew 18-20 per cent YoY in Nov ’22, aided by the absence of festive seasons and the low base of last year due to sand mining issues in the East region. We estimate combined volume growth of 6-7 per cent YoY in Oct-Nov ’22.

- We believe that cement demand is driven by improvement from the non-trade segment, largely driven by government infrastructure projects. IHB demand has yet to recover. We expect cement demand to register a growth of 5-6 per cent YoY in Dec ’22 and 7 per cent YoY in 3QFY23.

- Demand in the East and South regions seem to be strong, as per our discussions with industry participants. The demand trend is likely to remain positive, given the start of the peak construction period and pre-election government spending toward infrastructure development. We estimate overall demand growth of ~10 per cent YoY in FY23.

- The report further highlighted the pricing changes with details on the pan-India average price, which was up ~1 per cent MoM and ~7 per cent YoY in Nov ’22.

- Average cement prices increased Rs 5-15/bag MoM in the North, East, and Maharashtra markets, while they declined Rs 5/bag MoM in South India in Nov ’22. Cement prices remained flat in central India and Gujarat.

- The highest increase was seen in East India (up ~5 per cent MoM), followed by North and Maharashtra (up ~1 per cent MoM). Cement price in South India declined 2 per cent MoM (except in Kerala, up ~1 per cent). Although cement manufacturers announced price hikes of INR10/bag in Dec ’22, our channel checks indicate that cement prices have dropped by Rs 5-10/bag in the South region from 19th Dec.

- The pan-India average price seems to be up ~3 per cent QoQ in 3QFY23 QTD, with the highest increase seen in East (~9 per cent), followed by South and West (~4 per cent each). The average price is flat QoQ in the North, and there should be a marginal decline in central India (down 0.6 per cent QoQ).

Conclusion

“One of the primary concerns is that cement prices have not increased at a rate consistent with the increase in production and distribution costs. As we see it, this is an opportunity for the sector to analyse cost components by line item, from production to distribution. We are currently working on reducing our costs in order to remain competitive,” states Tiwari.

There is definitely an opportunity here. As a new year has dawned, signs of a strong demand revival are already visible for the cement sector. There are corrections in the offing with regards to lower realisations and higher operating costs. Year 2023 is looking promising for cement companies, starting with a rise in demand and price correction, which has already started in East and South India. As the government backs infrastructure projects and

real estate demand picks up pace, the year ahead looks buoyant for India’s cement sector and its disruptors.

You may like

Concrete

UltraTech Appoints Jayant Dua As MD-Designate For 2027

Executive named to succeed current managing director in 2027

Published

2 days agoon

March 10, 2026By

admin

UltraTech Cement has appointed Jayant Dua as managing director (MD) designate who will take charge in 2027, the company announced. The appointment signals a planned leadership transition at one of the country’s largest cement manufacturers. The board has set a clear timeline for the handover and has framed the move as part of a structured succession plan.

Jayant Dua will be referred to as MD after assuming the role and will be responsible for overseeing operations, strategy and growth initiatives across the company’s network. The company said the designation follows established governance norms and aims to ensure continuity in executive leadership. The appointment is expected to allow a phased transfer of responsibilities ahead of the formal changeover.

The decision is intended to provide strategic stability as UltraTech Cement navigates domestic infrastructure demand and evolving market dynamics. Management will continue to focus on operational efficiency, capacity utilisation and cost management while aligning investments with long term objectives. The board will monitor the transition and provide further information on leadership responsibilities closer to the effective date.

Investors and market observers will have time to assess the implications of the announcement before the change is effected, and analysts will review the company’s outlook in the context of the succession. The company indicated that it will communicate any additional executive appointments or organisational changes as they are finalised. Shareholders were advised to refer to formal filings and company releases for definitive details on governance or remuneration.

The leadership change will be managed with attention to stakeholder interests and operational continuity, and the company reiterated its commitment to delivery on ongoing projects and customer obligations. Senior management will engage with employees and partners to ensure a smooth handover while maintaining focus on safety and compliance. Further updates will be provided through official investor communications in due course.

Concrete

Merlin Prime Spaces Acquires 13,185 Sq M Land Parcel In Pune

Rs 273 crore purchase broadens the developer’s Pune presence

Published

6 days agoon

March 6, 2026By

admin

Merlin Prime Spaces (MPS) has acquired a 13,185 sq m land parcel in Pune for Rs 273 crore, marking a notable expansion of its footprint in the city.

The transaction value converts to Rs 2,730 mn or Rs 2.73 bn.

The parcel is located in a strategic area of Pune and the firm described the acquisition as aligned with its growth objectives.

The deal follows recent activity in the region and will be watched by investors and developers.

MPS said the acquisition will support its planned development pipeline and enable delivery of commercial and residential space to meet local demand.

The company expects the site to provide flexibility in product design and phased development to respond to market conditions.

The move reflects an emphasis on land ownership in key suburban markets.

The emphasis on land acquisition reflects a strategy to secure inventory ahead of demand cycles.

The purchase follows a period of sustained investor interest in Pune real estate, driven by expanding office ecosystems and residential demand from professionals.

MPS will integrate the new holding into its existing portfolio and plans to engage with local authorities and stakeholders to progress approvals and infrastructure readiness.

No financial partners were disclosed in the announcement.

The firm indicated that timelines will depend on approvals and prevailing market conditions.

Analysts note that strategic land acquisitions at scale can help developers manage costs and timelines while preserving optionality for future projects.

MPS will now hold an enlarged land bank in the region as it pursues growth, and the acquisition underlines continued corporate appetite for measured expansion in second tier cities.

The company intends to move forward with detailed planning in the coming months.

Stakeholders will assess how the site is positioned relative to existing infrastructure and connectivity.

Concrete

Adani Cement and Naredco Partner to Promote Sustainable Construction

Collaboration to focus on skills, technology and greener practices

Published

6 days agoon

March 6, 2026By

admin

Adani Cement has entered a strategic partnership with the National Real Estate Development Council (Naredco) to support India’s construction needs with a focus on sustainability, workforce capability and modern building technologies. The collaboration brings together Adani Cement’s building materials portfolio, research and development strengths and technical expertise with Naredco’s nationwide network of more than 15,000 member organisations. The agreement aims to address evolving demand across housing, commercial and infrastructure sectors.

Under the partnership, the organisations will roll out skill development and certification programmes for masons, contractors and site supervisors, with training to emphasise contemporary construction techniques, safety practices and quality standards. The programmes are intended to improve project execution and on-site efficiency and to raise labour productivity through standardised competencies. Emphasis will be placed on practical training and certification pathways that can be scaled across regions.

The alliance will function as a platform for knowledge sharing and technology exchange, facilitating access to advanced concrete solutions, innovative construction practices and modern materials. The effort is intended to enhance structural durability, execution quality and environmental responsibility across developments while promoting adoption of low-carbon technologies and green cement alternatives. Companies expect these measures to contribute to longer term resilience of built assets.

Senior executives conveyed that the partnership reflects a shared commitment to strengthening quality and sustainability in construction and that closer engagement with developers will help integrate advanced materials and technical support throughout the project lifecycle. Leadership noted the need for responsible construction practices as urbanisation accelerates and indicated that the association should encourage wider adoption of green building norms and collaboration within the real estate and construction ecosystem.

The organisations said they will also explore integrated building solutions, including ready-mix concrete offerings, while supporting initiatives aligned with affordable and inclusive housing. The partnership will progress through engagements, conferences and joint training programmes targeting rapidly urbanising cities and growth centres where demand for efficient and environmentally responsible construction grows. Naredco, established under the aegis of the Ministry of Housing and Urban Affairs, will leverage its policy and advocacy role to support implementation.

UltraTech Appoints Jayant Dua As MD-Designate For 2027

Merlin Prime Spaces Acquires 13,185 Sq M Land Parcel In Pune

Adani Cement and Naredco Partner to Promote Sustainable Construction

Operational Excellence Redefined!

World Cement Association Annual Conference 2026 in Bangkok

UltraTech Appoints Jayant Dua As MD-Designate For 2027

Merlin Prime Spaces Acquires 13,185 Sq M Land Parcel In Pune

Adani Cement and Naredco Partner to Promote Sustainable Construction

Operational Excellence Redefined!