The evolution of classifiers has hinged on improvement of their cutting ability, with a better sorting of fines and coarse and a lower by-pass, writes Anjani Kumar.

The continuous demand of increased strength cement by users has forced cement manufacturers to ensure cement of a higher fineness. The 33 grade has been upgraded to 53 grade or more and to do so, cement manufacturers have to either increase the fineness or reduce the residues on either # 272 or #72 mesh.

The result of increasing fineness has practically reduced the total productivity of a typical grinding system by 10 to 15per cent. The total capacity of the plant had gone down considerably, too. The increase in the cost of raw materials and energy, coupled with reduction in the productivity of the plant grinding systems calls urgently for new technology that can produce high strength cement without reducing the capacity of the existing grinding circuit.

Evolution of separators

Soon, classifiers came on the scene, converting open circuit grinding circuits into closed circuit grinding. The first generation separators were able to separate coarse from the fine but not the other way around. This was not meeting the desired requirements and so, further innovation led to the development of dynamic classifiers. The use of the separators allowed the product to be separated into fines and coarse fractions but the preciseness of separation depended on the efficiency and effectiveness of the separator.

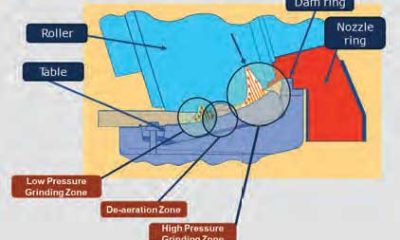

Traditionally, the ground particles from the grinding plant are fed to the separator for segregating into fine and coarse, and the coarse is again fed back to the grinding plant for further grinding. The principle of separation depends on the use of centrifugal forces in case of first generation separators and proper balancing of drag, gravitational and centrifugal forces in case of dynamic classifiers.

The second generation dynamic classifier has a rotating plate for dispersion of the materials. Air circulation is ensured by a rotating rotor that is fixed in the upper part. The final product falls down under gravity and is recovered via in a double conical casing. An additional fan is added to the circuit to suck the gas output with the fines instead of rotating rotor, and this has further improved the separation efficiency in what is is known as the third- generation classifiers.

Development of LVT classifiers

Further development to the design of the rotor blades and guide vanes by LV Technology in Bangkok, helped in the evolution of the fourth- generation classifier with the highest separation efficiency and lowest pressure drop across the separating zone. In 2009, some more features were added by redesigning the rotor blades and the seals to improve further the classifying efficiency. Classifiers for all the applications including fly-ash were developed subsequently.

LVT classifiers are installed for various applications, at various grinding circuits, including ball mills, vertical mills, high pressure grinding roller press circuit (both in semi-finish and finish modes), vertical roller pre-grinder mills (both in semi-finish and finish modes), fly-ash.

Advantages of LVT classifiers

The LVT classifier is a fourth-generation classifier, in which separation takes place due to two opposing forces: the centrifugal force due to rotor blades rotation and the drag force due to passage of gases. The particle in equilibrium when these two forces are in balance and equal, determines the cutting diameter. By adjusting the rotor speed, the cutting diameter can be defined. The particles which are coarser than the cutting diameter undergoing higher centrifugal force than the drag force, are ejected out and fall due to gravity into the rejects grit cone. The finer particles for which the centrifugal force is lower than the drag force are attracted towards the centre and carried out by the gas.

Feeding arrangement

The feed is provided at the bottom and is kept in suspension. This type of arrangement ensures a proper and uniform distribution of material fluid in the entire cross- section of the rotor area. Another advantage of such an arrangement is it requires less space and can easily be used in vertical mills and air- swept ball mills.

LV packet type guide and rotor blades

The flow of the gas is controlled by the LV packet type guide vanes, which allows the tangential speed of the gas to be adapted to the speed of rotor blades so as to obtain only the radial speed of the rotor blades. Therefore, a drag force which is directly opposite to the centrifugal force is obtained, which reduces the wear on the blades considerably. The spacing and sizing of the blades also ensure proper homogeneity of the speed profiles upon inlet of the rotor on its periphery and height.

The configuration of the rotor blades ensures the cutting precision along with a high slope of separation. The rotor blades are designed in such a way that, regardless of the position in the passage between two blades, the cutting diameter is the same, which means the centrifugal and drag forces are the same for a given diameter of the particle. Two different shapes of rotor blades are developed and both will ensure the balancing of these two forces in order to maintain the same cut size throughout the blade length and width. Hence, the separating zone is not only limited to the rotor periphery but also extends to the entire passage between the blades.

The performance of a classifier is determined from the tromp curve which demonstrates the output for each size of particle.

The parameters are:

- Cut size: Particle size corresponds to 50 per cent.

- Kappa: Slope of the curve (Particle size distribution).

- Delta (By-pass): Lowest point on the curve. (Amount of by-pass).

Conclusion

In addition to improvements in productivity, the classifier also improves the quality and ensures reduction in overall power consumption. LVT classifiers have achieved more than 85 per cent efficiency in separation of fines and they do the job with a minimum pressure drop, thus saving power on the fan. The main advantage of the classifier is improved particle size distribution, famously known as ‘psd.’. With LVT classifiers, the psd is very steep and thus even with lower fineness, achieving higher strengths is possible.

In case of raw material grinding and coal/pet coke grinding, with LVT classifiers, the fineness has reduced considerably, hence the burning has become easier and also combustion improved, ultimately improving the overall performance of the plant. More than 300 LNVT successful installations are presently in operation.

KV Anjani Kumar, General Manager, (Process & Commissioning) Email:anjani@lnvt.com LNV Technology