Process

Cement manufacturers: Weathering the storm

Published

4 years agoon

By

admin

The Indian cement industry, has, over the years, employed the best available technology for production. Given their high degree of blended cement usage, Indian cement producers are at the forefront of both fuel and electrical energy consumption on a per tonne- of- product basis.

The Indian cement industry today, enjoys pride of place, being the second largest cement producer in the world. It has made rapid strides, not only in capacity addition but also in producing world-class quality cement from state-of-the-art technology. The industry currently accounts for about 7 per cent of the global production. On the energy front, the industry has proactively responded to the initiatives of the Bureau of Energy Efficiency in improvement of and reduction in energy consumption and some of the Indian plants have become global benchmarks in energy consumption, second only to Japan. The industry has also contributed significantly to the eco-friendly use of industrial wastes, thereby reducing its carbon emission. It currently consumes around 27 per cent of fly ash generated from thermal power plants, an environmentally hazardous waste and almost hundred per cent slag generated by the steel industry.

NA Viswanathan, Secretary General, Cement Manufacturers’ Association says, "The current economic slowdown has inevitably left a severe dent in the growth of the cement industry. The decline of the cement industry from an average growth of around 8 per cent to 9 per cent in the last couple of years to the present low of five per cent has shown no sign of improvement in capacity utilisation and this is still a major cause of concern. Currently, the demand-supply situation of cement is highly skewed, with the latter being significantly higher by over 90 million tonnes since the cement demand projections made by the government earlier have not materialised."

"Cement consumption has grown by about five per cent in FY2012-13 as compared to 7.1 per cent in FY2011-12. The demand growth in most of the regions is either declining or stagnating, with very few pockets of positive growth. Demand in the June quarter also remained weak due to early and heavy monsoons across India and poor infrastructure related growth," says Sumit Banerjee, Vice Chairman, Reliance Cement. Sumit adds, "The cement industry should bounce back in the next couple of years." According to RP Gupta, Chairman and Managing Director, Shiva Cement, substantial capacity was added in the recent past, in anticipation of a growth in demand. Gupta then goes on to say, , "Unfortunately, demand remains sluggish due to the slowdown in infrastructure and economy as a whole. However, such cyclical effects have been witnessed in the past,too. The cement industry being a core sector, the medium and long- term view should be taken, and that is certainly promising. Demand growth will definitely bounce back and excess capacity will bottom out in the next two years. Then again, new capacity additions are becoming difficult due to regulatory hurdles in land acquisition, mining leases and environmental approval. If these issues are not addressed, it can create a huge shortage and price hikes."

Speaking about the logistics issues, Gupta adds, "The logistics costs in our country are too high. Inadequate capacity in railways aggravates the problem for long- distance despatch of bulky product like cement, coal and minerals. In the larger interest of the country, we must transfer the traffic of goods by road to the railways; this is cost-efficient and reduces the burden of imported energy. This needs a major restructuring of railway and augmenting investment of Rs.12 lakh crore in the 12th Plan, as against the Rs 2.6 lakh crore of the 11th Plan."

Speaking about some of the challenges the industry faces, Pawan Ahluwalia, Managing Director, KJS Cement had this to say: "Taxation is highly skewed for cement; we would like to see a rationalised tax structure. Another issue is that the demand-supply scenario is out of sync, yet major players are into augmentation of capacity. The input costs have gone up; the logistic costs are heading north, as also overhead costs. These are impacting an industry which is still in consolidation mode. So, the growth of the cement industry, as per my understanding, is going to be about 11 to 12 per cent, as has been projected by the Planning Commission."

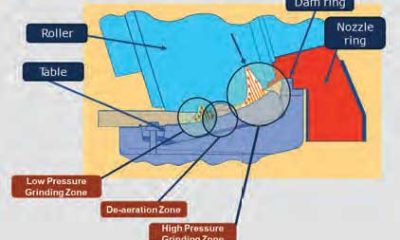

Voicing his concern about the lack of support from the government at policy level, Alok Sanghi, Director, Sanghi Industries, says, "The excise duty on steel is just four per cent, whereas for cement it is 12 per cent. My question is, why should there be such a difference in duty between two building materials which are used for the same purpose? Ultimately, the cost of housing is increasing because of the increase in taxes. If you look at the ex- factory cost of cement and if you add the taxes we are paying, it is equivalent to luxury goods, and cement is essential goods. So I think the government really needs to focus on how they can reduce the cost of cement, either by reducing the royalties or reducing the excise duty, VAT, etc. My view is, the most important thing the government can do is to increase the percentage spend on infrastructure development. For example, China spends almost 12 per cent of its GDP on infrastructure development whereas India spends less than five per cent. So, if the government increases its infrastructure spend, it will automatically have a huge impact on the demand for cement and that obviously will help in capacity utilisation." Speaking about the technological advancement in the industry, Bidyut Bhattacharya, Technical Director, Sinoma International Engg Co India says, "The Indian cement industry, over the years, has employed the best available technology for production. Thanks to a high degree of blended cement utilisation, Indian cement producers are at the forefront of fuel and electrical energy consumption on a per tonne- of- product basis. An additional benefit in terms of sustainability is the lower per tonne CO2 emission. Stricter regulatory requirements are leading to greener technologies, and they in turn, lead to further energy efficiency." According to him, utilising a vertical roller mill or roll press circuit in finish grinding mode for raw material grinding is the industry norm today, and this makes for a significant energy cost reduction when compared to the traditional closed circuit ball mill system. Likewise, for coal grinding, a vertical mill is used, and for the energy- intensive finish grinding process, the ball mill plus roll press system is widely popular. In specific cases where slag grinding is involved with high percentage moisture, the VRM technology for finish grinding is used. Only in extreme cases do we get a request for close circuit ball mill for grinding, this is inherently less energy- efficient. High efficiency separators are the standard today for all milling systems."

Bidyut adds, "As regards the pyro-processing area, Indian cement producers continuously strive to achieve the lowest specific fuel consumption along with high power savings. High efficiency fourth- generation grate coolers are being widely used; they provide high recuperation efficiency along with lower maintenance interventions. As the total cooling air requirement reduces from the earlier 2.2Nm3/kg clinker to say, 1.8Nm3/kg clinker, there is a lot of savings through reduced exhaust air and fans` power consumption.

To achieve lower fuel consumption, six stage pre-heater systems are the popular choice, along with in- line calciners. Advanced low NOx technologies are used in many cement plants. As regards process fans, a static efficiency = 82 per cent and use of variable speed drives reduces power consumption."

According to him, however, there is scope for improvement, especially with regard to waste heat recovery systems which is slowly catching on in India. Bidyut says, "It is imperative to make WHR a mandatory requirement for any new cement plant, as is the case in some emerging countries. A significant portion of the energy requirement can be sourced through utilisation of waste heat from the pre-heater and cooler. In this context, Indian cement producers/consultants need to do a more specific, case- to- case basis, cost- benefit analysis for the six stage vs. the five stage pre-heater system, specifically when raw material moisture is high or when civil design parameters like wind speed/seismic conditions are not favourable. Also, these days, the usage of alternate fuels in cement processing is quickly picking up.

Considering the dwindling quality/supply of domestic coal and the logistic issues of imported supply, a variety of alternate fuels are being utilised cost- effectively; not only pet coke but a host of other materials from tyres to rice husk, plastic, sawdust, are all being used. Utilisation of municipal wastes/ sludge is still in its infancy in India, primarily due to supply- side bottlenecks."

Bidytu ends, saying, " It is worthwhile to mention here that cement pyro-processing systems are highly suitable for burning waste materials, apart from contributing to the calorific value, because of some pertinent factors: the very high incineration temperature, close to 1,800 to 2,000 deg C at the flame zone, the higher residence time, say five to six seconds in calciners, the assimilation of heavy metals in the clinker, negligible dust emissions through the kiln bag filters and the dry dust curtains with high surface area in the pre-heater which scrubs the gases of pollutants."

You may like

-

Double Tap to Go Green

-

15th Cement EXPO to be held in March 2025 in Hyderabad

-

14th Cement EXPO

-

Vinita Singhania receives Lifetime Achievement Award at the 7th Indian Cement Review Awards

-

Increasing Use of Supplementary Cementitious Materials

-

Indian Cement Review Touts Decarbonisation Mantra & Awards Growth

Concrete

Steel: Shielded or Strengthened?

CW explores the impact of pro-steel policies on construction and infrastructure and identifies gaps that need to be addressed.

Published

3 weeks agoon

January 31, 2026By

admin

Going forward, domestic steel mills are targeting capacity expansion

of nearly 40 per cent through till FY31, adding 80-85 mt, translating

into an investment pipeline of $ 45-50 billion. So, Jhunjhunwala points

out that continuing the safeguard duty will be vital to prevent a surge

in imports and protect domestic prices from external shocks. While in

FY26, the industry operating profit per tonne is expected to hold at

around $ 108, similar to last year, the industry’s earnings must

meaningfully improve from hereon to sustain large-scale investments.

Else, domestic mills could experience a significant spike in industry

leverage levels over the medium term, increasing their vulnerability to

external macroeconomic shocks.(~$ 60/tonne) over the past one month,

compressing the import parity discount to ~$ 23-25/tonne from previous

highs of ~$ 70-90/tonne, adds Jhunjhunwala. With this, he says, “the

industry can expect high resistance to further steel price increases.”

Domestic HRC prices have increased by ~Rs 5,000/tonne

“Aggressive

capacity additions (~15 mt commissioned in FY25, with 5 mt more by

FY26) have created a supply overhang, temporarily outpacing demand

growth of ~11-12 mt,” he says…

Process

Price hikes, drop in input costs help cement industry to post positive margins: Care Ratings

Published

4 years agoon

October 21, 2021By

admin

Region-wise,the southern region comprises 35% of the total cement capacity, followed by thenorthern, eastern, western and central region comprising 20%, 18%, 14% and 13%of the capacity, respectively.

The cement industry is expected to post positive margins on decent price hikes over the months, falling raw material prices and marked drop in overall production costs, said an analysis of Care Ratings.

Wholesale and retail prices of cement have increased 11.9% and 12.4%, respectively, in the current financial year. As whole prices have remained elevated in most of the markets in the months of FY20, against the corresponding period of the previous year.

Similarly, electricity and fuel cost have declined 11.9% during 9M FY20 due to drop in crude oil prices. Logistics costs, the biggest cost for cement industry, has also dropped 7.7% (selling and distribution) as the Railways extended the benefit of exemption from busy season surcharge. Moreover, the cost of raw materials, too, declined 5.1% given the price of limestone had fallen 11.3% in the same aforementioned period, the analysis said.

According to Care Ratings, though the overall sales revenue has increased only 1.3%, against 16% growth in the year-ago period, the overall expenditure has declined 3.2% which has benefited the industry largely given the moderation in sales.

Even though FY20 has been subdued in terms of production and demand, the fall in cost of production has still supported the cement industry by clocking in positive margins, the rating agency said.

Cement demand is closely linked to the overall economic growth, particularly the housing and infrastructure sector. The cement sector will be seeing a sharp growth in volumes mainly due to increasing demand from affordable housing and other government infrastructure projects like roads, metros, airports, irrigation.

The government’s newly introduced National Infrastructure Pipeline (NIP), with its target of becoming a $5-trillion economy by 2025, is a detailed road map focused on economic revival through infrastructure development.

The NIP covers a gamut of sectors; rural and urban infrastructure and entails investments of Rs.102 lakh crore to be undertaken by the central government, state governments and the private sector. Of the total projects of the NIP, 42% are under implementation while 19% are under development, 31% are at the conceptual stage and 8% are yet to be classified.

The sectors that will be of focus will be roads, railways, power (renewable and conventional), irrigation and urban infrastructure. These sectors together account for 79% of the proposed investments in six years to 2025. Given the government’s thrust on infrastructure creation, it is likely to benefit the cement industry going forward.

Similarly, the Pradhan Mantri Awaas Yojana, aimed at providing affordable housing, will be a strong driver to lift cement demand. Prices have started correcting Q4 FY20 onwards due to revival in demand of the commodity, the agency said in its analysis.

Industry’s sales revenue has grown at a CAGR of 7.3% during FY15-19 but has grown only 1.3% in the current financial year. Tepid demand throughout the country in the first half of the year has led to the contraction of sales revenue. Fall in the total expenditure of cement firms had aided in improving the operating profit and net profit margins of the industry (OPM was 15.2 during 9M FY19 and NPM was 3.1 during 9M FY19). Interest coverage ratio, too, has improved on an overall basis (ICR was 3.3 during 9M FY19).

According to Cement Manufacturers Association, India accounts for over 8% of the overall global installed capacity. Region-wise, the southern region comprises 35% of the total cement capacity, followed by the northern, eastern, western and central region comprising 20%, 18%, 14% and 13% of the capacity, respectively.

Installed capacity of domestic cement makers has increased at a CAGR of 4.9% during FY16-20. Manufacturers have been able to maintain a capacity utilisation rate above 65% in the past quinquennium. In the current financial year due to the prolonged rains in many parts of the country, the capacity utilisation rate has fallen from 70% during FY19 to 66% currently (YTD).

Source:moneycontrol.com

Process

Wonder Cement shows journey of cement with new campaign

Published

4 years agoon

October 21, 2021By

admin

The campaign also marks Wonder Cement being the first ever cement brand to enter the world of IGTV…

ETBrandEquity

Cement manufacturing company Wonder Cement, has announced the launch of a digital campaign ‘Har Raah Mein Wonder Hai’. The campaign has been designed specifically to run on platforms such as Instagram, Facebook and YouTube.

#HarRaahMeinWonderHai is a one-minute video, designed and conceptualised by its digital media partner Triature Digital Marketing and Technologies Pvt Ltd. The entire journey of the cement brand from leaving the factory, going through various weather conditions and witnessing the beauty of nature and wonders through the way until it reaches the destination i.e., to the consumer is very intriguing and the brand has tried to showcase the same with the film.

Sanjay Joshi, executive director, Wonder Cement, said, "Cement as a product poses a unique marketing challenge. Most consumers will build their homes once and therefore buy cement once in a lifetime. It is critical for a cement company to connect with their consumers emotionally. As a part of our communication strategy, it is our endeavor to reach out to a large audience of this country through digital. Wonder Cement always a pioneer in digital, with the launch of our IGTV campaign #HarRahMeinWonderHai, is the first brand in the cement category to venture into this space. Through this campaign, we have captured the emotional journey of a cement bag through its own perspective and depicted what it takes to lay the foundation of one’s dreams and turn them into reality."

The story begins with a family performing the bhoomi poojan of their new plot. It is the place where they are investing their life-long earnings; and planning to build a dream house for the family and children. The family believes in the tradition of having a ‘perfect shuruaat’ (perfect beginning) for their future dream house. The video later highlights the process of construction and in sequence it is emphasising the value of ‘Perfect Shuruaat’ through the eyes of a cement bag.

Tarun Singh Chauhan, management advisor and brand consultant, Wonder Cement, said, "Our objective with this campaign was to show that the cement produced at the Wonder Cement plant speaks for itself, its quality, trust and most of all perfection. The only way this was possible was to take the perspective of a cement bag and showing its journey of perfection from beginning till the end."

According to the company, the campaign also marks Wonder Cement being the first ever cement brand to enter the world of IGTV. No other brand in this category has created content specific to the platform.

Refractory demands in our kiln have changed

Digital supply chain visibility is critical

Redefining Efficiency with Digitalisation

Cement Additives for Improved Grinding Efficiency

Digital Pathways for Sustainable Manufacturing

Refractory demands in our kiln have changed

Digital supply chain visibility is critical

Redefining Efficiency with Digitalisation

Cement Additives for Improved Grinding Efficiency