Economy & Market

A Strategic Asset for the Future

Published

2 months agoon

By

admin

As decarbonisation reshapes cement manufacturing, refractory systems have become pivotal to both operational resilience and future-ready kiln design. Professor Procyon Mukherjee explains how their evolution now defines the limits and possibilities of the industry’s transformation.

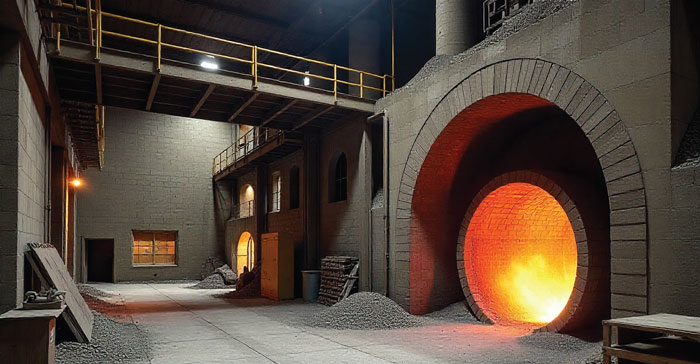

Refractory materials and pyro-processing remain the beating heart of cement manufacture. As attention shifts from incremental efficiency gains to decarbonisation and resilience, refractories and kiln-system technologies are both constraint and opportunity: they determine how fast plants can adopt alternative fuels, electrified heat, oxy-fuel systems or CCS, and they often account for a material portion of operating cost, downtime risk and capital renewal. In this article, I have tried to synthesise market signals, emerging technologies, green pathways, supplier developments and the cost outlook you need to brief for designing strategic investments for the cement industry in particular.

Demand drivers and industry structure

The global refractories market — of which cement is a major end-use alongside steel and glass — is large and growing, driven by construction activity in APAC, replacement demand (wear and corrosion), and investments related to kiln retrofits and decarbonisation projects. Recent market analyses place the refractories industry value in the multiple tens of billions of dollars and forecast steady mid-single-digit growth over the coming decade, with Asia (especially China and India) accounting for the largest regional share.

Market structure is oligopolistic at the high end. A handful of global players (RHI Magnesita, Vesuvius, Calderys/Imerys, Saint-Gobain, Krosaki Harima, Morgan Advanced Materials, etc.) supply engineered refractories, backed by regional and specialist vendors that dominate lower-cost or commodity segments. Mergers and vertical integration around alumina/magnesia feedstocks are active themes as refractory firms seek to secure raw-material supply and control quality and costs. A recent example is RHI Magnesita’s strategic acquisition of the U.S. alumina producer Resco, aimed at supply-chain security for alumina-based refractories. Most strategic sourcing models are moving to long term partnerships, which could extend to service models as well.

From the purchaser’s side, refractory selection is now evaluated not only against thermal and chemical resilience but on a broader life-cycle basis: uptime impact, ability to tolerate alternative fuels (biomass, waste-derived fuels, SRF/plastics), compatibility with oxy-fuel or electrified heat, and the ease of condition monitoring and targeted repairs. Key technical drivers include:

- Resistance to alkali attack and melt penetration under high-chloride / high-alkali fuels.

- Thermal shock tolerance as preheater/cooler cycling increases with flexible operation.

- Low thermal conductivity with structural strength to reduce heat losses.

- Compatibility with sensor embedding and digital monitoring to enable predictive maintenance.

These needs are changing refractory specifications — and therefore supplier offerings — quickly.

Emerging technologies

Several material and process innovations are maturing that directly affect kiln reliability and total cost of ownership:

1. Advanced engineered monolithics and castables: Improved bonding chemistries, nano-modifiers, and lower alkali reactivity variants lengthen campaign life and reduce patch repairs. These allow quicker repairs and less kiln downtime.

2. 3D printing and prefabricated brick assemblies: Additive manufacturing of complex refractory shapes (for riser ducts, burner blocks, throat areas) enables bespoke geometries and faster onsite installation with better dimensional control where space/access is constrained.

3. Sensorised refractories and embedded monitoring: Thermocouples, acoustic emission sensors

and distributed fibre-optic temperature measurement are being embedded to give real-time maps of lining health. These digital twins enable condition-based maintenance rather than calendar-based shutdowns.

4. Hybrid lining systems: Combining high-performance bricks in the hot face with insulating monolithics behind them to optimise performance vs cost.

Publications and industry trials in 2023–25 show pilot uptake of these technologies; embedding sensors and using predictive analytics is particularly impactful for reducing unplanned outages.

Pyro-processing trends

Decarbonisation is reshaping kiln-system choices more than any other factor this decade:

- Fuel flexibility and waste fuels: Plants are accepting higher shares of SRF, biomass and RDF. These fuels introduce chemical aggressors (chlorides, alkalis) that stress refractories and increase corrosion; refractory chemistry and cooling strategies must adapt.

- Electrification and high-temperature electricity: Technologies ranging from electrified calciners to resistive or induction heating for preheaters are under review. Recent reviews highlight electrified process heat and electrochemical routes as credible pathways, especially where grid decarbonisation is advanced.

- Oxy-fuel combustion and CCS readiness: Oxy-fuel retrofits enable easier CO2 capture but change the thermal and chemical environment in the preheater and kiln. Some pilot CCS projects in Europe, linked to cement plants and clustered transport/storage (e.g., projects coordinated out of Norway), are already operational or scaling. Cement companies with aggressive Net Zero targets are factoring refractory compatibility into their CCS roadmaps.

- Hydrogen and power-to-X: Hydrogen co-firing trials have started at modest scales; hydrogen changes flame temperature profiles and may accelerate certain refractory degradation modes if not managed.

From an engineering standpoint, conversion choices are constrained by refractory life: a kiln that can’t tolerate the chemical profile from high biomass firing, or the different flue-gas composition from oxy-fuel, will force expensive lining redesigns.

Green initiatives

Sustainability actions in cement are not solely about CO2 numbers; they alter operating envelopes:

- Clinker substitution: LC3 and blended cements reduce kiln duty and thermal load per tonne of cement, indirectly lowering refractory wear rates per unit of cement produced. LC3 deployment at scale (notably in India and other markets) is beginning to change clinker demand profiles and feedstock strategies.

- Energy efficiency upgrades: Improved preheaters/coolers and waste heat recovery change temperature gradients and gas flows; refractories must be specified for the new steady-state and transient regimes.

- Circularity in refractory materials: Recycling of spent refractories (where feasible) and substitution with lower embodied carbon raw materials (e.g., using locally sourced calcined clays or tailored industrial by-products) are receiving attention in R&D and supplier pilot programs.

- Carbon capture deployment: As CCS is pilot-scaled, refractory selection increasingly considers compatibility with capture solvents and altered flue-gas chemistries.

New suppliers and supply-chain resilience

While the well-known global refractory houses dominate engineered solutions, the landscape sees three simultaneous moves:

1. Vertical integration by majors: Acquisitions of alumina producers and feedstock businesses (e.g., RHI Magnesita’s purchase moves) to secure quality and reduce volatility.

2. Regional challengers and Chinese manufacturers: Lower-cost suppliers are increasing capacity and technical capability; large cement groups in Asia often source locally, pressuring pricing and forcing global suppliers to differentiate on performance, warranties and service.

3. Specialist technology start-ups: Firms focusing on 3D-printing of refractory shapes, sensor embedding or novel binder chemistries are becoming acquisition targets for established players.

For procurement teams, this means re-assessing TCO: supplier choice is now as much about data services, installation competence, and lifecycle guarantees as it is about price per ton of bricks.

Where are costs headed?

Costs for refractory systems will be driven by four linked forces:

1. Raw-material price pressure: Prices of magnesia, bauxite/alumina and specialty clays move with energy, mining constraints and geopolitical supply; vertical integrations indicate producers expect sustained volatility.

2. Capex for decarbonisation: Retrofits for oxy-fuel, electrification, CCS readiness, and hydrogen blending often require modified kiln internals and more frequent, higher-quality linings; these add upfront cost but can lower total emissions and long-term operating risk.

3. Service and digital premiums: Sensorised systems, data analytics and condition-based maintenance contracts add cost but lower unplanned downtime and extend campaign life — often commercially attractive for large plants.

4. Regional divergence: Costs will diverge geographically. Plants in jurisdictions with strong carbon pricing, subsidies for CCS, or higher electricity costs will see different economics than plants in low-cost coal regions. Market reports forecast moderate refractory price inflation overall, but with pockets of higher increase tied to feedstock bottlenecks and decarbonisation capex.

Practical recommendations for senior engineers and CMOs and CPOs:

1. Embed refractory strategy in decarbonisation planning: Any decision to scale biomass, oxy-fuel, hydrogen or CCS must have a refractory impact assessment and budget for both material and installation adaptations.

2. Specify for monitorability: Require suppliers to support embedded sensors and data interfaces; insist on warranties that link lining life to clearly defined operating envelopes.

3. Partner on trials: Work with one global and one regional supplier on co-funded trials for 3D-printed shapes, new monolithic mixes, or sensorised linings — accelerate learning before full retrofit.

4. Stress test supply chains: Given recent upstream consolidation, model raw-material failure modes and engage in off-take agreements or joint-stock buffering where alumina or magnesia supplies are strategic.

5. Financially model TCO, not unit price: Factor in longer campaign life, reduced outage probability, and digital services when comparing quotes.

Conclusion

Refractories and pyro-processing are no longer ‘just materials.’ They are strategic assets that determine whether a cement plant can safely and economically transition to lower-carbon fuels and new heat sources. The coming decade will be shaped by a mixture of material science advances (3D printing, sensorised linings, hybrid systems), operational technologies (electrified heat, oxy-fuel, CCS), and shifting supplier dynamics (vertical integration and new entrants). Senior engineers must therefore treat refractory strategy as a cross-functional lever — part of the decarbonisation, reliability and procurement playbook — and design decisions with total cost, not short-term price, at the fore.

About the author:

Professor Procyon Mukherjee, ex-CPO Lafarge-Holcim India, ex-President Hindalco, ex-VP Supply Chain Novelis Europe, holds deep expertise in logistics, procurement, operations and supply chain management. An author and academic, he now teaches at leading institutions and advises global firms on SCM, industrial leadership, and the aluminum and cement sectors.

Concrete

Compliance and growth go hand in h and

Published

2 minutes agoon

February 19, 2026By

admin

Pankaj Kejriwal, Whole Time Director and COO, Star Cement, on driving efficiency today and designing sustainability for tomorrow.

In an era where the cement industry is under growing pressure to decarbonise while scaling capacity, Star Cement is charting a pragmatic yet forward-looking path. In this conversation, Pankaj Kejriwal, Whole Time Director and COO, Star Cement, shares how the company is leveraging waste heat recovery, alternative fuels, low-carbon products and clean energy innovations to balance operational efficiency with long-term sustainability.

How has your Lumshnong plant implemented the 24.8 MW Waste Heat Recovery System (WHRS), and what impact has it had on thermal substitution and energy costs?

Earlier, the cost of coal in the Northeast was quite reasonable, but over the past few years, global price increases have also impacted the region. We implemented the WHRS project about five years ago, and it has resulted in significant savings by reducing our overall power costs.

That is why we first installed WHRS in our older kilns, and now it has also been incorporated into our new projects. Going forward, WHRS will be essential for any cement plant. We are also working on utilising the waste gases exiting the WHRS, which are still at around 100 degrees Celsius. To harness this residual heat, we are exploring systems based on the Organic Rankine Cycle, which will allow us to extract additional power from the same process.

With the launch of Star Smart Building Solutions and AAC blocks, how are you positioning yourself in the low-carbon construction materials segment?

We are actively working on low-carbon cement products and are currently evaluating LC3 cement. The introduction of autoclaved aerated concrete (AAC) blocks provided us with an effective entry into the consumer-facing segment of the industry. Since we already share a strong dealer network across products, this segment fits well into our overall strategy.

This move is clearly supporting our transition towards products with lower carbon intensity and aligns with our broader sustainability roadmap.

With a diverse product portfolio, what are the key USPs that enable you to support India’s ongoing infrastructure projects across sectors?

Cement requirements vary depending on application. There is OPC, PPC and PSC cement, and each serves different infrastructure needs. We manufacture blended cements as well, which allows us to supply products according to specific project requirements.

For instance, hydroelectric projects, including those with NHPC, have their own technical norms, which we are able to meet. From individual home builders to road infrastructure, dam projects, and regions with heavy monsoon exposure, where weather-shield cement is required, we are equipped to serve all segments. Our ability to tailor cement solutions across diverse climatic and infrastructure conditions is a key strength.

How are you managing biomass usage, circularity, and waste reduction across

your operations?

The Northeast has been fortunate in terms of biomass availability, particularly bamboo. Earlier, much of this bamboo was supplied to paper plants, but many of those facilities have since shut down. As a result, large quantities of bamboo biomass are now available, which we utilise in our thermal power plants, achieving a Thermal Substitution Rate (TSR) of nearly 60 per cent.

We have also started using bamboo as a fuel in our cement kilns, where the TSR is currently around 10 per cent to 12 per cent and is expected to increase further. From a circularity perspective, we extensively use fly ash, which allows us to reuse a major industrial waste product. Additionally, waste generated from HDPE bags is now being processed through our alternative fuel and raw material (AFR) systems. These initiatives collectively support our circular economy objectives.

As Star Cement expands, what are the key logistical and raw material challenges you face in scaling operations?

Fly ash availability in the Northeast is a constraint, as there are no major thermal power plants in the region. We currently source fly ash from Bihar and West Bengal, which adds significant logistics costs. However, supportive railway policies have helped us manage this challenge effectively.

Beyond the Northeast, we are also expanding into other regions, including the western region, to cater to northern markets. We have secured limestone mines through auctions and are now in the process of identifying and securing other critical raw material resources to support this expansion.

With increasing carbon regulations alongside capacity expansion, how do you balance compliance while sustaining growth?

Compliance and growth go hand in hand for us. On the product side, we are working on LC3 cement and other low-carbon formulations. Within our existing product portfolio, we are optimising operations by increasing the use of green fuels and improving energy efficiency to reduce our carbon footprint.

We are also optimising thermal energy consumption and reducing electrical power usage. Notably, we are the first cement company in the Northeast to deploy EV tippers at scale for limestone transportation from mines to plants. Additionally, we have installed belt conveyors for limestone transfer, which further reduces emissions. All these initiatives together help us achieve regulatory compliance while supporting expansion.

Looking ahead to 2030 and 2050, what are the key innovation and sustainability priorities for Star Cement?

Across the cement industry, carbon capture is emerging as a major focus area, and we are also planning to work actively in this space. In parallel, we see strong potential in green hydrogen and are investing in solar power plants to support this transition.

With the rapid adoption of solar energy, power costs have reduced dramatically – from 10–12 per unit to around2.5 per unit. This reduction will enable the production of green hydrogen at scale. Once available, green hydrogen can be used for electricity generation, to power EV fleets, and even as a fuel in cement kilns.

Burning green hydrogen produces only water and oxygen, eliminating carbon emissions from that part of the process. While process-related CO2 emissions from limestone calcination remain a challenge, carbon capture technologies will help address this. Ultimately, while becoming a carbon-negative industry is challenging, it is a goal we must continue to work towards.

Economy & Market

FORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

Published

2 weeks agoon

February 5, 2026By

admin

FORNNAX TECHNOLOGY has appointed industry veteran Dieter Jerschl as its new sales partner in Germany to strengthen its presence across Central Europe. The partnership aims to accelerate the adoption of FORNNAX’s high-capacity, sustainable recycling solutions while building long-term regional capabilities.

FORNNAX TECHNOLOGY, one of the leading advanced recycling equipment manufacturers, has announced the appointment of a new sales partner in Germany as part of its strategic expansion into Central Europe. The company has entered into a collaborative agreement with Mr. Dieter Jerschl, a seasoned industry professional with over 20 years of experience in the shredding and recycling sector, to represent and promote FORNNAX’s solutions across key European markets.

Mr. Jerschl brings extensive expertise from his work with renowned companies such as BHS, Eldan, Vecoplan, and others. Over the course of his career, he has successfully led the deployment of both single machines and complete turnkey installations for a wide range of applications, including tyre recycling, cable recycling, municipal solid waste, e-waste, and industrial waste processing.

Speaking about the partnership, Mr. Jerschl said,

“I’ve known FORNNAX for over a decade and have followed their growth closely. What attracted me to this collaboration is their state-of-the-art & high-capacity technology, it is powerful, sustainable, and economically viable. There is great potential to introduce FORNNAX’s innovative systems to more markets across Europe, and I am excited to be part of that journey.”

The partnership will primarily focus on Central Europe, including Germany, Austria, and neighbouring countries, with the flexibility to extend the geographical scope based on project requirements and mutual agreement. The collaboration is structured to evolve over time, with performance-driven expansion and ongoing strategic discussions with FORNNAX’s management. The immediate priority is to build a strong project pipeline and enhance FORNNAX’s brand presence across the region.

FORNNAX’s portfolio of high-performance shredding and pre-processing solutions is well aligned with Europe’s growing demand for sustainable and efficient waste treatment technologies. By partnering with Mr. Jerschl—who brings deep market insight and established industry relationships—FORNNAX aims to accelerate adoption of its solutions and participate in upcoming recycling projects across the region.

As part of the partnership, Mr. Jerschl will also deliver value-added services, including equipment installation, maintenance, and spare parts support through a dedicated technical team. This local service capability is expected to ensure faster project execution, minimise downtime, and enhance overall customer experience.

Commenting on the long-term vision, Mr. Jerschl added,

“We are committed to increasing market awareness and establishing new reference projects across the region. My goal is not only to generate business but to lay the foundation for long-term growth. Ideally, we aim to establish a dedicated FORNNAX legal entity or operational site in Germany over the next five to ten years.”

For FORNNAX, this partnership aligns closely with its global strategy of expanding into key markets through strong regional representation. The company believes that local partnerships are critical for navigating complex market dynamics and delivering solutions tailored to region-specific waste management challenges.

“We see tremendous potential in the Central European market,” said Mr. Jignesh Kundaria, Director and CEO of FORNNAX.

“Partnering with someone as experienced and well-established as Mr. Jerschl gives us a strong foothold and allows us to better serve our customers. This marks a major milestone in our efforts to promote reliable, efficient and future-ready recycling solutions globally,” he added.

This collaboration further strengthens FORNNAX’s commitment to environmental stewardship, innovation, and sustainable waste management, supporting the transition toward a greener and more circular future.

Economy & Market

Budget 2026–27 infra thrust and CCUS outlay to lift cement sector outlook

Published

2 weeks agoon

February 2, 2026By

admin

Higher capex, city-led growth and CCUS funding improve demand visibility and decarbonisation prospects for cement

Mumbai

Cement manufacturers have welcomed the Union Budget 2026–27’s strong infrastructure thrust, with public capital expenditure increased to Rs 12.2 trillion, saying it reinforces infrastructure as the central engine of economic growth and strengthens medium-term prospects for the cement sector. In a statement, the Cement Manufacturers’ Association (CMA) has welcomed the Union budget 2026-27 for reinforcing the ambitions for the nation’s growth balancing the aspirations of the people through inclusivity inspired by the vision of Narendra Modi, Prime Minister of India, for a Viksit Bharat by 2047 and Atmanirbharta.

The budget underscores India’s steady economic trajectory over the past 12 years, marked by fiscal discipline, sustained growth and moderate inflation, and offers strong demand visibility for infrastructure linked sectors such as cement.

The Budget’s strong infrastructure push, with public capital expenditure rising from Rs 11.2 trillion in fiscal year 2025–26 to Rs 12.2 trillion in fiscal year 2026–27, recognises infrastructure as the primary anchor for economic growth creating positive prospects for the Indian cement industry and improving long term visibility for the cement sector. The emphasis on Tier 2 and Tier 3 cities with populations above 5 lakh and the creation of City Economic Regions (CERs) with an allocation of Rs 50 billion per CER over five years, should accelerate construction activity across housing, transport and urban services, supporting broad based cement consumption.

Logistics and connectivity measures announced in the budget are particularly significant for the cement industry. The announcement of new dedicated freight corridors, the operationalisation of 20 additional National Waterways over the next five years, the launch of the Coastal Cargo Promotion Scheme to raise the modal share of waterways and coastal shipping from 6 per cent to 12 per cent by 2047, and the development of ship repair ecosystems should enhance multimodal freight efficiency, reduce logistics costs and improve the sector’s carbon footprint. The announcement of seven high speed rail corridors as growth corridors can be expected to further stimulate regional development and construction demand.

Commenting on the budget, Parth Jindal, President, Cement Manufacturers’ Association (CMA), said, “As India advances towards a Viksit Bharat, the three kartavya articulated in the Union Budget provide a clear context for the Nation’s growth and aspirations, combining economic momentum with capacity building and inclusive progress. The Cement Manufacturers’ Association (CMA) appreciates the Union Budget 2026-27 for the continued emphasis on manufacturing competitiveness, urban development and infrastructure modernisation, supported by over 350 reforms spanning GST simplification, labour codes, quality control rationalisation and coordinated deregulation with States. These reforms, alongside the Budget’s focus on Youth Power and domestic manufacturing capacity under Atmanirbharta, stand to strengthen the investment environment for capital intensive sectors such as Cement. The Union Budget 2026-27 reflects the Government’s focus on infrastructure led development emerging as a structural pillar of India’s growth strategy.”

He added, “The Rs 200 billion CCUS outlay for various sectors, including Cement, fundamentally alters the decarbonisation landscape for India’s emissions intensive industries. CCUS is a significant enabler for large scale decarbonisation of industries such as Cement and this intervention directly addresses the technology and cost requirements of the Cement sector in context. The Cement Industry, fully aligned with the Government of India’s Net Zero commitment by 2070, views this support as critical to enabling the adoption and scale up of CCUS technologies while continuing to meet the Country’s long term infrastructure needs.”

Dr Raghavpat Singhania, Vice President, CMA, said, “The government’s sustained infrastructure push supports employment, regional development and stronger local supply chains. Cement manufacturing clusters act as economic anchors across regions, generating livelihoods in construction, logistics and allied sectors. The budget’s focus on inclusive growth, execution and system level enablers creates a supportive environment for responsible and efficient expansion offering opportunities for economic growth and lending momentum to the cement sector. The increase in public capex to Rs 12.2 trillion, the focus on Tier 2 and Tier 3 cities, and the creation of City Economic Regions stand to strengthen the growth of the cement sector. We welcome the budget’s emphasis on tourism, cultural and social infrastructure, which should broaden construction activity across regions. Investments in tourism facilities, heritage and Buddhist circuits, regional connectivity in Purvodaya and North Eastern States, and the strengthening of emergency and trauma care infrastructure in district hospitals reinforce the cement sector’s role in enabling inclusive growth.”

CMA also noted the Government’s continued commitment to fiscal discipline, with the fiscal deficit estimated at 4.3 per cent of GDP in FY27, reinforcing macroeconomic stability and investor confidence.

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence

FORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

Budget 2026–27 infra thrust and CCUS outlay to lift cement sector outlook

Steel: Shielded or Strengthened?

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence

FORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

Budget 2026–27 infra thrust and CCUS outlay to lift cement sector outlook