Concrete

Cement Beyond Carbon

Published

3 months agoon

By

admin

Ashok Kumar Dembla, President & MD and Deepti Varshney, General Manager – Tendering, KHD Humboldt Wedag, outline how next-generation technologies, alternative materials and carbon management strategies can help India’s cement industry move beyond efficiency-driven decarbonisation toward a truly Net Zero future.

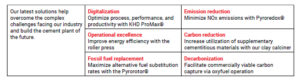

The cement industry, crucial for global and Indian infrastructure, contributes 7-8 per cent of global CO2 emissions. India, the second-largest producer, faces rising cement demand with ongoing infrastructure growth. While energy efficiency and the Perform, Achieve and Trade (PAT) scheme have driven progress, achieving net-zero requires more than efficiency alone. Reducing emissions is vital for sustainability and aligning with the Paris Agreement’s 1.5–2?°C goals. The transition to net-zero also spurs innovation, R&D, sustainable product markets, green investments and job creation, combining growth with environmental protection. As a committed partner, KHD evaluates current emissions, explores low-CO2 technologies, and considers economic and policy factors to help the cement industry reach net-zero targets.

Targets and challenges

The cement industry is a significant source of global CO2 emissions, with clinker production alone releasing 0.6–0.8 tonnes per tonne of clinker, depending on technology and energy efficiency. Grinding contributes less—about 0.1–0.3 tonnes per tonne of cement—impacted by energy sources and use of supplementary materials (SCMs).

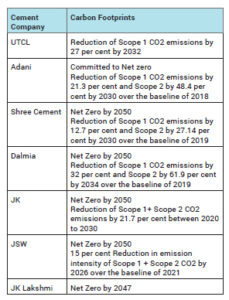

Global cement emissions rose from 0.57 billion tonnes in 1990 to 2.9 billion tonnes in 2022, led by China, India, Europe, and the US India’s 480-million-tonne clinker capacity emits roughly 240 million tonnes of CO2, considering utilisation and efficiency gains. Without strong action, IEA projects cement could reach 13 per cent of global CO2 by 2050, emphasising the urgency of emission reduction. Looking into the scenario the global initiatives are on the peak be it the Paris Agreement and NDCs, Carbon Pricing and Emissions Trading Systems (ETS), Mission Innovation – Cement Challenge or the Global Cement and Concrete Association (GCCA)Sustainability Charter. Few of Indian cement companies are members of GCCA and committed to road map of Net Zero by 2050. Based on the targets set the companies have already taken advance steps to sustain their commitment of net zero.

Low CO2 emission technologies

GCCA and TERI have mapped the roadmap for the Indian cement industry based on the various available and viable measures which can help to achieve the Net Zero goal.

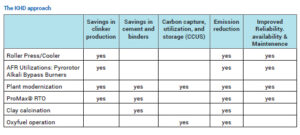

The methods involve using alternative raw materials and fuels, incorporating carbon capture, utilisation and storage (CCUS) techniques, as well as exploring carbon offsetting and sustainable practices. Additionally, advancements such as alkali-activated cements and the utilisation of alternative raw materials play significant roles in reducing the overall carbon footprint of cement production. These technologies present a promising avenue to reconcile cement production with environmental stewardship and climate change mitigation effort. The KHD approach is well aligned with the global as well as India initiatives. The solutions provided and the impacts are captured in the matrix.

a) Carbon capture, utilisation and storage

The benefits of Carbon Capture, Utilisation, and Storage (CCUS) in the cement industry are substantial. One of the primary advantages is the ability to transform CO2 from a pollutant into a valuable resource. By using CO2 to produce construction materials, the industry can advance towards a circular economy, minimising waste and optimising resource utilisation. Additionally, incorporating CO2 into cementitious products enhances the overall sustainability of the industry. However, several challenges need to be addressed.

The development of CCUS technologies is crucial to improve their efficiency and reduce costs, making them more accessible for widespread adoption. One such establishment is KHD oxyfuel Technology. KHD Humboldt Wedag’s Oxyfuel Kiln Technology is an advanced solution for sustainable cement production, enabling a concentrated CO2 stream of up to 85 per cent, which greatly facilitates carbon capture. By recirculating exhaust gas enriched with oxygen, the system ensures optimal fuel oxidation while significantly reducing fuel consumption. This technology can be retrofitted to existing kiln plants, offering substantial savings in both CAPEX and OPEX for carbon capture installations. Successful implementation requires tight sealing technologies and specific cooler adaptations, ensuring high efficiency and reliability. KHD’s Oxyfuel Technology empowers cement plants to achieve lower emissions without compromising operational performance.

b) Alternative raw materials and alternative fuels

Using alternative raw materials like fly ash and slag, which are by-products, helps reduce energy consumption and lower carbon emissions during cement production. Natural pozzolans and calcined clays provide environmentally friendly substitutes for clinker, further minimising CO2 emissions. Additionally, alternative fuels such as biomass and waste-derived fuels are renewable sources that decrease reliance on fossil fuels and address waste management challenges.

These alternatives collectively contribute to sustainable and greener cement manufacturing, effectively addressing environmental concerns and promoting circular economy principles. Incorporating alternative raw materials and fuels into cement production mitigates the industry’s environmental impact by decreasing reliance on traditional resources, lowering energy consumption, reducing CO2 emissions, and promoting circular economy practices through the utilisation of waste materials. Furthermore, this approach aligns with the industry’s sustainability goals, contributing to a more environmentally responsible cement manufacturing process. However, appropriate processing, quality control, and regulatory compliance are essential to ensure the successful integration of these alternatives into cement production.

c) Carbon offsetting and sustainable practices

Carbon offsetting lets cement companies compensate for unavoidable CO2 emissions by funding verified projects—like reforestation, renewable energy, or efficiency initiatives—that remove or avoid an equivalent amount of greenhouse gases. Sustainable cement production focuses on reducing emissions at source through better resource use and cleaner inputs: replacing clinker with SCMs (fly ash, slag, calcined clays), co-processing biomass and alternative fuels, recovering waste heat from kilns, and adopting more efficient kiln and grinding technologies. Together these measures lower CO2 intensity, cut energy use, ease pressure on raw materials, and buy time for longer-term solutions such as electrification and CCUS.

KHD has various options of using alternative raw materials and fuels into manufacturing process. KHD’s Flash Tube Calciner delivers exceptional performance in clay calcination, offering the highest heat efficiency and superior process control. It ensures excellent product quality, precise colour consistency and reliable operation under all conditions. The system is capable of utilising a wide range of alternative fuels, providing flexibility and sustainability. All components are well-proven within KHD’s portfolio, backed by decades of operational experience and reliability.

Another sustainable practice involves responsible sourcing and supply chain management. By ensuring that raw materials are ethically sourced and supply chains adhere to sustainable practices, the industry minimises its ecological footprint and upholds social responsibility.

d) Innovative approaches and emerging technologies

Innovative approaches and emerging technologies in cement production are pivotal in revolutionising the industry towards sustainability. Alkali-activated cements, utilising alternative raw materials, and biomass co-processing are at the forefront. Alkali-activated cements significantly reduce CO2 emissions by operating at lower temperatures. Alternative raw materials like fly ash and slag mitigate the environmental impact by substituting clinker. Biomass co-processing not only offers an alternative fuel source but also manages waste. Moreover, electrification, CCU, and novel production techniques including biomimicry and bioinspired cementitious materials promise a more eco-friendly and efficient future, essential for achieving a sustainable cement sector.

Prospective advancements

Emerging trends in cement are converging on sustainability and tech-driven efficiency: scaling carbon capture and storage, low-clinker solutions (eg: calcined clay), electrification powered by renewables, and digital optimisation via AI/IoT are cutting emissions and energy use, while circular practices, waste-heat recovery, and life-cycle assessments improve material and resource efficiency. Advanced innovations — from nanotechnology to additive manufacturing and hybrid integrated plants — are enhancing performance and enabling new construction methods. As a technology provider, KHD plays a vital role across these steps, supplying the equipment and solutions needed to manage carbon and drive the industry toward a low-carbon future.

Blueprints for a Net Zero carbon sector

By fostering active collaboration among governments, industry players, research institutions and communities, the cement sector can transition smoothly to low-carbon production: implementing the table’s recommendations will enable adoption of low-CO2 technologies, alternative raw materials and fuels, and targeted measures to overcome barriers such as high costs and regulatory gaps. Collective innovation, coordinated financing and policy support will drive pilots into scaled deployment, reduce emissions at source and position the industry as a pivotal contributor to global climate action while setting a sustainability precedent for other sectors.

A phased CO2 roadmap from 2024–2050 structures this shift: the Foundation phase (2024–2030) focuses on policy design, finance mobilization, technology pilots and public awareness to create the enabling environment; the Acceleration phase (2031–2040) scales up renewables, decarbonizes logistics and industry heat, and deploys CCUS demonstrations at scale; and the Net Zero Transition phase (2041–2050) targets aggressive emission reductions, widescale negative-emissions solutions and international cooperation to achieve net-zero outcomes by 2050.

Conclusion

The roadmap presents a clear, practical path to decarbonize the historically carbon-intensive cement industry, stressing urgency as infrastructure demand grows. It highlights key levers — CCU/CCS, renewables, alternative raw materials and fuels, and efficiency upgrades — and showcases KHD’s solutions at every step. While policy support, finance, and economic viability are essential, technical, infrastructure and social challenges remain; overcoming them will require coordinated action, knowledge sharing, and innovation. Adoption of these measures can steer the sector to a resilient, Net Zero future.

ABOUT THE AUTHOR:

Ashok Kumar Dembla, President and Managing Director, KHD Humboldt Wedag, holds over 40 years of experience in the cement industry and has led plant operations, projects, and global partnerships.

Deepti Varshney, General Manager, KHD Humboldt Wedag, is an environmental management professional with expertise in leadership, project management, and business development.

Concrete

FORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

Published

2 weeks agoon

February 5, 2026By

admin

FORNNAX TECHNOLOGY has appointed industry veteran Dieter Jerschl as its new sales partner in Germany to strengthen its presence across Central Europe. The partnership aims to accelerate the adoption of FORNNAX’s high-capacity, sustainable recycling solutions while building long-term regional capabilities.

FORNNAX TECHNOLOGY, one of the leading advanced recycling equipment manufacturers, has announced the appointment of a new sales partner in Germany as part of its strategic expansion into Central Europe. The company has entered into a collaborative agreement with Mr. Dieter Jerschl, a seasoned industry professional with over 20 years of experience in the shredding and recycling sector, to represent and promote FORNNAX’s solutions across key European markets.

Mr. Jerschl brings extensive expertise from his work with renowned companies such as BHS, Eldan, Vecoplan, and others. Over the course of his career, he has successfully led the deployment of both single machines and complete turnkey installations for a wide range of applications, including tyre recycling, cable recycling, municipal solid waste, e-waste, and industrial waste processing.

Speaking about the partnership, Mr. Jerschl said,

“I’ve known FORNNAX for over a decade and have followed their growth closely. What attracted me to this collaboration is their state-of-the-art & high-capacity technology, it is powerful, sustainable, and economically viable. There is great potential to introduce FORNNAX’s innovative systems to more markets across Europe, and I am excited to be part of that journey.”

The partnership will primarily focus on Central Europe, including Germany, Austria, and neighbouring countries, with the flexibility to extend the geographical scope based on project requirements and mutual agreement. The collaboration is structured to evolve over time, with performance-driven expansion and ongoing strategic discussions with FORNNAX’s management. The immediate priority is to build a strong project pipeline and enhance FORNNAX’s brand presence across the region.

FORNNAX’s portfolio of high-performance shredding and pre-processing solutions is well aligned with Europe’s growing demand for sustainable and efficient waste treatment technologies. By partnering with Mr. Jerschl—who brings deep market insight and established industry relationships—FORNNAX aims to accelerate adoption of its solutions and participate in upcoming recycling projects across the region.

As part of the partnership, Mr. Jerschl will also deliver value-added services, including equipment installation, maintenance, and spare parts support through a dedicated technical team. This local service capability is expected to ensure faster project execution, minimise downtime, and enhance overall customer experience.

Commenting on the long-term vision, Mr. Jerschl added,

“We are committed to increasing market awareness and establishing new reference projects across the region. My goal is not only to generate business but to lay the foundation for long-term growth. Ideally, we aim to establish a dedicated FORNNAX legal entity or operational site in Germany over the next five to ten years.”

For FORNNAX, this partnership aligns closely with its global strategy of expanding into key markets through strong regional representation. The company believes that local partnerships are critical for navigating complex market dynamics and delivering solutions tailored to region-specific waste management challenges.

“We see tremendous potential in the Central European market,” said Mr. Jignesh Kundaria, Director and CEO of FORNNAX.

“Partnering with someone as experienced and well-established as Mr. Jerschl gives us a strong foothold and allows us to better serve our customers. This marks a major milestone in our efforts to promote reliable, efficient and future-ready recycling solutions globally,” he added.

This collaboration further strengthens FORNNAX’s commitment to environmental stewardship, innovation, and sustainable waste management, supporting the transition toward a greener and more circular future.

Concrete

Budget 2026–27 infra thrust and CCUS outlay to lift cement sector outlook

Published

2 weeks agoon

February 2, 2026By

admin

Higher capex, city-led growth and CCUS funding improve demand visibility and decarbonisation prospects for cement

Mumbai

Cement manufacturers have welcomed the Union Budget 2026–27’s strong infrastructure thrust, with public capital expenditure increased to Rs 12.2 trillion, saying it reinforces infrastructure as the central engine of economic growth and strengthens medium-term prospects for the cement sector. In a statement, the Cement Manufacturers’ Association (CMA) has welcomed the Union budget 2026-27 for reinforcing the ambitions for the nation’s growth balancing the aspirations of the people through inclusivity inspired by the vision of Narendra Modi, Prime Minister of India, for a Viksit Bharat by 2047 and Atmanirbharta.

The budget underscores India’s steady economic trajectory over the past 12 years, marked by fiscal discipline, sustained growth and moderate inflation, and offers strong demand visibility for infrastructure linked sectors such as cement.

The Budget’s strong infrastructure push, with public capital expenditure rising from Rs 11.2 trillion in fiscal year 2025–26 to Rs 12.2 trillion in fiscal year 2026–27, recognises infrastructure as the primary anchor for economic growth creating positive prospects for the Indian cement industry and improving long term visibility for the cement sector. The emphasis on Tier 2 and Tier 3 cities with populations above 5 lakh and the creation of City Economic Regions (CERs) with an allocation of Rs 50 billion per CER over five years, should accelerate construction activity across housing, transport and urban services, supporting broad based cement consumption.

Logistics and connectivity measures announced in the budget are particularly significant for the cement industry. The announcement of new dedicated freight corridors, the operationalisation of 20 additional National Waterways over the next five years, the launch of the Coastal Cargo Promotion Scheme to raise the modal share of waterways and coastal shipping from 6 per cent to 12 per cent by 2047, and the development of ship repair ecosystems should enhance multimodal freight efficiency, reduce logistics costs and improve the sector’s carbon footprint. The announcement of seven high speed rail corridors as growth corridors can be expected to further stimulate regional development and construction demand.

Commenting on the budget, Parth Jindal, President, Cement Manufacturers’ Association (CMA), said, “As India advances towards a Viksit Bharat, the three kartavya articulated in the Union Budget provide a clear context for the Nation’s growth and aspirations, combining economic momentum with capacity building and inclusive progress. The Cement Manufacturers’ Association (CMA) appreciates the Union Budget 2026-27 for the continued emphasis on manufacturing competitiveness, urban development and infrastructure modernisation, supported by over 350 reforms spanning GST simplification, labour codes, quality control rationalisation and coordinated deregulation with States. These reforms, alongside the Budget’s focus on Youth Power and domestic manufacturing capacity under Atmanirbharta, stand to strengthen the investment environment for capital intensive sectors such as Cement. The Union Budget 2026-27 reflects the Government’s focus on infrastructure led development emerging as a structural pillar of India’s growth strategy.”

He added, “The Rs 200 billion CCUS outlay for various sectors, including Cement, fundamentally alters the decarbonisation landscape for India’s emissions intensive industries. CCUS is a significant enabler for large scale decarbonisation of industries such as Cement and this intervention directly addresses the technology and cost requirements of the Cement sector in context. The Cement Industry, fully aligned with the Government of India’s Net Zero commitment by 2070, views this support as critical to enabling the adoption and scale up of CCUS technologies while continuing to meet the Country’s long term infrastructure needs.”

Dr Raghavpat Singhania, Vice President, CMA, said, “The government’s sustained infrastructure push supports employment, regional development and stronger local supply chains. Cement manufacturing clusters act as economic anchors across regions, generating livelihoods in construction, logistics and allied sectors. The budget’s focus on inclusive growth, execution and system level enablers creates a supportive environment for responsible and efficient expansion offering opportunities for economic growth and lending momentum to the cement sector. The increase in public capex to Rs 12.2 trillion, the focus on Tier 2 and Tier 3 cities, and the creation of City Economic Regions stand to strengthen the growth of the cement sector. We welcome the budget’s emphasis on tourism, cultural and social infrastructure, which should broaden construction activity across regions. Investments in tourism facilities, heritage and Buddhist circuits, regional connectivity in Purvodaya and North Eastern States, and the strengthening of emergency and trauma care infrastructure in district hospitals reinforce the cement sector’s role in enabling inclusive growth.”

CMA also noted the Government’s continued commitment to fiscal discipline, with the fiscal deficit estimated at 4.3 per cent of GDP in FY27, reinforcing macroeconomic stability and investor confidence.

Concrete

Steel: Shielded or Strengthened?

CW explores the impact of pro-steel policies on construction and infrastructure and identifies gaps that need to be addressed.

Published

2 weeks agoon

January 31, 2026By

admin

Going forward, domestic steel mills are targeting capacity expansion

of nearly 40 per cent through till FY31, adding 80-85 mt, translating

into an investment pipeline of $ 45-50 billion. So, Jhunjhunwala points

out that continuing the safeguard duty will be vital to prevent a surge

in imports and protect domestic prices from external shocks. While in

FY26, the industry operating profit per tonne is expected to hold at

around $ 108, similar to last year, the industry’s earnings must

meaningfully improve from hereon to sustain large-scale investments.

Else, domestic mills could experience a significant spike in industry

leverage levels over the medium term, increasing their vulnerability to

external macroeconomic shocks.(~$ 60/tonne) over the past one month,

compressing the import parity discount to ~$ 23-25/tonne from previous

highs of ~$ 70-90/tonne, adds Jhunjhunwala. With this, he says, “the

industry can expect high resistance to further steel price increases.”

Domestic HRC prices have increased by ~Rs 5,000/tonne

“Aggressive

capacity additions (~15 mt commissioned in FY25, with 5 mt more by

FY26) have created a supply overhang, temporarily outpacing demand

growth of ~11-12 mt,” he says…

FORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

Budget 2026–27 infra thrust and CCUS outlay to lift cement sector outlook

Steel: Shielded or Strengthened?

JK Cement Commissions 3 MTPA Buxar Plant, Crosses 31 MTPA

JK Cement Crosses 31 MTPA Capacity with Commissioning of Buxar Plant in Bihar

FORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

Budget 2026–27 infra thrust and CCUS outlay to lift cement sector outlook

Steel: Shielded or Strengthened?

JK Cement Commissions 3 MTPA Buxar Plant, Crosses 31 MTPA