Economy & Market

Shaping a Low-Carbon Cement Future

Published

3 months agoon

By

admin

ICR explores how India’s cement industry is redefining emission control through advanced filtration, digital process optimisation, and low-carbon innovation.

Cement plants emit four key pollutants—CO2, NOx, SOx, and particulate matter (PM)—each arising from different stages of production. Most CO2 stems from limestone calcination and kiln fuel combustion, and while the sector’s CO2 intensity has remained flat, it must decline by ~4 per cent annually by 2030 to align with net-zero goals, as mentioned in or a report by the IEA. In kilns, thermal NOx dominates due to high flame temperatures (~1,200°C), SO2 originates from sulphur in fuel and raw materials, and PM is released from raw mill handling and clinker grinding—as mentioned in or a report by the EEA Guidebook (2023). At the global level, cement accounts for 6 per cent to 8 per cent of total CO2 emissions, highlighting the need for integrated emission strategies, as mentioned in or a report by the GCCA. India’s installed capacity grew from ~510 MTPA (2019) to ~632 MTPA (2024), reflecting ~4.4 per cent CAGR, as mentioned in or a report by JMK Research (2024). National GHG emissions reached ~4.13 GtCO2e in 2024, with cement responsible for 6 per cent to 7 per cent, largely concentrated among top producers, as mentioned in or a report by CARE Edge ESG (2025).

India’s cement roadmap targets net-zero CO2 by 2070, with milestones tied to efficiency, alternative fuels, SCMs, and carbon capture, as mentioned in or a report by TERI (2025). Policy frameworks are evolving accordingly: Continuous Emission Monitoring Systems (CEMS) for PM, SO2, and NOx are mandated to strengthen compliance and transparency, as mentioned in or a report by the CPCB. Globally, the IEA’s Breakthrough Agenda Report (2025) emphasises that achieving real decarbonisation requires parallel progress in process control, AFR, SCMs, and CCS, since total CO2 emissions remain above 2015 levels and intensity gains have plateaued. For India, the path forward lies in combining strict regulatory oversight with accelerated technology adoption—ensuring each tonne of clinker produced moves closer to compliance, efficiency, and long-term net-zero alignment.

Modern filtration systems: The first line of defence

Cement plants are swiftly moving beyond legacy electrostatic precipitators (ESPs) to high-efficiency baghouses, hybrids, and smart filter media that achieve ultra-low particulate emissions with tighter control. India’s regulatory drive has been crucial—CPCB’s 30 mg/Nm3 PM limit (also enforced by Delhi DPCC) has accelerated retrofits and new installations, as mentioned in or a report by CPCB and DPCC. Modern systems often outperform these standards: a Thermax kiln-raw mill project guaranteed =25 mg/Nm3, while an ESP-to-baghouse conversion in Asia cut dust from 40 to 9 mg/Nm3 (—78 per cent), as mentioned in or a report by Thermax and a peer-reviewed study. Indian majors like UltraTech are scaling this approach—converting hybrid filters to pulse-jet baghouses and upgrading cooler ESPs to further reduce PM, as mentioned in or a report by the company’s environmental filings.

Performance gains now hinge on advanced filter media. Plants using ePTFE/PTFE-membrane bags achieve cleaner filtration and drops from ~50 to ~30 mg/Nm³, while maintaining stable pressure loss, as mentioned in or a report by Orient Cement’s compliance report and an ePTFE study. Nanofiber-laminated felts and electrostatically enhanced baghouses promise lower pressure drop, longer bag life, and reduced fan power, as mentioned in or a report by the US EPA baghouse compendium. Vendors like Intensiv-Filter Himenviro now offer baghouses achieving <10 mg/Nm3 under optimal design and maintenance. The trend is clear: pulse-jet baghouses with advanced membranes and selective ESP upgrades are providing India’s cement sector with the compliance flexibility, energy efficiency, and reliability needed to thrive under its tighter emission regime.

Advanced process optimisation

Digitalisation and AI-based process optimisation have emerged as key levers for emission reduction in cement manufacturing, addressing pollutants at their source rather than at the stack. Across global and Indian plants, AI-driven kiln control systems like ABB’s Expert Optimiser and Carbon Re’s AI for Pyroprocess are redefining precision by integrating real-time data from sensors and APC loops to stabilise combustion, optimise fuel use, and limit NOx and CO formation. As mentioned in or a report by ABB (2024), advanced process control has cut fuel consumption by 3 per cent to 5 per cent and CO2 emissions by up to 5 per cent, while as mentioned in or a report by Carbon Re (2024), European plants achieved 4 per cent lower fuel use and 2 per cent CO2 reduction through AI kiln optimisation.

Indian majors like UltraTech, Dalmia, and Shree Cement are piloting such hybrid models combining process, energy, and environmental data for smarter emission management.

Vijay Mishra, Commercial Director, Knauf India says, “India’s construction materials sector is making steady progress toward circularity, moving beyond the earlier focus on “green buildings” to now addressing lifecycle impacts and resource recovery. While global leaders, particularly in Europe, benefit from mature collection and recycling infrastructure for materials like gypsum, metals, and aggregates, India is still in the early stages of building that ecosystem—but the momentum and policy direction are clearly positive. The country’s massive construction pipeline presents a unique opportunity: even modest gains in material reuse and low-carbon manufacturing could yield enormous environmental benefits. The main challenge remains infrastructure—segregation at site level, recovery logistics, and recycling facilities—but as these improve, the economics of circular materials will become more compelling. Looking ahead, the next decade of emission-conscious manufacturing will be shaped by material circularity, manufacturing efficiency, and digital traceability—turning waste into value, cutting emissions at source, and ensuring every sustainable action can be measured and rewarded. For manufacturers, this balance between innovation and responsibility will define the future of India’s low-carbon construction movement.”

The benefits extend beyond combustion. Real-time monitoring and predictive analytics enable operators to anticipate emission spikes and recalibrate process parameters automatically. As mentioned in or a report by the CII–Sohrabji Godrej Green Business Centre (2023), India’s top plants operate below 70 kWh/t cement (electrical) and 690 kcal/kg clinker (thermal)—benchmarks sustained through digital oversight. Digital twins and AI-driven models now simulate NOx reduction and fuel substitution scenarios, cutting trial errors. As mentioned in or a report by the IEA (2025), digitalisation is among the top three global levers for industrial decarbonisation, capable of reducing cement CO2 emissions by up to 8 per cent by 2030. The future of emission control will depend less on end-of-pipe systems and more on intelligent, adaptive process control that keeps every second of kiln operation cleaner, stable, and efficient.

From capture to co-processing

The cement industry’s decarbonisation pathway now rests on two pivotal levers—Carbon Capture, Utilisation and Storage (CCUS) and Alternative Fuels and Raw Materials (AFR)—each addressing a distinct source of emissions. While process emissions from limestone calcination are unavoidable, CCUS provides a route to capture, reuse, or store CO2, whereas AFR mitigates combustion-related emissions by substituting fossil fuels with renewable or waste-derived alternatives. Together, they form the “dual engine” of deep decarbonisation, capable of reducing total CO2 emissions by over 40 per cent in advanced systems, as mentioned in or a report by the Global Cement and Concrete Association (GCCA, 2024). Globally, CCUS is moving from pilots to commercial reality—as mentioned in or a report by Heidelberg Materials (2024), the Brevik CCS plant in Norway will capture 400,000 tonnes of CO2 annually, while Holcim’s GO4ZERO project in Belgium aims for 1.1 million tonnes by 2029, establishing Europe as the proving ground for full-scale capture. As mentioned in or a report by TERI (2025), India is now developing its own CCUS roadmap, with Dalmia Cement and Carbon Clean partnering on a 500,000 tCO2/year project in Tamil Nadu—the country’s first commercial-scale cement CCUS initiative. Meanwhile, as mentioned in or a report by the NITI Aayog–GCCA policy brief (2024), frameworks are being designed for carbon capture finance corporations and shared storage clusters to accelerate deployment.

Raj Bagri, CEO, Kapture says, “Decarbonising cement production is crucial, but while the focus is often on the main kiln, the surrounding infrastructure, including essential diesel generators remains a source of carbon pollution. These generators provide crucial backup or primary power for on-site operations, contributing to a plant’s overall carbon footprint. Kapture addresses this with a cost- effective, easily retrofittable technology that captures CO2 directly from diesel generator exhaust. Kapture’s innovative approach transforms the captured carbon into a stable, solid byproduct. This material then closes the loop by being sequestered in concrete. By serving as a direct replacement for a portion of virgin clinker, Kapture’s. byproduct actively offsets the hard-to-abate process emissions that dominate the cement industry. This circular economy model provides a powerful solution. It immediately cuts combustion emissions from the auxiliary power source and simultaneously reduces the need for high-carbon raw materials in the concrete mix, Kapture offers the cement industry a pathway to both clean up their power and drastically lower the carbon intensity of their end-product.”

Parallel to carbon capture, the rise of AFR is redefining combustion efficiency and circularity across Indian plants. As mentioned in or a report by the CII–Sohrabji Godrej Green Business Centre (2023), India’s Thermal Substitution Rate (TSR) averages 6 per cent to 8 per cent, with leaders such as UltraTech, ACC, and Geocycle already achieving 15 per cent to 20 per cent through co-processing Refuse-Derived Fuel (RDF), biomass, and industrial waste. This transition reduces dependence on coal and petcoke while diverting thousands of tonnes of waste from landfills. The MoEFCC aims to raise TSR to 25 per cent by 2025, in line with India’s Circular Economy Action Plan, and as mentioned in or a report by the IEA (2023), such substitution can cut specific CO2 emissions by 12 per cent to 15 per cent. Although cost, scale, and infrastructure remain challenges, India’s combined progress in CCUS and AFR signals a powerful shift—toward a future where carbon is captured and reused, waste becomes a valuable fuel, and cement production evolves into a truly circular, low-emission system.

Instrumentation, data transparency, and continuous monitoring

Real-time monitoring has become central to emission management in cement manufacturing, replacing periodic sampling with Continuous Emission Monitoring Systems (CEMS) that track PM, SO2, and NOx continuously. As mentioned in or a report by the CPCB (2024), CEMS installation is now mandatory for all integrated plants in India, with live data streaming to regulatory servers for verification. These systems enhance transparency and allow operators to act before emissions exceed limits. Complementing them, IoT-based sensors for baghouse performance and draft fans are cutting downtime by up to 30 per cent, as mentioned in or a report by Frost and Sullivan (2024). Many states now mandate continuous online air-quality reporting, creating a real-time loop between regulators, operators, and technology providers. As mentioned in or a report by the GCCA (2024/25), leading producers are integrating digital emission platforms that combine CEMS data, process sensors, and ESG metrics, building both compliance and investor confidence. Globally, as mentioned in or a report by the IEA (2025), smart sensors and automated reporting can cut non-compliance events by up to 40 per cent while boosting efficiency. For India, scaling such data-driven frameworks will ensure emission control evolves from a reactive measure to a proactive, intelligence-led sustainability system.

Regulatory framework and global benchmarks

India’s cement industry operates under one of the most stringent emission control regimes among developing nations, with the Central Pollution Control Board (CPCB) setting specific stack emission limits for key pollutants—30 mg/Nm³ for particulate matter (PM), 800 mg/Nm3 for NOx, and 100 mg/Nm3 for SO2 from kiln and clinker cooler outlets, as mentioned in or a report by the CPCB (2024). These norms are comparable to the EU-Best Available Techniques (EU-BAT) reference levels, which stipulate 10–30 mg/Nm3 for PM, 200–800 mg/Nm3 for NOx, and 50–400 mg/Nm3 for SO2, depending on plant design and fuel type—as mentioned in or a report by the European Commission’s BAT Reference Document (BREF, 2023). Meanwhile, US-EPA’s National Emission Standards for Hazardous Air Pollutants (NESHAP) require PM to be maintained below 30 mg/Nm3 for new cement kilns, reinforcing global convergence toward tighter thresholds. India’s 2016 revision of cement emission norms marked a watershed moment, reducing permissible PM levels from 150 mg/Nm3 to 30 mg/Nm3, driving widespread retrofits of ESPs and installation of high-efficiency baghouses across major plants. As highlighted in a TERI policy paper (2025), nearly 80 per cent of India’s integrated cement capacity now complies with these upgraded standards, supported by Continuous Emission Monitoring Systems (CEMS) and regular digital reporting to state pollution control boards—placing India’s emission control framework among the most advanced and transparent in the Global South.

Building a low-emission, high-performance industry

India’s cement sector stands at a defining crossroads—where growth and sustainability must advance together. With production projected to exceed 600 million tonnes by 2028, as mentioned in or a report by JMK Research (2024), India’s leadership in emission control will shape global low-carbon manufacturing. Over the past decade, regulatory reform, CPCB’s 30 mg/Nm3 PM limits, continuous monitoring, and ESP-to-baghouse conversions have brought India close to EU and US benchmarks. The next leap requires integrated decarbonisation—linking AI-driven optimisation, renewable energy, alternative fuels, and carbon capture. As mentioned in or a report by the IEA (2025), digital technologies can reduce CO2 emissions by up to 8 per cent by 2030, while CCUS and AFR could cut process-related emissions by 40 per cent to 50 per cent. Meanwhile, R&D in LC³ and belite cements, combined with circular-economy co-processing, is reshaping both the chemistry and carbon profile of Indian cement. Policy incentives, carbon finance, and strong industry–academia collaboration will be key to making India a pioneer in green cement.

Ultimately, emission control is becoming a strategic advantage, not just compliance. The future cement plant will be a hybrid of automation, accountability, and adaptive design, where digital twins optimise processes and every gram of carbon is tracked. By coupling robust policy frameworks with investment in skills, digital infrastructure, and collaborative innovation, India can redefine sustainable heavy industry. The goal now is not incremental change but transformational adoption, where every avoided emission strengthens both the planet and profitability. With its evolving ecosystem of technology, regulation, and intent, India’s cement sector is poised to become a global benchmark for low-emission, high-performance manufacturing and a model for industrial decarbonisation.

Carbon Emissions in Ready-Mix Concrete

This case study, published in Case Studies in Construction Materials (Elsevier, Jan 2025) by Zuojiang Lin, Guangyao Lyu, and Kuizhen Fang, examines carbon emissions in C30–C80 ready-mix concrete in China and explores CO2 reduction through SCMs, transport optimisation, and manufactured sand use.

This study analyses the carbon emissions of C30–C80 ready-mixed concrete using a large-scale mix proportion dataset from across China. The research applies a life-cycle assessment (LCA) based on IPCC and ISO 14040 standards to calculate total emissions, covering raw material production, transportation, manufacturing, and concrete delivery. The findings reveal that average carbon emissions range between 262.61 and 401.78 kgCO2e/m3, with cement accounting for about 90 per cent of embodied emissions. The study establishes that emission variations primarily arise from differences in cement dosage and raw material composition rather than energy use in manufacturing or transport.

The study identifies Supplementary Cementitious Materials (SCMs)—such as fly ash, ground granulated blast furnace slag, and silica fume—as major contributors to CO2 reduction. By partially replacing cement, SCMs lowered total emissions by 5 per cent to 30 per cent while maintaining equivalent strength levels. However, around 11 per cent of samples showed negative reduction rates, indicating that improper SCM selection or inconsistent material quality can offset benefits. The relationship between SCM substitution rates and CO2 reduction was found to be positively correlated but weakly linear, with considerable data dispersion due to mix variability.

Transport distance was also evaluated as a significant but secondary factor influencing emissions. The study found that CO2 reduction benefits from SCMs remained stable until transport distances exceeded 4166 km, beyond which the gains were nullified. For every additional 100 km of SCM transport by truck, the carbon reduction rate decreased by only 0.45 per cent. Comparatively, long-distance transport of aggregates from 100 km to 500 km increased concrete’s carbon emissions by over 10 per cent. This highlights the higher sensitivity of total emissions to aggregate logistics than SCM transport.

Lastly, the study analysed manufactured sand (MS) as a substitute for natural fine aggregates (NFA). While MS reduces transport-related emissions due to shorter sourcing distances, it increases total production energy consumption and can reduce concrete strength. When 50 per cent to 100 per cent of NFA was replaced with MS, total CO2 emissions remained largely unchanged. The authors conclude that SCMs offer clear and stable low-carbon benefits, whereas MS requires technological optimisation to realise its potential. Overall, the research provides quantitative evidence supporting low-carbon labelling standards for China’s concrete industry and underscores the importance of balancing strength, sourcing, and sustainability.

Reducing CO2 in Cement Production

This case study, published in Industrial & Engineering Chemistry Research (ACS Publications, Sept 2024) by Franco Williams and Aidong Yang, investigates CO2 reduction in cement manufacturing through alternative clinker compositions and CO2 mineralisation, achieving up to 45.5 per cent energy and 35.1 per cent CO2 savings in simulations.

This study investigates strategies for reducing CO2 emissions in cement production, which currently contributes around 8 per cent of global anthropogenic CO2. Using Aspen Plus V12.1 process simulations, seven clinker production scenarios were analysed — including Ordinary Portland Cement (OPC), three variants of High-Ferrite Clinker (HFC), Belite-Ye’elimite-Ferrite Clinker (BYF), Calcium Silicate Cement (CSC), and a hybrid option combining OPC with a Supplementary Cementitious Material (SCM) produced via CO2 mineralisation. The objective was to quantify differences in energy demand and CO2 emissions under natural gas–fuelled conditions and assess the decarbonisation potential of each composition.

The simulations revealed that alternative clinkers significantly outperform OPC in both energy efficiency and carbon footprint. OPC clinker production required 1220.4 kWh/t, emitting 741.5 kgCO2/t clinker, while CSC clinker achieved the lowest total energy intensity at 665.1 kWh/t, corresponding to a 45.5 per cent energy reduction and 35.1 per cent CO2 reduction. This efficiency stems from CSC’s low CaCO3 input (989.7 kg/t clinker) and sintering temperature of 1250°C, compared to OPC’s 1271.5 kg/t and 1500°C. The BYF clinker followed with 31.3 per cent energy savings and 27.5 per cent CO2 reduction, while HFC variants achieved moderate reductions of 3.1 per cent to 6.4 per cent in CO2 emissions.

For the SCM + OPC scenario, 25 per cent of the clinker was replaced with SCM derived from CO2 mineralisation. Despite a higher total energy requirement (1239.6 kWh/t) due to capture and mineralisation energy, this option delivered the greatest CO2 reduction—up to 44.8 per cent relative to OPC. The benefit was attributed to CO2 absorption during mineralisation and reduced clinker mass. However, the study noted that the energy intensity of mineralisation (1.30 kWh/kg SCM) exceeded that of clinker production (1.22 kWh/kg), indicating that this strategy’s effectiveness depends on access to low-carbon electricity sources.

Geographical variations also influenced the overall carbon footprint. When accounting for electricity grid emissions, Brazil showed the lowest total CO2 output (482.7 kgCO2/t) for SCM-integrated cement due to its green energy mix, compared to 601.6 kgCO2/t in China and 556.1 kgCO2/t in the United States. For CSC clinker, total reductions were 35.7 per cent, 36.0 per cent, and 35.3 per cent respectively across these countries. This emphasises that decarbonisation gains are highly dependent on the carbon intensity of local power grids.

Supporting simulations demonstrated that lowering sintering temperatures alone (to 1350°C or 1250°C) could reduce total energy consumption by 7 per cent to 17.5 per cent and CO2 emissions by 1 per cent to 2.6 per cent. However, these results are modest compared to the full compositional changes in alternative clinkers, confirming that reducing CaCO3 content in the raw meal contributes more significantly to CO2 mitigation. The decomposition of CaCO3 releases 0.44 kg CO2 per kg CaCO3 and requires 179.4 kJ/kmol of heat; hence, formulations with reduced limestone and alite (C3S) contents inherently lower both emissions and energy demand.

In conclusion, the study establishes that Calcium Silicate Cement (CSC) is the most energy-efficient clinker alternative, while SCM-integrated OPC achieves the highest CO2 reduction potential under green-energy conditions. The authors highlight that the decarbonisation of electricity supply is crucial for maximising the benefits of CO2 mineralisation-based SCMs. These results underscore that altering clinker chemistry and incorporating CO2 utilisation pathways are practical, high-impact strategies for achieving deep decarbonisation in the cement industry and align with global net-zero goals.

Concrete

Our strategy is to establish reliable local partnerships

Published

3 hours agoon

February 19, 2026By

admin

Jean-Jacques Bois, President, Nanolike, discusses how real-time data is reshaping cement delivery planning and fleet performance.

As cement producers look to extract efficiency gains beyond the plant gate, real-time visibility and data-driven logistics are becoming critical levers of competitiveness. In this interview with Jean-Jacques Bois, President, Nanolike, we discover how the company is helping cement brands optimise delivery planning by digitally connecting RMC silos, improving fleet utilisation and reducing overall logistics costs.

How does SiloConnect enable cement plants to optimise delivery planning and logistics in real time?

In simple terms, SiloConnect is a solution developed to help cement suppliers optimise their logistics by connecting RMC silos in real time, ensuring that the right cement is delivered at the right time and to the right location. The core objective is to provide real-time visibility of silo levels at RMC plants, allowing cement producers to better plan deliveries.

SiloConnect connects all the silos of RMC plants in real time and transmits this data remotely to the logistics teams of cement suppliers. With this information, they can decide when to dispatch trucks, how to prioritise customers, and how to optimise fleet utilisation. The biggest savings we see today are in logistics efficiency. Our customers are able to sell and ship more cement using the same fleet. This is achieved by increasing truck rotation, optimising delivery routes, and ultimately delivering the same volumes at a lower overall logistics cost.

Additionally, SiloConnect is designed as an open platform. It offers multiple connectors that allow data to be transmitted directly to third-party ERP systems. For example, it can integrate seamlessly with SAP or other major ERP platforms, enabling automatic order creation whenever replenishment is required.

How does your non-exclusive sensor design perform in the dusty, high-temperature, and harsh operating conditions typical of cement plants?

Harsh operating conditions such as high temperatures, heavy dust, extreme cold in some regions, and even heavy rainfall are all factored into the product design. These environmental challenges are considered from the very beginning of the development process.

Today, we have thousands of sensors operating reliably across a wide range of geographies, from northern Canada to Latin America, as well as in regions with heavy rainfall and extremely high temperatures, such as southern Europe. This extensive field experience demonstrates that, by design, the SiloConnect solution is highly robust and well-suited for demanding cement plant environments.

Have you initiated any pilot projects in India, and what outcomes do you expect from them?

We are at the very early stages of introducing SiloConnect in India. Recently, we installed our

first sensor at an RMC plant in collaboration with FDC Concrete, marking our initial entry into the Indian market.

In parallel, we are in discussions with a leading cement producer in India to potentially launch a pilot project within the next three months. The goal of these pilots is to demonstrate real-time visibility, logistics optimisation and measurable efficiency gains, paving the way for broader adoption across the industry.

What are your long-term plans and strategic approach for working with Indian cement manufacturers?

For India, our strategy is to establish strong and reliable local partnerships, which will allow us to scale the technology effectively. We believe that on-site service, local presence, and customer support are critical to delivering long-term value to cement producers.

Ideally, our plan is to establish an Indian entity within the next 24 months. This will enable us to serve customers more closely, provide faster support and contribute meaningfully to the digital transformation of logistics and supply chain management in the Indian cement industry.

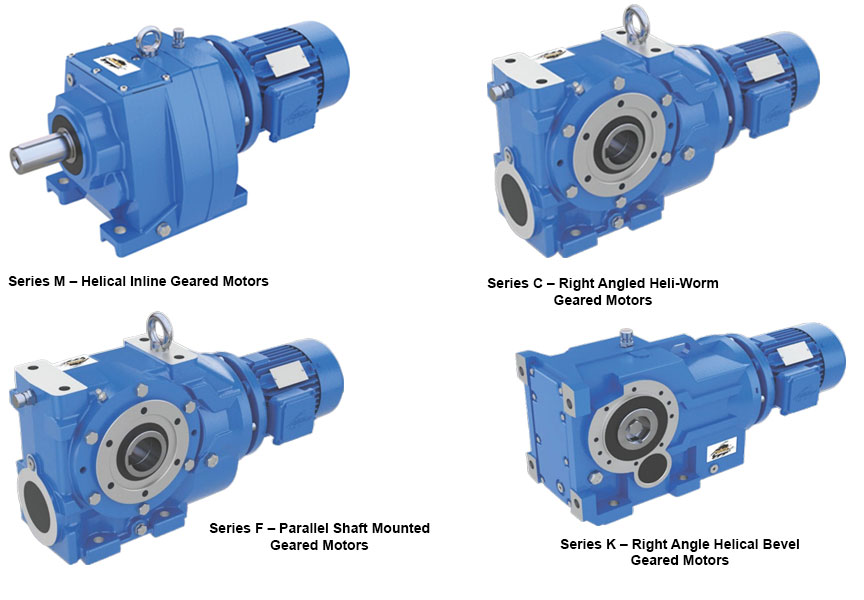

A deep dive into Core Gear Series of products M, C, F and K, by Power Build, and how they represent precision in motion.

At the heart of every high-performance industrial system lies the need for robust, reliable, and efficient power transmission. Power Build answers this need with its flagship geared motor series: M, C, F and K. Each series is meticulously engineered to serve specific operational demands while maintaining the universal promise of durability, efficiency, and performance.

Series M – Helical Inline Geared Motors

Compact and powerful, the Series M delivers exceptional drive solutions for a broad range of applications. With power handling up to 160kW and torque capacity reaching 20,000 Nm, it is the trusted solution for industries requiring quiet operation, high efficiency, and space-saving design. Series M is available with multiple mounting and motor options, making it a versatile choice for manufacturers and OEMs globally.

Series C – Right Angled Heli-Worm Geared Motors

Combining the benefits of helical and worm gearing, the Series C is designed for right-angled power transmission. With gear ratios of up to 16,000:1 and torque capacities of up to 10,000 Nm, this series is optimal for applications demanding precision in compact spaces. Industries looking for a smooth, low-noise operation with maximum torque efficiency rely on Series C for dependable performance.

Series F – Parallel Shaft Mounted Geared Motors

Built for endurance in the most demanding environments, Series F is widely adopted in steel plants, hoists, cranes and heavy-duty conveyors. Offering torque up to 10,000 Nm and high gear ratios up to 20,000:1, this product features an integral torque arm and diverse output configurations to meet industry-specific challenges head-on.

Series K – Right Angle Helical Bevel Geared Motors

For industries seeking high efficiency and torque-heavy performance, Series K is the answer. This right-angled geared motor series delivers torque up to 50,000 Nm, making it a preferred choice in core infrastructure sectors such as cement, power, mining and material handling. Its flexibility in mounting and broad motor options offer engineers the freedom in design and reliability in execution.

Together, these four series reflect Power Build’s commitment to excellence in mechanical power transmission. From compact inline designs to robust right-angle drives, each geared motor is a result of decades of engineering innovation, customer-focused design and field-tested reliability. Whether the requirement is speed control, torque multiplication or space efficiency, Radicon’s Series M, C, F and K stand as trusted powerhouses for global industries.

http://www.powerbuild.in

Call: +919727719344

Pankaj Kejriwal, Whole Time Director and COO, Star Cement, on driving efficiency today and designing sustainability for tomorrow.

In an era where the cement industry is under growing pressure to decarbonise while scaling capacity, Star Cement is charting a pragmatic yet forward-looking path. In this conversation, Pankaj Kejriwal, Whole Time Director and COO, Star Cement, shares how the company is leveraging waste heat recovery, alternative fuels, low-carbon products and clean energy innovations to balance operational efficiency with long-term sustainability.

How has your Lumshnong plant implemented the 24.8 MW Waste Heat Recovery System (WHRS), and what impact has it had on thermal substitution and energy costs?

Earlier, the cost of coal in the Northeast was quite reasonable, but over the past few years, global price increases have also impacted the region. We implemented the WHRS project about five years ago, and it has resulted in significant savings by reducing our overall power costs.

That is why we first installed WHRS in our older kilns, and now it has also been incorporated into our new projects. Going forward, WHRS will be essential for any cement plant. We are also working on utilising the waste gases exiting the WHRS, which are still at around 100 degrees Celsius. To harness this residual heat, we are exploring systems based on the Organic Rankine Cycle, which will allow us to extract additional power from the same process.

With the launch of Star Smart Building Solutions and AAC blocks, how are you positioning yourself in the low-carbon construction materials segment?

We are actively working on low-carbon cement products and are currently evaluating LC3 cement. The introduction of autoclaved aerated concrete (AAC) blocks provided us with an effective entry into the consumer-facing segment of the industry. Since we already share a strong dealer network across products, this segment fits well into our overall strategy.

This move is clearly supporting our transition towards products with lower carbon intensity and aligns with our broader sustainability roadmap.

With a diverse product portfolio, what are the key USPs that enable you to support India’s ongoing infrastructure projects across sectors?

Cement requirements vary depending on application. There is OPC, PPC and PSC cement, and each serves different infrastructure needs. We manufacture blended cements as well, which allows us to supply products according to specific project requirements.

For instance, hydroelectric projects, including those with NHPC, have their own technical norms, which we are able to meet. From individual home builders to road infrastructure, dam projects, and regions with heavy monsoon exposure, where weather-shield cement is required, we are equipped to serve all segments. Our ability to tailor cement solutions across diverse climatic and infrastructure conditions is a key strength.

How are you managing biomass usage, circularity, and waste reduction across

your operations?

The Northeast has been fortunate in terms of biomass availability, particularly bamboo. Earlier, much of this bamboo was supplied to paper plants, but many of those facilities have since shut down. As a result, large quantities of bamboo biomass are now available, which we utilise in our thermal power plants, achieving a Thermal Substitution Rate (TSR) of nearly 60 per cent.

We have also started using bamboo as a fuel in our cement kilns, where the TSR is currently around 10 per cent to 12 per cent and is expected to increase further. From a circularity perspective, we extensively use fly ash, which allows us to reuse a major industrial waste product. Additionally, waste generated from HDPE bags is now being processed through our alternative fuel and raw material (AFR) systems. These initiatives collectively support our circular economy objectives.

As Star Cement expands, what are the key logistical and raw material challenges you face in scaling operations?

Fly ash availability in the Northeast is a constraint, as there are no major thermal power plants in the region. We currently source fly ash from Bihar and West Bengal, which adds significant logistics costs. However, supportive railway policies have helped us manage this challenge effectively.

Beyond the Northeast, we are also expanding into other regions, including the western region, to cater to northern markets. We have secured limestone mines through auctions and are now in the process of identifying and securing other critical raw material resources to support this expansion.

With increasing carbon regulations alongside capacity expansion, how do you balance compliance while sustaining growth?

Compliance and growth go hand in hand for us. On the product side, we are working on LC3 cement and other low-carbon formulations. Within our existing product portfolio, we are optimising operations by increasing the use of green fuels and improving energy efficiency to reduce our carbon footprint.

We are also optimising thermal energy consumption and reducing electrical power usage. Notably, we are the first cement company in the Northeast to deploy EV tippers at scale for limestone transportation from mines to plants. Additionally, we have installed belt conveyors for limestone transfer, which further reduces emissions. All these initiatives together help us achieve regulatory compliance while supporting expansion.

Looking ahead to 2030 and 2050, what are the key innovation and sustainability priorities for Star Cement?

Across the cement industry, carbon capture is emerging as a major focus area, and we are also planning to work actively in this space. In parallel, we see strong potential in green hydrogen and are investing in solar power plants to support this transition.

With the rapid adoption of solar energy, power costs have reduced dramatically – from 10–12 per unit to around2.5 per unit. This reduction will enable the production of green hydrogen at scale. Once available, green hydrogen can be used for electricity generation, to power EV fleets, and even as a fuel in cement kilns.

Burning green hydrogen produces only water and oxygen, eliminating carbon emissions from that part of the process. While process-related CO2 emissions from limestone calcination remain a challenge, carbon capture technologies will help address this. Ultimately, while becoming a carbon-negative industry is challenging, it is a goal we must continue to work towards.

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence

FORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence