Economy & Market

Logistics: A cost-effective approach

Published

15 years agoon

By

admin

With the industry showing a downward trend in profit margins, better logistics management proves beneficial to many of the cement manufacturers. Nitin Madkaikar, Economist, FirstInfo Centre, explores the various modes of logistics that can provide a cost-effective means of cement transportation.

Cement, being a bulk commodity, transporting is a costly affair. The selling and distribution costs account for around 18 per cent of sales revenues. In 2009-10, top 30 cement companies spent more than Rs 10,000 crore to carry cement to the consumer. The domestic cement industry has been making continuous efforts to cut its logistic costs.

At the time when the industry was entering into the downside of the cycle, with profit margins coming down to 20-25 per cent from 35-40 per cent, better logistics management proved beneficial to many of the cement manufacturers. Using more railway routes than roads, shrinking lead distance (distance between the manufacturing facility and market) and opting for sea-routes wherever possible were some of the ways the industry explored. Currently, for every 50-kg bag of cement, the logistic cost comes to around Rs 18-25 by road and Rs 12-15 by the railway, depending on the distance. For example, the country’s third-largest cement maker, Ambuja Cements, opted for sea-routes to transport its cement from Gujarat to southern market.

Today, 70 per cent of the cement movement worldwide is by sea compared to just 1-2 per cent in India. However, the scenario is changing with most of the big players like L&T, ACC and Grasim having set up their bulk terminals.

About 3 per cent of the gross revenue is spent on inward logistics while outward logistics accounts for another bulk of 15 per cent. Inward logistics include, coal and limestone transportation, while outward logistics is mostly the final product cement. Some companies also incur outbound logistics cost on transporting clinker to their grinding plants. Plants that are closer to the collieries, the inbound transportation costs are less. For plants located far away from the collieries they have the option to import coal.

While the freight cost could be optimised on the imported coal through usage of company’s own ships for part of the quantity, the international prices of imported coal and its volatility together with the strengthening of the dollar against rupee could derail this. This could impact the delivery prices of imported coal and also the cost of production.

In case of final product, the costs of handling and secondary movement are very high. Although transportation by sea is the cheapest option, unless there is right connectivity from the port to the consuming centre the gains are minimum.

Companies, which have plants located closer to the markets as well as to the source of raw materials have an advantage over their peers, as this leads to lower freight costs. Also, plants located in coastal belts find it much cheaper to transport cement by the sea route in order to cater to the coastal markets such as Mumbai and the states of Gujarat and Tamil Nadu.

Checking logistics costs is an ongoing process for the cement companies. Many are trying to reduce the costs by around 5-7 per cent by optimising the distance of transport. Statistics suggest that about 45 per cent of the cement produced in the country is being transported by the railway. Cement makers prefer roads for shorter distances.

Looking ahead

With demand for cement expected to remain strong in 2011 with a growth of over 10 per cent, the logistic activities are in for a boom. In the 2011-12 fiscal, additional cement capacity of 27 million tonne is likely to go on stream. With the bulk of the capacities coming up in the South, the demand supply imbalance in 2011 would continue to be a cause of concern in the South, though it is expected to improve or remain in a status quo position in other regions.

The dwindling availability of coal linkage and the move to sell high grade indigenous coal at international prices are likely to impact power and fuel costs. The prices of other major inputs mainly slag, gypsum and fly ash are likely to further harden in 2011, whilst the increase in petroleum product prices would continue to impact freight costs. A shortage in railway wagon availability may adversely impact despatches in peak months.

The Indian cement industry is the second largest in the world after China, with a total capacity of close to 300 million tonne and plays a major role in the development of the Nation. Therefore, considering the role of Industry in the economy’s development, it is necessary to incentivise bulk transportation and thereby optimize cost, save fuel and reducing carbon emission while ensuring safe carriage.

Railways to levy surcharge

Indian Railways will levy a surcharge of up to 7 per cent from 1 April to earn a higher freight earning during busy season. The move is likely to add to the inflationary pressure on the economy even as finance ministry is expecting a lower inflation during 2011-12.

As per the railway decision, a surcharge of 5 per cent will be charged on coal and coke group, while all other commodities will attract a busy season charge of 7 per cent. Container traffic has been exempt from any such charge. Railway considers the entire year barring July-September of every year as busy period.

In 2010-11 also, railways had increased freight rates of iron ore, coal, sugar, cement, steel, potash, coke and some petroleum products.

Railways has also decided to levy a congestion charge of flat 20 per cent on traffic to neighbouring Bangladesh and Pakistan. The measure has been taken to encourage faster clearance of rakes at the borders.

Logistics cost reduction cannot be the sole objective and seen in isolation by the cement industry. The most important part is the service. At the end of the day, if one is unable to serve the customer he will never be in the industry. – Rajeev Mehta

How do you evaluate logistics in cement industry?

Logistics costs are going to come down provided one is on the right track. If he chases cost in isolation by just working in cost reduction, he cannot reduce cost in an inflationary world. The process of cost negotiations of olden days are over now. Under negotiation, one arrived only at the lowest quoted price and was content assumingly to have reduced the cost. Here, he only arrives at the best negotiated prices but not at a best cost. Today the concept of negotiation is no more prevalent. If one wants to work the truck freight to a particular destination, the right cost should take into account all the statutory duties, all the toll taxes, fuel cost, and all other allied cost, cost of vehicles, turnaround efficiency, everything. These known efficiency parameters should be arrived at the right price. Here the cost can be reduced only by increasing the efficiency.

The second most important factor is to use technology to the helm. The real time visibility is the key to success. Through technology one can find whether the truck is detained, which route is appropriate, entry restriction, etc. Technology plays a key role in aligning these activities.

What are functional bottlenecks?

In the old system, the key was to have a godown and the evacuation quantity used to be very small. Today one rack carry 3,800 metric tonne as against 1,700 to 1,800 metric tonne earlier. Now the size has almost doubled. Unfortunately in India, evacuation resources have not kept pace with the requirement. Most goods sheds are under control of the union, the fleet size has not expanded as per the growth of the cement business, labour is controlled by the union, labour availability has not increased as per the increment in volumes.

There is no mechanisation process in India, in spite of the wishes of the industry. Here the government has to play an active role. Industry on its own cannot make mechanisation happen. It should be a collaborative effort. Mechanisation, in the short run will create turbulence, but in the long run everybody will be benefitted. People need to be educated and prepared to face these short term turbulences.

What is your estimate of losses due to prevalent evacuation system

Mechanisation can alone reduce cost by a minimum of 10 per cent. The company could currently evacuate 3,000 tonne by manual route from goods shed, just because systems are not mechanised. Going ahead, labour in India will become a scare commodity, so one should be prepared for such eventuality in 2015-2020. The industry will have to join hands and take up a pilot project. It has to be a collaborative effort.

This has driven the logistics to almost 15 per cent of total cost which is very high by global standards given the volumes.

Logistics cost in India is going to come down a) efficiency b) technology is the key c) mechanisation is another area d) last but not the least, people should know the right cost. There has to be organised movement of transport. Every truck coming to Mumbai should log-in at the octroi point, when they are going back from Mumbai and in which destination they want to go. Those people who want to send material to that location can also log-in. So it can be marriage of both, need business and who are willing to give business. Today only brokers are there in this field. They are making money by non-visibility of information. That cost of brokers is unnecessarily borne by the company and the end-user. Make a transportation where every information is visible. Let people log-in and say we are interested in transporting our good.

Railways haul about 40 per cent of cement, what are the bottlenecks there?

Railways has very good system, which gives real time visibility. On technology front, the railways has done a great job. Per se, for any bottleneck railways cannot be blamed. It continues to be a socialistic set-up and at the pace at which the economy is growing the railways has limited resources. Railways have increased the number of trains but where are the tracks. This has to move parallel. Every year railways add 100 of passenger and goods trains, running on the same track. It is not railway that is slow it is a general problem in the country. The time taken to conceive a project and to execute that project is huge.

What are the inwards and outwards logistics, the cost proportion?

In cement industry, inward logistics costs are about three per cent of gross revenue and outbound close to 15 per cent. Clinker going to grinder it is outward.

What are preferred modes of transportation of cement?

Roads are cheaper up to a lead of 300 km, over which it is railways. Sea route is the most economical. But in India sea route is viable only on the west coast, where limestone and markets, both are available. On the east cost the problem is that the regions does not have limestone. In Gujarat limestone is available bang on the coast. Sea route is economical but not available across.

What are the new challenges in road transport?

The toll taxes are a concern now on roads. There has been a progressive increase in the toll rates and the number of points. On a stretch on 200 km there a 5-6 toll points, which hinders speed. This has resulted in increased cost and time. There is an urgent need for high tech toll booths.

What is the focus on logistics going ahead?

Every industry has its own efficiency levels and are trying to address them in different ways. In cement, per se, volumes have gone up and in spite of all these limitations the thrust is to move towards better services.

You may like

Concrete

Our strategy is to establish reliable local partnerships

Published

6 hours agoon

February 19, 2026By

admin

Jean-Jacques Bois, President, Nanolike, discusses how real-time data is reshaping cement delivery planning and fleet performance.

As cement producers look to extract efficiency gains beyond the plant gate, real-time visibility and data-driven logistics are becoming critical levers of competitiveness. In this interview with Jean-Jacques Bois, President, Nanolike, we discover how the company is helping cement brands optimise delivery planning by digitally connecting RMC silos, improving fleet utilisation and reducing overall logistics costs.

How does SiloConnect enable cement plants to optimise delivery planning and logistics in real time?

In simple terms, SiloConnect is a solution developed to help cement suppliers optimise their logistics by connecting RMC silos in real time, ensuring that the right cement is delivered at the right time and to the right location. The core objective is to provide real-time visibility of silo levels at RMC plants, allowing cement producers to better plan deliveries.

SiloConnect connects all the silos of RMC plants in real time and transmits this data remotely to the logistics teams of cement suppliers. With this information, they can decide when to dispatch trucks, how to prioritise customers, and how to optimise fleet utilisation. The biggest savings we see today are in logistics efficiency. Our customers are able to sell and ship more cement using the same fleet. This is achieved by increasing truck rotation, optimising delivery routes, and ultimately delivering the same volumes at a lower overall logistics cost.

Additionally, SiloConnect is designed as an open platform. It offers multiple connectors that allow data to be transmitted directly to third-party ERP systems. For example, it can integrate seamlessly with SAP or other major ERP platforms, enabling automatic order creation whenever replenishment is required.

How does your non-exclusive sensor design perform in the dusty, high-temperature, and harsh operating conditions typical of cement plants?

Harsh operating conditions such as high temperatures, heavy dust, extreme cold in some regions, and even heavy rainfall are all factored into the product design. These environmental challenges are considered from the very beginning of the development process.

Today, we have thousands of sensors operating reliably across a wide range of geographies, from northern Canada to Latin America, as well as in regions with heavy rainfall and extremely high temperatures, such as southern Europe. This extensive field experience demonstrates that, by design, the SiloConnect solution is highly robust and well-suited for demanding cement plant environments.

Have you initiated any pilot projects in India, and what outcomes do you expect from them?

We are at the very early stages of introducing SiloConnect in India. Recently, we installed our

first sensor at an RMC plant in collaboration with FDC Concrete, marking our initial entry into the Indian market.

In parallel, we are in discussions with a leading cement producer in India to potentially launch a pilot project within the next three months. The goal of these pilots is to demonstrate real-time visibility, logistics optimisation and measurable efficiency gains, paving the way for broader adoption across the industry.

What are your long-term plans and strategic approach for working with Indian cement manufacturers?

For India, our strategy is to establish strong and reliable local partnerships, which will allow us to scale the technology effectively. We believe that on-site service, local presence, and customer support are critical to delivering long-term value to cement producers.

Ideally, our plan is to establish an Indian entity within the next 24 months. This will enable us to serve customers more closely, provide faster support and contribute meaningfully to the digital transformation of logistics and supply chain management in the Indian cement industry.

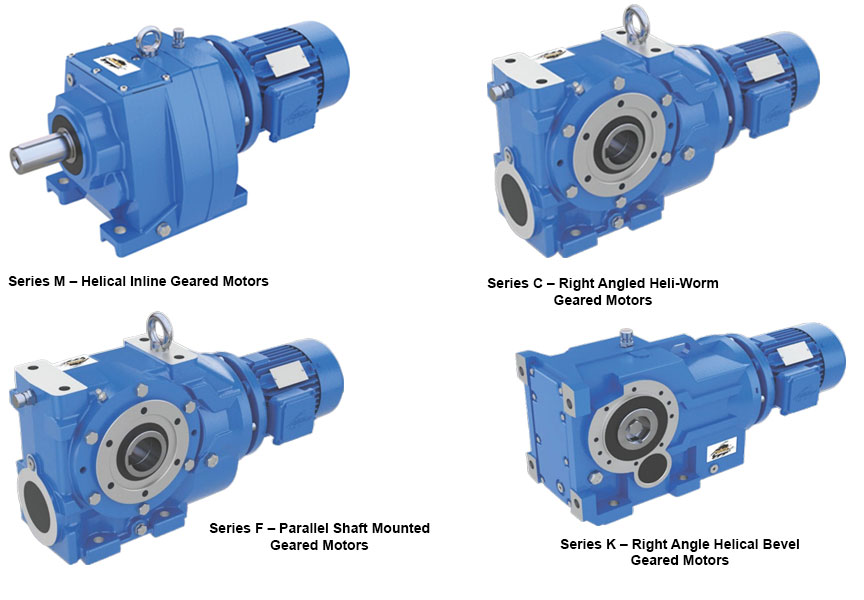

A deep dive into Core Gear Series of products M, C, F and K, by Power Build, and how they represent precision in motion.

At the heart of every high-performance industrial system lies the need for robust, reliable, and efficient power transmission. Power Build answers this need with its flagship geared motor series: M, C, F and K. Each series is meticulously engineered to serve specific operational demands while maintaining the universal promise of durability, efficiency, and performance.

Series M – Helical Inline Geared Motors

Compact and powerful, the Series M delivers exceptional drive solutions for a broad range of applications. With power handling up to 160kW and torque capacity reaching 20,000 Nm, it is the trusted solution for industries requiring quiet operation, high efficiency, and space-saving design. Series M is available with multiple mounting and motor options, making it a versatile choice for manufacturers and OEMs globally.

Series C – Right Angled Heli-Worm Geared Motors

Combining the benefits of helical and worm gearing, the Series C is designed for right-angled power transmission. With gear ratios of up to 16,000:1 and torque capacities of up to 10,000 Nm, this series is optimal for applications demanding precision in compact spaces. Industries looking for a smooth, low-noise operation with maximum torque efficiency rely on Series C for dependable performance.

Series F – Parallel Shaft Mounted Geared Motors

Built for endurance in the most demanding environments, Series F is widely adopted in steel plants, hoists, cranes and heavy-duty conveyors. Offering torque up to 10,000 Nm and high gear ratios up to 20,000:1, this product features an integral torque arm and diverse output configurations to meet industry-specific challenges head-on.

Series K – Right Angle Helical Bevel Geared Motors

For industries seeking high efficiency and torque-heavy performance, Series K is the answer. This right-angled geared motor series delivers torque up to 50,000 Nm, making it a preferred choice in core infrastructure sectors such as cement, power, mining and material handling. Its flexibility in mounting and broad motor options offer engineers the freedom in design and reliability in execution.

Together, these four series reflect Power Build’s commitment to excellence in mechanical power transmission. From compact inline designs to robust right-angle drives, each geared motor is a result of decades of engineering innovation, customer-focused design and field-tested reliability. Whether the requirement is speed control, torque multiplication or space efficiency, Radicon’s Series M, C, F and K stand as trusted powerhouses for global industries.

http://www.powerbuild.in

Call: +919727719344

Pankaj Kejriwal, Whole Time Director and COO, Star Cement, on driving efficiency today and designing sustainability for tomorrow.

In an era where the cement industry is under growing pressure to decarbonise while scaling capacity, Star Cement is charting a pragmatic yet forward-looking path. In this conversation, Pankaj Kejriwal, Whole Time Director and COO, Star Cement, shares how the company is leveraging waste heat recovery, alternative fuels, low-carbon products and clean energy innovations to balance operational efficiency with long-term sustainability.

How has your Lumshnong plant implemented the 24.8 MW Waste Heat Recovery System (WHRS), and what impact has it had on thermal substitution and energy costs?

Earlier, the cost of coal in the Northeast was quite reasonable, but over the past few years, global price increases have also impacted the region. We implemented the WHRS project about five years ago, and it has resulted in significant savings by reducing our overall power costs.

That is why we first installed WHRS in our older kilns, and now it has also been incorporated into our new projects. Going forward, WHRS will be essential for any cement plant. We are also working on utilising the waste gases exiting the WHRS, which are still at around 100 degrees Celsius. To harness this residual heat, we are exploring systems based on the Organic Rankine Cycle, which will allow us to extract additional power from the same process.

With the launch of Star Smart Building Solutions and AAC blocks, how are you positioning yourself in the low-carbon construction materials segment?

We are actively working on low-carbon cement products and are currently evaluating LC3 cement. The introduction of autoclaved aerated concrete (AAC) blocks provided us with an effective entry into the consumer-facing segment of the industry. Since we already share a strong dealer network across products, this segment fits well into our overall strategy.

This move is clearly supporting our transition towards products with lower carbon intensity and aligns with our broader sustainability roadmap.

With a diverse product portfolio, what are the key USPs that enable you to support India’s ongoing infrastructure projects across sectors?

Cement requirements vary depending on application. There is OPC, PPC and PSC cement, and each serves different infrastructure needs. We manufacture blended cements as well, which allows us to supply products according to specific project requirements.

For instance, hydroelectric projects, including those with NHPC, have their own technical norms, which we are able to meet. From individual home builders to road infrastructure, dam projects, and regions with heavy monsoon exposure, where weather-shield cement is required, we are equipped to serve all segments. Our ability to tailor cement solutions across diverse climatic and infrastructure conditions is a key strength.

How are you managing biomass usage, circularity, and waste reduction across

your operations?

The Northeast has been fortunate in terms of biomass availability, particularly bamboo. Earlier, much of this bamboo was supplied to paper plants, but many of those facilities have since shut down. As a result, large quantities of bamboo biomass are now available, which we utilise in our thermal power plants, achieving a Thermal Substitution Rate (TSR) of nearly 60 per cent.

We have also started using bamboo as a fuel in our cement kilns, where the TSR is currently around 10 per cent to 12 per cent and is expected to increase further. From a circularity perspective, we extensively use fly ash, which allows us to reuse a major industrial waste product. Additionally, waste generated from HDPE bags is now being processed through our alternative fuel and raw material (AFR) systems. These initiatives collectively support our circular economy objectives.

As Star Cement expands, what are the key logistical and raw material challenges you face in scaling operations?

Fly ash availability in the Northeast is a constraint, as there are no major thermal power plants in the region. We currently source fly ash from Bihar and West Bengal, which adds significant logistics costs. However, supportive railway policies have helped us manage this challenge effectively.

Beyond the Northeast, we are also expanding into other regions, including the western region, to cater to northern markets. We have secured limestone mines through auctions and are now in the process of identifying and securing other critical raw material resources to support this expansion.

With increasing carbon regulations alongside capacity expansion, how do you balance compliance while sustaining growth?

Compliance and growth go hand in hand for us. On the product side, we are working on LC3 cement and other low-carbon formulations. Within our existing product portfolio, we are optimising operations by increasing the use of green fuels and improving energy efficiency to reduce our carbon footprint.

We are also optimising thermal energy consumption and reducing electrical power usage. Notably, we are the first cement company in the Northeast to deploy EV tippers at scale for limestone transportation from mines to plants. Additionally, we have installed belt conveyors for limestone transfer, which further reduces emissions. All these initiatives together help us achieve regulatory compliance while supporting expansion.

Looking ahead to 2030 and 2050, what are the key innovation and sustainability priorities for Star Cement?

Across the cement industry, carbon capture is emerging as a major focus area, and we are also planning to work actively in this space. In parallel, we see strong potential in green hydrogen and are investing in solar power plants to support this transition.

With the rapid adoption of solar energy, power costs have reduced dramatically – from 10–12 per unit to around2.5 per unit. This reduction will enable the production of green hydrogen at scale. Once available, green hydrogen can be used for electricity generation, to power EV fleets, and even as a fuel in cement kilns.

Burning green hydrogen produces only water and oxygen, eliminating carbon emissions from that part of the process. While process-related CO2 emissions from limestone calcination remain a challenge, carbon capture technologies will help address this. Ultimately, while becoming a carbon-negative industry is challenging, it is a goal we must continue to work towards.

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence

FORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence