Economy & Market

Innovating Energy

Published

5 months agoon

By

admin

Energy optimisation is a cornerstone of a smart cement plant, as it helps in lowering costs and cutting carbon. ICR delves into the different aspects that make a cement plant more energy efficient, accountable and sustainable.

The cement industry is among the most energy-intensive sectors globally, representing a critical frontier for energy efficiency gains. According to the International Energy Agency, global cement production today consumes roughly 100 kWh of electricity per tonne of cement, alongside thermal energy intensity of about 3.6 GJ per tonne of clinker. This energy intensity must fall to below 90 kWh and 3.4 GJ respectively by 2030 to align with Net-Zero trajectories.

India’s cement sector already stands out as relatively energy efficient. According to the OECD, the national average thermal energy consumption hovers at 725 kcal per kg of clinker (˜3.04 GJ/t), and electrical energy usage averages about 80 kWh per tonne of cement, both notably lower than the global averages of approximately 934 kcal/kg clinker and 107 kWh/t cement.

Still, there’s significant room for improvement. The Confederation of Indian Industry’s latest benchmarking shows that while average electrical energy consumption in the Indian cement sector has fallen from 88 kWh/tonne in 2014 to 73.75 kWh/tonne in 2023, the best-performing plants have pushed that down even further—to about 56 kWh/tonne of cement, and 675 kcal/kg of clinker in thermal terms. These figures spotlight the potential—and the urgency—for the rest of the industry to accelerate its energy efficiency trajectory.

Need for Energy Efficiency

Global energy efficiency is rightly dubbed the ‘first fuel’ in the clean-energy transition. According to the International Energy Agency, enhancing energy efficiency is the single most cost-effective and fastest route to cut CO2 emissions while lowering operational costs and strengthening energy security. Efficiency gains alone could fulfil up to 40 per cent of the greenhouse-gas reductions needed to meet Paris Agreement goals, making them indispensable for sectors like cement that are poised for long-term infrastructure growth.

Speaking about the need for cement manufacturers to invest in energy efficiency solutions, MM Rathi, Joint President, Power Management, Shree Cement, says, “Because it directly reduces operating costs, ensures compliance with tightening regulations, and strengthens carbon credentials at a time when financing and markets reward low-carbon players. With mature technologies and strong incentives available, delaying only increases both cost and risk.”

Uma Suryam, SVP and Head Manufacturing – Northern Region, Nuvoco Vistas, explains, “We adopt a comprehensive approach to measure and benchmark energy performance across our plants. Key metrics include Specific Heat Consumption (kCal/kg of clinker) and Specific Power Consumption (kWh/tonne of cement), which are continuously tracked against Best Available Technology (BAT) benchmarks, industry peers and global standards such as the WBCSD-CSI and CII benchmarks.

To ensure consistency and drive improvements, we conduct regular internal energy audits, leverage real-time dashboards and implement robust KPI tracking systems. These tools enable us to compare performance across plants effectively, identify optimisation opportunities and set actionable targets for energy efficiency and sustainability.”

Alex Nazareth, Whole-time Director and CEO, Innomotics India, expounds, “In the cement industry, the primary high-power applications are fans and mills. Among these, fans have the greatest potential for energy savings. Examples, the pre-heater fan, bag house fan, and cooler fans. When there are variations in airflow or the need to maintain a constant pressure in a process, using a variable speed drive (VSD) system is a more effective option for starting and controlling these fans. This adaptive approach can lead to significant energy savings. For instance, vanes and dampers can remain open while the variable frequency drive and motor system manage airflow regulation efficiently.”

In cement manufacturing, energy footprint looms large: production of this indispensable material accounts for 7–8 per cent of global CO2 emissions due to energy-intensive processes and raw-material calcination. A recent report by Reuters confirms that over half of cement’s emissions stem from clinker production, highlighting how inefficient

thermal operations translate directly into climate and cost concerns. In this context, every percentage

point of energy saved not only cuts fuel and electricity costs but also contributes meaningfully to decarbonisation efforts.

With regards to innovations in energy efficiency, Dr Avijit Mondal, Deputy General Manager (DGM), NTPC Energy Technology Research Alliance (NETRA), NTPC, exemplifies, “Cement manufacturing is among the most energy-intensive industrial processes, with continuous high loads from kilns, grinding mills, crushers and conveyors. Integrating a hybrid behind-the-meter microgrid offers a powerful solution to improve energy efficiency, reduce power costs and enhance operational resilience. A typical integrated cement plant can deploy a hybrid system comprising 8-15 MWp of rooftop and ground-mounted solar PV, 8-25 MW of waste heat recovery (WHR) capacity, and a Battery Energy Storage System (BESS) sized for 15-30 minutes of peak plant load. In this configuration, solar PV supplies the daytime base load for processes like grinding and material transport, WHR delivers steady baseload power for kiln and cooler exhaust, and BESS handles ramping and flicker control.”

Barriers to Adoption

Rathi points out that the single biggest barrier is the high upfront capital cost and longer payback periods. According to a study published in PubMed Central, capital limitations are the third most significant barrier to sustainability transformation in the sector—particularly given the hefty investment and slow payback associated with energy projects such as waste-heat recovery systems (WHR) and captive power plants. The report highlights costs of approximately US$2.4 million per MW for WHR systems and US$1 million per MW for captive

power, making rapid returns challenging for many manufacturers.

Suryam shares, “Adopting energy-efficient technologies in brownfield cement plants presents a unique set of challenges due to the constraints of working within existing infrastructure. Another major challenge is minimising production disruptions during installation. Since brownfield plants are already operational, upgrades must be planned meticulously to avoid affecting output.”

Raman Bhatia, Founder and Managing Director, Servotech Renewable Power System, states, “Deploying large-scale solar solutions, comes with unique challenges that require careful planning and execution. One of the primary hurdles in such projects is the structural readiness of industrial rooftops, as they must be able to support the weight and scale of the installation while ensuring long-term safety and durability.”

Beyond financial constraints, there remains a glaring awareness and information gap across the industry. A 2017 report by the International Finance Corporation (IFC) identifies several non-financial barriers, including regulatory uncertainty, lack of project-level knowledge, limited access to sustainable energy financing and internal misalignment of priority between expansion projects and energy efficiency initiatives. Despite the strong long-term returns, energy-saving measures are often overshadowed due to lack of clarity, understanding or management focus within cement organisations.

Finally, the skills deficit stands is a major drag on energy efficiency deployment—not just in renewables but across industrial sectors including cement. According to Reuters, India’s clean energy ambitions are being undermined by an acute shortage of skilled professionals. In the solar industry alone, there’s a shortfall of around 1.2 million trained workers, a gap expected to grow by 2027. Without robust technical know-how—whether for installation, operations, digital monitoring or maintenance—cement plants struggle to implement and sustain efficiency technologies effectively.

Digital Transformation of Energy

Digital transformation is reshaping the cement industry, turning traditional analogue plants into data-driven operations. Internet of Things (IoT) and Industrial IoT (IIoT) systems are being deployed across operations to capture real-time data from kilns, mills, conveyors, and control systems. This information integrates into Energy Management Systems (EMS) that monitor consumption, optimise equipment use and quickly flag inefficiencies. Automation tools like VFDs, smart MCCs and sensors enable not just monitoring, but also proactive control of power-intensive assets—unlocking substantial energy savings through real-time adjustments.

Artificial Intelligence (AI) is adding another layer of sophistication. According to industry estimates, AI in cement manufacturing can reduce energy consumption by up to 15 per cent and cut electricity usage by approximately 28 per cent, thanks to real-time monitoring and feedback loops. Moreover, smart cement plant research indicates that AI implementation can lower overall energy use by 22.7 per cent, reduce downtime by 75 per cent and improve clinker consistency by nearly 12 per cent. These gains underline how machine learning and process-optimisation algorithms can deliver both cost and carbon dividends in one go.

Referring to energy-efficient technologies as vital, Rathi states, “They will lower operating costs, enable decarbonisation and accelerate the shift toward digital, circular and low-carbon manufacturing, making energy efficiency the backbone of competitiveness and sustainability.”

Beyond AI, the rise of digital twins and advanced modelling is giving plant managers unprecedented foresight. Simulated virtual replicas of cement lines let operators test energy-saving scenarios without risking real-world performance. According to a report by Ramco, predictive quality analytics and kiln-fuel blending driven by machine learning enable optimal resource utilisation, lowering both energy consumption and emissions. These systems are especially promising where alternative fuels or clinker substitutes are used—helping ensure consistency and efficiency in challenging process conditions.

Citing the example of modern mineral processing with digital technology, Karen Thompson, President, Haver & Boecker Niagara’s North American and Australian Operations, referred to Artificial intelligence (AI) as a practical tool that’s reshaping how quarries operate. “One of the most impactful applications is in predictive analytics. Unplanned downtime not only disrupts production but also leads to increased energy use, emergency repairs and premature equipment disposal — all of which have environmental consequences. Predictive maintenance technologies help mitigate these risks. Tools like condition monitoring and vibration analysis use wireless sensors to continuously assess equipment health,” she states.

Smart energy management tools powered by IIoT are bridging operations, maintenance, and strategic dashboards. ABB’s Ability™ Knowledge Manager, for instance, allows integration of production, downtime, quality, energy, and emissions data into a unified platform—and deliver insights even via mobile access. A leading Indian cement producer implemented the suite across multiple plants, achieving ROI in just eight months, cutting costs by 3-5 per cent and extending asset lifecycles—demonstrating how digital tools are central to modernising

energy management.

The Green Route

In an industry where energy constitutes up to 40 per cent of production costs, unlocking free sources of power can be a game-changer. Waste Heat Recovery Systems (WHRS) tap into high-temperature exhaust—like kiln preheater gases—and convert up to 30 per cent of a plant’s electricity needs into usable power, using steam turbines or Rankine cycles. A report by the Ministry of New and Renewable Energy mentions that the Indian cement sector possesses a WHRS potential of nearly 1.3 GW, which could annually reduce coal use by approximately 8.6 million tonnes and cut 12.8 million tonnes of CO2 emissions.

Commenting about viable renewable energy solutions, Ghosh says, “Cement industry is a continuous process industry with high power intensity. It requires green, reliable and cost-effective power solutions. Historically, cement plants have preferred the group captive model given the scale of power requirement. From a green power solutions perspective, round-the-clock solutions with a mix of solar, wind and battery storage (or PSP storage) are best suited to meet the power needs of the cement industry. With reduction in battery CAPEX and further learning curves, we see the cost effectiveness of RTC solutions continues to improve in the near term. An important element to make this competitive is to size the configuration based on very granular analytics, such as optimisation of the battery cycling rate through the life of the plant.”

“Most energy efficiency measures are also value accretive. In fact, if you were to draw the marginal abatement cost curve – you will find that >50 per cent of measures to reduce carbon footprint also being in cost reduction, which is a win-win. This is true not just for cement plant operations but across the value chain including logistics. For example, reducing the per tonne per kilometre (PTPK) costs also help in significant carbon footprint reduction which can be achieved by improving packing efficiencies, route optimisation, etc. Hence, energy efficiency helps improve the cost competitiveness in heavy industries and is not contrarian in nature,” he added.

Narrowing down on solar energy, Bhatia shares, “Our patented peak-shaving technology is designed to optimise energy usage efficiency by reducing costly demand spikes that are common in energy-intensive operations. In industries like cement manufacturing, where power consumption can suddenly surge due to heavy machinery, these peaks often translate into higher demand charges on electricity bills. By intelligently managing when and how energy is drawn from the grid and dispatching battery energy storage (BESS) during peak grid usage, we ensure smoother load profiles, lower costs and mitigate tariff exposure.”

Despite its promise, WHRS adoption isn’t universal. A report by ICRA indicates that Indian cement producers plan to invest around Rs.1,400–1,700 crore by FY2022 to add 175 MW of WHRS capacity, which brings the cumulative installed base to 520 MW—covering only about 16 per cent of their power needs. However, the low marginal power cost from WHRS—at just around Rs.1-1.5 per kWh compared to Rs.4.5–5 for captive thermal power—delivers an estimated 14-18 per cent reduction in power expenses, boosting operating margins by 1.1-1.4 percentage points.

Parallel to WHRS, alternative fuels and raw materials are creating dual efficiencies by cutting both energy demand and raw-material inputs. According to CMA, India’s sector-wide Thermal Substitution Rate (TSR) has grown from 0.6 per cent in 2010 to 4 per cent in 2017, with some plants achieving TSR levels of 25-35 per cent using Refuse-Derived Fuel (RDF), agro-waste, sludge and other residues. These co-processing strategies lower dependence on fossil fuels and reduce environmental impacts — moving both raw materials and energy into a more circular usage cycle.

Looking ahead, the synergy between efficiency gains and circular economy gains positions cement firms for long-term competitiveness. WHRS delivers an immediate reduction in operational cost and carbon footprint, while alternative fuel and raw-material integration opens pathways for regulatory resilience, lower input costs and brand differentiation in a sustainability-conscious market. Yet realising their full potential requires overcoming technical challenges, scaling effective logistics and embracing policy frameworks that support both waste valorisation and energy innovation.

Energy Audits

Energy audits serve as foundational tools in the pursuit of operational efficiency within the cement sector, spotlighting precisely where energy is being wasted and where savings can be unlocked. A detailed study by the National Council for Cement and Building Materials (NCB) revealed that kilns are sometimes operated with heat consumption as high as 850 kcal/kg clinker, whereas the industry’s best-performing plants function around 675-685 kcal/kg clinker. Energy audits helped bridge this gap by pinpointing inefficiencies like cooler losses and false air entry—in one case, a reduction of just five kcal/kg clinker yielded annual cost savings of approximately Rs.45-50 lakh for a 1 Mtpa plant. A report by NCB underscores this: energy audits can deliver substantial returns by diagnosing hidden inefficiencies and guiding corrective actions.

Complementing audits, benchmarking empowers cement producers to realistically gauge their energy performance against industry leaders. According to the latest CII benchmarking manual, while

average electrical consumption stands at 73.75 kWh/MT cement, the top 10 plants operate at an impressively efficient 56.14 kWh/MT. Similarly, thermal benchmarks show a gap—from the sector average of 726 kcal/kg clinker to best-in-class levels around 675 kcal/kg. These metrics allow companies to set ambitious yet achievable targets, fostering continuous improvement and motivating strategic investments in efficiency technologies.

Data plays a crucial role in this process.

Debabrata Ghosh, Head of India, Aurora Energy Research, states, “Advanced analytics has several use cases to enhance cement plant performance in improving quality, increasing throughput and reducing cost thereby improving margins/ realisations. Use cases differ by part of the process. Availability of granular and high-quality data captured real time through effective information systems is the primary requisite. Typically, use cases with low effort and high impact should be prioritised to capture low hanging fruits. Structural, big-ticket solutions typically bring about medium term impact on either/ all the three metrics.”

Skill Development for Efficiency

India’s hammering of energy efficiency in manufacturing hinges critically on skilled manpower—a resource that remains alarmingly sparse. According to a Reuters report titled ‘Skills shortage hobbles India’s clean energy aspirations,’ the renewable sector faces a skill gap of approximately 1.2 million workers, projected to rise to 1.7 million by 2027, severely impacting deployment and operational effectiveness of technologies like solar, wind and energy-efficient systems. As clean-energy integration grows, this shortage threatens to stall progress across sectors—including cement—where specialised knowledge in automation, digital monitoring and system optimisation is increasingly indispensable.

Within the cement industry itself, the urgency for upskilling is clear. A recent industry snapshot by ZIPDO Education reveals that 48 per cent of workers feel unprepared for the digital transformation of their plants, while 53 per cent lack basic digital literacy, and 58 per cent report shortages in AI and data analytics skills. However, the same report also signals momentum: 72 per cent of cement firms anticipate expanding digital training programs by 2025, and 80 per cent deem reskilling essential to meet sustainability goals. These figures underscore both the magnitude of the gap and the growing recognition that skill development is no longer optional—but foundational to staying energy-competitive.

OEMs, EPCs and Cement Producers Collaboration

Strategic collaboration between Original Equipment Manufacturers (OEMs), Engineering-Procurement-Construction (EPC) firms and cement producers is proving to be a game-changer in operational efficiency. For instance, a case highlighted in Indian Cement Review recounts how JK Cement’s switch to Mobil SHC™ 632 premium lubricants—not just designed but optimised in coordination with OEM partners—enhanced gearbox efficiency by about 0.8 per cent, saved 263 litres of oil, and delivered cost savings of US$18,764 (Rs.13.1 lakh) annually. This partnership model underscores how nuanced inputs from technical suppliers, paired with operational insights from plant engineers, can translate directly into energy and cost gains.

Similarly, EPC collaborations are demonstrating real traction in energy optimisation. At a leading cement producer’s site in Rajasthan, EPC partner Thermax implemented a blend of operational and capital interventions—like Variable Frequency Drives (VFDs) and auto-control flow logics—for both captive power and WHRS. The results were tangible: cost savings of Rs.7.24 million from capex and Rs.1.88 million from opex in the captive plant, plus Rs.870,000 and Rs.190,000 respectively in the WHR facility. This affirms how EPC-led evaluation and targeted upgrades can yield substantial efficiency returns.

Long Term ROI

In the long run, energy-efficient systems are not merely cost-saving tools—they are strategic investments with powerful paybacks. According to an ICRA report, Indian cement companies planned to deploy 175 MW of Waste Heat Recovery Systems (WHRS) by FY 2021–22, involving a total investment of Rs.1,400–1,700 crore. This investment is expected to widen operating margins by 1.10-1.40 per cent, as WHRS-powered electricity costs just Rs.1.3-Rs.1.5 per kWh, compared to Rs.4.5-Rs.5 per kWh for conventional captive thermal power. Furthermore, Global Cement’s market analysis reveals that WHRS-generated power typically comes in at just US$0.02/kWh, significantly lower than the ~US$0.70/kWh from coal-based captive plants, which allows for around 15 per cent savings in power costs when covering 25 per cent of capacity.

Beyond direct savings, integrating energy-efficient technologies like WHRS or advanced refractories contributes materially to carbon footprint reduction, bolstering ESG performance and potentially unlocking regulatory or market advantages. A detailed case study published by Indian Cement Review in 2024 notes that upgrading kiln burning zones with high-insulation refractories can reduce fuel consumption by 6 per cent, translating into annual savings of roughly `3.5 crore for a 6,000 TPD kiln. The switch also results in an estimated 0.1 tonne of CO2 reduction per tonne of clinker, highlighting how operational efficiencies can create both cost and carbon dividends.

Conclusion

Energy efficiency in cement manufacturing is no longer just a choice—it is an imperative for competitiveness, compliance, and climate responsibility. From waste heat recovery systems to digital transformation and advanced refractories, the sector has already demonstrated that operational savings and carbon reductions can go hand in hand. According to ICRA, WHRS investments alone can expand operating margins by 1.10-1.40 per cent for Indian cement players, showing that the financial case for efficiency is robust. These tangible benefits are proving that efficiency measures are not incremental improvements but transformative enablers for long-term resilience.

At the same time, the industry must overcome barriers such as high upfront costs, limited awareness and skill gaps. Energy audits, benchmarking practices and collaborations between OEMs, EPC contractors and cement producers are emerging as essential tools to bridge these gaps. As noted in multiple case studies, even relatively modest upgrades—such as switching to high-performance refractories—can yield significant savings in fuel costs and emissions reductions. These wins create a strong foundation upon which deeper decarbonisation strategies can be built.

Looking ahead, the integration of emerging technologies—AI, IoT and smart energy management—will further optimise cement operations. Combined with alternative fuels, raw materials and large-scale carbon capture, these innovations are positioning the industry to drastically lower its energy intensity and carbon footprint. The pace of adoption will determine how quickly the sector transitions from incremental efficiency gains to systemic decarbonisation. With India expected to double its cement demand by 2030, scaling these solutions is both a necessity and an opportunity.

The future of cement lies in aligning energy efficiency with the global net-zero agenda. By 2050, achieving net-zero cement production will require a mix of aggressive efficiency measures, deep electrification, large-scale use of alternative fuels and breakthrough technologies such as CCUS. The journey is complex, but the direction is clear: energy efficiency is not only the first step but also the cornerstone of a sustainable cement industry. Those who act decisively today will not only cut costs and carbon but also secure their place as leaders in a net-zero future.– Kanika Mathur

Concrete

Our strategy is to establish reliable local partnerships

Published

7 hours agoon

February 19, 2026By

admin

Jean-Jacques Bois, President, Nanolike, discusses how real-time data is reshaping cement delivery planning and fleet performance.

As cement producers look to extract efficiency gains beyond the plant gate, real-time visibility and data-driven logistics are becoming critical levers of competitiveness. In this interview with Jean-Jacques Bois, President, Nanolike, we discover how the company is helping cement brands optimise delivery planning by digitally connecting RMC silos, improving fleet utilisation and reducing overall logistics costs.

How does SiloConnect enable cement plants to optimise delivery planning and logistics in real time?

In simple terms, SiloConnect is a solution developed to help cement suppliers optimise their logistics by connecting RMC silos in real time, ensuring that the right cement is delivered at the right time and to the right location. The core objective is to provide real-time visibility of silo levels at RMC plants, allowing cement producers to better plan deliveries.

SiloConnect connects all the silos of RMC plants in real time and transmits this data remotely to the logistics teams of cement suppliers. With this information, they can decide when to dispatch trucks, how to prioritise customers, and how to optimise fleet utilisation. The biggest savings we see today are in logistics efficiency. Our customers are able to sell and ship more cement using the same fleet. This is achieved by increasing truck rotation, optimising delivery routes, and ultimately delivering the same volumes at a lower overall logistics cost.

Additionally, SiloConnect is designed as an open platform. It offers multiple connectors that allow data to be transmitted directly to third-party ERP systems. For example, it can integrate seamlessly with SAP or other major ERP platforms, enabling automatic order creation whenever replenishment is required.

How does your non-exclusive sensor design perform in the dusty, high-temperature, and harsh operating conditions typical of cement plants?

Harsh operating conditions such as high temperatures, heavy dust, extreme cold in some regions, and even heavy rainfall are all factored into the product design. These environmental challenges are considered from the very beginning of the development process.

Today, we have thousands of sensors operating reliably across a wide range of geographies, from northern Canada to Latin America, as well as in regions with heavy rainfall and extremely high temperatures, such as southern Europe. This extensive field experience demonstrates that, by design, the SiloConnect solution is highly robust and well-suited for demanding cement plant environments.

Have you initiated any pilot projects in India, and what outcomes do you expect from them?

We are at the very early stages of introducing SiloConnect in India. Recently, we installed our

first sensor at an RMC plant in collaboration with FDC Concrete, marking our initial entry into the Indian market.

In parallel, we are in discussions with a leading cement producer in India to potentially launch a pilot project within the next three months. The goal of these pilots is to demonstrate real-time visibility, logistics optimisation and measurable efficiency gains, paving the way for broader adoption across the industry.

What are your long-term plans and strategic approach for working with Indian cement manufacturers?

For India, our strategy is to establish strong and reliable local partnerships, which will allow us to scale the technology effectively. We believe that on-site service, local presence, and customer support are critical to delivering long-term value to cement producers.

Ideally, our plan is to establish an Indian entity within the next 24 months. This will enable us to serve customers more closely, provide faster support and contribute meaningfully to the digital transformation of logistics and supply chain management in the Indian cement industry.

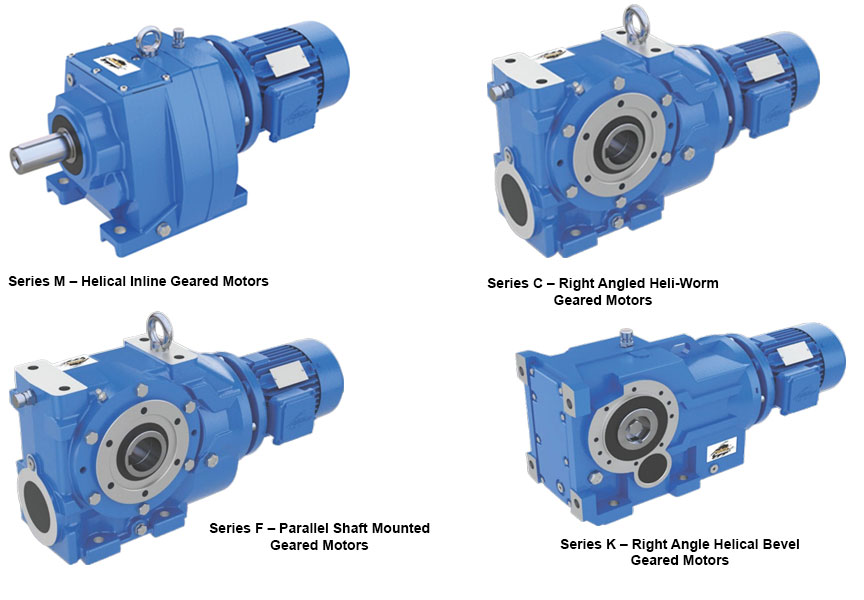

A deep dive into Core Gear Series of products M, C, F and K, by Power Build, and how they represent precision in motion.

At the heart of every high-performance industrial system lies the need for robust, reliable, and efficient power transmission. Power Build answers this need with its flagship geared motor series: M, C, F and K. Each series is meticulously engineered to serve specific operational demands while maintaining the universal promise of durability, efficiency, and performance.

Series M – Helical Inline Geared Motors

Compact and powerful, the Series M delivers exceptional drive solutions for a broad range of applications. With power handling up to 160kW and torque capacity reaching 20,000 Nm, it is the trusted solution for industries requiring quiet operation, high efficiency, and space-saving design. Series M is available with multiple mounting and motor options, making it a versatile choice for manufacturers and OEMs globally.

Series C – Right Angled Heli-Worm Geared Motors

Combining the benefits of helical and worm gearing, the Series C is designed for right-angled power transmission. With gear ratios of up to 16,000:1 and torque capacities of up to 10,000 Nm, this series is optimal for applications demanding precision in compact spaces. Industries looking for a smooth, low-noise operation with maximum torque efficiency rely on Series C for dependable performance.

Series F – Parallel Shaft Mounted Geared Motors

Built for endurance in the most demanding environments, Series F is widely adopted in steel plants, hoists, cranes and heavy-duty conveyors. Offering torque up to 10,000 Nm and high gear ratios up to 20,000:1, this product features an integral torque arm and diverse output configurations to meet industry-specific challenges head-on.

Series K – Right Angle Helical Bevel Geared Motors

For industries seeking high efficiency and torque-heavy performance, Series K is the answer. This right-angled geared motor series delivers torque up to 50,000 Nm, making it a preferred choice in core infrastructure sectors such as cement, power, mining and material handling. Its flexibility in mounting and broad motor options offer engineers the freedom in design and reliability in execution.

Together, these four series reflect Power Build’s commitment to excellence in mechanical power transmission. From compact inline designs to robust right-angle drives, each geared motor is a result of decades of engineering innovation, customer-focused design and field-tested reliability. Whether the requirement is speed control, torque multiplication or space efficiency, Radicon’s Series M, C, F and K stand as trusted powerhouses for global industries.

http://www.powerbuild.in

Call: +919727719344

Pankaj Kejriwal, Whole Time Director and COO, Star Cement, on driving efficiency today and designing sustainability for tomorrow.

In an era where the cement industry is under growing pressure to decarbonise while scaling capacity, Star Cement is charting a pragmatic yet forward-looking path. In this conversation, Pankaj Kejriwal, Whole Time Director and COO, Star Cement, shares how the company is leveraging waste heat recovery, alternative fuels, low-carbon products and clean energy innovations to balance operational efficiency with long-term sustainability.

How has your Lumshnong plant implemented the 24.8 MW Waste Heat Recovery System (WHRS), and what impact has it had on thermal substitution and energy costs?

Earlier, the cost of coal in the Northeast was quite reasonable, but over the past few years, global price increases have also impacted the region. We implemented the WHRS project about five years ago, and it has resulted in significant savings by reducing our overall power costs.

That is why we first installed WHRS in our older kilns, and now it has also been incorporated into our new projects. Going forward, WHRS will be essential for any cement plant. We are also working on utilising the waste gases exiting the WHRS, which are still at around 100 degrees Celsius. To harness this residual heat, we are exploring systems based on the Organic Rankine Cycle, which will allow us to extract additional power from the same process.

With the launch of Star Smart Building Solutions and AAC blocks, how are you positioning yourself in the low-carbon construction materials segment?

We are actively working on low-carbon cement products and are currently evaluating LC3 cement. The introduction of autoclaved aerated concrete (AAC) blocks provided us with an effective entry into the consumer-facing segment of the industry. Since we already share a strong dealer network across products, this segment fits well into our overall strategy.

This move is clearly supporting our transition towards products with lower carbon intensity and aligns with our broader sustainability roadmap.

With a diverse product portfolio, what are the key USPs that enable you to support India’s ongoing infrastructure projects across sectors?

Cement requirements vary depending on application. There is OPC, PPC and PSC cement, and each serves different infrastructure needs. We manufacture blended cements as well, which allows us to supply products according to specific project requirements.

For instance, hydroelectric projects, including those with NHPC, have their own technical norms, which we are able to meet. From individual home builders to road infrastructure, dam projects, and regions with heavy monsoon exposure, where weather-shield cement is required, we are equipped to serve all segments. Our ability to tailor cement solutions across diverse climatic and infrastructure conditions is a key strength.

How are you managing biomass usage, circularity, and waste reduction across

your operations?

The Northeast has been fortunate in terms of biomass availability, particularly bamboo. Earlier, much of this bamboo was supplied to paper plants, but many of those facilities have since shut down. As a result, large quantities of bamboo biomass are now available, which we utilise in our thermal power plants, achieving a Thermal Substitution Rate (TSR) of nearly 60 per cent.

We have also started using bamboo as a fuel in our cement kilns, where the TSR is currently around 10 per cent to 12 per cent and is expected to increase further. From a circularity perspective, we extensively use fly ash, which allows us to reuse a major industrial waste product. Additionally, waste generated from HDPE bags is now being processed through our alternative fuel and raw material (AFR) systems. These initiatives collectively support our circular economy objectives.

As Star Cement expands, what are the key logistical and raw material challenges you face in scaling operations?

Fly ash availability in the Northeast is a constraint, as there are no major thermal power plants in the region. We currently source fly ash from Bihar and West Bengal, which adds significant logistics costs. However, supportive railway policies have helped us manage this challenge effectively.

Beyond the Northeast, we are also expanding into other regions, including the western region, to cater to northern markets. We have secured limestone mines through auctions and are now in the process of identifying and securing other critical raw material resources to support this expansion.

With increasing carbon regulations alongside capacity expansion, how do you balance compliance while sustaining growth?

Compliance and growth go hand in hand for us. On the product side, we are working on LC3 cement and other low-carbon formulations. Within our existing product portfolio, we are optimising operations by increasing the use of green fuels and improving energy efficiency to reduce our carbon footprint.

We are also optimising thermal energy consumption and reducing electrical power usage. Notably, we are the first cement company in the Northeast to deploy EV tippers at scale for limestone transportation from mines to plants. Additionally, we have installed belt conveyors for limestone transfer, which further reduces emissions. All these initiatives together help us achieve regulatory compliance while supporting expansion.

Looking ahead to 2030 and 2050, what are the key innovation and sustainability priorities for Star Cement?

Across the cement industry, carbon capture is emerging as a major focus area, and we are also planning to work actively in this space. In parallel, we see strong potential in green hydrogen and are investing in solar power plants to support this transition.

With the rapid adoption of solar energy, power costs have reduced dramatically – from 10–12 per unit to around2.5 per unit. This reduction will enable the production of green hydrogen at scale. Once available, green hydrogen can be used for electricity generation, to power EV fleets, and even as a fuel in cement kilns.

Burning green hydrogen produces only water and oxygen, eliminating carbon emissions from that part of the process. While process-related CO2 emissions from limestone calcination remain a challenge, carbon capture technologies will help address this. Ultimately, while becoming a carbon-negative industry is challenging, it is a goal we must continue to work towards.

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence

FORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence