Technology

Digital technologies are transforming safety

Published

6 months agoon

By

admin

Raju Ramchandran, SVP and Head Manufacturing – Eastern Region, Nuvoco Vistas, on how the company is setting new benchmarks in industrial safety and operational resilience, with smart technologies and a proactive approach.

In the high-risk environment of cement manufacturing, safety is more than a compliance requirement—it is a strategic imperative. Raju Ramchandran, SVP and Head – Manufacturing, Eastern Region, Nuvoco Vistas, shares how the company is redefining workplace safety through technology, accountability and next-generation systems. In this in-depth conversation, he outlines the evolving risks, robust safety frameworks and the future of digital-first safety culture.

How has the approach to safety evolved in cement manufacturing over the past decade?

Over the past decade, safety in cement manufacturing has evolved from being a regulatory checkbox to becoming an intrinsic part of organisational culture. At Nuvoco, safety is not just a priority, it is a core value, deeply woven into the way we operate every single day. Guided by our ‘Zero Harm’ philosophy, we strive to ensure that every individual stepping into our premises returns home safely.

We have moved towards a more proactive and preventive approach and building strong behavioural safety practices. Specialised training programmes, regular incident reviews and active Safety Committee engagements have strengthened accountability and vigilance across all units. Initiatives such as Cross-Unit Safety Audits, improved workplace hygiene standards, and the successful rollout of the ‘Safety Buddy’ programme reflect our emphasis on collaboration and shared responsibility for safety.

Additionally, best-in-class measures from mandatory safety nets and harnesses to advanced risk assessments for high-hazard tasks are now standard practice across our sites. Supported by leadership commitment, digital monitoring tools and real-time feedback mechanisms, these efforts have transformed safety from a procedural obligation into a shared mindset.

At Nuvoco, safety is a non-negotiable tenet—it is a way of life, and we are constantly raising the bar to protect every member of our workforce.

What are biggest safety risks unique to cements plant today?

Cement manufacturing is an intense, high-temperature and operation-heavy process, where safety is paramount at every stage. The environment presents several unique risks that require constant vigilance and robust preventive measures.

Mining operations within the industry bring their own set of hazards, with strict adherence to Directorate General of Mines Safety (DGMS) guidelines being essential. Exposure to dust is another area of concern, necessitating advanced dust suppression systems and protective equipment to safeguard workers’ health.

Electrical safety and proper energy isolation are also crucial, given the complexity of the equipment involved. Confined space entries, conveyor belt operations and machine guarding present additional risks that call for specialised procedures and continuous monitoring to prevent accidents. Preheaters and precalciners also pose challenges during maintenance activities, such as cleaning cyclone jams, while fire hazards remain present in areas with flammable materials. Additionally, working at heights continues to be one of the major risk activities, making stringent fall protection protocols a non-negotiable.

At Nuvoco, we tackle these risks with a layered approach combining engineering controls, digital monitoring and rigorous safety protocols backed by continuous training and regular mock drills to ensure preparedness for any eventuality. Safety is an unwavering commitment to safeguarding everyone who works in and around our plants.

What role does technology play in enhancing plant safety?

Digital technologies are transforming safety management in cement manufacturing, enabling a shift from reactive measures to a predictive and preventive approach. At Nuvoco, we leverage cutting-edge tools and systems to minimise risk, strengthen hazard management and create safer workplaces for everyone.

Our advanced energy isolation systems such as Lock Out, Tag Out, Try Out (LOTOTO) processes are in place to safeguard electrical operations, while machines are fitted with Visual Cutoff Switches (VCS) for enhanced local control. GPS and Vehicle Tracking Systems (VTS) ensure the safe movement of commuting vehicles across sites.

Real-time monitoring through IoT sensors allows us to track critical parameters like, temperature fluctuations, harmful gases in coal mills and machinery vibrations. These early alerts help prevent potential fires, explosions, and equipment failures. To limit human exposure to hazardous environments, drones are used for inspecting kilns, chimneys and high structures during shutdowns, while robots perform cleaning tasks in preheaters and confined spaces, keeping people out of high-risk areas.

We have also introduced devices such as gas detectors and real-time location trackers that enables faster emergency responses.

Complementing these efforts, our STARS (SHE [Safety, Health & Environment], Tracking, Analysis and Reporting System) software ensures comprehensive tracking of leading and lagging indicators, while mobile apps enable instant reporting of near misses, safety observations and audits. These tools ensure quick corrective actions and strengthen our safety culture across all operations.

By embedding technology into every layer of safety management, Nuvoco has built a digitally enabled, proactive safety framework—one that not only mitigates risks but empowers employees to work confidently, knowing their well-being is protected at every step.

How do you ensure contractor and third-party compliance with your safety standards?

Ensuring contractor and third-party compliance with safety standards in the building material industry involves a comprehensive process that spans prequalification, onboarding, active supervision and post-contract evaluation. It begins at the selection stage, where contractors are assessed not only for their technical competence but also for their safety track record, relevant certifications, availability of personal protective equipment, and the preparedness of their personnel. These expectations are formalised through contractual agreements that clearly outline health and safety responsibilities, legal obligations and consequences in case of non-compliance.

Prior to starting work, contractors undergo mandatory onboarding and training, which cover site-specific hazards, protocols and emergency procedures often communicated in local languages to ensure clarity. For high-risk activities such as hot work, working at heights or confined space entry, a permit-to-work system is in place, supported by detailed risk assessments jointly signed by contractor representatives and plant personnel to reinforce

shared accountability.

During execution, trained supervisors are deployed to monitor compliance on the ground through daily toolbox talks, spot checks and documented audits. Safety performance is closely tracked using both leading and lagging indicators, such as participation in safety initiatives, near-miss and injury reporting. In the event of repeated violations, appropriate enforcement actions are taken, ranging from temporary work stoppage and financial penalties to permanent disqualification while contractors demonstrating consistent adherence are recognised through structured reward and recognition programmes.

Towards the end of the contract period, each contractor’s safety performance is formally reviewed, with the insights feeding into future selection processes. This continuous cycle of evaluation and improvement ensures that safety expectations remain consistent across all stakeholders working within the plant environment.

How are you investing in next-generation safety equipment or systems?

We are investing in next-generation safety systems that not only reduce risks but also transform the way hazards are detected, monitored and controlled across our operations.

We have invested in IoT-enabled sensors provide real-time insights into high temperatures, carbon monoxide levels in coal mills, oxygen levels in pyro processes, and vibrations in heavy machinery, while flame detection via CCTV ensures early alerts for potential fire incidents.

Robotic descalers are used for refractory de-bricking inside preheaters, while drone surveillance is deployed to inspect tall structures such as stacks and silos. This helps identify structural hazards, material build-up and assess the condition of coatings in silos and preheater cyclones. These technologies significantly reduce human exposure to high-risk areas while improving inspection accuracy and efficiency.

Furthermore, we have strengthened fire and explosion protection with advanced suppression systems in coal mills and dust collectors, supported by thermal imaging, we are also exploring the use of AI-enabled cameras for instant detection and response. In hauling operations, driver fatigue detection cameras provide real-time alerts to prevent accidents, while environmental safety is reinforced through live dust monitoring systems with alarms and visual displays at plant gates for corrective action. By embracing these next-generation technologies, we are building a safer, smarter and sustainable world.

Concrete

Turning Downtime into Actionable Intelligence

Published

6 hours agoon

February 19, 2026By

admin

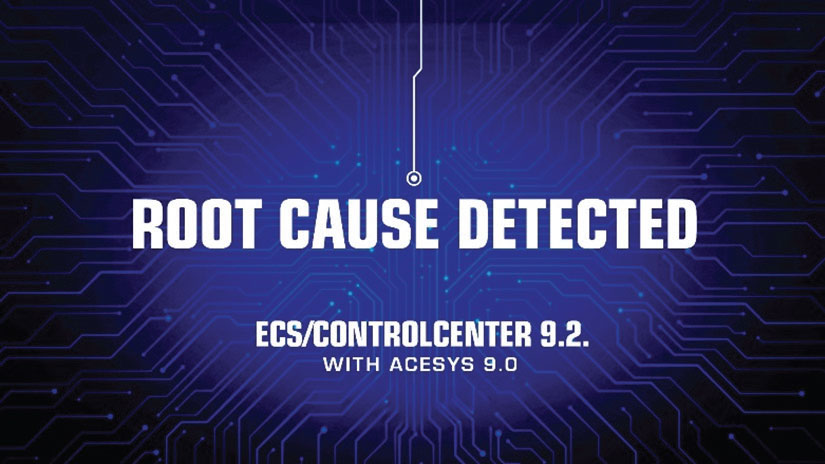

Stoppage Insights instantly identifies root causes and maps their full operational impact.

In cement, mining and minerals processing operations, every unplanned stoppage equals lost production and reduced profitability. Yet identifying what caused a stoppage remains frustratingly complex. A single motor failure can trigger cascading interlocks and alarm floods, burying the root cause under layers of secondary events. Operators and maintenance teams waste valuable time tracing event chains when they should be solving problems. Until now.

Our latest innovation to our ECS Process Control Solution(1) eliminates this complexity. Stoppage Insights, available with the combined updates to our ECS/ControlCenter™ (ECS) software and ACESYS programming library, transforms stoppage events into clear, actionable intelligence. The system automatically identifies the root cause of every stoppage – whether triggered by alarms, interlocks, or operator actions – and maps all affected equipment. Operators can click any stopped motor’s faceplate to view what caused the shutdown instantly. The Stoppage UI provides a complete record of all stoppages with drill-down capabilities, replacing manual investigation with immediate answers.

Understanding root cause in Stoppage Insights

In Stoppage Insights, ‘root cause’ refers to the first alarm, interlock, or operator action detected by the control system. While this may not reveal the underlying mechanical, electrical or process failure that a maintenance team may later discover, it provides an actionable starting point for rapid troubleshooting and response. And this is where Stoppage Insights steps ahead of traditional first-out alarm systems (ISA 18.2). In this older type of system, the first alarm is identified in a group. This is useful, but limited, as it doesn’t show the complete cascade of events, distinguish between operator-initiated and alarm-triggered stoppages, or map downstream impacts. In contrast, Stoppage Insights provides complete transparency:

- Comprehensive capture: Records both regular operator stops and alarm-triggered shutdowns.

- Complete impact visibility: Maps all affected equipment automatically.

- Contextual clarity: Eliminates manual tracing through alarm floods, saving critical response time.

David Campain, Global Product Manager for Process Control Systems, says, “Stoppage Insights takes fault analysis to the next level. Operators and maintenance engineers no longer need to trace complex event chains. They see the root cause clearly and can respond quickly.”

Driving results

1.Driving results for operations teams

Stoppage Insights maximises clarity to minimise downtime, enabling operators to:

• Rapidly identify root causes to shorten recovery time.

• View initiating events and all affected units in one intuitive interface.

• Access complete records of both planned and unplanned stoppages

- Driving results for maintenance and reliability teams

Stoppage Insights helps prioritise work based on evidence, not guesswork:

• Access structured stoppage data for reliability programmes.

• Replace manual logging with automated, exportable records for CMMS, ERP or MES.(2)

• Identify recurring issues and target preventive maintenance effectively.

A future-proof and cybersecure foundation

Our Stoppage Insights feature is built on the latest (version 9) update to our ACESYS advanced programming library. This industry-leading solution lies at the heart of the ECS process control system. Its structured approach enables fast engineering and consistent control logic across hardware platforms from Siemens, Schneider, Rockwell, and others.

In addition to powering Stoppage Insights, ACESYS v9 positions the ECS system for open, interoperable architectures and future-proof automation. The same structured data used by Stoppage Insights supports AI-driven process control, providing the foundation for machine learning models and advanced analytics.

The latest releases also respond to the growing risk of cyberattacks on industrial operational technology (OT) infrastructure, delivering robust cybersecurity. The latest ECS software update (version 9.2) is certified to IEC 62443-4-1 international cybersecurity standards, protecting your process operations and reducing system vulnerability.

What’s available now and what’s coming next?

The ECS/ControlCenter 9.2 and ACESYS 9 updates, featuring Stoppage Insights, are available now for:

- Greenfield projects.

- ECS system upgrades.

- Brownfield replacement of competitor systems.

Stoppage Insights will also soon integrate with our ECS/UptimeGo downtime analysis software. Stoppage records, including root cause identification and affected equipment, will flow seamlessly into UptimeGo for advanced analytics, trending and long-term reliability reporting. This integration creates a complete ecosystem for managing and improving plant uptime.

(1) The ECS Process Control Solution for cement, mining and minerals processing combines proven control strategies with modern automation architecture to optimise plant performance, reduce downtime and support operational excellence.

(2) CMMS refers to computerised maintenance management systems; ERP, to enterprise resource planning; and MES to manufacturing execution systems.

Economy & Market

From Vision to Action: Fornnax Global Growth Strategy for 2026

Published

1 month agoon

January 19, 2026By

admin

Jignesh Kundaria, Director & CEO, Fornnax Recycling Technology

As 2026 begins, Fornnax is accelerating its global growth through strategic expansion, large-scale export-led installations, and technology-driven innovation across multiple recycling streams. Backed by manufacturing scale-up and a strong people-first culture, the company aims to lead sustainable, high-capacity recycling solutions worldwide.

As 2026 begins, Fornnax stands at a pivotal stage in its growth journey. Over the past few years, the company has built a strong foundation rooted in engineering excellence, innovation, and a firm commitment to sustainable recycling. The focus ahead is clear: to grow faster, stronger, and on a truly global scale.

“Our 2026 strategy is driven by four key priorities,” explains Mr. Jignesh Kundaria, Director & CEO of Fornnax.

First, Global Expansion

We will strengthen our presence in major markets such as Europe, Australia, and the GCC, while continuing to grow across our existing regions. By aligning with local regulations and customer requirements, we aim to establish ourselves as a trusted global partner for advanced recycling solutions.

A major milestone in this journey will be export-led global installations. In 2026, we will commission Europe’s highest-capacity shredding line, reinforcing our leadership in high-capacity recycling solutions.

Second, Product Innovation and Technology Leadership

Innovation remains at the heart of our vision to become a global leader in recycling technology by 2030. Our focus is on developing solutions that are state-of-the-art, economical, efficient, reliable, and environmentally responsible.

Building on a decade-long legacy in tyre recycling, we have expanded our portfolio into new recycling applications, including municipal solid waste (MSW), e-waste, cable, and aluminium recycling. This diversification has already created strong momentum across the industry, marked by key milestones scheduled to become operational this year, such as:

- Installation of India’s largest e-waste and cable recycling line.

- Commissioning of a high-capacity MSW RDF recycling line.

“Sustainable growth must be scalable and profitable,” emphasizes Mr. Kundaria. In 2026, Fornnax will complete Phase One of our capacity expansion by establishing the world’s largest shredding equipment manufacturing facility. This 23-acre manufacturing unit, scheduled for completion in July 2026, will significantly enhance our production capability and global delivery capacity.

Alongside this, we will continue to improve efficiency across manufacturing, supply chain, and service operations, while strengthening our service network across India, Australia, and Europe to ensure faster and more reliable customer support.

Finally: People and Culture

“People remain the foundation of Fornnax’s success. We will continue to invest in talent, leadership development, and a culture built on ownership, collaboration, and continuous improvement,” states Mr. Kundaria.

With a strong commitment to sustainability in everything we do, our ambition is not only to grow our business, but also to actively support the circular economy and contribute to a cleaner, more sustainable future.

Guided by a shared vision and disciplined execution, 2026 is set to be a defining year for us, driven by innovation across diverse recycling applications, large-scale global installations, and manufacturing excellence.

Concrete

Technology plays a critical role in achieving our goals

Published

2 months agoon

December 24, 2025By

admin

Arasu Shanmugam, Director and CEO-India, IFGL, discusses the diversification of the refractory sector into the cement industry with sustainable and innovative solutions, including green refractories and advanced technologies like shotcrete.

Tell us about your company, it being India’s first refractory all Indian MNC.

IFGL Refractories has traditionally focused on the steel industry. However, as part of our diversification strategy, we decided to expand into the cement sector a year ago, offering a comprehensive range of solutions. These solutions cover the entire process, from the preheater stage to the cooler. On the product side, we provide a full range, including alumina bricks, monolithics, castables, and basic refractories.

In a remarkably short span of time, we have built the capability to offer complete solutions to the cement industry using our own products. Although the cement segment is new for IFGL, the team handling this business vertical has 30 years of experience in the cement industry. This expertise has been instrumental in establishing a brand-new greenfield project for alumina bricks, which is now operational. Since production began in May, we are fully booked for the next six months, with orders extending until May 2025. This demonstrates the credibility we have quickly established, driven by our team’s experience and the company’s agility, which has been a core strength for us in the steel industry and will now benefit our cement initiatives.

As a 100 per cent Indian-owned multinational company, IFGL stands out in the refractory sector, where most leading players providing cement solutions are foreign-owned. We are listed on the stock exchange and have a global footprint, including plants in the United Kingdom, where we are the largest refractory producer, thanks to our operations with Sheffield Refractories and Monocon. Additionally, we have a plant in the United States that produces state-of-the-art black refractories for critical steel applications, a plant in Germany providing filtering solutions for the foundry sector, and a base in China, ensuring secure access to high-quality raw materials.

China, as a major source of pure raw materials for refractories, is critical to the global supply chain. We have strategically developed our own base there, ensuring both raw material security and technological advancements. For instance, Sheffield Refractories is a leader in cutting-edge shotcreting technology, which is particularly relevant to the cement industry. Since downtime in cement plants incurs costs far greater than refractory expenses, this technology, which enables rapid repairs and quicker return to production, is a game-changer. Leading cement manufacturers in the country have already expressed significant interest in this service, which we plan to launch in March 2025.

With this strong foundation, we are entering the cement industry with confidence and a commitment to delivering innovative and efficient solutions.

Could you share any differences you’ve observed in business operations between regions like Europe, India, and China? How do their functionalities and approaches vary?

When it comes to business functionality, Europe is unfortunately a shrinking market. There is a noticeable lack of enthusiasm, and companies there often face challenges in forming partnerships with vendors. In contrast, India presents an evolving scenario where close partnerships with vendors have become a key trend. About 15 years ago, refractory suppliers were viewed merely as vendors supplying commodities. Today, however, they are integral to the customer’s value creation chain.

We now have a deep understanding of our customers’ process variations and advancements. This integration allows us to align our refractory solutions with their evolving processes, strengthening our role as a value chain partner. This collaborative approach is a major differentiator, and I don’t see it happening anywhere else on the same scale. Additionally, India is the only region globally experiencing significant growth. As a result, international players are increasingly looking at India as a potential market for expansion. Given this, we take pride in being an Indian company for over four decades and aim to contribute to making Aatma Nirbhar Bharat (self-reliant India) a reality.

Moving on to the net-zero mission, it’s crucial to discuss our contributions to sustainability in the cement industry. Traditionally, we focused on providing burnt bricks, which require significant fuel consumption during firing and result in higher greenhouse gas emissions, particularly CO2. With the introduction of Sheffield Refractories’ green technology, we are now promoting the use of green refractories in cement production. Increasing the share of green refractories naturally reduces CO2 emissions per ton of clinker produced.

Our honourable Prime Minister has set the goal of achieving net-zero emissions by 2070. We are committed to being key enablers of this vision by expanding the use of green refractories and providing sustainable solutions to the cement industry, reducing reliance on burnt refractories.

Technology is advancing rapidly. What role does it play in helping you achieve your targets and support the cement industry?

Technology plays a critical role in achieving our goals and supporting the cement industry. As I mentioned earlier, the reduction in specific refractory consumption is driven by two key factors: refining customer processes and enhancing refractory quality. By working closely as partners with our customers, we gain a deeper understanding of their evolving needs, enabling us to continuously innovate. For example, in November 2022, we established a state-of-the-art research centre in India for IFGL, something we didn’t have before.

The primary objective of this centre is to leverage in-house technology to enhance the utilisation of recycled materials in manufacturing our products. By increasing the proportion of recycled materials, we reduce the depletion of natural resources and greenhouse gas emissions. In essence, our focus is on developing sustainable, green refractories while promoting circularity in our business processes. This multi-faceted approach ensures we contribute to environmental sustainability while meeting the industry’s demands.

Of course, this all sounds promising, but there must be challenges you’re facing along the way. Could you elaborate on those?

One challenge we face is related to India’s mineral resources. For instance, there are oxide deposits in the Saurashtra region of Gujarat, but unfortunately, they contain a higher percentage of impurities. On the magnesite side, India has deposits in three regions: Salem in Tamil Nadu, Almora in Uttarakhand, and Jammu. However, these magnesite deposits also have impurities. We believe the government should take up research and development initiatives to beneficiate these minerals, which are abundantly available in India, and make them suitable for producing high-end refractories. This task is beyond the capacity of an individual refractories company and requires focused policy intervention. While the government is undertaking several initiatives, beneficiation of minerals like Indian magnesite and Indian oxide needs to become a key area of focus.

Another crucial policy support we require is recognising the importance of refractories in industrial production. The reality is that without refractories, not even a single kilogram of steel or cement can be produced. Despite this, refractories are not included in the list of core industries. We urge the government to designate refractories as a core industry, which would ensure dedicated focus, including R&D allocations for initiatives like raw material beneficiation. At IFGL, we are taking proactive steps to address some of these challenges. For instance, we own Sheffield Refractories, a global leader in shotcrete technology. We are bringing this technology to India, with implementation planned from March onwards. Additionally, our partnership with Marvel Refractories in China enables us to leverage their expertise in providing high-quality refractories for steel and cement industries worldwide.

While we are making significant efforts at our level, policy support from the government—such as recognising refractories as a core industry and fostering research for local raw material beneficiation—would accelerate progress. This combined effort would greatly enhance India’s capability to produce high-end refractories and meet the growing demands of critical industries.

Could you share your opinion on the journey toward achieving net-zero emissions? How do you envision this journey unfolding?

The journey toward net zero is progressing steadily. For instance, even at this conference, we can observe the commitment as a country toward this goal. Achieving net zero involves having a clear starting point, a defined objective, and a pace to progress. I believe we are already moving at an impressive speed toward realising this goal. One example is the significant reduction in energy consumption per ton of clinker, which has halved over the past 7–8 years—a remarkable achievement.

Another critical aspect is the emphasis on circularity in the cement industry. The use of gypsum, which is a byproduct of the fertiliser and chemical industries, as well as fly ash generated by the power industry, has been effectively incorporated into cement production. Additionally, a recent advancement involves the use of calcined clay as an active component in cement. I am particularly encouraged by discussions around incorporating 12 per cent to 15 per cent limestone into the mix without the need for burning, which does not compromise the quality of the final product. These strategies demonstrate the cement industry’s constructive and innovative approach toward achieving net-zero emissions. The pace at which these advancements are being adopted is highly encouraging, and I believe we are on a fast track to reaching this critical milestone.

– Kanika Mathur

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence

FORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence