Concrete

Fastest Growing Cement Companies in India

Published

12 months agoon

By

admin

India is the world’s second-largest cement producer, with over 7 per cent of global installed capacity. The installed cement capacity in India is 553 mtpa, with a production of 298 mtpa. Ready availability of raw materials for making cement, such as limestone and coal, is a key factor aiding the growth of the sector.

Capacity addition in the cement industry is estimated at 63-70 mt between FY25 and FY26, with approximately 33-35 mt expected in FY25 alone. This is driven by an increasing spend on housing and infrastructure activities. The capacity utilisation is expected to rise to 71 per cent in FY25 from 70 per cent in FY24, backed by higher cement volumes, driven by demands in roads, urban infrastructure and commercial real estate. India’s cement production was expected to reach 457 mt by FY25, a growth rate of 5 per cent per cent year on year.

The cement industry is mainly driven by the consequential number of construction activities with growing demand and a surging need for residential complexes for the urbanised population. Further, the construction of various infrastructure projects such as airports and roads, undertaken by the Government in recent times, propels the growth of the market.

Consumption of cement has also been growing consistently on the back of rising rural housing demand. Strong expansion of the industrial sector is one of the main demand drivers for the cement industry. As a result, there is a strong potential for an increase in long-term demand. Initiatives such as the development of 98 smart cities are expected to significantly boost the sector.

Massive modernisation and assimilation of state-of-the-art technology have made cement plants energy-efficient and environment-friendly. The cement industry contributes to environmental cleanliness by consuming hazardous waste like fly ash (around 30 mt) from thermal power plants and the entire 8 million tonne of granulated slag produced by steel manufacturing units. It uses alternate fuels and raw materials through advanced and environment-friendly technologies.

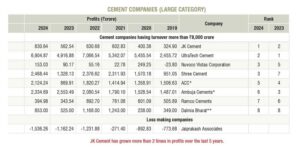

JSW Cement is the only company in the list to have achieved double digit year-on-year growth of 25 per cent outperforming its peers.

Sagar Cements (SCL) acquired Andhra Cements (ACL) in 2023 at a cost of Rs.922 crore, helping

it achieve capacity guidance of 10 million tonnes per annum (mtpa) before 2025.

Star Cements ranks as the second largest in profits with an impressive growth of 34 per cent.

NCL Industries has more than doubled its growth from 2023 to 2024, outperforming its competitors.

Fastest Growing Cement Companies – Large JK Cement

JK Cement’s operations commenced with commercial production at its flagship grey cement unit at Nimbahera, Rajasthan, in 1975. Today, it is one of India’s leading manufacturers of grey cement, with an installed capacity of 20 mtpa, and one of the world’s leading white cement manufacturers, with a total white cement capacity of 1.20 mtpa and wall putty capacity of 1.2 mtpa. Its vision is to be the preferred manufacturer of cement and cement-based products that partners in nation-building. It is India’s No. 1 white cement and wall putty company and has been at the forefront of the country’s cement industry, focusing on quality, innovation and sustainability with superior products and a strong brand name.

JK white cement is sold across 43 countries around the globe. The company has a strong international presence with two subsidiaries, JK Cement

Works Fujairah FZC and JK White Cement (Africa). Over four decades, it has partnered India’s multisectoral infrastructure needs on the strength of its product excellence, customer orientation and technology leadership.

The recent acquisition of Toshali Cement for Rs.900 million marks a significant expansion into the Eastern Indian market, adding 0.6 mtpa to its cement production capacity. Toshali Cement, based in Odisha, operates two key units: an integrated unit in Koraput with a clinker capacity of 0.33 mtpa and a grinding capacity of 0.2 mtpa, and a grinding unit in Cuttack with a capacity of 0.44 mtpa. Additionally, the acquisition includes a limestone mining license for which JK Cement will pay an extra `670 million. This strategic move strengthens its footprint in a region poised for growth owing to government infrastructure projects and housing initiatives.

The company reported net sales of Rs.105.6315 billion during the financial year ending 31 March 2024, compared to Rs.90.9391 billion the previous year. Notably, it recorded a PAT of Rs.8.3064 billion, a significant increase from the

Rs.5.2068 billion reported the previous year. This growth is reflected in an improved EPS of `107.5, up from `65.06 in the preceding financial year.

Ultra Tech Cement

Ultra Tech Cement is the cement flagship company of the Aditya Birla Group and the largest manufacturer of grey cement, RMC and white cement in India. It provides a range of products that caters to the needs of various aspects of construction, from foundation to finish, under five business verticals: Grey Cement, White Cement, Concrete, Building Products and Ultra Tech Building Solutions.

It is the only cement company globally (outside China) to have 100+ mtpa of cement manufacturing capacity in a single country. Its business operations span the UAE, Bahrain, Sri Lanka and India. It has a consolidated installed capacity of 132.45 mtpa and 23 manufacturing units, 28 grinding units, one clinkerisation unit and eight bulk packaging terminals. It is the third-largest cement producer in the world, excluding China.

In the white cement segment, Ultra Tech operates under the brand name Birla White. It has one white cement unit and three wall care putty units, with a current capacity of 1.98 mtpa. With 185+ RMC plants in 85+ cities, Ultra Tech is the largest manufacturer of concrete in India. A founding member of the Global Cement and Concrete Association (GCCA), it is a signatory to the GCCA Climate Ambition 2050 and has committed to the Net Zero Concrete Roadmap announced by GCCA. It is focused on accelerating the decarburisation of its operations.

The acquisition of a 1.1 mtpa grinding unit from India Cements for Rs.3.15 billion marks a strategic move to strengthen its market presence in Maharashtra. The unit, located in Parli, comes with a captive railway siding, enhancing logistics and operational efficiency. This acquisition is part of the company’s broader plan to expand capacity, as it also announced a Rs.5.04 billion investment to expand its Parli and Dhule units. With these expansions, it aims to cater to future growth in the region, aligning with its target to boost total capacity to nearly 200 mtpa by FY26.

Total revenue jumped 12 per cent to Rs.686.41 billion for FY2023-24, from Rs.612.37 billion in FY2022-23. Profit before tax was Rs.93.88 billion, compared to Rs.72.62 billion the previous year. Net profit

was Rs.69.05 billion, compared to Rs.49.51 billion for 2022-2023.

Shree Cement

Shree Cement is one of India’s top three cement producers, with operations spanning both the domestic and international markets. It is known for its range of cement products, including OPC, PPC and clinker. With a focus on efficiency and sustainability, it has positioned itself as one of the lowest-cost producers in the country. Its commitment to innovation is reflected in the diverse range of solutions it offers for construction, from housing to large-scale infrastructure projects.

The company operates across India and abroad, with a total production capacity of 50.4 mtpa. It has 12 integrated cement plants and multiple grinding units, making it one of the largest cement manufacturers in the country. Its reach extends to the UAE and its expansion plans are aligned with its goal of achieving 80 mtpa by 2030. Additionally, it has invested significantly in green energy, with a power generation capacity of 474 mw, including renewable energy sources such as solar and wind.

In FY2024, Shree Cement reported robust financial performance, with a revenue of Rs.205.2 billion, representing a 15 per cent increase from the previous year. Net income for FY2024 stood at Rs.24 billion, reflecting an impressive 89 per cent growth compared to FY2023. The profit margin also increased to

12 per cent, up from 7.1 per cent the previous year. These strong financial results were driven by increased operational efficiency and higher revenues from expanding operations.

Nuvoco Vistas Corporation

Nuvoco Vistas Corporation, a part of the Nirma Group, is one of India’s leading cement manufacturers, with a strong presence in the country’s building materials industry. With a total installed capacity of 25.0 MTPA, the company operates 11 cement plants, including integrated units, grinding units, and ready-mix concrete plants across key regions such as Chhattisgarh, Jharkhand, Rajasthan, Haryana, and West Bengal. As part of its long-term expansion strategy, Nuvoco plans to increase its total capacity to 31.0 MTPA by Q3 FY27 through strategic acquisitions and greenfield expansions.

Nuvoco focuses on sustainable and innovative cement solutions, offering a premium product portfolio, including Concreto, Duraguard, and Zero M (a low-carbon cement). The company is also a key player in the ready-mix concrete (RMX) market, operating 56 RMX plants nationwide. As part of its cost optimisation initiative (Project Bridge 2.0), the company continues to enhance operational efficiencies, focusing on reducing power and fuel costs while improving its distribution network.

As part of its growth strategy, Nuvoco is leveraging its recent Vadraj Cement acquisition, which will add 6.0 MTPA of cement capacity and 3.5 MTPA of clinker capacity, strengthening its position in Gujarat and Maharashtra. This acquisition will diversify its footprint across North and West India, making it the third-largest player in the Western market. The company also benefits from strong backward integration, with captive limestone mines, power generation capabilities, and a 50 MW renewable energy portfolio, including waste heat recovery systems (WHRS) and solar power.

For 9M FY25, Nuvoco Vistas reported a total revenue of Rs.73.3 billion, with an EBITDA of Rs.8.35 billion. Cement sales volume stood at 4.7 million tons in Q3 FY25, reflecting a 16% YoY growth. With a strong focus on capacity expansion, premiumisation, and sustainability, Nuvoco is well-positioned to capitalise on infrastructure demand and market growth, further strengthening its cost efficiency and brand leadership.

Fastest Growing Cement Companies – Medium

JSW Cement

Part of the diversified $ 23 billion JSW Group, JSW Cement is India’s leading green cement company with a current capacity of 19 mtpa and is on a mission to support the country’s growth in core economic sectors with speed and innovation, delivering the best-quality green cement to customers. Its vision is to build a self-reliant India by boosting infrastructure and the fast-growing economy through projects setting new benchmarks.

The company’s world-class facilities and technological advancements give it the firepower to keep expanding to newer geographies around the country and target new customer segments. It has manufacturing units in Vijayanagar, Karnataka; Nandyal, Andhra Pradesh; Salboni, West Bengal; Jajpur, Odisha; Dolvi, Maharashtra and Fujairah, UAE, among others. With a strong presence in 11 major states in India, it is expanding its footprint in the country and overseas by adding to its existing five active state-of-the-art manufacturing plants and three mines, and intends to increase its production capacity. It is targeting 25 mtpa production by 2023 and all its current business investments are driven to achieve this goal.

JSW Cement is present across the value chain of building materials comprising cement, concrete and construction chemicals. This gives it a unique advantage to cater to the diverse needs of the construction industry with premium, high-quality and eco-friendly products. Its subsidiary, Shiva Cement, is currently investing over `15 billion in a 1.36 mtpa clinker unit to be established in Sundergarh, Odisha. The project includes setting up a 1 mtpa grinding unit and associated facilities.

During FY2023-24, the company reported total income of `59.5189 billion, compared to `49.0114 billion in FY2022-23. PAT was reported at `2.2092 billion in FY2023-24, compared to `2.4975 billion the previous year.

Star Cement

Star Cement is the No. 1 cement brand in India’s Northeast and one of the fastest growing cement brands in West Bengal and Bihar. Its state-of-the-art cement plants bring together innovation and technology to provide high-quality cement, focusing on best-in-class sustainable construction. It has established itself as the most accredited brand in the region for providing high-quality cement and fair pricing.

The company has gained a prominent

position in the Indian construction industry for its premium quality cement, focusing on sustainable development, to meet today’s challenging building material needs and home-building aspirations of millions of customers, supported by pioneering marketing initiatives. It is powered by three cement plants located at Lumshnong in Meghalaya, Sonapur-Guwahati in Assam and Mohitnagar Jalpaiguri in West Bengal, making it one of the largest manufacturers of cement in eastern India. It is proud to have consistently earned recognition and top awards in the construction industry.

The company’s product range for construction includes OPC 43 and 53 grades, PPC and Portland slag cement (PSC). Anti-rust cement (ARC) is another marquee product in the value-added segment in line with evolving customer and construction needs. Known for competence and quality, these products are sought after by customers, engineers, dealers

and contractors.

Star Cement recorded a total revenue of Rs.29.11 billion in FY2023-24, compared to Rs.27.05 billion in FY2022-23. It reported an EBITDA of Rs.5.83 billion in FY2023-24, compared to Rs.5.2 billion the previous year. PAT stood at

Rs.2.95 billion, compared to Rs.2.48 billion in FY2022-23. Projected EPS is Rs.7.3 in FY 2023-24, compared to Rs.6.1 the previous year.

Orient Cement

Orient Cement is a prominent player in India’s cement industry, with a strong presence across key regions. It manufactures and markets high-quality cement under the brands Birla A1 Premium and Birla A1 Strong Crete. It operates three integrated cement plants and a grinding unit, catering to markets in Maharashtra, Telangana and Karnataka. With a strategic focus on sustainability, it is also making strides in reducing its carbon footprint and adopting cleaner energy sources.

In addition to domestic operations, the company has been exploring growth opportunities in new geographies, aiming to strengthen its market position across India. Its efforts towards product innovation and capacity expansion have helped it capture a larger market share in competitive regions. Its strategic investments in modernising manufacturing facilities are expected to improve operational efficiency and increase output. A customer-centric approach and strong distribution network have also played a key role in maintaining its competitive edge.

In FY2024, Orient Cement demonstrated steady financial performance, reporting a revenue of Rs.7.2058 billion for Q2, which marked a 17.11 per cent year-on-year increase. Net profit for the same period stood at Rs.246.3 million, a significant improvement compared to a loss of Rs.95 million in the previous year. This reflects its focus on cost management and operational efficiency. For Q3 FY24, revenue increased to Rs.7.5131 billion while net profit surged by 63.5 per cent to Rs.449.9 million.

JK Lakshmi Cement

JK Lakshmi Cement, a subsidiary of the JK Organisation, is a key player in the Indian cement industry, with an installed capacity of 16.5 MTPA. The company operates integrated cement plants in Rajasthan and Chhattisgarh, along with grinding units in Gujarat, Haryana, Odisha, and West Bengal. Its subsidiary, Udaipur Cement Works Ltd. (UCWL), contributes an additional 4.7 MTPA, enhancing its overall market presence.

JK Lakshmi is on track to achieve 30 MTPA capacity by 2030 through strategic greenfield and brownfield expansions.

The company offers a diversified product portfolio, including blended cement, ready-mix concrete (RMC), and autoclaved aerated concrete (AAC) blocks. It has also launched low-carbon and premium cement products, catering to growing sustainability demands. JK Lakshmi is investing heavily in renewable energy, with 48% of its power sourced from WHRS and solar. The company’s focus on cost leadership has enabled it to maintain one of the lowest cement production costs in the industry.

As part of its expansion strategy, JK Lakshmi Cement is developing additional grinding units in Surat (1.35 MTPA) and Prayagraj, Madhubani, and Patratu (3.4 MTPA combined). Additionally, it is expanding clinker capacity at its Durg plant (2.3 MTPA) and foraying into the North Eastern market with a clinker unit (1.0 MTPA) and a cement grinding unit (1.5 MTPA) in Assam. These projects will strengthen its market reach and logistics efficiencies, ensuring long-term growth and profitability.

For 9M FY25, JK Lakshmi Cement reported a total revenue of `42.95 billion, with an EBITDA of `5.44 billion. Despite volume pressures, the company remains focused on cost efficiency, premiumisation, and market expansion. Its Project Bridge 2.0 initiative is driving operational improvements, helping JK Lakshmi maintain its position as a cost-efficient and growth-driven cement producer in India.

Fastest Growing Cement Companies – Small

Udaipur Cement Works

Udaipur Cement Works (UCWL) is one of India’s leading cement manufacturers, with its roots in Udaipur, the city of lakes in Rajasthan. A subsidiary of JK Lakshmi Cement (JKLC), it is a manufacturer and supplier of cement and cementitious products with manufacturing facilities in Rajasthan. With an integrated cement manufacturing unit with an installed cement production capacity of 2.2 mtpa, it manufactures a range of cement, including PPC, OPC and clinker.

The company is relentlessly focused on product quality, customer satisfaction and innovation, which has helped push boundaries and tap the immense potential for development in the infrastructure and construction sectors in India. Its philosophy is based on sustainable growth and a developmental framework that works for a better and happier future. Working principles have been aligned to contribute to the nation’s commitment to meet the UN Sustainable Development Goals and it upholds the highest levels of system standards, such as the ISO Certification for Environment (14001), Occupational Health and Safety (45001), Energy (50001), and Quality Management (9001) systems. It has also inventoried its carbon and water footprint as per ISO 14064 – 1 and ISO 14046.

The company reported a total income of Rs.11.7436 billion during FY2023-24 compared to Rs.10.3226 billion in FY2022-23. It posted a PAT of Rs.628.8 million for FY 2023-24 as against Rs.351 million the previous year and EPS of Rs.1.25 compared to Rs.1.15.

On July 31, 2024, as part of its amalgamation plan, JK Lakshmi Cement Ltd’s board approved the merger of its three subsidiaries – Udaipur Cement Works Ltd, Hansdeep Industries & Trading Co and Hidrive Developers and Industries Pvt Ltd – with itself.

Shree Digvijay Cements

Shree Digvijay Cements is one of India’s pioneers in manufacturing cement, having started operations in 1944 in the coastal township of Digvijaygram (Sikka) in Jamnagar district,Gujarat. Since 2019, it is part of True North, formerly known as India Value Fund Advisers (IVFA). The company’s licensed capacity stands at 3 mtpa, housing a fully automatic modern cement plant which is ISO 9001, ISO 14001 and OHSAS 18000 certified.

The company is one of the key exporters of cement and cement clinker throughout the world, for which it received the Certificate of Honour of Export House from the President of India. It has a Gujarat-wide network of over 1,000 channel partners selling cement under the brand name Kamal Cement. In addition, it is among the earliest accredited companies awarded with the prestigious license from the American Petroleum Institute (API) for manufacturing oil well cement – API 10A Class G HSR cement. It has been a trendsetter in providing superior quality ordinary and special Portland cement. Its commitment to sustainable development and

high ethical standards in business dealings have been appreciated.

The company offers a unique combination of product quality and customer-tailored logistics solutions through a combination of road, railways and captive seaport that can harbour and handle 3,000 to 5,000 DWT vessels along the jetty. Safe anchorage for 5,000 to 35,000 DWT vessels is available 5 km from the port/wharf site. For safe anchorage of 50,000-100,000 DWT vessels, 20-25 m of water is available 10 km from the port site.

During FY 2023-24, the company reported net sales of 1.358 million tonne, up 7.8 per cent from 1.259 million tonne in FY2022-23. Total revenue was Rs.8.0097 billion, up 9.4 per cent from Rs.7.3192 billion in FY2022-23 and PAT was Rs.877.6 million, up 52 per cent compared to Rs.577.1 million the previous year.

NCL Industries

NCL Industries is a well-established player in the building materials sector, with diversified interests in cement, RMC, hydropower and cement particleboards. It operates under the Nagarjuna Cement brand and has expanded its footprint across multiple regions in India. Founded in 1980, it has steadily grown its production capacity and product offerings, contributing significantly to the infrastructure and construction sectors.

The company’s growth is driven by its continued investment in modernisation and expansion of its production facilities. This includes efforts to improve its production capabilities in cement and allied products. Additionally, it is committed to sustainability, with initiatives to enhance energy-efficiency in operations.

In FY2024, NCL Industries achieved substantial growth in both production and sales. Cement production during Q1 FY 2024 increased by 23 per cent year on year to 751,000 tonne, while sales volumes rose to 742,000 tonne during the same period. This growth reflects the company’s strategic focus on capacity expansion and operational efficiency. With a revenue of Rs.18.7 billion for FY2024, it has solidified its market position in India’s cement industry.

Sagar Cements

Sagar Cements, a key player in the Southern and Eastern Indian cement market, operates with a total installed cement capacity of 10.50 MTPA. The company has a strong presence across Telangana, Andhra Pradesh, Odisha, Maharashtra, and Madhya Pradesh, supported by integrated and grinding units in Mattampally, Bayyavaram, Gudipadu, and Jajpur. It is backed by AvH Resources India Pvt. Ltd. (a Belgian major) and Premji Invest, holding 19.64 per cent and 10.10 per cent equity stakes, respectively.

Sagar Cements continues to invest in sustainability and cost optimisation, with 102.96 MW of captive power capacity and an increasing share of green energy, including waste heat recovery systems (WHRS) and solar power plants. In January 2025, the company commissioned a 6 MW Solar Power Plant at its Gudipadu Unit, with plans for an additional 6 MW at Dachepalli. To reduce logistics costs and improve operational efficiencies, the company has also introduced electric vehicles (EVs) for raw material and cement transportation across key locations.

As part of its growth strategy, Sagar Cements is expanding its Dachepalli plant, increasing clinker capacity from 1.85 MTPA to 2.31 MTPA and cement capacity from 2.25 MTPA to 3.00 MTPA. This project is expected to be completed by FY26, with a total investment of Rs.4.70 billion. Additionally, the company is enhancing green energy infrastructure, with 9 MW WHRS at Dachepalli and 4.5 MW at Gudipadu, ensuring long-term sustainability.

For Q3 FY25, Sagar Cements reported a total revenue of Rs.5.64 billion, marking a 16 per cent YoY decline, with cement sales volume at 1.38 million tons. Operating EBITDA stood at Rs.0.38 billion, with an EBITDA margin of 7 per cent. The company continues to focus on cost optimisation, green energy transition, and capacity expansion, positioning itself for long-term growth and improved profitability in the Indian cement market.

KCP Cement

KCP Cement, a leading cement manufacturer in South India, operates with a total installed cement capacity of 4.3 MTPA across its plants in Macherla and Muktyala, Andhra Pradesh. The company produces Grade 53 Ordinary Portland Cement (OPC) and Portland Pozzolana Cement (PPC) under the brands KCP Cement and Shreshtaa. With a strong market presence in Andhra Pradesh and Tamil Nadu, KCP Cement caters to a wide customer base, including infrastructure developers, real estate companies, and retail buyers.

The company is committed to sustainable manufacturing, with a focus on waste heat recovery, solar, wind, and hydel power to reduce its carbon footprint. KCP Cement continues to invest in energy efficiency, aiming to lower production costs and environmental impact. Apart from cement, KCP operates in heavy engineering, sugar, and hospitality, ensuring a diversified revenue base. The company is also optimising its logistics and distribution network, expanding its fleet and improving supply chain efficiency to enhance operational effectiveness.

As part of its growth strategy, KCP Cement is leveraging its engineering expertise to strengthen its market position. The company is focused on cost efficiency, product diversification, and capacity expansion to improve profitability. Additionally, ongoing investments in alternative fuels and resource efficiency are expected to drive long-term sustainability and competitiveness.

For 9M FY25, KCP Cement reported a total revenue of Rs.10.31 billion, with an EBITDA loss of Rs.0.64 billion. The company’s total expenses stood at Rs.1,068.63 crore, reflecting operational challenges. Despite short-term pressures, KCP remains committed to capacity expansion, operational improvements, and strategic investments to solidify its presence in the South Indian cement market.

Concrete

Lodha Signs Joint Development Agreement For Parel–Sewri Land

Deal covers 10 acres at Rs 3,640 million (mn)

Published

19 hours agoon

February 27, 2026By

admin

Lodha Developers has signed a joint development agreement with Sahana Group for a 10-acre parcel in the Parel–Sewri corridor of Mumbai. The agreement is valued at Rs 3,640 million (mn), reflecting the consideration reported for the transaction. The joint development arrangement will see the land owners and the developer collaborate on planning and construction while sharing development proceeds under the terms of the contract. The arrangement is subject to customary closing conditions and regulatory approvals.

The site in Parel–Sewri occupies a strategic location within central Mumbai and offers opportunities for urban redevelopment given its proximity to transport links and established neighbourhoods. The parties have agreed to pursue statutory approvals and detailed project planning before commencing construction activity. The arrangement is described as a long-term development collaboration focused on unlocking the value of the site. Stakeholders will monitor progress as statutory milestones are reached.

For Lodha Developers, the deal reinforces its pipeline of land parcels available for development in the Mumbai metropolitan area and is expected to expand its capacity to deliver built assets. For Sahana Group, partnering with a developer on a joint development agreement provides a route to monetise land holdings while retaining a share in future realisation. The structure aligns incentives to complete the project efficiently and to move through planning milestones. Market reception and execution pace will shape the ultimate returns for both parties.

The financial terms and timetable for completion will depend on regulatory clearances and market conditions, with returns to be realised as phases of development are sold or leased. Both parties will need to coordinate with municipal authorities and service providers to meet infrastructure and compliance requirements. The agreement signals continued investor interest in central Mumbai land parcels and may encourage further collaborative ventures between land owners and developers. Further disclosures will be issued.

Concrete

Seppa Township Road Being Paved With Bituminous Concrete

Township road upgrade uses bituminous concrete

Published

19 hours agoon

February 27, 2026By

admin

Work is underway to pave the main township road in Seppa with bituminous concrete, marking a significant upgrade to the local transport network. The project is being overseen by the district administration and carried out by municipal contractors using mechanised laying equipment. The initiative aims to replace older surface material that had become potholed and dusty, and to improve all weather access for residents and public services. Local officials have coordinated traffic diversions and site safety measures to minimise disruption during construction.

The work includes preparing the base, applying a bituminous concrete layer and compacting the surface to enhance load bearing capacity. Engineers are ensuring proper drainage and edge sealing to extend pavement life and reduce water ingress. The choice of bituminous concrete reflects considerations of durability and ease of maintenance in the local climatic conditions. Equipment on site includes pavers, rollers and material stabilisers operated by trained crews.

Residents and business owners along the route are expected to benefit from smoother journeys and reduced vehicle operating costs once the surface is completed. The administration has scheduled work to avoid peak movement hours and has informed local transport operators about temporary changes in stops and routes. Environmental precautions have been put in place to control dust and run off during construction and to dispose of surplus material responsibly. The project has also provided short term employment opportunities for local labour.

Officials said routine maintenance will be scheduled to preserve the new surface and that monitoring will continue to assess performance and inform future works. The improved road is intended to support daily mobility, emergency access and the movement of goods, contributing to broader local development goals. Authorities will review the outcome of the works and plan any necessary follow up interventions to maintain serviceability. Community members expressed relief at the reduced dust and smoother travel that the pavement is expected to deliver.

Concrete

Gautam Adani Inspects Godda 2,300 MW Power Plant

Inspection follows MP request and points to cement plan

Published

2 days agoon

February 26, 2026By

admin

Gautam Adani visited Godda on Sunday to carry out a first inspection of the power plant in the district, where electricity generation of 2,300 megawatts (MW) is being undertaken through five units. The visit involved a walkthrough of production areas and technical installations and included meetings with senior plant executives. The inspection was described by officials as focused on operational readiness and optimisation of output.

Officials said the establishment of the plant followed a request from the local member of parliament, who provided cooperation during project development, and indicated that plans to establish a cement plant in Godda are likely to materialise soon. The electricity produced at the facility is currently being supplied to Bangladesh, and officials confirmed that the possibility of exporting power to other neighbouring countries is under consideration. Company representatives indicated that the project aims to balance regional energy demand with commercial export obligations.

During the review of all units, plant leadership set out steps to accelerate commissioning and enhance maintenance regimes to ensure sustained generation. The commissioning of the power plant has already been credited with contributing significantly to the development of Godda, and the proposed cement plant is expected to add industrial capacity and create large-scale employment in the region. Local authorities are monitoring progress with a view to aligning infrastructure improvements and workforce development.

Stakeholders expect the visit to accelerate operational momentum at the site and to clarify timelines for further investment and local supply arrangements. The inspection was followed by technical briefings and an internal review of safety and environmental practices to support reliable operations. Officials said subsequent measures will focus on connectivity, logistics and community engagement to ensure the project delivers intended economic benefits.

Lodha Signs Joint Development Agreement For Parel–Sewri Land

Seppa Township Road Being Paved With Bituminous Concrete

Gautam Adani Inspects Godda 2,300 MW Power Plant

Govt Exempts Tailings Recycling In Mines From Fresh Green Clearance

Cement Demand Revives As Prices Decline In Q3 FY26

Lodha Signs Joint Development Agreement For Parel–Sewri Land

Seppa Township Road Being Paved With Bituminous Concrete

Gautam Adani Inspects Godda 2,300 MW Power Plant

Govt Exempts Tailings Recycling In Mines From Fresh Green Clearance

Cement Demand Revives As Prices Decline In Q3 FY26

Trending News

-

Concrete1 month ago

Concrete1 month agoNITI Aayog Unveils Decarbonisation Roadmaps

-

Economy & Market4 weeks ago

Economy & Market4 weeks agoBudget 2026–27 infra thrust and CCUS outlay to lift cement sector outlook

-

Concrete4 weeks ago

Concrete4 weeks agoJK Cement Commissions 3 MTPA Buxar Plant, Crosses 31 MTPA

-

Economy & Market3 weeks ago

Economy & Market3 weeks agoFORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe