Concrete

Cement Sector Growth Slows Down

Muted demand lowers FY25 growth forecast

Concrete

World Cement Association Annual Conference 2026 in Bangkok

Global leaders to focus on decarbonisation and digitisation

Concrete

Assam Chief Minister Opens Star Cement Plant In Cachar

New plant aims to boost local industry and supply chains

Concrete

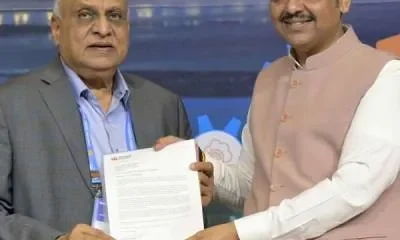

Adani Cement, NAREDCO Form Strategic Alliance

Partnership to advance skills and sustainable construction

-

Economy & Market4 weeks ago

Economy & Market4 weeks agoBudget 2026–27 infra thrust and CCUS outlay to lift cement sector outlook

-

Economy & Market4 weeks ago

Economy & Market4 weeks agoFORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

-

Concrete2 weeks ago

Concrete2 weeks agoRefractory demands in our kiln have changed

-

Concrete2 weeks ago

Concrete2 weeks agoDigital supply chain visibility is critical