Concrete

Innovative AFR

Published

2 years agoon

By

admin

Asok Kr. Dikshit, Richa Mazumder, Sanjeev Kr. Chaturvedi and Lok Pratap Singh, National Council for Cement and Building Materials (NCB), discuss the themes of sustainable development in India’s cement sector, in the concluding section of a three-part series.

Studies carried out in NCB in the area of raw material substitution are discussed below:

I. Investigation for Standardisation of High Magnesia (MgO) Clinker for the Manufacture of PPC and PSC Blended Cement

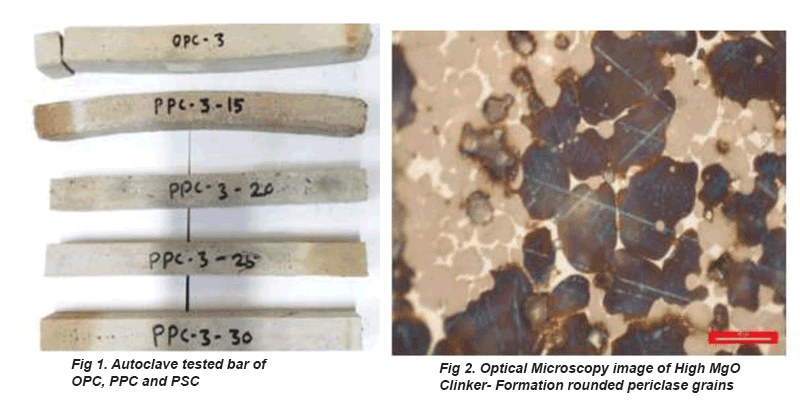

The objective of this study was to investigate the performance of PPC and PSC cements prepared from high magnesia clinker to utilise high MgO bearing low grade limestone for the manufacturing of Portland clinker resulting in preservation of natural resources and sustainable development. Four types of high MgO clinker samples containing MgO as high as upto 8.4 per cent from different cement plants were procured along with other cementitious and additive samples such as fly ash, GBF slag and gypsum for the manufacture of OPC, PPC and PSC. These cement samples were prepared by intergrinding the constituents in a laboratory ball mill keeping the fineness level 350±10 m2/kg. The results of investigation revealed that addition of fly ash and granulated blast furnace slag (GBFS) in the blended cements prepared from high MgO clinker samples were found to have potential effect on arresting the expansion caused by periclase (MgO). The minimum fly ash content was optimised to be 25 per cent by weight in case of PPC and the minimum slag content was optimised to be 35 per cent in case PSC while utilising high MgO clinker for the manufacture of blended cement. The performance results obtained so far are quite encouraging. Use of high magnesia (MgO) clinker for the manufacturing of the PPC and PSC will pave the way for utilisation of high MgO content low grade limestone containing high MgO resulting in increased mine life besides improved sustainability in cement manufacture.

II. Manufacture of Synthetic Gypsum from Marble Slurry for Subsequent use in

Cement Production

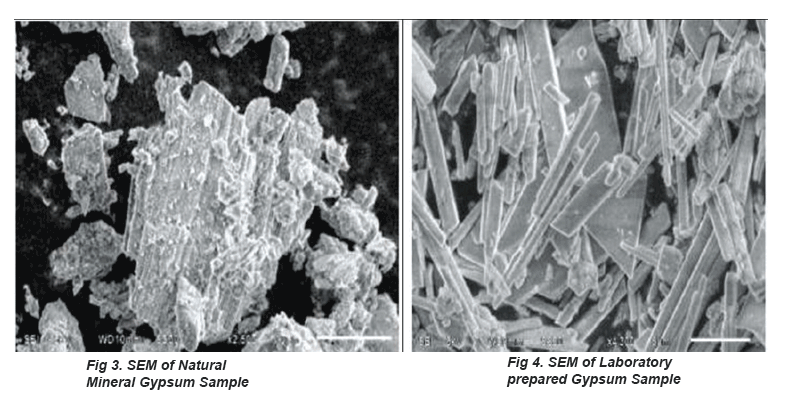

The generation of waste marble slurry in India is in the range of 5 to 6 million tonnes per annum. The heaps of this waste material occupy large land areas and remain scattered all around at the marble processing unit, affecting the environment, eco-system and health of the people in the area. The chemical composition of marble slurry indicates predominance of calcium carbonate which is a suitable raw material for various industrial applications. One of its possible areas of utilisation is its conversion into gypsum that can be used as set controller in cement industry. Marble slurry samples were collected from clusters at Kishangarh, Makrana, Rajsamand and Udaipur in Rajasthan and characterised for their physical and chemico-mineralogical properties. Samples of synthetic gypsum with well grown crystalline phases were prepared in the laboratory by inducing chemical reaction using sulphuric acid and marble slurry. The amount of sulphuric acid to be consumed in its complete reaction with marble slurry was found to be dependent on the composition of the marble slurry especially on CaO and MgO content. The physical characteristics like specific gravity and whiteness index of the laboratory prepared gypsum samples were found to be more or less comparable to mineral gypsum. The percentage purity of different synthetic gypsum samples prepared were 87.91, 89.55, 86.02 and 88.26 per cent.

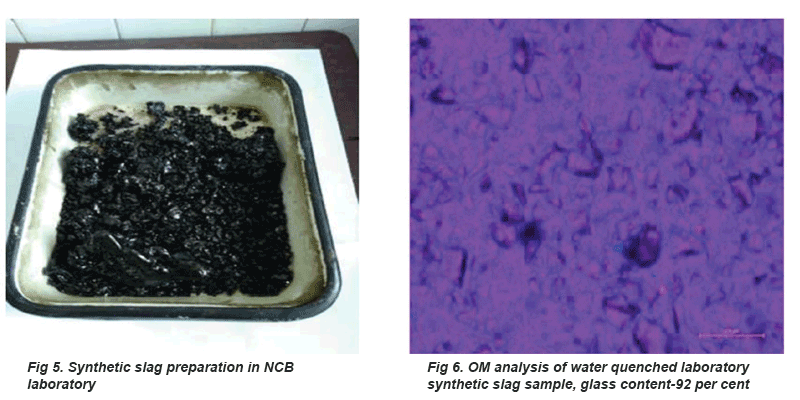

III. Production of Synthetic Slag from Low Grade Limestone

For development of Synthetic Slag using low-grade limestone, a study was carried out at NCB laboratory. In this study laboratory slag samples prepared with low-grade limestones and other additive materials, which found to be conforming the IS: 12089-1987. These laboratories made synthetic slag samples as shown in Fig 9. were also investigated by optical microscopy as shown in Fig 10. They found to have maximum 92 per cent glass content, which is greater than 85 per cent as specified in IS-12089. PSC samples were prepared with 40 and 60 per cent synthetic slag replacing equal quantity of clinker. The performance of PSC blends prepared using synthetic slag sample equal quantity of clinker. The performance of PSC blends prepared using synthetic slag sample were found as per requirements of Indian Standard Specification, IS: 455-1989 for PSC. As the limestone, which is getting depleted and has reached to an alarming level where the availability of cement grade limestone in India has reduced to 8949 million tonnes only, Synthetic Slag may play a vital role to replace clinker or indirectly cement grade limestone. However, the main challenge would be to produce synthetic slag at industrial scale.

Clinker substitution

A very effective strategy towards resource management and reduce CO2 emissions is to substitute some of the Portland cement clinker with other materials. These are known variously as mineral additions or supplementary cementitious materials (SCMs), and also include almost inert materials, which may also be called fillers. Clinker can be blended with a range of alternative materials, including pozzolans, finely ground limestone and waste materials or industrial by-products. The most common clinker substitutes are reactive by-products from other industries: granulated blast furnace slag (GBFS),a by-product of pig-iron production in blast furnaces, and fly ash (FA), generated by burning coal to produce electricity.

The clinker-to-cement ratio (percentage of clinker compared to other non-clinker components) has an impact on the properties of cement so standards determine the type and proportion of alternative main constituents that can be used. To ensure the future use of other constituents, the cement industry is dependent on the local supply of these materials. The use of other constituents in cement and the reduction of the clinker-to-cement ratio means lower emissions and lower energy use. Other materials that can be used: Natural pozzolans, such as clays, shale and certain types of sedimentary rocks., Limestone (finely ground), which can be added to clinker (without being heated and transformed into lime), Silica fume, a pozzolanic material and a by-product in the production of silicon or ferrosilicon alloys, Granulated blast furnace slag (GBFS), Fly ash etc.

Apart from these NCB also worked on several projects like Portland Limestone Cement, Composite cement, Portland Dolomitic Cement etc. NCB in one of its projects has successfully utilised up to 15 per cent dolomite as an additive replacing equal quantity of clinker. The cement performance was found to be similar to that of control cement prepared without dolomite.

Similarly, NCB has carried out several studies on composite cement wherein combinations of fly ash and granulated blast furnace slag were used for preparing composite cement blends. BIS has brought out standard specification IS: 16415-2015 for composite cement on recommendations of NCB.

Development of Portland Composite Cement (Fly ash/Slag and Limestone based), Development of Portland Limestone Cement (PLC), utilisation of low grade limestone and mines rejects, Utilisation of Construction and demolished waste (C&D) waste based aggregates in concrete structures and pavements are some of the key areas, where Indian Cement Industry and NCB is working together towards natural resource management and promoting circular economy which are the key themes towards sustainable development in cement sector. Some of the work that has been carried out in NCB discussed below:

I. Investigations on Development of Portland Composite Cements based on Fly Ash and Limestone

Portland composite cement blends were prepared (80 nos.) with four types of clinker from different regions of India along with the regional available Fly ash and limestone. The materials were ground in a laboratory ball mill with a capacity of about 8 kg by inter-grinding method. The clinker inter-ground with 3.7 per cent of gypsum by mass is referred to as OPC. A series of tests was carried out on various mixes of limestone-fly ash cement mortars in order to investigate the effects of using different percentages of lime and fly ash as a replacement of cement on the compressive strength of such mortars at various ages. Different mix proportions were adopted for the experimental work. Clinker quality plays an important role on performance of limestone and fly ash based composite cements. PCC samples containing Fly ash and Limestone up to the level off 30 per cent and 7 per cent respectively comply with IS 16415-2015 at all ages. Lower levels of limestone additions show higher percentage of difference between IS requirements and obtained results. Whereas 10 per cent replacement shows marginal difference between IS requirements and obtained results. PCC samples of 5 per cent replacement of Flyash with Limestone comply performance with respective PPC samples at all ages.

II. Investigations on Portland Limestone Cement

European Standard EN-197-1 permits the use of maximum 35 per cent limestone in the manufacture of Portland Limestone Cement. Presently, in India, there is no standard on Portland Limestone Cement. The main objective of the study is to investigate the feasibility of using different grades of limestone in development of Portland Limestone Cement in order to formulate new Indian standard for its commercialisation along with lowering in clinker factor in cement for environmental sustainability. To carry out the study, different Portland Limestone Cement blends were prepared by inter-grinding of 10, 20 and 30 wt. per cent cement grade of limestone, dolomitic limestone and low grade limestone with OPC clinker and gypsum. The cement blends were designated as PLC-A, PLC-B and PLC-C corresponding to cement grade limestone, dolomitic limestone and low grade limestone. The trend of compressive strength development showed marginal reduction in strength development with increasing dosages of limestone in cement mix. However, increase in the early strength has observed with addition of low quality of limestone that may be attributed to the formation of monocarboaluminate phase.

Alternative Binders

The idea of alternative binders/novel cements is to introduce different raw materials in clinker and cement manufacturing processes without compromising the efficiency and quality of cement that will emit less CO2 and utilise less energy. Below is a detailed description of potential alternative binders/novel cements.

A. Alkali-Activated Cements: Alkali-activated cements belong to family of hydraulic cements that are characterised by a high content of aluminosilicates bonding phase. Aluminosilicates are not reactive with water, or their reaction is too slow. However, due to their high amorphous content, they hydrolyse and condense when placed in alkaline medium, forming 3-D polymeric structures that have load-bearing ability (Habert et al. 2014). In cements, the natural alkalinity of the system and portlandite fulfill these reactions, while in the absence of Portland cement, a strong base is needed to activate the amorphous aluminosilicates (Habert et al. 2014). Based upon the composition of cementitious components, alkali-activated cements are classified into five major categories (Shi et al. 2018)

I. Alkali-activated slag-based cements

II. Alkali-activated pozzolan cements

III. Alkali-activated lime-pozzolan/slag cements

IV. Alkali-activated calcium aluminate blended cements

V. Alkali-activated Portland blended cements

In NCB a study on Investigation on Development of Geopolymeric Cements has been carried out and discussed in detail below:

I. Development of Geopolymeric Cements

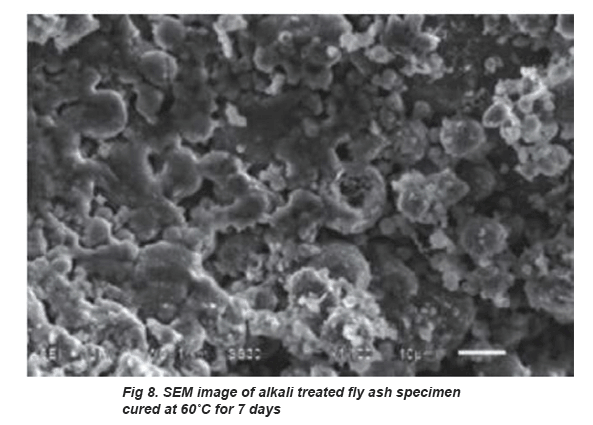

Investigation on formation and properties of geopolymeric cements based on alkali investigation of low lime coarser flyash have being taken up. The alkali treated flyash sample were subjected to initial thermal curing at two different temperatures upto 90° C for varying retention periods. SEM studies indicated the formation of geopolymers.

The performance of geopolymeric cement was found to be influenced by initial thermal curing conditions and therefore need optimisation. Investigations have also been carried out for preparation of cementitious binders at 27°C temperature using rationalised curing conditions by alkali activation of blends of fly ash with granulated blast furnace slag (GBFS) having 94 percent glass content. Studies indicated that ratio of fly ash and GGBFS in the blend affects the compressive strength property. The blend ratio as well as water content at fixed range of Na2O required to be optimised to obtain better compressive strength property. SEM image of alkali activated fly ash – GGBFS system cured for 28 days indicated formation of CSH gel along with NASH in this system resulting in development of compressive strength at 27°C

B. Belite-Rich Portland Cement: Belite-rich Portland clinkers are produced with the same process as ordinary Portland cement clinkers, but with less limestone in the clinker raw material mix, as well as lower clinkering temperatures so CO2 generation is reduced. The concept of belite-rich Portland cement is not new, but it takes advantage of the fact that modern OPCs have very high alite (C3S) contents. Market demand for rapid concrete hardening has driven cement manufacturers towards higher and higher alite contents, at the expense of higher

GHG emissions.

Belite-rich Portland cement belong to the same family as ordinary Portland cement in terms of clinker mineralogy, i.e., they are in the C2S-C3S-C3A-C4AF system. They are also commonly known as high belite cements (HBC). The difference in clinker composition lies mainly in the belite/alite ratio. For HBC the belite content is generally more than 40 per cent and alite normally less than 35 per cent, making belite the most abundant phase, as opposed to alite.

It has been established by various researches that belite-rich Portland cement typically exhibit similar setting times, lower water demands, lower heat evolution and early strength gain but

higher later age strength, and lower drying shrinkage compared with OPC. It has also shown better resistance to sulfates and chlorides, mainly due to the smaller proportion of portlandite in the hydration products.

It typically attains similar 28-day strengths to OPCs, and gain additional strength more rapidly than OPCs at later ages (Gartner et al. 2016).

A key reason they are not currently widely used is that they gain strength much more slowly than most OPCs. Such cements are well suited for niche markets where the strength gain after a few days is not critical. They are mainly employed for reasons of their low heat of hydration in the construction of massive concrete dams and foundations.

C. Calcium Sulfoaluminate (CSA) Cement: Calcium sulfoaluminate (CSA) cements are types of cements that contain high alumina content. To produce CSA clinker, bauxite, limestone, and gypsum are mixed together in a rotary kiln (Phair et al. 2006). By utilising CSA compositions, limestone quantity is reduced in the kiln that not only benefits in reduced thermal energy (up to 25 per cent) but also decreased CO2 emissions (up to 20 per cent) compared to the Portland cement. Industrial waste materials can also be used as raw materials for manufacturing CSA cements and thus calcium sulfoaluminate cements have significant environmental advantages.

It has the characteristics of early strength, high strength, high impermeability, high frost resistance, corrosion resistance, low alkali and low production energy consumption. They are widely used in rapid construction, rapid repair, winter construction, marine environments and underground engineering (Wang et al. 1999, Coppola et al. 2018). Its clinker is mainly composed of C4A3S (ye’elimite, 3CaO•3Al2O3•CaSO4) and ß-C2S (belite, 2CaO•SiO2). Among them, C4A3S is an early strength mineral that can quickly hydrate to AFt (ettringite, 3CaO•Al2O3•3CaSO4•32H2O) in the presence of gypsum to provide early strength (Hargis et al. 2013). Compared with C3S (alite, 3CaO•SiO2), the main mineral component of Portland cement, the formation temperature of C4A3S and the content of CaO are lower (Ali et al. 1994). Advantages of using CSA is that it not only saves a great deal of coal, power and limestone resources thus help in natural resource management but also reduces GHG emissions. However, it has many disadvantages also, such as the low percentage and slow hydration of C2S, resulting in no significant increase in the later strength of CSA and the formation of C4A3S, (ye’elimite) requires a large amount of natural gypsum and high-quality aluminium resources (Su et al. 2019).

Alternative fuels

Alternative Fuel (AF) becomes more popular to the cement manufacturer due to increasing fossil fuel prices, limited fossil fuel resources and environmental concerns. Generally fossil fuels such as coal, petroleum coke (petcoke) and natural gas provide the thermal energy required for cement industry. Usage of AF cover all non-fossil fuels and waste from other industries including tire-derived fuels, biomass residues, sewage sludge and different commercial wastes (Nielsen et al. 2011). These alternative fuels not only reduce CO2 emissions but also contribute to waste management and promote circular economy principles. Additionally, advancements in technology and improved combustion processes have made the use of alternative fuels more efficient and cost-effective.

The use of alternative fuels in cement manufacturing not only promotes circular economy but also helps in natural resource management. It is also one of the effective methods of achieving lower production costs. The process of clinker production in kiln systems creates favourable conditions for use of alternative fuels which include: high temperatures, long residence times, an oxidising atmosphere, alkaline environment, ash retention in clinker, and high thermal inertia. These conditions make certain that the fuel’s organic part is destroyed and the inorganic part, including heavy metals is trapped and combined in the product.

The cement manufacturers are consuming all possible Alternative fuels like refuse-derived fuel (RDF), industrial plastic, biomass, tyre chips, waste generated by pharmaceutical industry, Paint industry, Agro industry, Paper industry, chemical industry etc. (Mohapatra et al. 2014; Shaw et al. 2017). It is proposed to use either solar energy or hydrogen gas to mitigate for future energy demand in cement plants. India also has plan to emerge as a global electrolysers manufacturing hub to meet domestic demand and to emerge as a leading electrolyser exporter in future.

Conclusion

NCB’s current Research areas are well aligned to national priorities and requirement of society at large and include research in the area of low carbon and multi component blended cements, alternative binders and cementitious materials, alternate fuels and raw materials, productivity and environment improvement in cement industry etc. The research outcomes from these projects will provide Indian cement, building materials and construction industry a technologically sound platform to further reduce CO2 emissions, energy consumption and resource and environment conservation, higher thermal substitution rates etc. to achieve sustainability and cost optimisation taking due care of national and international commitments. The Research and Innovation projects of NCB are well aligned with the vision and mission of Government of India like decarbonisation, implementation of circular economy, increased sustainability etc.

Acknowledgment

*The Authors wish to acknowledge the Director General of National Council for Cement and Building Materials (NCB) for giving permission for publication and DPIIT, Ministry of Commerce and Industry, GOI, through various R&D projects supporting financial support for sustainable development of cement Industry. The Authors also acknowledge all scientific and technical staff of NCB for cooperation through R&D work for sustainability of cement

industry related projects.

Conflict of interest: The authors have no conflicts of interest, financially and ethically, to publish in this review work.

For a full list of references, visit www.indiancementreview.com.

Concrete

Merlin Prime Spaces Acquires 13,185 Sq M Land Parcel In Pune

Rs 273 crore purchase broadens the developer’s Pune presence

Published

3 days agoon

March 6, 2026By

admin

Merlin Prime Spaces (MPS) has acquired a 13,185 sq m land parcel in Pune for Rs 273 crore, marking a notable expansion of its footprint in the city.

The transaction value converts to Rs 2,730 mn or Rs 2.73 bn.

The parcel is located in a strategic area of Pune and the firm described the acquisition as aligned with its growth objectives.

The deal follows recent activity in the region and will be watched by investors and developers.

MPS said the acquisition will support its planned development pipeline and enable delivery of commercial and residential space to meet local demand.

The company expects the site to provide flexibility in product design and phased development to respond to market conditions.

The move reflects an emphasis on land ownership in key suburban markets.

The emphasis on land acquisition reflects a strategy to secure inventory ahead of demand cycles.

The purchase follows a period of sustained investor interest in Pune real estate, driven by expanding office ecosystems and residential demand from professionals.

MPS will integrate the new holding into its existing portfolio and plans to engage with local authorities and stakeholders to progress approvals and infrastructure readiness.

No financial partners were disclosed in the announcement.

The firm indicated that timelines will depend on approvals and prevailing market conditions.

Analysts note that strategic land acquisitions at scale can help developers manage costs and timelines while preserving optionality for future projects.

MPS will now hold an enlarged land bank in the region as it pursues growth, and the acquisition underlines continued corporate appetite for measured expansion in second tier cities.

The company intends to move forward with detailed planning in the coming months.

Stakeholders will assess how the site is positioned relative to existing infrastructure and connectivity.

Concrete

Adani Cement and Naredco Partner to Promote Sustainable Construction

Collaboration to focus on skills, technology and greener practices

Published

3 days agoon

March 6, 2026By

admin

Adani Cement has entered a strategic partnership with the National Real Estate Development Council (Naredco) to support India’s construction needs with a focus on sustainability, workforce capability and modern building technologies. The collaboration brings together Adani Cement’s building materials portfolio, research and development strengths and technical expertise with Naredco’s nationwide network of more than 15,000 member organisations. The agreement aims to address evolving demand across housing, commercial and infrastructure sectors.

Under the partnership, the organisations will roll out skill development and certification programmes for masons, contractors and site supervisors, with training to emphasise contemporary construction techniques, safety practices and quality standards. The programmes are intended to improve project execution and on-site efficiency and to raise labour productivity through standardised competencies. Emphasis will be placed on practical training and certification pathways that can be scaled across regions.

The alliance will function as a platform for knowledge sharing and technology exchange, facilitating access to advanced concrete solutions, innovative construction practices and modern materials. The effort is intended to enhance structural durability, execution quality and environmental responsibility across developments while promoting adoption of low-carbon technologies and green cement alternatives. Companies expect these measures to contribute to longer term resilience of built assets.

Senior executives conveyed that the partnership reflects a shared commitment to strengthening quality and sustainability in construction and that closer engagement with developers will help integrate advanced materials and technical support throughout the project lifecycle. Leadership noted the need for responsible construction practices as urbanisation accelerates and indicated that the association should encourage wider adoption of green building norms and collaboration within the real estate and construction ecosystem.

The organisations said they will also explore integrated building solutions, including ready-mix concrete offerings, while supporting initiatives aligned with affordable and inclusive housing. The partnership will progress through engagements, conferences and joint training programmes targeting rapidly urbanising cities and growth centres where demand for efficient and environmentally responsible construction grows. Naredco, established under the aegis of the Ministry of Housing and Urban Affairs, will leverage its policy and advocacy role to support implementation.

Operational excellence in cement is no longer about producing more—it is about producing smarter, cleaner and more reliably, where cost per tonne meets carbon per tonne.

Operational excellence in cement has moved far beyond the old pursuit of ‘more tonne’. The new benchmark is smarter, cleaner, more reliable production—delivered with discipline across process, people and data. In an industry where energy can account for nearly 30 per cent of manufacturing cost, even marginal gains translate into meaningful value. As Dr SB Hegde, Professor, Jain College of Engineering & Technology, Hubli and Visiting Professor, Pennsylvania State University, USA, puts it, “Operational excellence… is no longer about producing more. It is about producing smarter, cleaner, more reliably, and more sustainably.” The shift is structural: carbon per tonne will increasingly matter as much as cost per tonne, and competitiveness will be defined by the ability to stabilise operations while steadily lowering emissions.

From control rooms to command centres

The modern cement plant is no longer a handful of loops watched by a few operators. Control rooms have evolved from a few hundred signals to thousands—today, up to 25,000 signals can compete for attention. Dr Rizwan Sabjan, Head – Global Sales and Proposals, Process Control and Optimization, Fuller Technologies, frames the core problem plainly: plants have added WHRS circuits, alternative fuels, higher line capacities and tighter quality expectations, but human attention remains finite. “It is very impossible for an operator to operate the plant with so many things being added,” he says. “We need somebody who can operate 24×7… without any tiredness, without any distraction… The software can do that for us better.”

This is where advanced process control shifts from ‘automation spend’ to a financial lever. Dr Hegde underlines the logic: “Automation is not a technology expense. It is a financial strategy.” In large kilns, a one per cent improvement is not incremental—it is compounding.

Stability is the new productivity

At the heart of operational excellence lies stability. Not because stability is comfortable, but because it is profitable—and increasingly, low-carbon. When setpoints drift and operators chase variability, costs hide in refractory damage, thermal shocks, stop-start losses and quality swings. Dr Sabjan argues that algorithmic control can absorb process disturbances faster than any operator, acting as ‘a co-pilot or an autopilot’, making changes ‘as quick as possible’ rather than waiting for manual intervention. The result is not just fuel saving—it is steadier operation that extends refractory life and reduces avoidable downtime.

The pay-off can be seen through the lens of variability: manual operation often amplifies swings, while closed-loop optimisation tightens control. As Dr Sabjan notes, “It’s not only about savings… there are many indirect benefits, like increasing the refractory life, because we are avoiding the thermal shocks.”

Quality control

If stability is the base, quality is the multiplier. A high-capacity plant can dispatch enormous volumes daily, and quality cannot be a periodic check—it must be continuous. Yet, as Dr Sabjan points out, the biggest error is not in analysis equipment but upstream: “80 per cent of the error is happening at the sampling level.” If sampling is inconsistent, even the best XRF and XRD become expensive spectators.

Automation closes the loop by standardising sample collection, transport, preparation, analysis and corrective action. “We do invest a lot of money on analytical equipment like XRD and XRF, but if it is not put on the closed loop then there’s no use of it,” he says, because results become person-dependent and slow.

Raju Ramachandran, Chief Manufacturing Officer (East), Nuvoco Vistas Corp, reinforces the operational impact from the plant floor: “There’s a stark difference in what a RoboLab does… ensuring that the consistent quality is there… starts right from the sample collection.” For him, automation is not about removing people; it is about making outcomes repeatable.

Human-centric automation

One of the biggest barriers to performance is not hardware—it is fear. Dr Sabjan describes a persistent concern that digital tools exist to replace operators. “That’s not the way,” he says. “The technology is here to help operator… not to replace them… but to complement them.” The plants that realise this early tend to sustain performance because adoption becomes collaborative rather than forced.

Dr Hegde adds an important caveat: tools can mislead without competence. “If you don’t have the knowledge about the data… this will mislead you… it is like… using ChatGPT… it may tell the garbage.” His point is not anti-technology; it is pro-capability. Operational excellence now requires multidisciplinary teams—process, chemistry, physics, automation and reliability—working as one.

GS Daga, Managing Director, SecMec Consultants, takes the argument further, warning that the technology curve can outpace human readiness: “Our technology movement AI will move fast, and our people will be lagging behind.” For him, the industry’s most urgent intervention is systematic skilling—paired with the environment to apply those skills. Without that, even high-end systems remain underutilised.

Digital energy management

Digital optimisation is no longer confined to pilots; its impact is increasingly quantifiable. Raghu Vokuda, Chief Digital Officer, JSW Cement, describes the outcomes in practical terms: reductions in specific power consumption ‘close to 3 per cent to 7 per cent’, improvements in process stability ‘10 per cent to 20 per cent’, and thermal energy reductions ‘2–5 per cent’. He also highlights value beyond the process line—demand optimisation through forecasting models can reduce peak charges, and optimisation of WHRS can deliver ‘1 per cent to 3 per cent’ efficiency gains.

What matters is the operating approach. Rather than patchwork point solutions, he advocates blueprinting a model digital plant across pillars—maintenance, quality, energy, process, people, safety and sustainability—and then scaling. The difference is governance: defined ownership of data, harmonised OT–IT integration, and dashboards designed for each decision layer—from shopfloor to plant head to network leadership.

Predictive maintenance

Reliability has become a boardroom priority because the cost of failure is blunt and immediate. Dr Hegde captures it crisply: “One day of kiln stoppage can cost several crores.” Predictive maintenance and condition monitoring change reliability from reaction to anticipation—provided plants invest in the right sensors and a holistic architecture.

Dr Sabjan stresses the need for ‘extra investment’ where existing instrumentation is insufficient—kiln shell monitoring, refractory monitoring and other critical measurements. The goal is early warning: “How to have those pre-warnings… where the failures are going to come… and then ensure that the plant availability is high, the downtime is low.”

Ramachandran adds that IoT sensors are increasingly enabling early intervention—temperature rise in bearings, vibration patterns, motor and gearbox signals—moving from prediction to prescription. The operational advantage is not only fewer failures, but planned shutdowns: “Once the shutdown is planned in advance… you have lesser… unpredictable downtimes… and overall… you gain on the productivity.”

Alternative fuels and raw materials

As decarbonisation tightens, AFR becomes central—but scaling it is not simply a procurement decision. Vimal Kumar Jain, Technical Director, Heidelberg Cement, frames AFR as a structured programme built on three foundations: strong pre-processing infrastructure, consistent AFR quality, and a stable pyro process. “Only with the fundamentals in place can AFR be scaled safely—without compromising clinker quality or production stability.”

He also flags a ground reality: India’s AFR streams are often seasonal and variable. “In one season to another season, there is major change… high variation in the quality,” he says, making preprocessing capacity and quality discipline mandatory.

Ramachandran argues the sector also needs ecosystem support: a framework for AFR preprocessing ‘hand-in-hand’ between government and private players, so fuels arrive in forms that can be used efficiently and consistently.

Design and execution discipline

Operational excellence is increasingly determined upstream—by the choices made in concept, layout, technology selection, operability and maintainability. Jain puts it unambiguously: “Long term performance is largely decided before the plant is commissioned.” A disciplined design avoids bottlenecks that are expensive to fix later; disciplined execution ensures safe, smooth start-up with fewer issues.

He highlights an often-missed factor: continuity between project and operations teams. “When knowledge transfer is strong and ownership carries beyond commissioning, the plant stabilises much faster… and lifecycle costs reduce significantly.”

What will define the next decade

Across the value chain, the future benchmark is clear: carbon intensity. “Carbon per ton will matter as much as cost per ton,” says Dr Hegde. Vokuda echoes it: the industry will shift from optimising cost per tonne to carbon per ton.

The pathway, however, is practical rather than idealistic—low-clinker and blended cements, higher thermal substitution, renewable power integration, WHRS scaling and tighter energy efficiency. Jain argues for policy realism: if blended cement can meet quality, why it shall not be allowed more widely, particularly in government projects, and why supplementary materials cannot be used more ambitiously where performance is proven.

At the same time, the sector must prepare for CCUS without waiting for it. Jain calls for CCUS readiness—designing plants so capture can be added later without disruptive retrofits—while acknowledging that large-scale rollout may take time as costs remain high.

Ultimately, operational excellence will belong to plants that integrate—not isolate—the levers: process stability, quality automation, structured AFR, predictive reliability, disciplined execution, secure digitalisation and continuous learning. As Dr Sabjan notes, success will not come from one department owning the change: “Everybody has to own it… then only… the results could be wonderful.”

And as Daga reminds the industry, the future will reward those who keep their feet on the ground while adopting the new: “I don’t buy technology for the sake of technology. It has to make a commercial sense.” In the next decade, that commercial sense will be written in two numbers—cost per tonne and carbon per tonne—delivered through stable, skilled and digitally disciplined operations.

Merlin Prime Spaces Acquires 13,185 Sq M Land Parcel In Pune

Adani Cement and Naredco Partner to Promote Sustainable Construction

Operational Excellence Redefined!

World Cement Association Annual Conference 2026 in Bangkok

Assam Chief Minister Opens Star Cement Plant In Cachar

Merlin Prime Spaces Acquires 13,185 Sq M Land Parcel In Pune

Adani Cement and Naredco Partner to Promote Sustainable Construction

Operational Excellence Redefined!

World Cement Association Annual Conference 2026 in Bangkok