Product development

New Mines and Minerals Act

Published

10 years agoon

By

admin

In the concluding part of the article which stated from the earlier month; Dr HR Dandi now covers the new act in detail, the bidding process and its impact on the cement industry.

The Mines and Minerals (Development and Regulation) Act, 1957 regulates the mining sector in India and specifies the requirement for obtaining and granting mining leases for mining operations.

Process in brief

Rule 6: Eligibility for Mining Lease (Net Worth of Company)

(i)Value of Mineral >25 cr: Net worth shall >4 per cent of value of estimated resources

(ii)Value of Mineral <25 cr: Net worth shall >2 per cent of value of estimated resources (not being a individual applicant)

(iii)Value of Mineral <25 cr: Net worth shall >1 per cent of value of estimated resources (individual applicant)

VR = Estimated quantity of resource (tonne), X average price (tonne)

(iv)State government may reserve a mine for cement.

Rule 7: Electronic Auction

(i)Auction shall only through an online electronic auction platform.

Rule 8: Bidding parameters

(i)Reserve price as specified by State Government in tender document shall be value of mineral dispatched (= Mineral dispatched X sale price of mineral as published by IBM

(ii)The bidders shall quote, a percentage of value of mineral dispatched equal to or above the reserve price and the successful bidder shall pay to the state government, an amount equal to the product of ? percentage so quoted; and value of mineral dispatched.

Rule 9: Bidding Process

(i)Auction shall be an ascending forward online electronic auction and shall comprise two round

First Round

(ii)Bidder shall submit Technical Bid (TB) and Initial Price Offer (IPO)

(iii)Initial price offer of Technically Qualified Bidder (TQB) shall be opened

(iv)The top 50 per cent of the of TQB or 5 TQB whichever is higher shall be declared as qualified bidder (QB)

2nd round

(v)QB may submit their final price offer which shall be a percentage of value of mineral dispatched and greater than the floor price:

(vi)Qualified bidder who submits the highest final price offer shall be declared as the ?preferred bidder? immediately on conclusion of the auction.

Rule 10: Grant of Mining Lease:

(i)The preferred bidder shall submit

(a)Ist installment -10 per cent of upfront payment (UP)

(UP= 0.50 per cent of Value of Mineral (VR),

VR = Estimated quantity of resource (tonne) X average price (tonne)

(ii)LOI shall be issued Upon receipt of the first instalment of the upfront payment,

(iii)The preferred bidder shall be considered to be the ?successful bidder? upon

(a)Payment of the second instalment being ten per cent. of the upfront payment;

(b)Furnishing performance security (0.50 per cent of Value of Mineral)

(iv)Mine Development and Production Agreement (MDPA) shall be signed on obtaining all consents, approvals, permits, no-objections and the like as may be required under applicable laws for commencement of mining operations and payment of the third installment (80 per cent of the upfront payment ) subsequent to execution of MDPA

(v)ML shall be granted to the successful bidder and Mining Lease Deed shall be executed by the State Government within 30 days

Grant of Composite Licence

(a)Rule 16: Prerequisites for auction of CL

(i)Approval of the state government (Limestone being notified mineral)

(ii)At least general exploration (G3) has been completed (800 mts for regular habit 400 mts for irregular habit)

(*)Net worth shall >1 per cent of Value of estimated Resources

(b)Rule 17: Electronic Auction/ Bidding Parameters/Bidding Process – Same as for ML

(i)Auction shall only through an online electronic auction platform (c)Rule 18. Grant of CL:

(i)Upon completion of auction the preferred bidder shall submit performance security (0.25 per cent of Value of Mineral)

(ii) LOI shall be issued upon receipt of performance security

(iii) The preferred bidder shall be considered to be the ?successful bidder? upon (a)obtaining all consents, approvals, permits, no-objections and the like as may be required under applicable laws for commencement of prospecting operations; and submitting the scheme of prospecting.

(iv)Composite Licence shall be grated to successful bidder

(v)Licence so as to ascertain evidence of mineral contents as per minerals (Evidence of Mineral Contents) Rules, 2015,

(vi)LOI for ML shall be issued a application of mining lease and 10 per cent of Upfront Payment

(vii) Mine Development and Production Agreement (MDPA) shall be signed on obtaining all consents, approvals, permits, no-objections and the like as may be required under applicable laws for commencement of mining operations and payment of the 2nd installment (10 per cent of the upfront payment)

(viii)Subsequent to execution of the MDPA, ML shall be granted to the successful bidder and Mining Lease Deed shall be signed upon payment of 3rd installment, i.e 80 per cent of upfront payment.

Dilution of regulatory objective – Execution delays on the cards

A significant dilution in achieving the objectives of framing of the law may be observed in the final enactment of the MMDR 2015. The draft rule 6 which formed part of the draft Act published in April 2014 did not see the light of the day upon enactment. Rule 6 states:

?…prior to notification for auction the Government shall (b) obtain conditional clearance on the basis of recommendation of the committee constituted for the purposes of forest clearance under the Forest (Conservation) Act, 1980 and wildlife clearance under the Wild Life (Protection) Act, 1972 or any other law for the time being in force, so as to enable commencement of operations; and (c) obtain all necessary permissions from the owners of the land and those having occupation rights?

Realising the complications in getting NOC from the land owners and various other agencies all state governments opposed this clause. Deletion of this clause has made the new Act at par with old act while it has retained the objective of fetching high revenues for the state. Auction is expected to remain limited to the bidding for the mineral wealth with certain level of exploration on geological axis of UNFC with uncertainty on feasibility or economic axis due to inherent complex nature of land acquisition and approvals for converting them to 111, 112, 221 or 222 level of UNFC.

Poor exploration quality coupled with regional variation – leading to valuation risks of the mineral reserve

Consistency in ROM limestone is depends upon accuracy of limestone evaluation through geological model representing the grade at particular place. Less core recovery coupled with structural complexities induces problems in deciphering the litho-logical boundaries and their grade behavior. In limestone there are many mechanical and geological factors in drilling which can result in poor core recovery, like structural disturbance, discontinuities, clay band, chemical composition, topographic placement, inappropriate drill size, improper anchoring of rigs, high rotation speed. A conservative approach for reserve quantification due to than a specified percentage recovery has both upside and down side effect on the evaluation of limestone, particularly when good limestone deposit is depleting. .

The limestone block which shall come for auction may not have quality drilling. Understanding of core loss, require not only the drilling data but complete structural/ depositional behavior of limestone in that particular basin. While correlating core loss of limestone in various basins, the author has experienced a very complex behavior of limestone not even to basin level, but within sub- basin and semi-basins also. Is not always clay or karst or cavity or structural unconformity but the genesis of secondary or tertiary calcite cementation or crystallisation has also equal impact on core recovery. The description of the same shall be missing in exploration data. The Model Tender document uploaded on Ministry of Mines para 1.5 provide that "The State Government, its employees and advisors have no liability on account to accuracy, adequacy, correctness, completeness or reliability of the Tender Document and any assessment, assumption, statement or information contained therein or deemed to form part of this Tender Document or arising in any way from participation in this tender process." .

This rests the accountability and risks of error in estimates and hence valuation of a reserve on the participating bidder. While this will enhance the number of reserve put under auction earlier than later – utilisation of these reserves or optimization usage remains uncertain..

Stiff competition with other end users – non captive bidder for limestone mines Cement Industry has to compete with different categories of bidder with varied perception, and risk apatite. While a category may be maximum revenue fetcher by adopting selective mining and least concerned for mineral conservation other delivering the best use of mineral a low revenue generator..

First time for cement industry

Grant of ML: Two options, 1. Cement End Use 2. No End use (i)End Use: Cement may have to competitors

(a)Green field ? New projects

(b)Brown field – Expansion of existing capacity

(ii)No End Use (ML/CL) may have following competitors for same block Cement industry

(a)Green field

(b)Brown field expansion

(c)Resource augmentation

(d)Resource optimisation

(corrective)

Chemical / lime industry

(a)100 per cent captive consumption v (b)High grade for captive and low grade for open market sale

(c)Undersize high grade be sold to cement plant as corrective

Steel industry

(a)Other industries

(b)Selective mining for a selective market

(c)Selective mining based on day to day demand

(d)Semi-mechanised for multiple product

(e)Others

Equal participation of all interested parties under the new Act in the auction for limestone reserves calls for the cement companies to build their war chest for some stiff competition from other industries. While the usage of limestone in the non cement manufacturing sector is limited and categorical – valuation of the limestone mines may vary significantly when compared across industries and methodology of mining.

Key decision making factors – Access to mineral may not add cement capacity Exploration Data may be just sufficient to take a mining decision, but will not be sufficient to take investment decision for cement plant. Decision for setting up a cement plant cannot be solely made based on quality and quantity of limestone but it should have a proper quality data, because a cement plant decision will require following minimum important key decision making factors:

(i)Topographic Factors: Plain, undulating, hilly, mountainous, slope, catchment, drainage etc

(ii)Infrastructural Factors: Road, rail, power, water pre project basic amenity etc

(iii)Deposit Factors: Exploration level, quality, quantity, quality of exploration, deposit type, deposit uniformity vertical/horizontal, unconformity, parting, dolomitisation, quality and quantity of overburden, interbred etc

(iv)Mining Factors: Topography, stripping ratio, selectivity, mining dilution, bench height, ultimate pit depth, drainage, geotechnical stability, habitation, infrastructure, drainage and even mine vastu

(v)Environmental Factors: Forest, wild life, sanctuary, eco-sensitive zone, water bodies, protected area, rehabilitation, dump management

(vi)Social Factors: Population, NGO, law and order, custom, land holding etc

(vii) Logistical factors: Transportation mode, connectivity requirement , source of power, fly ash, corrective, additive, competitors, market, etc.

Concluding Remarks

If anything significant that is expected of the MMDR 2015 is the transparency in the allocation of the mineral reserves based on measurable quantitative parameters, participation of the serious end-users with sufficient financial capacity to mobilise resources for putting the natural resources to use, and time bound defined utilisation of the reserves where sufficient and reliable geological data is available for evaluation. Hoarding of reserves is expected to significantly lower.

Cost of acquisition of the mineral reserve for the cement manufacturing companies as well as the ROM cost of the mineral mines is expected to rise moderately if not significantly and hence incremental burden on the end consumer of the cement. The Act ensures government exchequer to get the fair valuation of the reserve while shedding any liability towards the extant of reserve available or accountability towards the expeditious utilisation of the reserve. It also strips the state government of its liberty to prioritise or promote any industry by discretionary allocation of the mineral blocks.

References

i. Working Group on Cement Industry for the Twelfth Five Year Plan

ii.Mines and Minerals (Development and Regulation) Amendment Act, 2015

iii.Minerals (Evidence of Mineral Contents) Rules, 2015

iv.Mineral (Auction) Rules, 2015

v.Mineral ( Non -Excusive Reconnaissance Permit) Rules , 2015

vi.National Mineral Policy -2006

vii.Theory of Auctions and Competitive Bidding- Paul R. Milgrom; Robert J. Weber

viii.Four Issues in Auctions and Market Design – R. Preston McAfee

ix.Economic Comparison of Mineral Exploration and Acquisition Strategies to Obtain Ore Reserves- R.L. Robinson and B.W. Mackenzie

x.Performance of Indian Cement Industry – L. G. Burange and Shruti Yamini

xi.Indian Minerals Yearbook – 2013

HIGHLIGHTS

Due to MMDR 2015, the transparency in allocation process is going to significantly increase.

Cost of acquisition of the mineral reserve is going to rise moderately if not significantly.

The Act ensures government exchequer to get the fair valuation of the reserve. It also strips the State Government of its liberty to prioritize any industry by discretionary allocation of the mineral blocks.

Dr Dandi is Vice President, Head – Business Development & Raw Materials, Reliance Cement.

Co-authored by SK Das, Vice President, Head – Mining & Geology and Tamal Pal, GM, Business Development, Reliance Cement.

… this article is continued from the previous issue of ICR

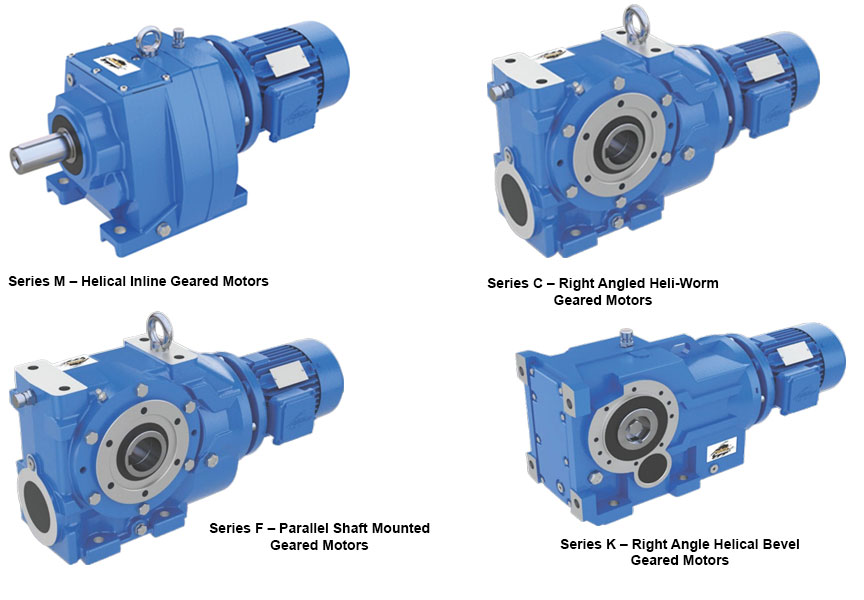

A deep dive into Core Gear Series of products M, C, F and K, by Power Build, and how they represent precision in motion.

At the heart of every high-performance industrial system lies the need for robust, reliable, and efficient power transmission. Power Build answers this need with its flagship geared motor series: M, C, F and K. Each series is meticulously engineered to serve specific operational demands while maintaining the universal promise of durability, efficiency, and performance.

Series M – Helical Inline Geared Motors

Compact and powerful, the Series M delivers exceptional drive solutions for a broad range of applications. With power handling up to 160kW and torque capacity reaching 20,000 Nm, it is the trusted solution for industries requiring quiet operation, high efficiency, and space-saving design. Series M is available with multiple mounting and motor options, making it a versatile choice for manufacturers and OEMs globally.

Series C – Right Angled Heli-Worm Geared Motors

Combining the benefits of helical and worm gearing, the Series C is designed for right-angled power transmission. With gear ratios of up to 16,000:1 and torque capacities of up to 10,000 Nm, this series is optimal for applications demanding precision in compact spaces. Industries looking for a smooth, low-noise operation with maximum torque efficiency rely on Series C for dependable performance.

Series F – Parallel Shaft Mounted Geared Motors

Built for endurance in the most demanding environments, Series F is widely adopted in steel plants, hoists, cranes and heavy-duty conveyors. Offering torque up to 10,000 Nm and high gear ratios up to 20,000:1, this product features an integral torque arm and diverse output configurations to meet industry-specific challenges head-on.

Series K – Right Angle Helical Bevel Geared Motors

For industries seeking high efficiency and torque-heavy performance, Series K is the answer. This right-angled geared motor series delivers torque up to 50,000 Nm, making it a preferred choice in core infrastructure sectors such as cement, power, mining and material handling. Its flexibility in mounting and broad motor options offer engineers the freedom in design and reliability in execution.

Together, these four series reflect Power Build’s commitment to excellence in mechanical power transmission. From compact inline designs to robust right-angle drives, each geared motor is a result of decades of engineering innovation, customer-focused design and field-tested reliability. Whether the requirement is speed control, torque multiplication or space efficiency, Radicon’s Series M, C, F and K stand as trusted powerhouses for global industries.

http://www.powerbuild.in

Call: +919727719344

Economy & Market

Conveyor belts are a vital link in the supply chain

Published

8 months agoon

June 16, 2025By

admin

Kamlesh Jain, Managing Director, Elastocon, discusses how the brand delivers high-performance, customised conveyor belt solutions for demanding industries like cement, mining, and logistics, while embracing innovation, automation, and sustainability.

In today’s rapidly evolving industrial landscape, efficient material handling isn’t just a necessity—it’s a competitive advantage. As industries such as mining, cement, steel and logistics push for higher productivity, automation, and sustainability, the humble conveyor belt has taken on a mission-critical role. In this exclusive interview, Kamlesh Jain, Managing Director, Elastocon, discusses how the company is innovating for tougher terrains, smarter systems and a greener tomorrow.

Brief us about your company – in terms of its offerings, manufacturing facilities, and the key end-user industries it serves.

Elastocon, a flagship brand of the Royal Group, is a trusted name in the conveyor belt manufacturing industry. Under the brand name ELASTOCON, the company produces both open-end and endless belts, offering tailor-made solutions to some of the most demanding sectors such as cement, steel, power, mining, fertiliser, and logistics. Every belt is meticulously engineered—from fabric selection to material composition—to ensure optimal performance in tough working conditions. With advanced manufacturing facilities and strict quality protocols, Elastocon continues to deliver high-performance conveyor solutions designed for durability, safety, and efficiency.

How is the group addressing the needs for efficient material handling?

Efficient material handling is the backbone of any industrial operation. At Elastocon, our engineering philosophy revolves around creating belts that deliver consistent performance, long operational life, and minimal maintenance. We focus on key performance parameters such as tensile strength, abrasion resistance, tear strength, and low elongation at working tension. Our belts are designed to offer superior bonding between plies and covers, which directly impacts their life and reliability. We also support clients

with maintenance manuals and technical advice, helping them improve their system’s productivity and reduce downtime.

How critical are conveyor belts in ensuring seamless material handling?

Conveyor belts are a vital link in the supply chain across industries. In sectors like mining, cement, steel, and logistics, they facilitate the efficient movement of materials and help maintain uninterrupted production flows. At Elastocon, we recognise the crucial role of belts in minimising breakdowns and increasing plant uptime. Our belts are built to endure abrasive, high-temperature, or high-load environments. We also advocate proper system maintenance, including correct belt storage, jointing, roller alignment, and idler checks, to ensure smooth and centered belt movement, reducing operational interruptions.

What are the key market and demand drivers for the conveyor belt industry?

The growth of the conveyor belt industry is closely tied to infrastructure development, increased automation, and the push for higher operational efficiency. As industries strive to reduce labor dependency and improve productivity, there is a growing demand for advanced material handling systems. Customers today seek not just reliability, but also cost-effectiveness and technical superiority in the belts they choose. Enhanced product aesthetics and innovation in design are also becoming significant differentiators. These trends are pushing manufacturers to evolve continuously, and Elastocon is leading the way with customer-centric product development.

How does Elastocon address the diverse and evolving requirements of these sectors?

Our strength lies in offering a broad and technically advanced product portfolio that serves various industries. For general-purpose applications, our M24 and DINX/W grade belts offer excellent abrasion resistance, especially for RMHS and cement plants. For high-temperature operations, we provide HR and SHR T2 grade belts, as well as our flagship PYROCON and PYROKING belts, which can withstand extreme heat—up to 250°C continuous and even 400°C peak—thanks to advanced EPM polymers.

We also cater to sectors with specialised needs. For fire-prone environments like underground mining, we offer fire-resistant belts certified to IS 1891 Part V, ISO 340, and MSHA standards. Our OR-grade belts are designed for oil and chemical resistance, making them ideal for fertiliser and chemical industries. In high-moisture applications like food and agriculture, our MR-grade belts ensure optimal performance. This diverse range enables us to meet customer-specific challenges with precision and efficiency.

What core advantages does Elastocon offer that differentiate it from competitors?

Elastocon stands out due to its deep commitment to quality, innovation, and customer satisfaction. Every belt is customised to the client’s requirements, supported by a strong R&D foundation that keeps us aligned with global standards and trends. Our customer support doesn’t end at product delivery—we provide ongoing technical assistance and after-sales service that help clients maximise the value of their investments. Moreover, our focus on compliance and certifications ensures our belts meet stringent national and international safety and performance standards, giving customers added confidence.

How is Elastocon gearing up to meet its customers’ evolving needs?

We are conscious of the shift towards greener and smarter manufacturing practices. Elastocon is embracing sustainability by incorporating eco-friendly materials and energy-efficient manufacturing techniques. In parallel, we are developing belts that seamlessly integrate with automated systems and smart industrial platforms. Our vision is to make our products not just high-performing but also future-ready—aligned with global sustainability goals and compatible with emerging technologies in industrial automation and predictive maintenance.

What trends do you foresee shaping the future of the conveyor belt industry?

The conveyor belt industry is undergoing a significant transformation. As Industry 4.0 principles gain traction, we expect to see widespread adoption of smart belts equipped with sensors for real-time monitoring, diagnostics, and predictive maintenance. The demand for recyclable materials and sustainable designs will continue to grow. Furthermore, industry-specific customisation will increasingly replace standardisation, and belts will be expected to do more than just transport material—they will be integrated into intelligent production systems. Elastocon is already investing in these future-focused areas to stay ahead of the curve.

Advertising or branding is never about driving sales. It’s about creating brand awareness and recall. It’s about conveying the core values of your brand to your consumers. In this context, why is branding important for cement companies? As far as the customers are concerned cement is simply cement. It is precisely for this reason that branding, marketing and advertising of cement becomes crucial. Since the customer is unable to differentiate between the shades of grey, the onus of creating this awareness is carried by the brands. That explains the heavy marketing budgets, celebrity-centric commercials, emotion-invoking taglines and campaigns enunciating the many benefits of their offerings.

Marketing strategies of cement companies have undergone gradual transformation owing to the change in consumer behaviour. While TV commercials are high on humour and emotions to establish a fast connect with the customer, social media campaigns are focussed more on capturing the consumer’s attention in an over-crowded virtual world. Branding for cement companies has become a holistic growth strategy with quantifiable results. This has made brands opt for a mix package of traditional and new-age tools, such as social media. However, the hero of every marketing communication is the message, which encapsulates the unique selling points of the product. That after all is crux of the matter here.

While cement companies are effectively using marketing tools to reach out to the consumers, they need to strengthen the four Cs of the branding process – Consumer, Cost, Communication and Convenience. Putting up the right message, at the right time and at the right place for the right kind of customer demographic is of utmost importance in the long run. It is precisely for this reason that regional players are likely to have an upper hand as they rely on local language and cultural references to drive home the point. But modern marketing and branding domain is exponentially growing and it would be an interesting exercise to tabulate and analyse its impact on branding for cement.

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence

FORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence