Economy & Market

Role of Market Research in Strategy Formulation

Published

14 years agoon

By

admin

In the first part of the paper presented by Soumen Karkun, Deputy Managing Director, Holtec Consulting, on the case study, the author elucidates the backdrop of the case and the Company’s internal and external scenario.The case presented in this paper is based on a market strategy assignment, executed by Holtec in early 2012, for a leading manufacturer of cement in India. It seeks to highlight the role that good market research can play in formulating a holistic marketing strategy.BACKDROPGeneral EnvironmentWith surplus conditions prevailing in the cement industry, decision-makers in different companies set about re-examining the marketing elements which could provide them a competitive advantage. The need to revalidate the existing perceptions of the 4 Ps viz., Product, Price, Place (Distribution) and Promotion necessitated the launching of a variety of market information gathering initiatives. One of these was market research.Company EnvironmentThe company addressed in this case, had traditionally been able to command a price premium over its competitors in its principal markets. Immediately prior to the assignment described in this case, the company had observed two disturbing trends – its premium was eroding and its market shares, in districts where its realization was better, were dwindling. It, therefore, commissioned Holtec to undertake an integrated marketing assignment which could enable it to achieve a targeted return of 30% on its investment in assets.ASSOCIATED EXERCISES

Strength -Weakness AnalysisA structured questionnaire was applied to volume-users, key channel functionaries and the company’s own management and marketing staff to obtain a strength-weakness profile of the marketing function. A total of 20 factors were graded on a 5-point scale. It was found that the company had two real strengths, eight marginal strengths (which, if not attended to, could become weaknesses), five marginal weaknesses (which, with minimal effort, could be converted to strengths) and four real weaknesses.Demand – Supply ForecastingWhile demand forecasts in markets relevant to the company were determined using a variety of econometric and end-use models, projected supply was determined through the use of Holtec’s dynamic database of projects in the pipeline. It was found that the overall surplus situation prevailing in early 2012 would moderately increase over the next 3-4 fiscals and thereafter show a slightly declining trend. The demand-supply forecasting exercise was performed not only at the national level but also at the regional level.Production PotentialA technical assessment of the company’s existing production facilities and input sources was used to ascertain its production potential over the next five years.Realization Potential from Sales RedistributionA bi-dimensional analysis was done in which each district in the four states which constituted a relevant market for the company, was mapped.Competitive Advantage was determined using factors such as marketing proximities, the company’s relative strength in the market (measured by price premiums, market shares, etc.), number of dealers vis-?vis competitors, etc.Market Attractiveness was determined using demand forecasts, prevailing prices, number of competitors existing/ expected, etc.Using the above data in conjunction with the price elasticities of demand in different markets, (which were determined) as well as the transport tariffs to move cement from sources to destinations, it was established that redistribution of sales could substantially add to the company’s realization.MARKET RESEARCHObjectivesThe objectives of the market research activity were to obtain a good, impartial insight of relevant market conditions, to test a set of hypothesis relevant to cement marketing and to use the information collected to develop market-oriented, competitor profilesResearch Dimensions, Methodologies & ToolsThe survey spanned the entire month of March 2012. The activities included questionnaire development, field investigator training, field data collection, data coding/ entry/ validation/ analysis and interpretation of results. The survey team consisted of 18 field investigators and 2 supervisors. The geographic coverage included a total of 32 districts in the company’s home state and the 3 states in its immediate vicinity. The research segments included trade channels and end users (individuals, private firms and government bodies). The research methodology consisted of personally administered, structured questionnaires as well as unstructured observations on market conditions. The statistically determined sample size consisted of 650 channel members and 125 end-users. This accounted for about 8.5% of the total market population.The analytical tools included regression analysis, statistical inference tests, hypothesis testing, etc.Information gathered through ResearchThe information areas and some of the important types of information, collected and analyzed for all districts and all competitors, are shown below:??Channel Information: Member sizes (storage/ sales), brands carried, exclusivity, supporting activities, other products sold, etc.??Product Perceptions: Attribute ranking, cement type perceptions (OPC, PPC, and PSC), preference reasons for products/ packing, etc.??Price Perceptions: Competitive price comparisons, seasonalities, elasticities, premium possible for a superior cement, discounts applicable for a lower category cement, etc.??Market Sizes/ Shares: Competitive market shares, incremental sales potential, segment shares, usage determination, etc.??Market Conditions: Sourcing requisition, delivery lead times, volume seasonalities, etc.??Channel Perceptions: Best cement ranking, perception of competitive marketing functions, brand recommendation reasons, etc.??Buyer Behaviour: Brand pulls & pushes, selection reasons, segment preferences, brand influencers, best cement ranking, brand usages, etc.??Promotion: Preferred media, media effectiveness, message recall, competitive publicity effectiveness & measures, etc. ??Channel Concerns: Availability, margin comparisons, supplier attention, complaints, problem areas, preferred promotion schemes, etc.??Hypothesis Tests: A set of 20 hypotheses was statistically tested for confirmation. These were applied to both channel members and end-users. Differences observable between the two states surveyed as well as between different consumer segments, were specifically analyzed. Some of the hypotheses tested are shown below:??Darker cement sells better??Quality varies widely between brands??Cement from a new plant is better in quality than that from an old plant??OPC gives better concrete strength as compared to PPC??Consumers are perceptive of short weights??Better quality cement has lower unit consumption in construction??Lower priced cement has more demand??Jute packing reduces price realization??Instructions on cement usage increases the brand’s demand, etc.Competitor ProfilesBased on the information collected through Market Research, and its subsequent analysis, meaningful competitor profiles were generated. These included competitor names, brands, production capacity (including timing of expected additions, if any), products & volumes, product quality, packing used, districts serviced, competitive advantage ranking in different districts, prices, marketing channels employed (types and volumes), user segments catered, supply lead times, promotion methods & schemes, message recalls, push/ pull statistics, etc. Apart from the above, district-wise comparisons with the company were carried out for factors such as reputation, publicity effectiveness, price leadership, incremental sales potential, etc.

Concrete

Our strategy is to establish reliable local partnerships

Published

8 hours agoon

February 19, 2026By

admin

Jean-Jacques Bois, President, Nanolike, discusses how real-time data is reshaping cement delivery planning and fleet performance.

As cement producers look to extract efficiency gains beyond the plant gate, real-time visibility and data-driven logistics are becoming critical levers of competitiveness. In this interview with Jean-Jacques Bois, President, Nanolike, we discover how the company is helping cement brands optimise delivery planning by digitally connecting RMC silos, improving fleet utilisation and reducing overall logistics costs.

How does SiloConnect enable cement plants to optimise delivery planning and logistics in real time?

In simple terms, SiloConnect is a solution developed to help cement suppliers optimise their logistics by connecting RMC silos in real time, ensuring that the right cement is delivered at the right time and to the right location. The core objective is to provide real-time visibility of silo levels at RMC plants, allowing cement producers to better plan deliveries.

SiloConnect connects all the silos of RMC plants in real time and transmits this data remotely to the logistics teams of cement suppliers. With this information, they can decide when to dispatch trucks, how to prioritise customers, and how to optimise fleet utilisation. The biggest savings we see today are in logistics efficiency. Our customers are able to sell and ship more cement using the same fleet. This is achieved by increasing truck rotation, optimising delivery routes, and ultimately delivering the same volumes at a lower overall logistics cost.

Additionally, SiloConnect is designed as an open platform. It offers multiple connectors that allow data to be transmitted directly to third-party ERP systems. For example, it can integrate seamlessly with SAP or other major ERP platforms, enabling automatic order creation whenever replenishment is required.

How does your non-exclusive sensor design perform in the dusty, high-temperature, and harsh operating conditions typical of cement plants?

Harsh operating conditions such as high temperatures, heavy dust, extreme cold in some regions, and even heavy rainfall are all factored into the product design. These environmental challenges are considered from the very beginning of the development process.

Today, we have thousands of sensors operating reliably across a wide range of geographies, from northern Canada to Latin America, as well as in regions with heavy rainfall and extremely high temperatures, such as southern Europe. This extensive field experience demonstrates that, by design, the SiloConnect solution is highly robust and well-suited for demanding cement plant environments.

Have you initiated any pilot projects in India, and what outcomes do you expect from them?

We are at the very early stages of introducing SiloConnect in India. Recently, we installed our

first sensor at an RMC plant in collaboration with FDC Concrete, marking our initial entry into the Indian market.

In parallel, we are in discussions with a leading cement producer in India to potentially launch a pilot project within the next three months. The goal of these pilots is to demonstrate real-time visibility, logistics optimisation and measurable efficiency gains, paving the way for broader adoption across the industry.

What are your long-term plans and strategic approach for working with Indian cement manufacturers?

For India, our strategy is to establish strong and reliable local partnerships, which will allow us to scale the technology effectively. We believe that on-site service, local presence, and customer support are critical to delivering long-term value to cement producers.

Ideally, our plan is to establish an Indian entity within the next 24 months. This will enable us to serve customers more closely, provide faster support and contribute meaningfully to the digital transformation of logistics and supply chain management in the Indian cement industry.

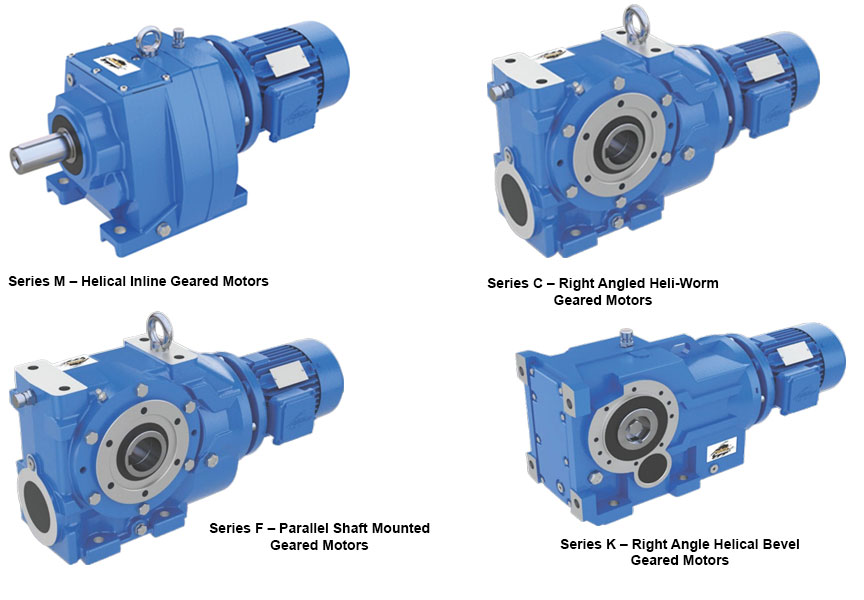

A deep dive into Core Gear Series of products M, C, F and K, by Power Build, and how they represent precision in motion.

At the heart of every high-performance industrial system lies the need for robust, reliable, and efficient power transmission. Power Build answers this need with its flagship geared motor series: M, C, F and K. Each series is meticulously engineered to serve specific operational demands while maintaining the universal promise of durability, efficiency, and performance.

Series M – Helical Inline Geared Motors

Compact and powerful, the Series M delivers exceptional drive solutions for a broad range of applications. With power handling up to 160kW and torque capacity reaching 20,000 Nm, it is the trusted solution for industries requiring quiet operation, high efficiency, and space-saving design. Series M is available with multiple mounting and motor options, making it a versatile choice for manufacturers and OEMs globally.

Series C – Right Angled Heli-Worm Geared Motors

Combining the benefits of helical and worm gearing, the Series C is designed for right-angled power transmission. With gear ratios of up to 16,000:1 and torque capacities of up to 10,000 Nm, this series is optimal for applications demanding precision in compact spaces. Industries looking for a smooth, low-noise operation with maximum torque efficiency rely on Series C for dependable performance.

Series F – Parallel Shaft Mounted Geared Motors

Built for endurance in the most demanding environments, Series F is widely adopted in steel plants, hoists, cranes and heavy-duty conveyors. Offering torque up to 10,000 Nm and high gear ratios up to 20,000:1, this product features an integral torque arm and diverse output configurations to meet industry-specific challenges head-on.

Series K – Right Angle Helical Bevel Geared Motors

For industries seeking high efficiency and torque-heavy performance, Series K is the answer. This right-angled geared motor series delivers torque up to 50,000 Nm, making it a preferred choice in core infrastructure sectors such as cement, power, mining and material handling. Its flexibility in mounting and broad motor options offer engineers the freedom in design and reliability in execution.

Together, these four series reflect Power Build’s commitment to excellence in mechanical power transmission. From compact inline designs to robust right-angle drives, each geared motor is a result of decades of engineering innovation, customer-focused design and field-tested reliability. Whether the requirement is speed control, torque multiplication or space efficiency, Radicon’s Series M, C, F and K stand as trusted powerhouses for global industries.

http://www.powerbuild.in

Call: +919727719344

Pankaj Kejriwal, Whole Time Director and COO, Star Cement, on driving efficiency today and designing sustainability for tomorrow.

In an era where the cement industry is under growing pressure to decarbonise while scaling capacity, Star Cement is charting a pragmatic yet forward-looking path. In this conversation, Pankaj Kejriwal, Whole Time Director and COO, Star Cement, shares how the company is leveraging waste heat recovery, alternative fuels, low-carbon products and clean energy innovations to balance operational efficiency with long-term sustainability.

How has your Lumshnong plant implemented the 24.8 MW Waste Heat Recovery System (WHRS), and what impact has it had on thermal substitution and energy costs?

Earlier, the cost of coal in the Northeast was quite reasonable, but over the past few years, global price increases have also impacted the region. We implemented the WHRS project about five years ago, and it has resulted in significant savings by reducing our overall power costs.

That is why we first installed WHRS in our older kilns, and now it has also been incorporated into our new projects. Going forward, WHRS will be essential for any cement plant. We are also working on utilising the waste gases exiting the WHRS, which are still at around 100 degrees Celsius. To harness this residual heat, we are exploring systems based on the Organic Rankine Cycle, which will allow us to extract additional power from the same process.

With the launch of Star Smart Building Solutions and AAC blocks, how are you positioning yourself in the low-carbon construction materials segment?

We are actively working on low-carbon cement products and are currently evaluating LC3 cement. The introduction of autoclaved aerated concrete (AAC) blocks provided us with an effective entry into the consumer-facing segment of the industry. Since we already share a strong dealer network across products, this segment fits well into our overall strategy.

This move is clearly supporting our transition towards products with lower carbon intensity and aligns with our broader sustainability roadmap.

With a diverse product portfolio, what are the key USPs that enable you to support India’s ongoing infrastructure projects across sectors?

Cement requirements vary depending on application. There is OPC, PPC and PSC cement, and each serves different infrastructure needs. We manufacture blended cements as well, which allows us to supply products according to specific project requirements.

For instance, hydroelectric projects, including those with NHPC, have their own technical norms, which we are able to meet. From individual home builders to road infrastructure, dam projects, and regions with heavy monsoon exposure, where weather-shield cement is required, we are equipped to serve all segments. Our ability to tailor cement solutions across diverse climatic and infrastructure conditions is a key strength.

How are you managing biomass usage, circularity, and waste reduction across

your operations?

The Northeast has been fortunate in terms of biomass availability, particularly bamboo. Earlier, much of this bamboo was supplied to paper plants, but many of those facilities have since shut down. As a result, large quantities of bamboo biomass are now available, which we utilise in our thermal power plants, achieving a Thermal Substitution Rate (TSR) of nearly 60 per cent.

We have also started using bamboo as a fuel in our cement kilns, where the TSR is currently around 10 per cent to 12 per cent and is expected to increase further. From a circularity perspective, we extensively use fly ash, which allows us to reuse a major industrial waste product. Additionally, waste generated from HDPE bags is now being processed through our alternative fuel and raw material (AFR) systems. These initiatives collectively support our circular economy objectives.

As Star Cement expands, what are the key logistical and raw material challenges you face in scaling operations?

Fly ash availability in the Northeast is a constraint, as there are no major thermal power plants in the region. We currently source fly ash from Bihar and West Bengal, which adds significant logistics costs. However, supportive railway policies have helped us manage this challenge effectively.

Beyond the Northeast, we are also expanding into other regions, including the western region, to cater to northern markets. We have secured limestone mines through auctions and are now in the process of identifying and securing other critical raw material resources to support this expansion.

With increasing carbon regulations alongside capacity expansion, how do you balance compliance while sustaining growth?

Compliance and growth go hand in hand for us. On the product side, we are working on LC3 cement and other low-carbon formulations. Within our existing product portfolio, we are optimising operations by increasing the use of green fuels and improving energy efficiency to reduce our carbon footprint.

We are also optimising thermal energy consumption and reducing electrical power usage. Notably, we are the first cement company in the Northeast to deploy EV tippers at scale for limestone transportation from mines to plants. Additionally, we have installed belt conveyors for limestone transfer, which further reduces emissions. All these initiatives together help us achieve regulatory compliance while supporting expansion.

Looking ahead to 2030 and 2050, what are the key innovation and sustainability priorities for Star Cement?

Across the cement industry, carbon capture is emerging as a major focus area, and we are also planning to work actively in this space. In parallel, we see strong potential in green hydrogen and are investing in solar power plants to support this transition.

With the rapid adoption of solar energy, power costs have reduced dramatically – from 10–12 per unit to around2.5 per unit. This reduction will enable the production of green hydrogen at scale. Once available, green hydrogen can be used for electricity generation, to power EV fleets, and even as a fuel in cement kilns.

Burning green hydrogen produces only water and oxygen, eliminating carbon emissions from that part of the process. While process-related CO2 emissions from limestone calcination remain a challenge, carbon capture technologies will help address this. Ultimately, while becoming a carbon-negative industry is challenging, it is a goal we must continue to work towards.

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence

FORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence