Technology

Barrage of praise!

Published

6 years agoon

By

admin

Built at a cost of Rs 27.32 billion in 24 months, the Annaram Barrage of the KLIS project made use of secant piling in the cut-off foundation for the first time in the world in barrage construction.

It’s a part two of our series on the Kaleshwaram Lift Irrigation Scheme (KLIS), among the world’s largest irrigation projects. In this edition, we showcase the construction of Annaram Barrage, constructed by Afcons Infrastructure. This barrage, combined with the Medigadda and Sundilla barrages constitute the ambitious KLIS. Almost 2,000 million cu ft (tmc) of water per day will be moved upriver through gravity canals from Medigadda barrage to Annaram barrage, from where it will be pumped further back to Sundilla barrage. From there, the water will be diverted to Yellampalli reservoir and then distributed to nearby districts.

"We entered the dam and barrage segment in 2017 with the Annaram barrage project, which is part of this mammoth water preservation project," says K Subramanian, Executive Vice-Chairman, Afcons Infrastructure. "Despite entering a new segment, Afcons has achieved several national benchmarks in concrete pumping in the irrigation and hydropower sector. Kudos to the entire team for bringing in the laurels!"

"Being part of such an amazing and extraordinary engineering marvel is an honour. Annaram was the first of the three barrages to be completed substantially before time," adds Sekhar Das, Project Manager, Annaram Barrage Project, Afcons Infrastructure. "The early delivery makes Afcons’s maiden venture into the irrigation segment extra special. With a capacity of 10.87 tmc, Annaram is the second-largest barrage in the entire KLIS." Annaram Barrage was built at a cost of Rs 27.32 billion in a timeframe of 24 months.

Civil scope

Here’s a look at the civil structure specifications of this barrage:

Dimensions: Length – 1,270 m; Width – 100 m

No. of piers: 72. Dimensions (each): Length – 100 m; Thickness – 4 m; Height – 24 m

Launching apron: Upstream – 71 m; Downstream – 116.4 m.

The scope of work included:

Construction of the barrage for a length of 1,270 m with 66 vents of 15 m along with energy dissipation arrangement and abutments, wing and return/flank wall, etc

All mechanical works related to the barrage radial gates of size 15 m +13 m (12 in total) for under sluice bay and for other bays of size 15 m + 12 m (54 in total)

Road bridge with clear carriageway of 7.50 m

Earth bunds in right and left side to connect the road

Construction of guide bunds of both the sides of barrage

Laying of CC block size of 1,500 x 1,500 x 900 mm with loose stone protection in both streams and along with water side of guide bunds.

Laying of stone pitching in upstream and downstream of barrage and launching apron with stones in water side of guide bunds

Design flood discharge – 65,000 cusecs.

Quantifying right

Materials such as cement,reinforcement steel, aggregate, structural steel and rock boulders have been used in the construction of this barrage.

Highlights include:

1,200,000 cu m of concreting done for the entire project

55,000 mt of reinforcement steel used

80 lakh cu m of earthwork moved

1,500 tonne of cement consumed on average per day

200 mt of steel used on average per day

About 6,000 cu m concrete poured on average per day

More than 1 lakh cu m concreting per month achieved for four consecutive months.

Fully equipped

As this project had a short deadline, Afcons sourced additional equipment and resources from time to time to complete work efficiently. "The initial change of scope and halt of work for over 45 days during floods meant extra resources were the key to getting this barrage completed in just 24 months," shares Das. He goes on to elaborate upon the equipment used in the construction of the barrage: 11 piling rigs; 120 dumper trucks; 60 excavators; 11 boring rigs; seven boom placers; four concrete pumps; 36 transit mixers; seven batching plants; two crusher plants with a capacity of 250 tph; vibro hammer for sheet piling; crawler cranes; pick-n-carry cranes; trailers; and dewatering pumps.

Further, Doka formwork was used in the construction of the piers, where 3-m height lift could be achieved in one go. Rolla deck sheets were used in place of precast panels for the road bridge, saving nearly two months" time for casting of panels, erection and material handling. "Moreover, the project progress was monitored in Primavera and financial status tracked on SAP to keep the project on track in all aspects," says Das. "All periodic reports were made as per formats prepared after discussion with all department heads. We also tracked daily progress through CCTV cameras, site visits and focused WhatsApp groups."

Innovation in execution

Conquering challenges

Effective planning and strong teamwork were definitely factors that helped the team overcome various difficulties during execution. As Das shares, "The approach to the site location was poor initially; so mobilisation was a major challenge. But with the help of the authorities and correct permissions, mobilisation could begin smoothly. For timely land acquisition, we conducted numerous meetings with the villagers and explained the benefits of the barrage and KLIS. It helped a great deal to expedite land acquisition. Local support was critical in timely completion."

Das shares other major challenges involved in constructing this barrage and how the team effectively overcame them:

Approach roads: There were no appropriate roadways to transport materials to the site. Many roads and approach paths were created before the project began to cater to this remote location.

Dewatering: As the barrage location was right on the riverbed, the entire area was filled with water. Dewatering arrangements were made using a multistage well-point dewatering system, which helped speed up the process.

River diversion: To start construction activities, the whole length of the river was diverted using separate bunds. The bunds were constructed upstream for temporary diversion and connected to the total length of the barrage.

Procurement: Procurement was a major challenge. Owing to the remoteness of the site location, even for small materials, one would have to travel at least 300 km. Hence, planning and procurement played a critical role in avoiding delays.

Change of barrage location: At the outset of the project, there was a big change in plan. The location of the barrage was shifted, increasing its length by 151 m. A new geological survey was done at the new site once again. This resulted in extra work of more than 4,000 piles and 20 per cent increase over the estimated quantities of concreting and steel. And while there was increase in work quantity, the survey also threw up another major challenge. The ground at the new site had differentiated strata with layers of sand, soil, gravel and, at times, hard rock. Thus secant piling was used in the cut-off foundation.

Safety first

Afcons established and maintained strong health, safety and environment protocols for this project. Consistent mobilisation of resources (machinery, formwork, manpower) in time was ensured for timely completion. The result: a clean safety record of 8.2 million safe man-hours!

SERAPHINA D’SOUZA

Project details

Location: Annaram, Telangana

Features/specifications: Construction of barrage for a length of 1,270 m with 66 vents of 15 m along with energy dissipation arrangement and abutments, wing and return/flank wall

Total cost: Rs 27.32 billion

Contractor: AFCONS-VIJETA-PES (JV). Afcons Infrastructure. Website:

www.afcons.com; Vijeta. Website: www.vijeta.in; PES. Website: www.peseng.net

Architect/planner: Central Design Organisation (CDO), Government of Telangana.

Cement/concrete: In-house production. Material was procured from many vendors.

You may like

Ponnusamy Sampathkumar, Consultant – Process Optimisation and Training, discusses the role of skilled operators as the decisive link between advanced additives, digital control and world-class mill performance.

The industry always tries to reduce the number of operators in the Centre Control Room. (CCR) Though the concept was succeeded to certain extent, still we need a skilled person in the CCR.

In an era where artificial intelligence (AI) grinding aids, performance enhancers, and digital optimisation tools are becoming increasingly sophisticated, it’s tempting to believe that chemistry alone can solve the challenges of mill efficiency. Yet plants that consistently outperform their peers share one common trait: highly skilled operators who understand the mill as a living system, not just a machine.

Additives can improve flowability, reduce agglomeration, and enhance separator efficiency, but they cannot replace the nuanced judgement that comes from experience. Grinding is a dynamic process influenced by raw material variability, moisture, liner wear, ball charge distribution, ventilation, and separator loading. No additive can fully compensate for poor control of these fundamentals.

Operators see what additives cannot

When I joined the cement industry in 1981, not much modernisation was available then. Mostly the equipment was run from the local panel. Once I was visiting the cement mills section. The cement mills were water sprayed over the shell to reduce the temperature to avoid the gypsum disintegration.

The operator stopped the feeding for one of the mills. When I asked the reason, he replied that mill was getting jammed, and he added that he could understand the mill condition by its sound. I also learned that and it was useful throughout my career. In another plant I saw the ‘Electronic Ear,’ which checked the sound of the mill and the signal was looped with feed control!

Whatever modernisation we achieve, it is from the human factor that the development starts.

Additives respond to conditions; operators interpret them.

A skilled operator can detect subtle shifts, like a change in mill sound, a slight variation in circulating load, or a drift in separator cut point. It’s long before instrumentation flags a problem. These micro-observations often prevent major efficiency losses.

Additives work best when the process is stable

I would like to share one real time incident. The mill was running on auto mode looped with the mill outlet bucket elevator kilowatt. (KW)There was a decrease in the KW, and the mill feed was increased by the auto control (PID). After a while, the operator stopped both the feed and the mill. He asked the local operator to check the airslide between mill outlet and the elevator. They found the airslide was jammed and no material flow to the elevator!

The operator deduced the abnormality by his experience by seeing the conditions and the rate of increase of the feed by the auto control.

It’s always the human factor that adds value to the optimisation.

Grinding aids are multipliers,

not magicians.

They deliver maximum benefit only when:

• Mill ventilation is correct

• Ball charge is balanced

• Feed moisture is controlled

• Separator speed and loading are improved

• Blaine targets are realistic

Without these fundamentals, even advanced additives may become costly investments. The operator is responsible for ensuring process stability, whether using a ball mill or a vertical mill. After ensuring the system is stable, the operator observes it briefly before transitioning to automatic control. If there is any anomaly in the system the operator at once takes control of the system, stabilises and bring back to auto control.

Skilled operators adapt in real time

It will be interesting to note that the operators who operate from local panel start to operate from DCS also. They have the experience and the ability to adapt the changes. Operator checks each parameter deeply. Any meagre change in the parameters is also visible to him.

Raw materials change. Weather changes. Wear patterns change.

A skilled operator adjusts:

• Feed rate

• Water injection

• Separator speed

• Grinding pressure (in VRMs)

• Mill load distribution.

These adjustments require intuition built from years of experience, something no additive can replicate.

Human insight prevents over reliance on additives

Plants sometimes increase additive dosage to mask deeper issues like:

• Poor clinker quality

• Inadequate drying capacity

• Incorrect ball gradation

• High residue due to worn separator internals.

A knowledgeable operator finds root causes instead of chasing temporary chemical fixes.

The real optimisation sweet spot is reached when:

• Operators understand how additives interact with their specific mill.

• Additive suppliers collaborate with plant teams.

• Process data is interpreted by humans who know the mill’s behaviour.

This constructive collaboration consistently delivers:

• Lower kWh/t

• Higher throughput

• Better product consistency

• Optimum standard deviation.

Advanced additives are powerful tools, but they are not substitutes for human ability. Grinding optimisation is ultimately a human driven discipline, where skilled operators make the difference between average performance and world class efficiency. Additives enhance the process but operators

control it.

About the author:

Ponnusamy Sampathkumar, Consultant – Process Optimisation and Training, is a seasoned cement process consultant with 43+ years of global experience in plant operations, process optimisation, refractory management, safety systems and training multicultural teams across international cement plants.

Concrete

Redefining Efficiency with Digitalisation

Published

2 weeks agoon

February 20, 2026By

admin

Professor Procyon Mukherjee discusses how as the cement industry accelerates its shift towards digitalisation, data-driven technologies are becoming the mainstay of sustainability and control across the value chain.

The cement industry, long perceived as traditional and resistant to change, is undergoing a profound transformation driven by digital technologies. As global infrastructure demand grows alongside increasing pressure to decarbonise and improve productivity, cement manufacturers are adopting data-centric tools to enhance performance across the value chain. Nowhere is this shift more impactful than in grinding, which is the energy-intensive final stage of cement production, and in the materials that make grinding more efficient: grinding media and grinding aids.

The imperative for digitalisation

Cement production accounts for roughly 7 per cent to 8 per cent of global CO2 emissions, largely due to the energy intensity of clinker production and grinding processes. Digital solutions, such as AI-driven process controls and digital twins, are helping plants improve stability, cut fuel use and reduce emissions while maintaining consistent product quality. In one deployment alongside ABB’s process controls at a Heidelberg plant in Czechia, AI tools cut fuel use by 4 per cent and emissions by 2 per cent, while also improving operational stability.

Digitalisation in cement manufacturing encompasses a suite of technologies, broadly termed as Industrial Internet of Things (IIoT), AI and machine learning, predictive analytics, cloud-based platforms, advanced process control and digital twins, each playing a role in optimising various stages of production from quarrying to despatch.

Grinding: The crucible of efficiency and cost

Of all the stages in cement production, grinding is among the most energy-intensive, historically consuming large amounts of electricity and representing a significant portion of plant operating costs. As a result, optimising grinding operations has become central to digital transformation strategies.

Modern digital systems are transforming grinding mills from mechanical workhorses into intelligent, interconnected assets. Sensors throughout the mill measure parameters such as mill load, vibration, mill speed, particle size distribution, and power consumption. This real-time data, fed into machine learning and advanced process control (APC) systems, can dynamically adjust operating conditions to maintain optimal throughput and energy usage.

For example, advanced grinding systems now predict inefficient conditions, such as impending mill overload, by continuously analysing acoustic and vibration signatures. The system can then proactively adjust clinker feed rates and grinding media distribution to sustain optimal conditions, reducing energy consumption and improving consistency.

Digital twins: Seeing grinding in the virtual world

One of the most transformative digital tools applied in cement grinding is the digital twin, which a real-time virtual replica of physical equipment and processes. By integrating sensor data and

process models, digital twins enable engineers to simulate process variations and run ‘what-if’

scenarios without disrupting actual production. These simulations support decisions on variables such as grinding media charge, mill speed and classifier settings, allowing optimisation of energy use and product fineness.

Digital twins have been used to optimise kilns and grinding circuits in plants worldwide, reducing unplanned downtime and allowing predictive maintenance to extend the life of expensive grinding assets.

Grinding media and grinding aids in a digital era

While digital technologies improve control and prediction, materials science innovations in grinding media and grinding aids have become equally crucial for achieving performance gains.

Grinding media, which comprise the balls or cylinders inside mills, directly influence the efficiency of clinker comminution. Traditionally composed of high-chrome cast iron or forged steel, grinding media account for nearly a quarter of global grinding media consumption by application, with efficiency improvements translating directly to lower energy intensity.

Recent advancements include ceramic and hybrid media that combine hardness and toughness to reduce wear and energy losses. For example, manufacturers such as Sanxin New Materials in China and Tosoh Corporation in Japan have developed sub-nano and zirconia media with exceptional wear resistance. Other innovations include smart media embedded with sensors to monitor wear, temperature, and impact forces in real time, enabling predictive maintenance and optimal media replacement scheduling. These digitally-enabled media solutions can increase grinding efficiency by as much as 15 per cent.

Complementing grinding media are grinding aids, which are chemical additives that improve mill throughput and reduce energy consumption by altering the surface properties of particles, trapping air, and preventing re-agglomeration. Technology leaders like SIKA AG and GCP Applied Technologies have invested in tailored grinding aids compatible with AI-driven dosing platforms that automatically adjust additive concentrations based on real-time mill conditions. Trials in South America reported throughput improvements nearing 19 per cent when integrating such digital assistive dosing with process control systems.

The integration of grinding media data and digital dosing of grinding aids moves the mill closer to a self-optimising system, where AI not only predicts media wear or energy losses but prescribes optimal interventions through automated dosing and operational adjustments.

Global case studies in digital adoption

Several cement companies around the world exemplify digital transformation in practice.

Heidelberg Materials has deployed digital twin technologies across global plants, achieving up to 15 per cent increases in production efficiency and 20 per cent reductions in energy consumption by leveraging real-time analytics and predictive algorithms.

Holcim’s Siggenthal plant in Switzerland piloted AI controllers that autonomously adjusted kiln operations, boosting throughput while reducing specific energy consumption and emissions.

Cemex, through its AI and predictive maintenance initiatives, improved kiln availability and reduced maintenance costs by predicting failures before they occurred. Global efforts also include AI process optimisation initiatives to reduce energy consumption and environmental impact.

Challenges and the road ahead

Despite these advances, digitalisation in cement grinding faces challenges. Legacy equipment may lack sensor readiness, requiring retrofits and edge-cloud connectivity upgrades. Data governance and integration across plants and systems remains a barrier for many mid-tier producers. Yet, digital transformation statistics show momentum: more than half of cement companies have implemented IoT sensors for equipment monitoring, and digital twin adoption is growing rapidly as part of broader Industry 4.0 strategies.

Furthermore, as digital systems mature, they increasingly support sustainability goals: reduced energy use, optimised media consumption and lower greenhouse gas emissions. By embedding intelligence into grinding circuits and material inputs like grinding aids, cement manufacturers can strike a balance between efficiency and environmental stewardship.

Conclusion

Digitalisation is not merely an add-on to cement manufacturing. It is reshaping the competitive and sustainability landscape of an industry often perceived as inertia-bound. With grinding representing a nexus of energy intensity and cost, digital technologies from sensor networks and predictive analytics to digital twins offer new levers of control. When paired with innovations in grinding media and grinding aids, particularly those with embedded digital capabilities, plants can achieve unprecedented gains in efficiency, predictability and performance.

For global cement producers aiming to reduce costs and carbon footprints simultaneously, the future belongs to those who harness digital intelligence not just to monitor operations, but to optimise and evolve them continuously.

About the author:

Professor Procyon Mukherjee, ex-CPO Lafarge-Holcim India, ex-President Hindalco, ex-VP Supply Chain Novelis Europe, has been an industry leader in logistics, procurement, operations and supply chain management. His career spans 38 years starting from Philips, Alcan Inc (Indian Aluminum Company), Hindalco, Novelis and Holcim. He authored the book, ‘The Search for Value in Supply Chains’. He serves now as Visiting Professor in SP Jain Global, SIOM and as the Adjunct Professor at SBUP. He advises leading Global Firms including Consulting firms on SCM and Industrial Leadership and is a subject matter expert in aluminum and cement. An Alumnus of IIM Calcutta and Jadavpur University, he has completed the LH Senior Leadership Programme at IVEY Academy at Western University, Canada.

Concrete

Digital Pathways for Sustainable Manufacturing

Published

2 weeks agoon

February 20, 2026By

admin

Dr Y Chandri Naidu, Chief Technology Officer, Nextcem Consulting highlights how digital technologies are enabling Indian cement plants to improve efficiency, reduce emissions, and transition toward sustainable, low-carbon manufacturing.

Cement manufacturing is inherently resource- and energy-intensive due to high-temperature clinkerisation and extensive material handling and grinding operations. In India, where cement demand continues to grow in line with infrastructure development, producers must balance capacity expansion with sustainability commitments. Energy costs constitute a major share of operating expenditure, while process-related carbon dioxide emissions from limestone calcination remain unavoidable.

Traditional optimisation approaches, which are largely dependent on operator experience, static control logic and offline laboratory analysis, have reached their practical limits. This is especially evident when higher levels of alternative fuel and raw materials (AFR) are introduced or when raw material variability increases.

Digital technologies provide a systematic pathway to manage this complexity by enabling

real-time monitoring, predictive optimisation and integrated decision-making across cement manufacturing operations.

Digital cement manufacturing is enabled through a layered architecture integrating operational technology (OT) and information technology (IT). At the base are plant instrumentation, analysers, and automation systems, which generate continuous process data. This data is contextualised and analysed using advanced analytics and AI platforms, enabling predictive and prescriptive insights for operators and management.

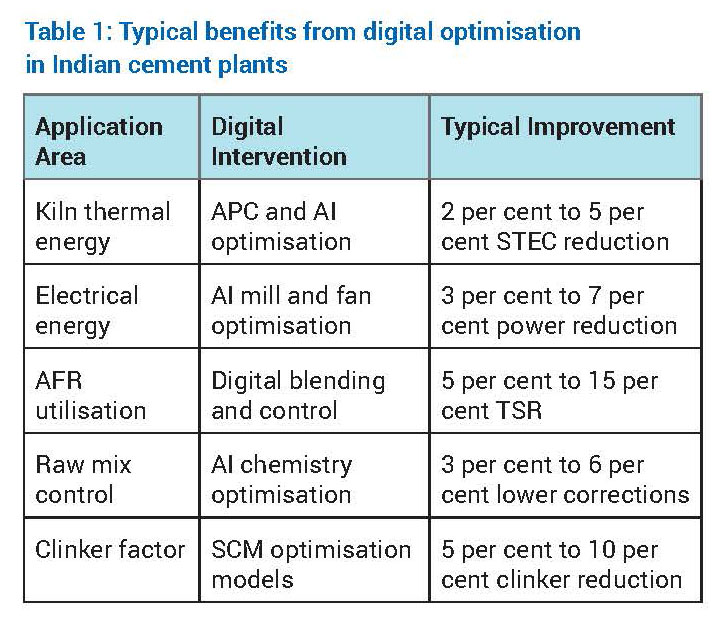

Digital optimisation of energy efficiency

- Thermal energy optimisation

The kiln and calciner system accounts for approximately 60 per cent to 65 per cent of total energy consumption in an integrated cement plant. Digital optimisation focuses on reducing specific thermal energy consumption (STEC) while maintaining clinker quality and operational stability.

Advanced Process Control (APC) stabilises critical parameters such as burning zone temperature, oxygen concentration, kiln feed rate and calciner residence time. By minimising process variability, APC reduces the need for conservative over-firing. Artificial intelligence further enhances optimisation by learning nonlinear relationships between raw mix chemistry, AFR characteristics, flame dynamics and heat consumption.

Digital twins of kiln systems allow engineers to simulate operational scenarios such as increased AFR substitution, altered burner momentum or changes in raw mix burnability without operational risk. Indian cement plants adopting these solutions typically report STEC reductions in the range of 2 per cent to 5 per cent. - Electrical energy optimisation

Electrical energy consumption in cement plants is dominated by grinding systems, fans and material transport equipment. Machine learning–based optimisation continuously adjusts mill parameters such as separator speed, grinding pressure and feed rate to minimise specific power consumption while maintaining product fineness.

Predictive maintenance analytics identify inefficiencies caused by wear, fouling or imbalance in fans and motors. Plants implementing plant-wide electrical energy optimisation typically achieve

3 per cent to 7 per cent reduction in specific power consumption, contributing to both cost savings and indirect CO2 reduction.

Digital enablement of AFR

AFR challenges in the Indian context: Indian cement plants increasingly utilise biomass, refuse-derived fuel (RDF), plastic waste and industrial by-products. However, variability in calorific value, moisture, particle size, chlorine and sulphur content introduces combustion instability, build-up formation and emission risks.

Digital AFR management: Digital platforms integrate real-time AFR quality data from online analysers with historical kiln performance data. Machine learning models predict combustion behaviour, flame stability and emission trends for different AFR combinations. Based on these predictions, fuel feed distribution, primary and secondary air ratios, and burner momentum are dynamically adjusted to ensure stable kiln operation. Digitally enabled AFR management in cement plants will result in increased thermal substitution rates by 5-15 percentage points, reduced fossil fuel dependency, and improved kiln stability.

Digital resource and raw material optimisation

Raw mix control: Raw material variability directly affects kiln operation and clinker quality. AI-driven raw mix optimisation systems continuously adjust feed proportions to maintain target chemical parameters such as Lime Saturation Factor (LSF), Silica Modulus (SM), and Alumina Modulus (AM). This reduces corrective material usage and improves kiln thermal efficiency.

Clinker factor reduction: Reducing clinker factor through supplementary cementitious materials (SCMs) such as fly ash, slag and calcined clay is a key decarbonisation lever. Digital models simulate blended cement performance, enabling optimisation of SCM proportions while maintaining strength and durability requirements.

Challenges and strategies for digital adoption

Key challenges in Indian cement plants include data quality limitations due to legacy instrumentation, resistance to algorithm-based decision-making, integration complexity across multiple OEM systems, and site-specific variability in raw materials and fuels.

Successful digital transformation requires strengthening the data foundation, prioritising high-impact use cases such as kiln APC and energy optimisation, adopting a human-in-the-loop approach, and deploying modular, scalable digital platforms with cybersecurity by design.

Future Outlook

Future digital cement plants will evolve toward autonomous optimisation, real-time carbon intensity tracking, and integration with emerging decarbonisation technologies such as carbon capture, utilisation and storage (CCUS). Digital platforms will also support ESG reporting and regulatory compliance.

Digital pathways offer a practical and scalable solution for sustainable cement manufacturing in India. By optimising energy consumption, enabling higher AFR substitution and improving resource efficiency, digital technologies deliver measurable environmental and economic benefits. With appropriate data infrastructure, organisational alignment and phased implementation, digital transformation will remain central to the Indian cement industry’s low-carbon transition.

About the author:

Dr Y Chandri Naidu is a cement industry professional with 30+ years of experience in process optimisation, quality control and quality assistance, energy conservation and sustainable manufacturing, across leading organisations including NCB, Ramco, Prism, Ultratech, HIL, NCL and Vedanta. He is known for guiding teams, developing innovative plant solutions and promoting environmentally responsible cement production. He is also passionate about mentoring professionals and advancing durable, resource efficient technologies for future of construction materials.

Merlin Prime Spaces Acquires 13,185 Sq M Land Parcel In Pune

Adani Cement and Naredco Partner to Promote Sustainable Construction

Operational Excellence Redefined!

World Cement Association Annual Conference 2026 in Bangkok

Assam Chief Minister Opens Star Cement Plant In Cachar

Merlin Prime Spaces Acquires 13,185 Sq M Land Parcel In Pune

Adani Cement and Naredco Partner to Promote Sustainable Construction

Operational Excellence Redefined!

World Cement Association Annual Conference 2026 in Bangkok

Assam Chief Minister Opens Star Cement Plant In Cachar

Trending News

-

Economy & Market4 weeks ago

Economy & Market4 weeks agoFORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

-

Concrete2 weeks ago

Concrete2 weeks agoRefractory demands in our kiln have changed

-

Concrete2 weeks ago

Concrete2 weeks agoDigital supply chain visibility is critical

-

Concrete2 weeks ago

Concrete2 weeks agoOur strategy is to establish reliable local partnerships