Environment

The Indian roadmap looks at the reduction potential from waste heat recovery

Published

4 years agoon

By

admin

Philip Fonta, Managing Director, World Business Council for Sustainable Development (WBCSD)

The launch of low carbon technology roadmap has opened new avenues for the Indian cement manufacturers in their quest for improving energy efficiency and bringing down the carbon footprint. In an exclusive interview with ICR, Philip Fonda, Managing Director, (WBCSD) throws light on the key features, and the various stakeholders need to focus for the road map to be successful in India.

Kindly brief us on what led to the launch of the ‘Technology Roadmap’ for the Indian cement industry?

Following the global roadmap in 2009, the Cement Sustainability Initiative (CSI), especially its members in India (CSI member companies in India represent around 60 per cent of the country’s cement production) decided the Indian cement industry needs a version that is more specific to the local context, i.e. taking into consideration the hot climate for concrete use, intermittent energy supplies for manufacture, huge urbanisation rates, growing market share in the global market (India being already the second largest cement producing country worldwide), notable policy barriers to implementation, potentially inferior quality of raw materials, high energy efficiency rates, and more. Like the global roadmap, this is a project in partnership with the International Energy Agency (IEA) and the 11 CSI members who operate in India1. The International Finance Corporation (IFC) funded 50 per cent of the project and provided some technical input, emphasising the need for the Roadmap’s second phase, through which some companies of CSI in India will implement some of the identified technologies directly on some of their plants to confirm the expected benefits.

The Confederation of Indian Industry (CII) Green Business Centre (a Regional Network partner of the World Business Council for Sustainable Development) was a technical consultant, as was the formerly-Govt-funded research institution the National Council for Cement and Building Materials (NCB).

The national Cement Manufacturers’ Association (CMA) validated the project (e.g. data used) to ensure it was representative of the whole industry, not just the CSI – this is an important point for engagement of the industry more widely and from India government.

How do you assess the growth potential of the Indian cement industry?

The Indian cement industry has achieved an installed capacity of around 300 million tonne (mt) (2011) and is anticipated to reach 320 mt by 2012 and 600 mt by 2020. Looking into the vision for deployment to 2050, the growth in domestic cement demand is expected to remain strong, rising to between 465 kg/capita and 810 kg/capita in 2050. Annual cement production is estimated to reach between 780 million tonne and 1360 million tonne by 2050. India’s population is set to increase by almost 40 per cent between 2010 and 2050. Over the same period, the rapid urbanisation seen recently is expected to accelerate and gross domestic product (GDP) is expected to boost significantly. These trends will drive up demand for concrete (which cement is the main ingredient of) in the building sector. The other main driver of this growth is the expected large-scale infrastructure development such as ports on the western coast, dams in the northern mountainous regions, and airports in the growing metropolitan areas. Climate change adaptation and mitigation measures are also expected to increase concrete use in India.

What are major objectives of the Technology Roadmap and what are the key messages it tries to deliver?

The "Technology Roadmap: Low-Carbon Technology for the Indian Cement Industry" document is accompanied by a set of technical papers called "Existing and Potential Technologies for Carbon Emissions Reductions in the Indian Cement Industry". Based on a solid technical foundation and wide stakeholder consultation, the roadmap outlines a practicable and achievable low-carbon growth pathway for the Indian cement industry that could lead to carbon intensity reductions of 45 per cent by 2050. The technical papers provide a detailed outline of 27 technologies which already exist or are more futuristic, and have the potential to reduce emissions. The document explains the technical characteristics, the cost, the emissions potential, the barriers to implementation etc for each technology.

The roadmap itself is built on these technical papers, as well as incorporating the modelling done by IEA using energy and emissions data from 65 per cent of the Indian industry (mostly from the CSI’s Getting the Numbers Right (GNR) database). Input from stakeholder discussions on policy barriers to technology implementation and on financing are also included. Key messages:

• Cement production in India is set to increase 3.6 – 6.3 fold before 2050.

• Energy consumption will in turn grow between 2.8 and 5 fold.

• If the roadmap technologies are implemented, up to 212 million tonne CO2 could be saved by 2050.

• Varied policy barriers exist at national, state and local levels which impede implementation – the roadmap provides specific recommendations for different government agencies.

• Additional investments of $ 29 billion would be required for the low-carbon growth pathway in the Indian cement industry outlined in the roadmap.

• About half these additional investments would be required for the application of carbon capture and storage (CCS) (which is not seen as a viable solution for/by India).

How does it differ from the global technology roadmap?

The global technology roadmap in 2009 is widely used by industry and other stakeholders. The technical papers in particular are used by cement companies when they assess energy efficiency improvements or technology changes in their production processes. Having said that, it is important to note that the 2009 roadmap is not directly linked to implementation, but rather a reference document. So the "Technology Roadmap: Low-Carbon Technology for the Indian Cement Industry", followed by the implementation phase is really the first one to consider introducing in the cement production some of the technologies identified in the theoretical roadmap exercise. By doing this, the cement sector in India demonstrates its leadership in reducing or mitigating energy consumption and associated CO2 emissions from the manufacture of cement.

What are the recommendations of the technology roadmap to encourage investment to achieve the objectives?

It is estimated that additional investments of $ 29 billion would be required for the low-carbon growth pathway in the Indian cement industry outlined in the roadmap. To encourage investment and financial support, this roadmap recommends:

• New mechanisms emerging from the climate negotiations, such as new market mechanisms and climate finance, combined with India’s PAT scheme ESCerts or REC scheme could allow for financing of CO2 reduction options in the cement industry. The industry should be actively engaged in the development of international mechanisms to ensure the creation of a viable funding path for low-carbon investment.

• Low-cost financing or blended financing (a blend of commercial and concessional finance) to make low-carbon initiatives financially viable, including mechanisms to support higher costs of retrofits.

• Raising awareness in India of existing funding mechanisms; for example, the World Bank’s energy efficiency funds, IFC blended financing options, and BEE’s energy efficiency incentivisation schemes.

• Continuing and improving of the CDM to simplify procedures and reduce transaction costs, thereby facilitating the funding of energy efficiency, alternative fuel use, clinker substitution projects, and the adoption of CCS in the cement industry.

• Allocating of international and national funding sources for the demonstration of a CO2 capture project.

• Funding of research institutes to advance demonstration projects for algal growth.

More than 50 per cent of the additional investments will be required for carbon capture. CCS development and demonstration will require support from the international community as the domestic industry cannot bear these costs alone. Post-combustion capture technology could double the investment needs of a cement plant. Traditional financing criteria used by industry are not appropriate for CCS unless a global carbon price (or incentive) is sufficiently high to correctly value the cost of mitigating CO2 emissions. Unlike energy efficiency technologies that show a return on investment through reduced fuels costs, carbon capture technologies result in higher operating costs. Funding for CCS demonstration in cement is urgently needed.

What support do you expect from the government on the policy level?

Companies need to manage natural (and social) capital via their operations, supply chains and investments – while Governments need to provide the policies and frameworks which make this possible, practical and scalable. Successful achievement of the energy efficiency improvements and emissions reduction goals outlined in the roadmap will require a well-designed and supportive policy framework. Headlines for key policy support needed are:

• Encourage and facilitate increased alternative fuel use

• Promote the adoption of best available technologies for new and retrofit kilns

• Encourage and facilitate increased clinker substitution

• Facilitate the development of CCS and biofuels production and use by the cement industry

• Encourage policies for predictable, objective and stable CO2 constraints and energy frameworks on an international level

• Enhance research and development capabilities, skills, expertise and innovation.

• Encourage international collaboration and public-private partnerships

In addition, a favourable public policy framework, can in turn further promote wider adoption of proactive initiative by business. CSI acknowledges that the main contacts with the Indian policy-makers will be managed by the various cement companies in India and through CMA, the CSI remains in support of this regular dialogue if so need to be.

Brief us on the materials that could be used as clinker substitution?

Substitution of clinker with alternative materials containing mineral components (gypsum, pozzolana, limestone, fly ash and slag) also contributes to reducing CO2 emissions from cement production (as the clinker production is the most energy-intensive of the cement manufacturing process), and these materials can add important properties to produce different types of blended cements. Increasingly, cement producers are using these alternative raw materials to reduce the amount of clinker required for a given batch of cement. In such cases, the end product is called "blended cementö; it can be customised to provide characteristics needed for the end-use. For example, all cement types contain around 4-5 per cent gypsum to control the setting time of the product. Hence, the proportion of theses raw materials varies according to circumstances and product properties required. If you look at the data presented at the CSI’s GNR database on volumes of mineral components (MIC) used to produce Portland and blended cements, you can track the amounts of mineral components used directly in cement, for India, globally and for other regions.

How is the roadmap for India as compared to the one launched in 2009?

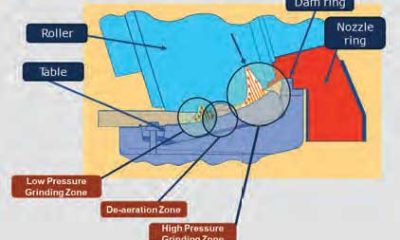

The India roadmap was developed along the same model as the global one which was the first report of its kind to provide an ambitious vision for carbon emissions reduction for one industry sector as a whole, up to 2050. In addition to the CO2 emission reduction levers identified in the global roadmap, the India roadmap also looks at the reduction potential from waste heat recovery technology and dedicates a chapter to captive power plants. (The latter are not part of the core cement manufacturing process and hence not included in the data modelling.)

What is the current energy consumption and CO2 emission of the Indian Cement Industry?

In 2010, the India cement industry’s share of the country’s total energy and process CO2 emissions was around 7 per cent. If current trajectories were to continue without intervention, by 2050, emissions from cement manufacture in India would reach between 488 million tonne CO2 and 835 million tonne CO2 a 255-510 per cent increase compared to today’s level.

This roadmap aims to identify technologies (especially those with particular relevance to India), supportive policy frameworks and investment needs that could lead to direct emissions reduction of about 0.28 tonne CO2 per tonne cement produced û i.e. from 0.63 tonne CO2 per tonne cement in 2010 to 0.35 tonne CO2 per tonne cement in 2050.

Such a reduction in emission intensity would limit the growth in CO2 emissions from the cement industry to between 100 and 240 per cent compared to the current level.

When you say a low carbon technology, what is the technology used in this roadmap?

The Indian cement industry’s efforts to reduce its carbon footprint by adopting the best available technologies and environmental practices are reflected in the achievement of reducing total CO2 emissions to an industrial average of 0.719 tonne CO2 per tonne cement in 2010 from a substantially higher level of 1.12 tonne CO2 per tonne cement in 1996. Yet opportunity for improvement exists, particularly in relation to five key levers that can contribute to emissions reduction:

• Alternative fuel and raw materials (AFR)

• Thermal and electrical energy efficiency and Clinker substitution;

• Waste heat recovery (WHR);

• Newer technologies.

Which are the areas where further improvements in energy efficiency is possible?

The Indian roadmap outlines a low-carbon growth pathway for the Indian cement industry that could lead to carbon intensity reductions of 45 per cent by 2050.

It proposes that these reductions could come from increased clinker substitution and alternative fuel use; further improvements to energy efficiency, and the development & widespread implementation of newer technologies. The vision laid out in the roadmap is ambitious but achievable. Wide stakeholder consultation took place throughout the process to bring in varied perspectives, and to reiterate that decisive action by all stakeholders is critical to realize the vision laid out in the roadmap. To achieve the proposed levels of efficiency improvements and emissions reduction, government and industry must join hands to take decisive and collaborative actions in creating an investment climate that will stimulate the scale-up of financing required.

What is the current framework for the Indian Cement industry and highlight the changes suggested?

We plan to take many actions but below mentioned are the key ones that will be taken in the next ten years:

• Decisive action by all stakeholders is critical to realise the vision laid out in this roadmap. To achieve the envisioned levels of efficiency improvements and emissions reduction, government and industry must take collaborative action. An investment climate that will stimulate the scale of financing required must be created. In particular:

• All stakeholders in India should intensify national and international collaboration to drive implementation of BAT and existing know-how, and to share experience and knowledge. The Indian cement industry should deploy existing state-of-the-art technologies in new cement plants and retrofit existing plants with energy efficient equipment when commercially viable.

• At the cement plant level across the country, assessments should be performed to analyse how low-carbon technologies can be implemented, and action plans developed to increase the speed and scale of implementation. CSI member companies in India have started this targeted work as an immediate follow-up from the India roadmap project.

• The Government of India needs to ensure strong regulations and standards are in place to enable increased use of clinker substitutes, and should support allocation of good quality linkage coal to the cement industry so low-grade limestone reserves can be used and the cement industry can consume surplus fly ash from coal-based power generation units.

• Waste legislation is also required to support the use of alternative fuels and raw materials (AFR) in cement kilns. Emissions monitoring must be regulated.

• Public and market barriers that currently impede co-processing (e.g. for hazardous waste) and AFR use in India must be addressed through modified regulation, awareness-raising campaigns and industry training. Awareness-raising and education is also required to ensure acceptance of blended cement by the Indian market and widespread dissemination.

• Expand public awareness campaigns; international collaboration and financing for demonstration of carbon capture and carbon use at cement plants. Develop near-term approaches to facilitate carbon capture and use demonstration.

• Globally, elaborate approaches to facilitate carbon capture and storage (CCS) demonstration and establish the technical and commercial viability of CCS. For new and alternative technologies, such as nanotechnology and geopolymer cement, government should ensure sustained funding and support mechanisms are in place nationally and internationally to support their development and deployment to offer potential for CO2 emissions reduction Provide a major thrust in R&D to move through pilot to demonstration phases to widespread deployment. For existing technologies, Government of India must develop policy and fiscal incentives.

Regulatory frameworks must also support greater financial viability of WHR power generation, including providing WHR with renewable energy status and providing associated incentives.

You may like

-

Double Tap to Go Green

-

15th Cement EXPO to be held in March 2025 in Hyderabad

-

14th Cement EXPO

-

Vinita Singhania receives Lifetime Achievement Award at the 7th Indian Cement Review Awards

-

Increasing Use of Supplementary Cementitious Materials

-

Indian Cement Review Touts Decarbonisation Mantra & Awards Growth

Concrete

We engineer smarter systems to reduce waste

Published

3 months agoon

December 12, 2025By

admin

Naveen Kumar Sharma, AVP – Sales and Marketing, Toshniwal Industries, talks about redefining instrumentation with customised, digitally enabled solutions engineered for harsh plant environments.

For over six decades, Toshniwal Industries has played a pioneering role in advancing process instrumentation for Indian manufacturing. In this exclusive conversation with Kanika Mathur, Naveen Kumar Sharma, AVP – Sales & Marketing, explains how the company designs kiln and grinding plant solutions tailored to the unique demands of the cement industry. As plants transition to higher AFR use and smarter automation, Toshniwal’s technologies offer greater reliability, accuracy and predictive insight.

Tell us how are your process instruments and condition monitoring system customised for cement kilns and grinding plant operations?

Toshniwal is a company with a legacy of over 65 years, and our experience has taught us that cement kilns and grinding units are fundamentally different in their operational demands. As an Indian company, we understand the unique requirements of Indian cement manufacturers. We work closely with our customers, engage deeply with their technical teams, and study operational challenges in real-time.

Based on these insights, we customise our solutions for both kiln and grinding applications. This tailoring is not just at a product level, but at a solution level—engineering design, instrumentation logic, and process optimisation. Our primary objective, for both the industry and our customers, is to reduce yield loss. Every customisation we implement is driven by this goal. We engineer smarter systems to reduce waste, improve consistency and increase plant reliability.

Ultimately, our solutions are built on an understanding that cement manufacturers require robust, practical and maintainable instruments. We design with this mindset so plants can operate more efficiently, with better control and higher profitability.

With the rising use of AFR, how do your solutions support thermal zone reliability and process time?

Our solutions are built around four core parameters: energy efficiency, yield loss reduction, product quality and environmental responsibility. These pillars drive our engineering decisions and define how our technologies support cement plants, especially as they adopt alternative fuels and raw materials (AFR).

We strongly believe in energy conservation. Every product we offer—whether for thermal monitoring, kiln control or flame optimisation—is engineered to improve energy performance. Reducing yield loss is another principle deeply embedded in our solutions, because production interruptions and material losses directly affect plant profitability and clinker quality.

We are also highly conscious of the end-product quality delivered by our customers to their markets. Consistency in burning, heat transfer, and thermal profiling directly influences clinker characteristics, and our instruments help maintain this stability.

Lastly, and most importantly, we care about the environment. We want to leave a greener world for the next generation. This mindset aligns with India’s digitalisation movement, advocated by our Prime Minister. Digital technologies are crucial for optimising AFR use, process stability, emissions and kiln efficiency. We are proud to contribute to this transition.

By optimising flame patterns, energy use, and pollution, our solutions deliver direct and indirect savings. Plants benefit from lower operational losses, reduced maintenance, and improved reliability, especially in pyroprocessing zones.

Tell us how do you address harsh environment challenges in cement plants, say dust, temperature, etc. with your sensor and monitoring?

This is a very important question because cement plants, steel plants, and power plants operate in extremely harsh environments. There are two major categories of specifications that we must respect while designing solutions: technical specifications and environmental specifications. Technical specifications relate to performance accuracy, measurement integrity, responsiveness and process safety. Environmental specifications, on the other hand, relate to high temperatures, heavy dust, humidity, vibrations and corrosive atmospheres. Our solutions are engineered to withstand both. We customise sensors, housings, mounting mechanisms and protective systems so that our instruments operate at 100 per cent functionality in harsh conditions. We ensure that the plant experiences minimal downtime from our systems. That is our engineering philosophy—solutions must work reliably in real-world environments, not just in ideal laboratory conditions.

What retrofit pathways do you offer for older cement lines to upgrade measurement and monitoring systems and how is the Indian market responding?

Every solution we provide is scalable and digitally adaptable. Technology evolves rapidly, and our offerings evolve with it. When we upgrade instruments or monitoring systems, we design them to integrate with existing plant infrastructure, so customers do not have to rebuild everything from scratch. Once our solution is installed, software upgrades or performance improvements can often be deployed without major cost. This ensures that customers continue to benefit from ongoing technological advancements. The Indian market has responded positively to this approach. Plant operators appreciate solutions that are future-ready and dynamic rather than static. Scalability helps them maintain competitiveness, extend asset life, and move toward smart manufacturing with confidence.

So how is your organisation leveraging digital technologies in your instrumentation portfolio for cement plants?

Digitalisation is at the core of every product we manufacture. We stand firmly behind the digital movement, not only because it represents efficiency, but because it is the direction in which the Indian industrial ecosystem is evolving. We deploy machine-vision technologies, advanced inline monitoring systems, and solutions capable of visualising the

inside of the furnace. These systems help reduce downtime, enable predictive asset management and provide actionable analytics to customers. All our technologies communicate seamlessly with Level 1, Level 2, and Level 3 automation. This allows integration across SCADA, DCS, ERP, and cloud ecosystems. Digitalisation for us is not an add-on—it is foundational to how our instrumentation is built.

What are your key innovation priorities to help Indian cement plant producers hit harder, higher substitution rates, lower emissions and smarter processing?

Sustainability is a national priority, and we are committed to supporting it. Our current portfolio already helps improve efficiency, reduce emissions, and support alternative fuel integration. But our innovation roadmap goes further. We are now developing specialised productivity-oriented software modules that will provide proactive alerts—not just alarms triggered after a fault has occurred. These modules will leverage artificial intelligence and machine learning to detect patterns early. The intention is to help plant teams take corrective actions ahead of time, reducing yield loss and environmental impact. Instead of informing the plant that a disruption has happened, the system will indicate that a disruption will happen, giving operators time to prevent it. We believe that within the next 12 to 18 months, we will launch these predictive solutions in combination with our instrumentation. When implemented, they will significantly improve decision-making, process stability and environmental performance across the Indian cement sector.

– Kanika Mathur

Concrete

India donates 225t of cement for Myanmar earthquake relief

Published

9 months agoon

June 17, 2025By

admin

On 23 May 2025, the Indian Navy ship UMS Myitkyina arrived at Thilawa (MITT) port carrying 225 tonnes of cement provided by the Indian government to aid post-earthquake rebuilding efforts in Myanmar. As reported by the Global Light of Myanmar, a formal handover of 4500 50kg cement bags took place that afternoon. The Yangon Region authorities managed the loading of the cement onto trucks for distribution to the earthquake-affected zones.

Concrete

Reclamation of Used Oil for a Greener Future

Published

9 months agoon

June 16, 2025By

admin

In this insightful article, KB Mathur, Founder and Director, Global Technical Services, explores how reclaiming used lubricants through advanced filtration and on-site testing can drive cost savings, enhance productivity, and support a greener industrial future. Read on to discover how oil regeneration is revolutionising sustainability in cement and core industries.

The core principle of the circular economy is to redefine the life cycle of materials and products. Unlike traditional linear models where waste from industrial production is dumped/discarded into the environment causing immense harm to the environment;the circular model seeks to keep materials literally in continuous circulation. This is achievedthrough processes cycle of reduction, regeneration, validating (testing) and reuse. Product once

validated as fit, this model ensures that products and materials are reintroduced into the production system, minimising waste. The result? Cleaner and greener manufacturing that fosters a more sustainable planet for future generations.

The current landscape of lubricants

Modern lubricants, typically derived from refined hydrocarbons, made from highly refined petroleum base stocks from crude oil. These play a critical role in maintaining the performance of machinery by reducing friction, enabling smooth operation, preventing damage and wear. However, most of these lubricants; derived from finite petroleum resources pose an environmental challenge once used and disposed of. As industries become increasingly conscious of their environmental impact, the paramount importance or focus is shifting towards reducing the carbon footprint and maximising the lifespan of lubricants; not just for environmental reasons but also to optimise operational costs.

During operations, lubricants often lose their efficacy and performance due to contamination and depletion of additives. When these oils reach their rejection limits (as they will now offer poor or bad lubrication) determined through laboratory testing, they are typically discarded contributing to environmental contamination and pollution.

But here lies an opportunity: Used lubricants can be regenerated and recharged, restoring them to their original performance level. This not only mitigates environmental pollution but also supports a circular economy by reducing waste and conserving resources.

Circular economy in lubricants

In the world of industrial machinery, lubricating oils while essential; are often misunderstood in terms of their life cycle. When oils are used in machinery, they don’t simply ‘DIE’. Instead, they become contaminated with moisture (water) and solid contaminants like dust, dirt, and wear debris. These contaminants degrade the oil’s effectiveness but do not render it completely unusable. Used lubricants can be regenerated via advanced filtration processes/systems and recharged with the use of performance enhancing additives hence restoring them. These oils are brought back to ‘As-New’ levels. This new fresher lubricating oil is formulated to carry out its specific job providing heightened lubrication and reliable performance of the assets with a view of improved machine condition. Hence, contributing to not just cost savings but leading to magnified productivity, and diminished environmental stress.

Save oil, save environment

At Global Technical Services (GTS), we specialise in the regeneration of hydraulic oils and gear oils used in plant operations. While we don’t recommend the regeneration of engine oils due to the complexity of contaminants and additives, our process ensures the continued utility of oils in other applications, offering both cost-saving and environmental benefits.

Regeneration process

Our regeneration plant employs state-of-the-art advanced contamination removal systems including fine and depth filters designed to remove dirt, wear particles, sludge, varnish, and water. Once contaminants are removed, the oil undergoes comprehensive testing to assess its physico-chemical properties and contamination levels. The test results indicate the status of the regenerated oil as compared to the fresh oil.

Depending upon the status the oil is further supplemented with high performance additives to bring it back to the desired specifications, under the guidance of an experienced lubrication technologist.

Contamination Removal ? Testing ? Additive Addition

(to be determined after testing in oil test laboratory)

The steps involved in this process are as follows:

1. Contamination removal: Using advanced filtration techniques to remove contaminants.

2. Testing: Assessing the oil’s properties to determine if it meets the required performance standards.

3. Additive addition: Based on testing results, performance-enhancing additives are added to restore the oil’s original characteristics.

On-site oil testing laboratories

The used oil from the machine passes through 5th generation fine filtration to be reclaimed as ‘New Oil’ and fit to use as per stringent industry standards.

To effectively implement circular economy principles in oil reclamation from used oil, establishing an on-site oil testing laboratory is crucial at any large plants or sites. Scientific testing methods ensure that regenerated oil meets the specifications required for optimal machine performance, making it suitable for reuse as ‘New Oil’ (within specified tolerances). Hence, it can be reused safely by reintroducing it in the machines.

The key parameters to be tested for regenerated hydraulic, gear and transmission oils (except Engine oils) include both physical and chemical characteristics of the lubricant:

- Kinematic Viscosity

- Flash Point

- Total Acid Number

- Moisture / Water Content

- Oil Cleanliness

- Elemental Analysis (Particulates, Additives and Contaminants)

- Insoluble

The presence of an on-site laboratory is essential for making quick decisions; ensuring that test reports are available within 36 to 48 hours and this prevents potential mechanical issues/ failures from arising due to poor lubrication. This symbiotic and cyclic process helps not only reduce waste and conserve oil, but also contributes in achieving cost savings and playing a big role in green economy.

Conclusion

The future of industrial operations depends on sustainability, and reclaiming used lubricating oils plays a critical role in this transformation. Through 5th Generation Filtration processes, lubricants can be regenerated and restored to their original levels, contributing to both environmental preservation and economic efficiency.

What would happen if we didn’t recycle our lubricants? Let’s review the quadruple impacts as mentioned below:

1. Oil Conservation and Environmental Impact: Used lubricating oils after usage are normally burnt or sold to a vendor which can be misused leading to pollution. Regenerating oils rather than discarding prevents unnecessary waste and reduces the environmental footprint of the industry. It helps save invaluable resources, aligning with the principles of sustainability and the circular economy. All lubricating oils (except engine oils) can be regenerated and brought to the level of ‘As New Oils’.

2. Cost Reduction Impact: By extending the life of lubricants, industries can significantly cut down on operating costs associated with frequent oil changes, leading to considerable savings over time. Lubricating oils are expensive and saving of lubricants by the process of regeneration will overall be a game changer and highly economical to the core industries.

3. Timely Decisions Impact: Having an oil testing laboratory at site is of prime importance for getting test reports within 36 to 48 hours enabling quick decisions in critical matters that may

lead to complete shutdown of the invaluable asset/equipment.

4. Green Economy Impact: Oil Regeneration is a fundamental part of the green economy. Supporting industries in their efforts to reduce waste, conserve resources, and minimise pollution is ‘The Need of Our Times’.

About the author:

KB Mathur, Founder & Director, Global Technical Services, is a seasoned mechanical engineer with 56 years of experience in India’s oil industry and industrial reliability. He pioneered ‘Total Lubrication Management’ and has been serving the mining and cement sectors since 1999.

World Cement Association Annual Conference 2026 in Bangkok

Assam Chief Minister Opens Star Cement Plant In Cachar

Adani Cement, NAREDCO Form Strategic Alliance

Walplast’s GypEx Range Secures GreenPro Certification

Smart Pumping for Rock Blasting

World Cement Association Annual Conference 2026 in Bangkok

Assam Chief Minister Opens Star Cement Plant In Cachar

Adani Cement, NAREDCO Form Strategic Alliance

Walplast’s GypEx Range Secures GreenPro Certification

Smart Pumping for Rock Blasting

Trending News

-

Economy & Market4 weeks ago

Economy & Market4 weeks agoBudget 2026–27 infra thrust and CCUS outlay to lift cement sector outlook

-

Economy & Market4 weeks ago

Economy & Market4 weeks agoFORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

-

Concrete1 month ago

Concrete1 month agoSteel: Shielded or Strengthened?

-

Concrete2 weeks ago

Concrete2 weeks agoRefractory demands in our kiln have changed