Economy & Market

On the Path of Transformation

Published

8 years agoon

By

admin

The logistics sector is fundamental to the development of a country. Logistics is a sector where the trend is determined by the country’s overall economic performance.

Logistics including transportation, inventory management, warehousing, materials handling and packaging, and integration of information, is related to management of flow of goods between the point of origin and the point of consumption. With the growing Indian economy and changing business perspectives, the scope of the logistics industry has broadened from rudimentary transportation of goods to include end-to-end supply chain solutions including warehousing and express delivery.

The Indian logistics industry was estimated to be approximately $160 billion in FY17. The key segments include road, rail, coastal, warehousing, cold chain and container freight stations and inland container depots (CFS/ICD). The domestic logistics market is expected to grow at a CAGR of approximately 10 per cent. Indian logistics market is expected to be driven by the growth in the manufacturing, retail, FMCG and e-commerce sectors.

Development of logistics-related infrastructure such as dedicated freight corridors, logistics parks, free trade warehousing zones, and container freight stations are expected to improve efficiency. The industry is dominated by transportation, which accounts for over 85 per cent of total value, and its share is expected to remain high over the next few years. The sector provides employment to more than 22 million people. Improving logistics sector has significant bearing on exports and media sources estimate that a 10 per cent decrease in indirect logistics cost could potentially increase 5 to 8 per cent of exports.

Of the various modes of transportation, roads and railway are the most preferred mode accounting for approximately 60 per cent and 30 per cent of the total cargo volumes handled, respectively. The share of other transportation modes comprising Inland shipping, pipelines and airways remains minimal accounting for the balance 10 per cent. The higher transportation costs in India can be associated with poor road infrastructure leading to lowering of the maximum distance that can be covered by any commercial vehicle, old vehicles fleet and higher cess and toll on the highways while the higher warehousing costs are on account of shortage of warehousing capacity in India, non-standardisation of warehouses in terms of IT application, etc.

As per the Ministry of Road Transport and Highways, India’s logistics cost as a per cent of GDP stood at 13-14 per cent compared to 10- 11 per cent for BRIC countries and 8-9 per cent for developed countries. The US spends 9.5 per cent and Germany 8 per cent of their GDP on logistics costs. A significant proportion of the higher cost can be attributed to the absence of an efficient intermodal and multimodal transport systems. Going forward, the logistics cost as a per cent of GDP for India is expected to decline driven by initiatives such as implementation of GST, investments towards road infrastructure, development of inland waterways and coastal shipping, thrust towards dedicated freight corridors, etc.

Currently the Indian logistics industry is highly fragmented and unorganised. Owing to the presence of numerous unorganised players in the industry, it remains fragmented with the organised players accounting for approximately 10 per cent of the total market share. With the consumer base of the sector encompassing a wide range of industries including retail, automobile, telecom, heavy industries, etc., logistics industry has been increasingly attracting investments in the last decade.

The sector is facing challenges such as under-developed material handling infrastructure, fragmented warehousing, multiple regulatory/policymaking bodies, lack of seamless movement of goods across modes, minimal integrated IT infrastructure. In order to develop this sector focus on new technology, improved investment, skilling, removing bottlenecks, improving intermodal transportation, automation, single-window system for giving clearances, and simplifying processes would be required.

Global scenario

Warehousing primarily refers to the storage of goods to be transported, whether inbound or outbound. The warehousing industry includes establishments operating warehousing and storage facilities for general merchandise, refrigerated goods and other warehouse products. Warehouses are one of the major segments of the rapidly growing logistics industry. Currently the segment has evolved from providing not only custody for goods but also offering value added services such as sorting, packing, blending and processing. With evolution of an organised retail sector modern warehouses for the storage of perishable goods have become indispensable In 2017, the global warehousing and storage market was estimated to be around $475 billion. The global warehousing and storage accounted for approximately 8 per cent of the overall logistics market in 2017. The warehousing and storage market was the fifth largest market in the global logistics market in 2017. North America is the largest geographic region accounting for nearly 28 per cent of the global market.

Globally, warehousing has moved ahead from single storey to multi-story warehouses in densely populated cities and expensive land spaces. A multi-story warehouse consists of more than one floor and is designed to increase the available floor space. It results in better land utilisation rate and enhances operational efficiency. Multi-story warehouses have been successful in densely populated cities predominantly in Asian countries such as China, Japan, Hong Kong and Singapore, due to high land and construction costs, small site areas and limited industrial land availability.

Domestic scenario

The warehousing market in India is highly fragmented with most warehouses having an area of less than 10,000 sq.ft. Approximately 90 per cent of the warehousing space in the country is controlled by unorganised players with smaller sized warehouses which have limited mechanisation. Fragmented warehousing footprint results in higher average inventory holding, in addition to resulting in higher storage and handling losses, driven by lower level of mechanisation.

Warehouses have become one of the major segments of the rapidly growing Indian logistics industry. Today they do not only provide custody for goods but also offer value added services such as sorting, packing, blending and processing. With evolution of an organised retail sector modern warehouses for the storage of perishable goods have become essential. The government’s initiatives to promote the growth of warehouses in the country through measures such as enactment of the Warehousing Act, 2007, investments in the establishment of logistic parks and Free trade warehouse zones (FTWZs) together with the introduction of Goods & Service Tax (GST) regime augurs well for the industry’s growth. Sensing the tremendous growth potential of the warehouse sector, the private players (including both domestic and international) have ventured with a view to bridge the gap between cost and efficiency of operations.

Nearly 60 per cent of the modern warehousing capacity in India is concentrated in the top six cities namely Ahmedabad, Bangalore, Chennai, Mumbai, NCR and Pune, with Hyderabad and Kolkata being the other major markets. This is driven by concentration of industrial activity and presence of sizeable urban population around these clusters. Going forward, due to factors like quality of infrastructure and availability of labour, these advantages are likely to remain with these cities. In all the segments of warehousing industry barring the agricultural segment, the majority of the capacity is controlled by the private sector. In the agricultural segment, approximately three-fourth is controlled by different government entities. The primary objective of a majority of these warehouses is to only store food grains and ensure food security.

Types of warehouses

Traditionally, warehouses were broadly classified into public-private, bonded, government and co-operative warehouses. Lately, cold chains, container freight stations (CFS) and inland container depots (ICD) are gaining importance.

Private warehouses: These warehouses are owned by private entities or individuals and are used exclusively for the goods owned, imported by or on behalf of the licensee. The warehouses are usually constructed at strategic locations to cater various manufacturing, business and service units. They are flexible enough to be customised in terms of storage and placement, according to the nature of the products.

Public warehouses: These Warehouses are licensed by the government to private entities, individual or cooperative societies to store goods of the general public. They are rented out against a fee and usually set up at transportation points of railways, highways and waterways, providing the facilities of receipt, dispatch, loading and unloading of goods. The government also regulates the functions and operations of these warehouses used mostly by manufacturers, wholesalers, exporters, importers, government agencies, etc.

Bonded warehouses: These warehouses are licenced by the Government to accept imported goods for storage until the payment of customs duty. They are located near the ports. They are either operated by the Government or work under the control of customs authorities. The warehouse is required to give an undertaking or "Bond" that it will not allow the goods to be removed without the consent of the custom authorities. The goods are held in bond and cannot be withdrawn without paying the customs duty. Such warehouses are very helpful to importers and exporters. If an importer is unable to pay customs duty immediately after the arrival of goods he can store the goods in a bonded warehouse. He can withdraw the goods in instalments by paying the customs duty proportionately. Goods lying in a bonded warehouse can be packaged, graded and branded for the purpose of sale.

Container freight stations (CFS)/inland container depots (ICDs): CFSs/ICDs are custom-bonded facility with public authority status for the handling and storage for containers. These depots equipped with warehousing space, adequate handling equipment and IT infrastructure.

Cold storage: A cold storage is a temperature controlled storage space catering mainly to agriculture and food industries. Cold stores are used for the storage and distribution of perishable goods such as fruits and vegetables, dairy products; frozen foods such as meat and ice cream, and temperature-sensitive pharmaceutical products. Given that India is primarily an agriculture country, cold storage has huge potential in India.

Government storage: The primary objectives of any government storage are 1) to ensure food security, and 2) enable trade movement both within and out of the country. Consequently, the Central Warehousing Corporation operates 431 warehouses (storage capacity of 100.28 lakh MT) including 44 custom bonded warehouses, 29 CFSs/ICDs, 3 air cargo complexes (ACCs) (5,961 MT) and 3 cold storage warehouses (2,419 MT). Further, various State Warehousing Corporations (SWC) manage a total capacity of 283.34 MT across 1,831 warehouses. The Food Corporation of India (FCI) works for holding agricultural produce to meet the requirements of various government schemes. FCI has its own storage capacity but also hires capacities from CWC, SWCs and the private sector.

Cold storage: There are over 7,700 cold storage warehouses with a capacity of over 36 million MT in India with a significant portion of the facilities being privately owned. India’s cold storage capacity is unorganised and dominated by traditional cold storage facilities. The distribution of cold storages is highly uneven with majority of the cold storages located in Uttar Pradesh, Gujarat, Punjab and Maharashtra. Further nearly two thirds of the total cold storage capacity is used for horticulture crops including potato. Despite the storage capacity, the Central Institute of Post-Harvest Engineering and Technology estimates that close to 15 per cent-16 per cent of fruits and vegetables perish as cold storages are located near consumption centres rather than farms. The cold storage segment is driven by growth in trading of perishable products both agricultural and others (e.g. pharmaceutical).

Regulations

WDRA rules: Warehouses (especially agricultural) in India are regulated and governed under The Warehousing (Regulatory and Development) Act, 2007. The main objective of this Act is to develop and regulate warehouses, negotiability of warehouse receipts, establishment of Warehousing Development and Regulatory Authority (WRDA) and for related matters.

Registration: The act makes it compulsory for a person to carry on warehousing business as a business and issue a negotiable receipt to obtain a certificate of registration.

Warehousing receipt: The warehouse would issue receipts only after ascertaining quantity, quality / grade and other particulars as may be mentioned in the receipts.

Authority and Powers under the Act: Some of the authorities and powers conferred under the Act are granting registration and cancellation/renewal of registration, specifying qualification of warehouseman, and regulating rates, advantages, terms and conditions that may be offered by warehouseman in respect of warehousing business.

Offenses under the Act: Failing to ascertain quality and quantity, failing to surrender negotiable receipt by depositor or endorsee and payment of all his lawful charges and cancellation of encumbrances endorsed on the receipt to deliver the goods represented by the receipt are some of the offences under the act.

Penalties: The offences committed under this Act shall be punishable with imprisonment of a term of up to three years or with fine of Rs 1,00,000 or both.

The industry also remains governed by various acts such as: Multimodal Transportation of Goods Act, 1993, Foreign Trade (Development and Regulation) Act, 1992, Customs Act, 1962, Carriage of goods law etc. regulating the movement of goods and allied services. Various policy changes have impacted the warehousing sector in India. These include the introduction of the Goods and Service Tax (GST), National Policy on Handling, Storage and Transportation, and increasing Public-Private Partnerships (PPP). Following are a few such policy measures:

GST: GST has consolidated the tax regime across states which will result in cost and time efficiencies across the supply chain. GST will also hasten the consolidation of warehouses thus accentuating the formalisation of the largely unorganised warehousing sector. For most logistics services like e-commerce logistics, warehousing and air freight (export), the tax rate is 18 per cent, which is an increase from the earlier rate of 15 per cent which includes service tax and cess. Services like ocean freight and road transportation are in the 5 per cent slab. Under GST, the tax on warehouse, storage and other labour services has increased from 15 per cent to 18 per cent.

Logistics Parks Policy: Launch of multi-modal logistics parks and the grant of "industry" status to the logistics sector.

Domestic manufacturing emphasis: The focus on "Make in India" is expected to increase domestic manufacturing and increase the requirement for associated activities such as warehousing.

Agri-warehousing activity covered under Priority Sector Lending by RBI Subsidy schemes such as 1) Grameen Bhandaran Yojana – a capital investment subsidy scheme offered by the NABARD, which ranges from 15 per cent to 33 per cent of project cost, depending on the location and operator, 2) National Agricultural Renewal Fund. Govt. of India – encourage private investment in the creation of agriculture infrastructure

Tax incentives such as 1) Tax relief under 80(I)(B): tax holiday on warehousing income, 2) Investment-linked deduction under Section 35AD: 100 per cent upfront depreciation for tax purposes

The government permits 100 per cent FDI under the automatic route for all logistics services except courier and air transportation services. In case of courier services, 100 per cent FDI is permitted subject to the approval of the Foreign Investment Promotion Board (FIPB) while FDI up to 74 per cent is permitted under the automatic route for air transport services including air cargo services. Further according to media reports, the government is working on a policy to create new logistics hubs by preparing an integrated logistics plan. The new integrated logistics plan would be prepared by the logistics division in the department of commerce in consultation with various stakeholders.

Trends

Warehouse consolidation due to GST: With the advent of GST and the consequent redrawing of supply chains, there will be significant consolidation of warehouses by companies in the consumption space. A bigger warehouse in an appropriate location would be able to better serve a larger area. This will lead to development of large modern technology based warehousing operations and rapid modernisation of unorganised godowns. Smaller local developers and property owners are expected to exit the space by selling out to the large institutional developers in existing clusters.

Reduction in inventory holding costs: Further the combining of smaller warehouses into a single larger one is also expected to reduce the inventory level requirements which are expected to positively impact the companies as inventory carrying cost is a significant share of costs.

Smart warehouses: With the increase in the warehousing and storage market there has been a concurrent increase in technology usage especially in the grade A/B warehouses. These warehouses use internet of things (IOT) to track a product in the warehouse and also helps in increasing efficiency and speed across supply chains. Variety of devices such as wearables, sensors and radio frequency identification tags are used to locate the products in the warehouse. This reduces the time to deliver the product to the customer and increases accuracy.

Rise of Direct Port Delivery (DPD): DPD involves the delivery of a shipment directly from a port to the consignee instead of initially holding it at a CFS (Container Freight Station). The DPD initiative under "Ease of Doing Business" has witnessed steady growth in terms of proportion of total containers handled. At JNPT, the share of Direct Port Delivery (DPD) has increased from 5.4 per cent in April 2016 to 39.2 per cent March 2018. This is likely to have an impact on the CFS. However, shortage of space at warehouses poses a challenge to service DPD clients efficiently.

High tonnage trucks sales are expected to rise: Supply chain realignment and check post discontinuation has led to a reduction in the travel time as well as fuel costs. This has led to a demand for larger more efficient trucks as warehouses are consolidating and larger loads are required at lower number of locations. Despite the higher upfront costs, such trucks are expected to reduce overall shipment costs by carrying a larger load per trip.

Negotiable warehouse receipts

Negotiable Warehouse Receipts (NWR) issued by registered warehouses enables farmers to seek loans from banks against NWRs and enables them to extend the sales period of modestly perishable products beyond the harvesting season. Consequently, NWRs can avoid distress sale of agricultural produce by the farmers in the peak marketing season. However, NWRs have not witnessed substantial growth due to 1) low levels of registered warehouses with WDRA, 2) minimal concession from banks for loans against NWRs, 3) presence of other collateral based lending entities, which do not require registration under WDRA.

Demand drivers for logistics

Emergence of MNCs and organised retail: One of the key demand drivers for the logistics industry has been emergence of MNCs and the share of organised retail has been increasing over the years. Most of the global MNCs prefer low cost manufacturing locations connecting the consuming market at the lowest possible cost and through highly efficient supply chain.

Emergence of 3PL and 4PL: Third party logistics or 3PL is a concept where a single logistics service provider manages the entire logistics function for a company. While the Indian 3PL market is still very much in its infancy compared with other countries, it is experiencing healthy growth and attracting new companies eager to capitalise on the plentiful opportunities it offers, In fourth party logistics 4PL, logistics is controlled by a service provider that does not own the assets to carry out logistics activities but outsources to subcontractors, the 3PL. 4PLs facilitate single-point reference for all logistics needs, possess knowledge of logistics to obtain most efficient and effective solutions, have manpower resources of higher quality to supervise vendors and ensure continuous process improvements and, above, all an IT base to network customer systems.

Robust trade growth: Post liberalisation there has been significant increase in economic growth which has led to an improvement in the domestic and international trade volumes. Consequently the requirement for transportation, handling and warehousing is growing at a robust pace and is driving the demand for integrated logistics solutions.

Globalisation of manufacturing systems: IT plays a key role in transportation and logistics industry. Today technology is present in all the areas for a logistics service provider. Technology helps organised logistics companies score over the unorganised ones, and will be key to their operations going ahead given the competition

Increasing investment in logistics parks: The concept of Logistics Park has gained attention from both public as well as private players. A large number of special economic zones have also necessitated the development of logistics centre for the domestic market as well as for trade purposes

Growth in the organised retail and the food processing sector is driving growth in the cold chain storage segment in India.

Challenges

Lower Standardisation: India’s logistics industry has been adversely affected by the lower standardisation of cargo and containerisation of logistics traffic, hampering the overall speed and thus increasing cost of storage and movement.

Need for large capital and issues related to land acquisition have also tempered the growth of the sector. However, with expected increase in investment by international players, the gap in funding requirement is expected to be addressed in the near future.

The industry revenue has grown at a modest CAGR of 2.5 per cent over the FY12 – FY17 period. Concurrently, the annual revenue growth rate has varied significantly over the same period. The companies generate the largest share of their revenues from rental i.e. storage charges; other sources of earnings include income from value added services such as such as sorting, packing, blending and processing. On the other hand, the key heads of expenses include employee costs, depreciation, SG&A costs, power & fuel costs and interest costs. Over the FY12-FY17 period, EBITDA margin has moved down as well as up ranging from a low of 7.2 per cent in FY14 to a high of 11 per cent in FY16 and declining to 10.1 per cent, while PAT margin has generally remained at around 2.5 per cent-4 per cent.

Although the debt levels of the companies have trended upwards, the debt to equity has generally remained stable, on the other hand, the interest coverage having peaked in FY15, has trended marginally downwards in the next two years. The decline in credit quality in the transportation and storage sector is on account of delays in debt servicing, liquidity constraints, decline in profitability and deterioration in the capital structure.

Outlook

CARE Ratings estimates that the warehousing industry will grow at a rate of 13-15 per cent in the medium term driven by the growth in manufacturing, retail, FMCG and ecommerce sector. Growth in overall production and consumption, organised retail, logistics outsourcing, and regulatory interventions such as WRDA Act and GST, private investments in logistics and other infrastructure developments such as Dedicated Freight Corridor (DFC) have also improved prospects of the organised professional warehousing segment. Further the implementation of GST is eliminating inefficiencies arising out of the erstwhile complex tax structure as well as interstate taxes.

Additionally, the government’s decision to allow FDI in retailing with emphasis on backend infrastructure such as modern warehousing space is also expected to provide further impetus to the sector.

Industrial warehousing is expected to grow due to various factors including the anticipated increase in global demand, growth in organised retail and increasing manufacturing activities, expansion of e-commerce options and growth in international trade. This segment is expected to witness significant activity as the presence of the unorganised segment which is dominant in the segment is also expected to significantly reduce and the companies would also be rationalising and consolidating their space requirements based on time to serve the market and not taxation.

Demand for agriculture warehousing is expected to grow moderately on account of high base and expected normal monsoons.

Integrated models, diversification across end-user industries are expected to drive growth of cold chain segment. Significant demand is also seen coming from storage of fruits and vegetables, and pharmaceutical segments.

The container freight station (CFS)/ inland container depot (ICD) industry although on a growth curve is expected to be under pressure due to the growth of Direct Port Delivery (DPD) and profitability is expected to be hampered with the anticipated loss of volumes and consequential lower utilisation.

However, the overall growth potential is limited by several key challenges like limitations in infrastructure connectivity, need for large capital and issues related to land acquisition which would need to be addressed for ensuring sustainable growth.

Source: CARE Ratings’ Industry Research on Overview of the India Warehousing Industry

India’s first multi-modal terminal on inland waterways! Prime Minister Narendra Modi inaugurated India’s first multi-modal terminal on the Ganga river in his parliamentary constituency and received the country’s first container cargo transported on inland waterways from Kolkata.

This is the first of the four multi-modal terminals being constructed on the National Waterway-1 (River Ganga) as part of the World Bank-aided "Jal Marg Vikas Project" of the Inland Waterways Authority of India. The total estimated cost of the project is Rs 5,369.18 crore, which will be equally shared between the Government of India and the World Bank. Its objective is to promote inland waterways as a cheap and an environment-friendly means of transportation, especially for cargo movement. The Inland Waterways Authority of India (IWAI) is the project implementing agency. The project entails construction of three multi-modal terminals (Varanasi, Sahibganj and Haldia), two inter-modal terminals, five roll-on-roll-off (Ro-Ro) terminal pairs, new navigation lock at Farakka, West Bengal, assured depth dredging, integrated vessel repair and maintenance facility, differential global positioning system (DGPS), river information system (RIS) and river training.

Disclaimer:

This report is prepared by CARE Ratings Ltd. CARE Ratings has taken utmost care to ensure accuracy and objectivity while developing this report based on information available in public domain. However, neither the accuracy nor completeness of information contained in this report is guaranteed. CARE Ratings is not responsible for any errors or omissions in analysis/inferences/views or for results obtained from the use of information contained in this report and especially states that CARE Ratings has no financial liability whatsoever to the user of this report.

You may like

Concrete

Our strategy is to establish reliable local partnerships

Published

7 hours agoon

February 19, 2026By

admin

Jean-Jacques Bois, President, Nanolike, discusses how real-time data is reshaping cement delivery planning and fleet performance.

As cement producers look to extract efficiency gains beyond the plant gate, real-time visibility and data-driven logistics are becoming critical levers of competitiveness. In this interview with Jean-Jacques Bois, President, Nanolike, we discover how the company is helping cement brands optimise delivery planning by digitally connecting RMC silos, improving fleet utilisation and reducing overall logistics costs.

How does SiloConnect enable cement plants to optimise delivery planning and logistics in real time?

In simple terms, SiloConnect is a solution developed to help cement suppliers optimise their logistics by connecting RMC silos in real time, ensuring that the right cement is delivered at the right time and to the right location. The core objective is to provide real-time visibility of silo levels at RMC plants, allowing cement producers to better plan deliveries.

SiloConnect connects all the silos of RMC plants in real time and transmits this data remotely to the logistics teams of cement suppliers. With this information, they can decide when to dispatch trucks, how to prioritise customers, and how to optimise fleet utilisation. The biggest savings we see today are in logistics efficiency. Our customers are able to sell and ship more cement using the same fleet. This is achieved by increasing truck rotation, optimising delivery routes, and ultimately delivering the same volumes at a lower overall logistics cost.

Additionally, SiloConnect is designed as an open platform. It offers multiple connectors that allow data to be transmitted directly to third-party ERP systems. For example, it can integrate seamlessly with SAP or other major ERP platforms, enabling automatic order creation whenever replenishment is required.

How does your non-exclusive sensor design perform in the dusty, high-temperature, and harsh operating conditions typical of cement plants?

Harsh operating conditions such as high temperatures, heavy dust, extreme cold in some regions, and even heavy rainfall are all factored into the product design. These environmental challenges are considered from the very beginning of the development process.

Today, we have thousands of sensors operating reliably across a wide range of geographies, from northern Canada to Latin America, as well as in regions with heavy rainfall and extremely high temperatures, such as southern Europe. This extensive field experience demonstrates that, by design, the SiloConnect solution is highly robust and well-suited for demanding cement plant environments.

Have you initiated any pilot projects in India, and what outcomes do you expect from them?

We are at the very early stages of introducing SiloConnect in India. Recently, we installed our

first sensor at an RMC plant in collaboration with FDC Concrete, marking our initial entry into the Indian market.

In parallel, we are in discussions with a leading cement producer in India to potentially launch a pilot project within the next three months. The goal of these pilots is to demonstrate real-time visibility, logistics optimisation and measurable efficiency gains, paving the way for broader adoption across the industry.

What are your long-term plans and strategic approach for working with Indian cement manufacturers?

For India, our strategy is to establish strong and reliable local partnerships, which will allow us to scale the technology effectively. We believe that on-site service, local presence, and customer support are critical to delivering long-term value to cement producers.

Ideally, our plan is to establish an Indian entity within the next 24 months. This will enable us to serve customers more closely, provide faster support and contribute meaningfully to the digital transformation of logistics and supply chain management in the Indian cement industry.

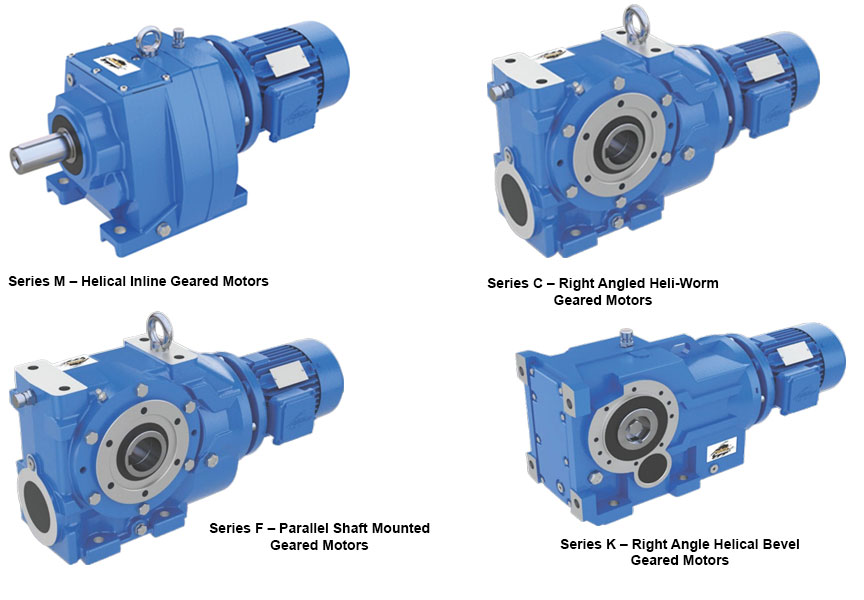

A deep dive into Core Gear Series of products M, C, F and K, by Power Build, and how they represent precision in motion.

At the heart of every high-performance industrial system lies the need for robust, reliable, and efficient power transmission. Power Build answers this need with its flagship geared motor series: M, C, F and K. Each series is meticulously engineered to serve specific operational demands while maintaining the universal promise of durability, efficiency, and performance.

Series M – Helical Inline Geared Motors

Compact and powerful, the Series M delivers exceptional drive solutions for a broad range of applications. With power handling up to 160kW and torque capacity reaching 20,000 Nm, it is the trusted solution for industries requiring quiet operation, high efficiency, and space-saving design. Series M is available with multiple mounting and motor options, making it a versatile choice for manufacturers and OEMs globally.

Series C – Right Angled Heli-Worm Geared Motors

Combining the benefits of helical and worm gearing, the Series C is designed for right-angled power transmission. With gear ratios of up to 16,000:1 and torque capacities of up to 10,000 Nm, this series is optimal for applications demanding precision in compact spaces. Industries looking for a smooth, low-noise operation with maximum torque efficiency rely on Series C for dependable performance.

Series F – Parallel Shaft Mounted Geared Motors

Built for endurance in the most demanding environments, Series F is widely adopted in steel plants, hoists, cranes and heavy-duty conveyors. Offering torque up to 10,000 Nm and high gear ratios up to 20,000:1, this product features an integral torque arm and diverse output configurations to meet industry-specific challenges head-on.

Series K – Right Angle Helical Bevel Geared Motors

For industries seeking high efficiency and torque-heavy performance, Series K is the answer. This right-angled geared motor series delivers torque up to 50,000 Nm, making it a preferred choice in core infrastructure sectors such as cement, power, mining and material handling. Its flexibility in mounting and broad motor options offer engineers the freedom in design and reliability in execution.

Together, these four series reflect Power Build’s commitment to excellence in mechanical power transmission. From compact inline designs to robust right-angle drives, each geared motor is a result of decades of engineering innovation, customer-focused design and field-tested reliability. Whether the requirement is speed control, torque multiplication or space efficiency, Radicon’s Series M, C, F and K stand as trusted powerhouses for global industries.

http://www.powerbuild.in

Call: +919727719344

Pankaj Kejriwal, Whole Time Director and COO, Star Cement, on driving efficiency today and designing sustainability for tomorrow.

In an era where the cement industry is under growing pressure to decarbonise while scaling capacity, Star Cement is charting a pragmatic yet forward-looking path. In this conversation, Pankaj Kejriwal, Whole Time Director and COO, Star Cement, shares how the company is leveraging waste heat recovery, alternative fuels, low-carbon products and clean energy innovations to balance operational efficiency with long-term sustainability.

How has your Lumshnong plant implemented the 24.8 MW Waste Heat Recovery System (WHRS), and what impact has it had on thermal substitution and energy costs?

Earlier, the cost of coal in the Northeast was quite reasonable, but over the past few years, global price increases have also impacted the region. We implemented the WHRS project about five years ago, and it has resulted in significant savings by reducing our overall power costs.

That is why we first installed WHRS in our older kilns, and now it has also been incorporated into our new projects. Going forward, WHRS will be essential for any cement plant. We are also working on utilising the waste gases exiting the WHRS, which are still at around 100 degrees Celsius. To harness this residual heat, we are exploring systems based on the Organic Rankine Cycle, which will allow us to extract additional power from the same process.

With the launch of Star Smart Building Solutions and AAC blocks, how are you positioning yourself in the low-carbon construction materials segment?

We are actively working on low-carbon cement products and are currently evaluating LC3 cement. The introduction of autoclaved aerated concrete (AAC) blocks provided us with an effective entry into the consumer-facing segment of the industry. Since we already share a strong dealer network across products, this segment fits well into our overall strategy.

This move is clearly supporting our transition towards products with lower carbon intensity and aligns with our broader sustainability roadmap.

With a diverse product portfolio, what are the key USPs that enable you to support India’s ongoing infrastructure projects across sectors?

Cement requirements vary depending on application. There is OPC, PPC and PSC cement, and each serves different infrastructure needs. We manufacture blended cements as well, which allows us to supply products according to specific project requirements.

For instance, hydroelectric projects, including those with NHPC, have their own technical norms, which we are able to meet. From individual home builders to road infrastructure, dam projects, and regions with heavy monsoon exposure, where weather-shield cement is required, we are equipped to serve all segments. Our ability to tailor cement solutions across diverse climatic and infrastructure conditions is a key strength.

How are you managing biomass usage, circularity, and waste reduction across

your operations?

The Northeast has been fortunate in terms of biomass availability, particularly bamboo. Earlier, much of this bamboo was supplied to paper plants, but many of those facilities have since shut down. As a result, large quantities of bamboo biomass are now available, which we utilise in our thermal power plants, achieving a Thermal Substitution Rate (TSR) of nearly 60 per cent.

We have also started using bamboo as a fuel in our cement kilns, where the TSR is currently around 10 per cent to 12 per cent and is expected to increase further. From a circularity perspective, we extensively use fly ash, which allows us to reuse a major industrial waste product. Additionally, waste generated from HDPE bags is now being processed through our alternative fuel and raw material (AFR) systems. These initiatives collectively support our circular economy objectives.

As Star Cement expands, what are the key logistical and raw material challenges you face in scaling operations?

Fly ash availability in the Northeast is a constraint, as there are no major thermal power plants in the region. We currently source fly ash from Bihar and West Bengal, which adds significant logistics costs. However, supportive railway policies have helped us manage this challenge effectively.

Beyond the Northeast, we are also expanding into other regions, including the western region, to cater to northern markets. We have secured limestone mines through auctions and are now in the process of identifying and securing other critical raw material resources to support this expansion.

With increasing carbon regulations alongside capacity expansion, how do you balance compliance while sustaining growth?

Compliance and growth go hand in hand for us. On the product side, we are working on LC3 cement and other low-carbon formulations. Within our existing product portfolio, we are optimising operations by increasing the use of green fuels and improving energy efficiency to reduce our carbon footprint.

We are also optimising thermal energy consumption and reducing electrical power usage. Notably, we are the first cement company in the Northeast to deploy EV tippers at scale for limestone transportation from mines to plants. Additionally, we have installed belt conveyors for limestone transfer, which further reduces emissions. All these initiatives together help us achieve regulatory compliance while supporting expansion.

Looking ahead to 2030 and 2050, what are the key innovation and sustainability priorities for Star Cement?

Across the cement industry, carbon capture is emerging as a major focus area, and we are also planning to work actively in this space. In parallel, we see strong potential in green hydrogen and are investing in solar power plants to support this transition.

With the rapid adoption of solar energy, power costs have reduced dramatically – from 10–12 per unit to around2.5 per unit. This reduction will enable the production of green hydrogen at scale. Once available, green hydrogen can be used for electricity generation, to power EV fleets, and even as a fuel in cement kilns.

Burning green hydrogen produces only water and oxygen, eliminating carbon emissions from that part of the process. While process-related CO2 emissions from limestone calcination remain a challenge, carbon capture technologies will help address this. Ultimately, while becoming a carbon-negative industry is challenging, it is a goal we must continue to work towards.

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence

FORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence