Product development

Infra and housing proposals to spur cement demand

Published

8 years agoon

By

admin

Cement demand is expected to grow by 4% to reach 300 million tonne in 2018-19. The number of infrastructure projects planned by the government are now in various phases where work is expected to progress faster.

The cement industry has been primarily driven by economic growth, which largely emanates from government spending on quality infrastructure and conducive policy guidelines. The thrust on infrastructure in the past two decades has spurred growth and thereby generated demand for cement. However, a lot more needs to be done and accomplished, like a statement needs to be converted into reality, which is seeing the gap widening instead of narrowing. In case of housing projects, the lead time for a medium size project is more than a year, for roads the same is not less than five years, for irrigation projects it is more than a decade. So the conversion of infrastructure project announcement and its conversion into demand for cement is a grey area.Overview

Indian cement industry with production capacity of nearly 425 million tonne, is the second largest globally, but in terms of output, the top producer China is almost 10 times bigger than India. Structurally, of the total capacity, 98 per cent is in the private sector and the rest in public sector. The top 20 companies account for around 70 per cent of the total production. About 210 large cement plants account for a cumulative installed capacity of over 350 million tonne, while over 350 mini cement plants have an estimated production capacity of nearly 11.10 million tonne (as of 2016).

Cement production over the past has remained subdued as demand moderated sharply. From an annual average of 5.4 per cent between 2011-12 to 2015-16, production declined 1.2 per cent in 2016-17 and was up 2.7 per cent in the first nine months of 2017-18. Thus, 2017-18 has been a relatively tough for the industry, with growth muted at low single digit. The obvious cause of this is the slowdown in the housing sector, which consumes about 65 per cent of India’s total cement. The year has also seen challenges – the ban on sand mining, and use of pet coke, diminishing market concentration of industry leaders.

Cement is in the highest GST rate slab, and hence there is no risk of rate hike any more. However, any southward change in GST will spur cement demand, and significantly improve realisation for the industry. As cement attracts 28 per cent GST, a higher rate of tax is leading to increased cost for the infrastructure and housing sector.Cement makers expected lower GST

Historically, the Indian cement industry has always remained prepared for any eventualities. In recent times, the industry has responded the government’s call for infrastructure push by expanding production capacity by almost 110 million ton of capacity in the last five years.

With a view to have inclusive growth of all sectors, emphasis would be to create demand for real estate sector with focus on affordable housing, government-led higher infra spending in the form of higher fund allocation and incentive for public private partnership (PPP) to keep robust demand for cement. Post GST, industry is also now exploring avenues for optimisation in logistics cost by direct supplies, creating hubs to serve distant markets at lower costs.

The government has been taking great steps to boost investment in the infrastructure sector, including the announcement of marquee projects like the Bharatmala and PM Awas Yojna. The Union Budget 2018 was expected to provide further impetus on developing rural infrastructure and urban infrastructure. The two major areas where cement industry expected the government to drive would be affordable housing and roads and infrastructure.

The cement industry has been under pressure for quite some time now, amid challenging macro environment, which subdued demand leading to low utilisation levels. The demand was also impacted by demonetisation, implementation of GST and Real Estate Regulation and Development Act (RERA). In addition, the regional issue pertaining to sand shortage and labour unavailability coupled with extended monsoons muted construction activities.

Specific to cement industry, some sort of tax relief was expected, given that cement is among the highest taxed industries, with GST at 28 per cent. It was expected that government may consider its legitimate demand of the need to bring down GST rate. Imposing the highest GST rate of 28 per cent was a major shocker for the industry, a tax bracket for luxury and demerit goods.

Moreover, the ambitious target set for constructing 15,000 km roads in 2017-18, saw only 4,944 km of roads constructed as of November 2017. The target of awarding 25,000 km of roads in the fiscal year appeared to be at far distant, given only 2,917 km could be managed for awarding until November end.

Thus, given the performance, cement industry was looking for initiatives from the Union Budget 2018-19 to revive the industry. The industry was looking for following boosters from the Budget:

Expected government’s focus on higher allocation of funds towards construction of infrastructure, irrigation, etc. to continue.

Freight cost, which account for 21-25 per cent of total operating costs, continues to be on the higher side due to surging diesel prices. Hence, cement industry would welcome any freight rationalisation for cement transportation in the Rail transport.

The housing sector, accounting for 65 per cent of overall cement consumption, has been the key driver for cement demand. Although, the government has taken several steps to make housing affordable, the affordability is still an issue due to high real estate prices and builders and high net worth investors refraining to divest their inventory. The cement industry expected Budget to introduce a 10 per cent tax on holding on to inventory after all aspects of building construction are complete, and the occupation certificate has been obtained. This would provide a boost to the housing sector and in turn the cement demand.

Of the total contribution of housing sector in cement industry, rural housing accounts for around 35 per cent and the rest by urban housing. Commercial and industrial sector accounts for 20-25 per cent of cement demand and balance 15-20 per cent is contributed by infrastructure projects. Hence, we believe that the Union Budget 2018-19 would provide the cement sector the requisite booster to revive. FICCI urge for duty on cement import

According to FICCI, the cement industry has been witnessing slow uptake in demand and badly needs a booster from the government in the Union Budget 2018. ‘Since 2007-08 import of cement into India is freely allowed without having to pay basic customs duty whereas all the major inputs for manufacturing cement such as limestone, gypsum, coal, pet coke, packing bags etc. attract customs duty’ FICCI said in its demand on the budget. It elaborated that due to low demand for cement more than 116 million tons of domestic capacity is idle and duty free import of cement was causing undue hardship to the industry already reeling under low capacity utilisation.

The FICCI pitched for providing a level-playing field. The industry has recommended that basic customs duty be levied on cement imports into India. Alternatively, import duties on inputs like coal, pet coke, tyre chips, limestone, packing materials and bags, gypsum, and refractories etc. -be abolished and freely allowed without levy of duty.Refractory industry wanted cheaper inputs

Refractory, a key component of core sectors like cement and steel, was hoping that the budget will take steps to address changes in the duty structure that will make inputs cheaper in comparison to finished products and help catalyse domestic manufacturing. Cement companies are primary consumers of refractories that are used to line kilns and furnaces. The shaky financial condition of many refractory clients has added to the woes of an industry that is struggling to rein in costs after a 40 per cent increase in the prices of raw materials that are largely imported from China.

The Rs 6,500-crore industry expected the government to provide necessary policy intervention in the Union Budget 2018 to enable the industry benefit from growing demand in the Indian market. Indian Refractory Makers Association said that the industry is currently at a point of inflexion where on one side it is encouraged by an expected steep rise in demand due to increase in steel and cement industry and on the other side it faces the challenge from cheap imports coming from China and disrupting the Indian market. Real estate pinning hopes on budget

A number of suggestions regarding budget provisions that can boost to the tepid real estate made rounds just before the Budget presentation. While experts had carefully curated list of suggestions, several industry bodies even organised special sessions and submitted memoranda to the government on fiscal measures that will breathe some life in the slowdown-hit market.

The National Real Estate Development Council (NAREDCO), an apex body of real estate sector in its pre-budget memorandum, had stressed on measures that will increase the purchasing power of homebuyers and more incentives for developers to maintain the demand and supply balance in the property market.

The populist measures of the government and its focused on ‘Housing For All’ amid transparency over the past three years, the hopes of some happy measures were high this time. The real estate industry eyed for tax breaks since the topmost on the common man’s list is increase in cap of interest paid on home loans, from Rs 2 lakh to at least Rs 3 lakh. With RERA and GST implemented in the past 18 months, the first-time homebuyers were hoping for higher income tax benefits. Under Section 80 EE, the first-time homebuyers was availing additional tax deduction of up to Rs 50,000 over and above the Rs 2 lakh limit under Section 24 of the Income Tax Act. This bracket was expected to be raised up to INR1 lakh to incentivise first-time homebuyers.

Industry status for the real estate sector was the first on their list. With the government according infrastructure status to affordable housing last year, the industry intensified their demand for the status for the sector this time. Single-window clearance for projects was another long-pending demand on which real estate sector expected a decisive move. With the implementation of RERA, speedy approvals for project from different departments was imperative. With the builders under pressure to complete the projects within a stipulated time frame, delay in approvals was a costly affair. According to Anuj Puri, Chairman – ANAROCK Property Consultants, ‘If implemented, single-window clearance can significantly reduce the overall projects cycle time and developers will be able to focus on their core business of project execution. Post-RERA, it has become all the more important to facilitate smooth clearances and approvals so that there are no execution delays due to procedural hindrances.’

While developers across the board were ruing the fact that GST norms were lacking clarity, lowering GST for realty projects was the key concern as 12 per cent on under-construction properties appeared higher than the previous taxes. NAREDCO’s most important demand was to bring housing under construction in 12 per cent GST rate from 18 per cent with 50 per cent abatement for land from 33 per cent. This would have brought tax rate at a level of around 6 per cent of the property cost.

Incentives for rental housing, as expected, could have also gone a long way in fulfilling the need of suitable living spaces for different groups. Taxing income from renting of housing properties at flat rate of 10 per cent may have incentivised rental housing. NAREDCO has suggested increasing deduction limit from 30 per cent to 50 per cent.

With the stage set to roll out of first REIT by end of 2017-18, it was time to simplify the tax norms on REITs. While issues like dividend distribution tax, long-term capital gains tax on transfer of units were resolved, REITS still has to to pay Stamp Duty charges at the state level. The reality sector had urged the government to convince the states to exempt REITs from Stamp Duty for, at least for the initial few years.Budget orchestrates higher spending to spur cement demand

While none of the demands put forth by the cement industry and various sectors that supplement and complement it were taken up in the Budget exercise, increased allocation to rural and urban affordable housing, irrigation, roads, railways and airports with overall hike in infra spending from Rs 4.94 lakh crore to Rs 5.94 lakh crore is expected to drive the demand for cement. Another allocation of Rs 2.04 lakh crore for Smart cities project will only add the incremental demand.

As the push for infrastructure continues, road sector allocation has been raised 16 per cent, which, on a reasonably high base, is significant. Some of the key categories in which allocations are hiked are railways (32 per cent), Smart Cities (54 per cent), and shipping and aviation. However, contrary to the general expectations, the allocation for rural and urban housing schemes is much lower. However, the push towards infrastructure projects is expected to create rural and urban employment, which in time will benefit the cement industry.

The Government allocates Rs 5.97 lakh crore for infra spending in 2018-19. Terming infrastructure as growth driver of the economy, Finance Minister Arun Jaitley announced an allocation of Rs 5.97 lakh crore for 2018-19 for infra spending, up by over Rs 1 lakh crore from the ongoing fiscal.

The Union Budget 2018-19 has accorded priority to the infrastructure sector evidently from the fact that Prime Minister is personally monitoring project targets and achievements. Using online monitoring system of Pragati alone, projects worth Rs 9.46 lakh crore have been facilitated and fast-tracked. In his budget speech the Finance Minister said, ‘Infrastructure is the growth driver of the economy. Our country needs massive investment in access of Rs 50 lakh crore in infrastructure to increase growth of GDP and integrate the nation with a network of roads, airports, railways, inland water and to provide good quality services to the people.’

To create employment and aid growth, the government has increased budgetary and extra budgetary expenditure on infrastructure for 2018-19 to Rs 97 lakh crore from Rs 4.94 lakh crore in 2017-18.

In roads, National Highways exceeding 9,000 km will be completed in 2018-19 while Bharatmala scheme is given thrust which will provide seamless connectivity to interior and backward areas and borders of the country. Under the phase-I of the project, 35,000 km of highways would be constructed at an estimated cost of INR5.35 lakh crore.

For Railways, the government has allocated capital expenditure of INR1.48 lakh crore for 2018-19, and all trains will have state-of-the-art facilities such as WiFi and CCTVs. The Budget also underlines urbanisation as an opportunity and priority and the government has already launched Smart City mission that aims at creating state-of-the-art amenities. ’99 cities have been selected at an outlay of INR2.04 lakh crore.

These cities have started implementing various projects like smart roads, solar roof, intelligent transport system. Projects worth INR2,350 crore have been completed and work of INR20,850 crore was under progress,’ Jaitley said in his speech adding that heritage cities will be preserved and revitalised. The resulting economic growth

The government was firmly on course to achieve high economic growth of 8 per cent plus as manufacturing, services and exports were back on good growth path. While GDP growth at 6.3 per cent in the second quarter of 2017-18 signalled turnaround of the economy, growth in the second half is likely to remain between 7.2 per cent to 7.5 per cent. The economy has shown remarkable resilience in adjusting with the structural reforms. IMF, in its latest Update, has forecast that India will grow at 7.4 per cent next year in the backdrop of services resuming high growth rates of 8 per cent plus, exports expected to grow at 15 per cent in 2017-18 and manufacturing back on good growth path.

The Finance Minister said that Government has taken up programmes to direct the benefits of structural changes and good growth to reach farmers, poor and other vulnerable sections of our society and to uplift the underdeveloped regions. He said, this Budget will consolidate these gains and particularly focus on strengthening agriculture and rural economy, provision of good health care to economically less privileged, taking care of senior citizens, infrastructure creation and working with the states to provide more resources for improving the quality of education in the country. The government has ensured that benefits reach eligible beneficiaries and are delivered to them directly and said that Direct Benefit Transfer mechanism of India is the biggest such exercise in the world and is a global success story.Going into 2018-19

Cement demand is expected to grow by 4 per cent to reach 300 million tonne in 2018-19. The number of infrastructure projects planned by the government are now in various phases where work is expected to progress faster. With general elections nearing it is expected that there would be a harder push by all agencies to progress these projects which will generate demand for building materials like steel, iron, cement, concrete etc. A rise in the prices of these materials will have a huge impact on the construction cost. The cost of cement is about 10 per cent – 12 per cent of the total construction cost, steel about 15 per cent – 20 per cent and other materials about 25 per cent to 30 per cent. The recent mining restriction, the doubling of prices, along with a further hike in input costs is likely to create pressure on cement consumption.

Despite the infrastructure push, cement industry will continue to face some severe headwinds, such as higher fuel prices which may cause an uptick in logistics cost with an ultimate impact on margins. Capacity utilisation will remain on the lower side which may put pressure on the prices. The industry has investment hugely expecting increase in cement demand. If in case chance this uptick in demand does not materialise, cement makers will experience a glut situation leading to an immediate and sharp fall in prices.– NITIN MADKAIKAR

You may like

Economy & Market

Power Build’s Core Gear Series

Published

21 hours agoon

February 19, 2026By

admin

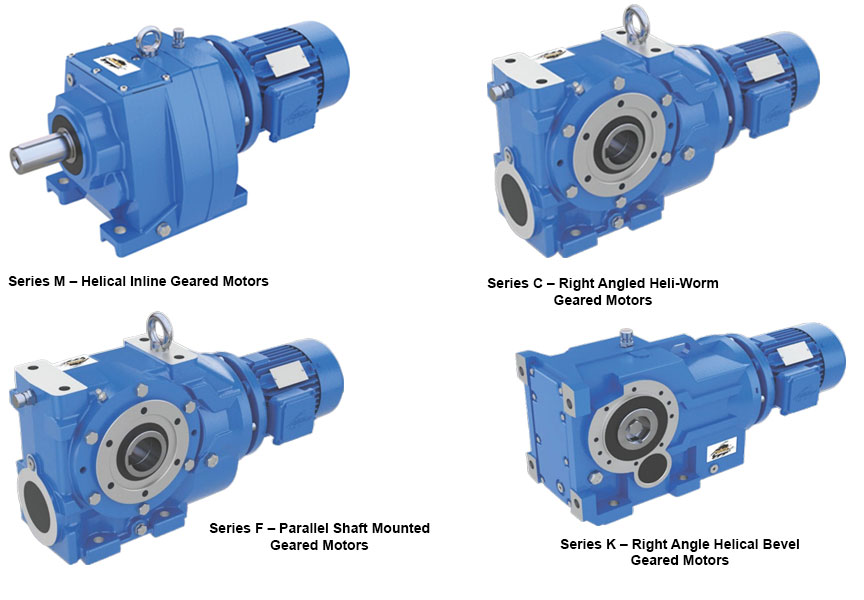

A deep dive into Core Gear Series of products M, C, F and K, by Power Build, and how they represent precision in motion.

At the heart of every high-performance industrial system lies the need for robust, reliable, and efficient power transmission. Power Build answers this need with its flagship geared motor series: M, C, F and K. Each series is meticulously engineered to serve specific operational demands while maintaining the universal promise of durability, efficiency, and performance.

Series M – Helical Inline Geared Motors

Compact and powerful, the Series M delivers exceptional drive solutions for a broad range of applications. With power handling up to 160kW and torque capacity reaching 20,000 Nm, it is the trusted solution for industries requiring quiet operation, high efficiency, and space-saving design. Series M is available with multiple mounting and motor options, making it a versatile choice for manufacturers and OEMs globally.

Series C – Right Angled Heli-Worm Geared Motors

Combining the benefits of helical and worm gearing, the Series C is designed for right-angled power transmission. With gear ratios of up to 16,000:1 and torque capacities of up to 10,000 Nm, this series is optimal for applications demanding precision in compact spaces. Industries looking for a smooth, low-noise operation with maximum torque efficiency rely on Series C for dependable performance.

Series F – Parallel Shaft Mounted Geared Motors

Built for endurance in the most demanding environments, Series F is widely adopted in steel plants, hoists, cranes and heavy-duty conveyors. Offering torque up to 10,000 Nm and high gear ratios up to 20,000:1, this product features an integral torque arm and diverse output configurations to meet industry-specific challenges head-on.

Series K – Right Angle Helical Bevel Geared Motors

For industries seeking high efficiency and torque-heavy performance, Series K is the answer. This right-angled geared motor series delivers torque up to 50,000 Nm, making it a preferred choice in core infrastructure sectors such as cement, power, mining and material handling. Its flexibility in mounting and broad motor options offer engineers the freedom in design and reliability in execution.

Together, these four series reflect Power Build’s commitment to excellence in mechanical power transmission. From compact inline designs to robust right-angle drives, each geared motor is a result of decades of engineering innovation, customer-focused design and field-tested reliability. Whether the requirement is speed control, torque multiplication or space efficiency, Radicon’s Series M, C, F and K stand as trusted powerhouses for global industries.

http://www.powerbuild.in

Call: +919727719344

Economy & Market

Conveyor belts are a vital link in the supply chain

Published

8 months agoon

June 16, 2025By

admin

Kamlesh Jain, Managing Director, Elastocon, discusses how the brand delivers high-performance, customised conveyor belt solutions for demanding industries like cement, mining, and logistics, while embracing innovation, automation, and sustainability.

In today’s rapidly evolving industrial landscape, efficient material handling isn’t just a necessity—it’s a competitive advantage. As industries such as mining, cement, steel and logistics push for higher productivity, automation, and sustainability, the humble conveyor belt has taken on a mission-critical role. In this exclusive interview, Kamlesh Jain, Managing Director, Elastocon, discusses how the company is innovating for tougher terrains, smarter systems and a greener tomorrow.

Brief us about your company – in terms of its offerings, manufacturing facilities, and the key end-user industries it serves.

Elastocon, a flagship brand of the Royal Group, is a trusted name in the conveyor belt manufacturing industry. Under the brand name ELASTOCON, the company produces both open-end and endless belts, offering tailor-made solutions to some of the most demanding sectors such as cement, steel, power, mining, fertiliser, and logistics. Every belt is meticulously engineered—from fabric selection to material composition—to ensure optimal performance in tough working conditions. With advanced manufacturing facilities and strict quality protocols, Elastocon continues to deliver high-performance conveyor solutions designed for durability, safety, and efficiency.

How is the group addressing the needs for efficient material handling?

Efficient material handling is the backbone of any industrial operation. At Elastocon, our engineering philosophy revolves around creating belts that deliver consistent performance, long operational life, and minimal maintenance. We focus on key performance parameters such as tensile strength, abrasion resistance, tear strength, and low elongation at working tension. Our belts are designed to offer superior bonding between plies and covers, which directly impacts their life and reliability. We also support clients

with maintenance manuals and technical advice, helping them improve their system’s productivity and reduce downtime.

How critical are conveyor belts in ensuring seamless material handling?

Conveyor belts are a vital link in the supply chain across industries. In sectors like mining, cement, steel, and logistics, they facilitate the efficient movement of materials and help maintain uninterrupted production flows. At Elastocon, we recognise the crucial role of belts in minimising breakdowns and increasing plant uptime. Our belts are built to endure abrasive, high-temperature, or high-load environments. We also advocate proper system maintenance, including correct belt storage, jointing, roller alignment, and idler checks, to ensure smooth and centered belt movement, reducing operational interruptions.

What are the key market and demand drivers for the conveyor belt industry?

The growth of the conveyor belt industry is closely tied to infrastructure development, increased automation, and the push for higher operational efficiency. As industries strive to reduce labor dependency and improve productivity, there is a growing demand for advanced material handling systems. Customers today seek not just reliability, but also cost-effectiveness and technical superiority in the belts they choose. Enhanced product aesthetics and innovation in design are also becoming significant differentiators. These trends are pushing manufacturers to evolve continuously, and Elastocon is leading the way with customer-centric product development.

How does Elastocon address the diverse and evolving requirements of these sectors?

Our strength lies in offering a broad and technically advanced product portfolio that serves various industries. For general-purpose applications, our M24 and DINX/W grade belts offer excellent abrasion resistance, especially for RMHS and cement plants. For high-temperature operations, we provide HR and SHR T2 grade belts, as well as our flagship PYROCON and PYROKING belts, which can withstand extreme heat—up to 250°C continuous and even 400°C peak—thanks to advanced EPM polymers.

We also cater to sectors with specialised needs. For fire-prone environments like underground mining, we offer fire-resistant belts certified to IS 1891 Part V, ISO 340, and MSHA standards. Our OR-grade belts are designed for oil and chemical resistance, making them ideal for fertiliser and chemical industries. In high-moisture applications like food and agriculture, our MR-grade belts ensure optimal performance. This diverse range enables us to meet customer-specific challenges with precision and efficiency.

What core advantages does Elastocon offer that differentiate it from competitors?

Elastocon stands out due to its deep commitment to quality, innovation, and customer satisfaction. Every belt is customised to the client’s requirements, supported by a strong R&D foundation that keeps us aligned with global standards and trends. Our customer support doesn’t end at product delivery—we provide ongoing technical assistance and after-sales service that help clients maximise the value of their investments. Moreover, our focus on compliance and certifications ensures our belts meet stringent national and international safety and performance standards, giving customers added confidence.

How is Elastocon gearing up to meet its customers’ evolving needs?

We are conscious of the shift towards greener and smarter manufacturing practices. Elastocon is embracing sustainability by incorporating eco-friendly materials and energy-efficient manufacturing techniques. In parallel, we are developing belts that seamlessly integrate with automated systems and smart industrial platforms. Our vision is to make our products not just high-performing but also future-ready—aligned with global sustainability goals and compatible with emerging technologies in industrial automation and predictive maintenance.

What trends do you foresee shaping the future of the conveyor belt industry?

The conveyor belt industry is undergoing a significant transformation. As Industry 4.0 principles gain traction, we expect to see widespread adoption of smart belts equipped with sensors for real-time monitoring, diagnostics, and predictive maintenance. The demand for recyclable materials and sustainable designs will continue to grow. Furthermore, industry-specific customisation will increasingly replace standardisation, and belts will be expected to do more than just transport material—they will be integrated into intelligent production systems. Elastocon is already investing in these future-focused areas to stay ahead of the curve.

Advertising or branding is never about driving sales. It’s about creating brand awareness and recall. It’s about conveying the core values of your brand to your consumers. In this context, why is branding important for cement companies? As far as the customers are concerned cement is simply cement. It is precisely for this reason that branding, marketing and advertising of cement becomes crucial. Since the customer is unable to differentiate between the shades of grey, the onus of creating this awareness is carried by the brands. That explains the heavy marketing budgets, celebrity-centric commercials, emotion-invoking taglines and campaigns enunciating the many benefits of their offerings.

Marketing strategies of cement companies have undergone gradual transformation owing to the change in consumer behaviour. While TV commercials are high on humour and emotions to establish a fast connect with the customer, social media campaigns are focussed more on capturing the consumer’s attention in an over-crowded virtual world. Branding for cement companies has become a holistic growth strategy with quantifiable results. This has made brands opt for a mix package of traditional and new-age tools, such as social media. However, the hero of every marketing communication is the message, which encapsulates the unique selling points of the product. That after all is crux of the matter here.

While cement companies are effectively using marketing tools to reach out to the consumers, they need to strengthen the four Cs of the branding process – Consumer, Cost, Communication and Convenience. Putting up the right message, at the right time and at the right place for the right kind of customer demographic is of utmost importance in the long run. It is precisely for this reason that regional players are likely to have an upper hand as they rely on local language and cultural references to drive home the point. But modern marketing and branding domain is exponentially growing and it would be an interesting exercise to tabulate and analyse its impact on branding for cement.

Refractory demands in our kiln have changed

Digital supply chain visibility is critical

Redefining Efficiency with Digitalisation

Cement Additives for Improved Grinding Efficiency

Digital Pathways for Sustainable Manufacturing

Refractory demands in our kiln have changed

Digital supply chain visibility is critical

Redefining Efficiency with Digitalisation

Cement Additives for Improved Grinding Efficiency