Jacob Brinch-Nielsen, Vice President of Professional Services, FLSmidth Cement, brings together recommendations from experts across the flow sheet to demonstrate the role of upgrades in optimising the cement manufacturing process.

Improving Preheater Efficiency and Heat Retention

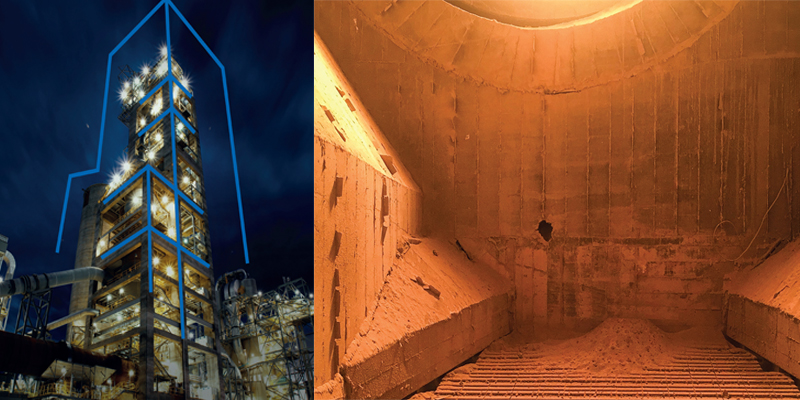

Preheaters play a critical role in cement plant energy efficiency, but outdated cyclone designs and corroded components can lead to excessive heat loss and higher fuel consumption. Plants that optimise preheater separation efficiency can reduce fuel use by up to 5 – 10 kcal/kg clinker while improving downstream performance. One area where upgrades can make a difference is in the central pipe elements. By switching to an advanced suspension design, plants can improve separation efficiency and extend wear life — offering both energy savings and operational benefits.

“The cast central pipe is installed in the preheater cyclones to improve separation and thermal efficiency,” explains Muthukumar Muthu, Senior Product Specialist, “Our patented design for the suspension of the cast pipe reduces corrosion (extending pipe life), while also making it easier to carry out maintenance work. Installation of one cast pipe in the lower cyclone stages can save customers 5 – 10 kcal/kg clinker, reducing power consumption in the ID fan drive by 4 to 8 per cent – a significant energy saving. Customers can choose whether to claim these benefits in cost savings or convert them to a 1 to 2 per cent increase in production. Either way, the cast pipe provides a quick ROI.”

The improvements to the cast central pipe elements reduce the stress across the element, and make it simpler to manufacture, which results in a more consistent quality, more durable product. This upgrade can be implemented during the annual maintenance shutdown with no disruption to operations.

Maximising Efficiency in Combustion

False air leaks and inefficient fuel combustion are two of the biggest sources of energy waste in cement kilns. Uncontrolled air ingress forces plants to burn more fuel to maintain operating temperatures, while the inefficient combustion of alternative fuels can create a volatile environment that reduces both efficiency and clinker quality. To address these issues, plants can implement sealing upgrades that prevent air leaks and burner modifications that optimise fuel-air mixing, ensuring more complete combustion and greater flexibility in alternative fuel use.

“We’ve introduced the new Spring Tensioned Graphite Seals to reduce false air entry and increase thermal efficiency – effectively lowering fuel consumption without affecting clinker quality,” says, Karthikeyan Arumugam, Senior Product Specialist.

In addition, advanced burner designs such as a JETFLEX® partial upgrade allow plants to retain the existing kiln burner pipe while improving fuel-air mixing, increasing alternative fuel utilisation and efficiency. This burner enables cement producers to use pulverised coal or petcoke, anthracite, oil, natural gas – or any mixture of these – as well as alternative fuels (such as plastic and wood chips, sewage sludge) with no difference in performance and minimal volatility in the kiln to support reliable and consistent production of high-quality clinker with low NOx emissions.

Cooling Efficiency as Easy as ABC Inlet

An inefficient or older generation cooler inlet leads to higher fuel consumption. Alternative fuels and petcoke produce dusty, sticky clinker that builds up easily, creating ‘snowmen’ in the cooler that disrupt the system, leading to inefficiencies and even unplanned shutdowns.

“The ABC Inlet upgrade continues to be one of our most successful cooler inlet upgrades because it resolves issues as a result alternative fuels usage and enables better heat recovery back to system,” explains Rene Hede, Cooler Product Specialist. “The ABC Inlet prevents snowmen formation with a patented in-grate design that pushes compressed air up through the grates, blasting agglomerations.”

In addition, the ABC Inlet’s rapid quenching process enables faster clinker cooling while maximising heat recovery to the pyro line, resulting in heat consumption savings of 10–30 kcal/kg of clinker. This also enhances clinker quality, providing greater flexibility in cement product formulation and allowing for clinker factor reductions that further improve grinding energy efficiency.

Part 2 of 3. Read Part 1 in the May issue of Indian Cement Review. Part 3 will be found in the July issue.

Economy & Market4 weeks ago

Economy & Market4 weeks ago

Economy & Market4 weeks ago

Economy & Market4 weeks ago

Concrete1 month ago

Concrete1 month ago

Concrete2 weeks ago

Concrete2 weeks ago