Concrete

The Future Looks Green

Published

3 years agoon

By

admin

Green Cement is no longer a distant thing, it is a concrete reality. As the Indian cement industry marches towards its net zero target, Dr Hitesh Sukhwal, Head – Environment, Udaipur Cement Works, gives an in-depth analysis of green cement and what the future holds for sustainability in cement manufacturing.

India is the second largest cement producing country in the world, after China, both in quality and technology. Indian cement plants are today the most energy efficient and environment friendly. The Indian cement industry is a frontrunner for implementing significant technology measures to ensure a greener future. The cement industry is an energy intensive and significant contributor to climate change. Cement production contributes greenhouse gasses directly and indirectly into the atmosphere through calcination and use of fossil fuels in an energy form. The industry believes in a circular economy by utilising alternative fuels and raw materials for making cement. Cement companies are focusing on major areas of energy efficiency by adoption of technology measures, clinker substitution by alternative raw material for cement making (blended cement), alternative fuels and green and clean energy resources. Cement industries are putting efforts on energy saving, reducing clinker factor (through blended cement) and CO2 footprint. All these efforts are being done for making green cement towards environment protection and a sustainable future.

Making Green Cement

While we talk about the carbon negative cement manufacturing process, our thrust is on green cement manufacturing. For cement industries, green is not a green cement in colour. It is a sustainable eco-friendly cement that can reduce the carbon footprint of cement production. The rise of blended cement, by utilising fly ash 30-35 per cent in Portland Pozzolana Cement (PPC) and slag 60-65 per cent in Portland Slag Cement (PSC), has made the cement green, which helps to reduce clinker factor and resultant minimise carbon footprint. The production of cement is estimated to rise over 600 million tonnes per annum by the year 2025. The Government of India has committed to five pledges called ‘Panchamrit’ at the COP26 summit.

- Reach net zero emission target by the year 2070.

- Installing non fossil fuel 500 GW electricity capacity by the year 2030.

- Generate half of all energy requirements by the year 2030 from renewable energy sources 4. Reduce emissions by 1 billion tonnes from now to 2030.

- Reduce emission intensity of GDP by 45 per cent by the year 2030.

The cement industries are a top source of carbon dioxide emissions generation through fuel as well as electricity consumption. Pressure for the cement industry to minimize carbon emissions has increased rapidly from investors and government, both. Cement industries are looking forward to various options to decarbonise cement through the decarbonisation road map.

Followings are considered for low carbon technology road map: - Energy efficiency measures

- Reduction of clinker factor through product mix (slag, fly ash, pozzolana and others)

- Generation of more power from waste heat recovery system

- Circular economy – utilisation of alternative fuel and raw materials (RDF, hazardous waste, etc)

- Use of renewable energy sources like solar and wind power

- Use biomass as an alternative fuel

- Modernisation/upgradation of manufacturing process

- Green supply chain: eco labelling, green sourcing, optimising transport routes and mode of transport (like railway, green fuel etc.)

- Technological innovation: carbon capture, use and storage technologies

- Carbon sequestration

Most of the cement plants have already implemented the above top seven points and minimised their carbon emissions. To reduce carbon emissions, the cement industry requires a large scale of investments on technologies for maintaining a low carbon technology road map.

Types of Green Cement

- Portland Pozzolana Cement (PP) – IS:1489-2015 (Part-I): Fly ash

- Portland Pozzolana Cement (PP) – IS:1489-2015 (Part-II): Calcined Clay

- Portland Slag Cement (PSC) – IS:455-2015

- Composite Cement – IS:16415-2015

- Sulphate Resisting Portland Cement – IS:12330-1988

- Super Sulphated Cement – IS:6909-1990

- Portland Limestone Cement (PLC)

- Portland Composite Cement (PCC)

- Portland Dolomitic Limestone Cement (PDC)

- Limestone Calcined Clay Cement (LC3)

- Reactive Belite reach Portland Cement (RBPC)

- Geopolymer Cement

Advantages of Green Cement

- It has potential to bring down carbon emission near about 80 per cent lower than the production of traditional cement.

- Best in construction for green building – acid resistance and lower atmospheric heat.

- Low chloride permeability as compared to OPC.

- Requires less amount of energy during manufacturing.

- Green cement is economically and environmentally friendly.

- Green cement reduces air and land pollution.

- High tensile strength and higher resistance to chemical corrosion.

- Low water demand thus water conservation.

- Natural resource conservation.

- Boost a circular economy.

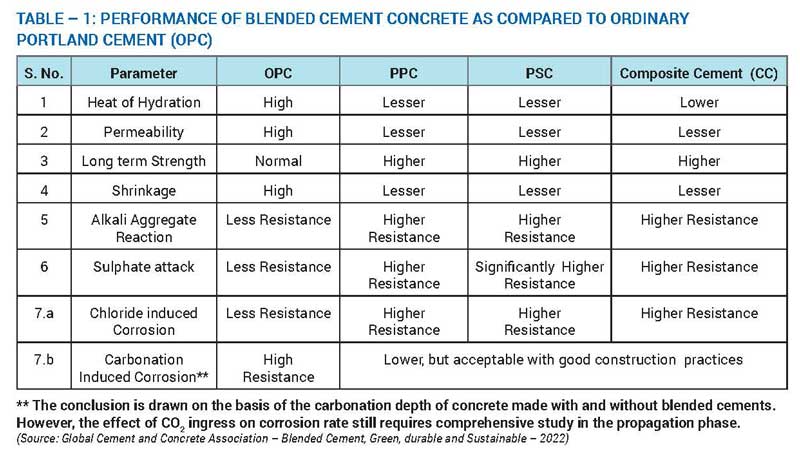

The analysis results from the above table, the performance of blended cement was observed better than OPC concrete excluding resistance against carbonation. Concrete made with PPC, PSC and composite cement has a longer service life as compared to OPC concrete in an aggressive environment.

Environmental Benefits of Green Cement

To analyse the environmental impacts of blended cement, various research is being performed by national and international agencies. In blended cement, as the clinker factor is reduced, the corresponding requirements of limestone, additives, coal and electrical energy for production of blended cement will be reduced proportionately. In PPC, PSC and composite cement, the clinker factor is reduced to 65 per cent, 40 per cent and 45 per cent respectively.

As per Indian standard specification IS: 455-2015, GBFS can be used in the range of 25-70 per cent in the PSC. Indian cement industries utilise about 92 per cent of granulated slag generated by the different steel plants. Currently, India produces approximately 25 million tonnes of blast furnace slag out of which 22 million tonnes of slag is granulated. At present, an average of 57 per cent (by weight) of GBFS is used in PSC in India1.

Fly ash is being used by the cement industry as a pozzolanic material in manufacturing of PPC. It saves both precious limestone and coal. The utilisation of fly ash in manufacturing of cement is a high value-added use. Fly ash conforming to standard IS: 3812 (1) 2013 can be used (up to 35 per cent maximum) in the manufacture of PPC as per IS: 1489 (part 1) 2015. The enhanced use of fly ash in PPC results in the reduction of clinker factor in cement, followed by lessened CO2 emissions through decreased fuel combustion and limestone calcination1.

In blended cement, while the clinker factor is reduced in PPC, PSC and composite cement, it will not only help to prevent land pollution due to increasing production of such types of high-volume industrial waste but also reduce corresponding direct emission of carbon dioxide.

Challenges

In the near future, as other industrial sectors are also having a decarbonise target, fly ash and slag from energy and steel industries could be in shorter supply as clinker substitutes. Biomass supply varies by region to region therefore its availability for utilisation as an alternative fuel could be a costly affair. The use of alternative fuels in the cement industry is growing rapidly to increase the Thermal Substitution Rate (TSR). The industry is now working towards TSR of 25 per cent by 2025 and 30 per cent by 2030 (CMA 2020 data). A region wise inventorisation of alternative fuel (like MSW, biomass, industrial byproduct, hazardous waste), which has high calorific value, is an urgent requirement. Moreover, there are several challenges associated like the segregation of MSW, collection of biomass, handling of hazardous waste etc.

Although the leading cement companies in India accepted the goal to achieve Net Zero target by 2050. However, carbon emission from calcination of limestone (process emissions) is still one of the biggest challenges for the cement industry. Here, technological innovations like carbon capture, use and storage (CCUS) and carbon sink require more R&D for mitigation of carbon dioxide emission, and hence for making more green cement.

Green is the Future

Green cement is the future of the cement industry and best for the environment. If we can reduce the clinker factor, it would reduce the significant amount of carbon emission during cement making. Besides manufacturing of PPC, PSC and Composite Cement, the cement industry is now doing R&D on PLC. The Indian cement industry is playing a catalytic role in natural resource conservation and boosting the circular economy. For making cement, utilisation of other industrial waste as an alternative fuel and raw material, adopting renewable energy sources, green procurement and supply chain management – all these efforts are put by cement industries for green cement production.

The use of PPC and PSC is permitted by national and international standards/specifications including most government bodies1. The partial replacement of clinker, which is an expensive component of cement as well as resource, energy and emission intensive, can be ground with these additives (like pozzolana and granulated blast furnace slag) to improve the sustainability of the material. Most importantly, the performance of cement can be improved through this replacement. The use of PPC conforming to requirement of IS:1489 in substructures of bridges is already permitted by the Ministry of Railways, Railway Board, Government of India.

In India, the production of OPC is continuously declining, with simultaneous increase in production of blended cements like PPC, PSC and composite cement based on granulated blast furnace slag and fly ash. Other cement formulations such as PLC and limestone calcined clay cement are also at different stages of development in India. At present, blended cements have a greater share (73 per cent) in comparison to OPC (27 per cent) of the total cement production. Blended cements provide the means to reduce the clinker factor even further soon, without a compromise on economy and safety1.

References

- Global Cement and Concrete Association – Blended Cement, Green, Durable and Sustainable – 2022

ABOUT THE AUTHOR:

Dr Hitesh Sukhwal is the Head – Environment at JK Lakshmi Cement. He is the Environment Coordinator for the North-West region units. He has MSc and PhD degrees in Environmental Sciences from Mohanlal Sukhadia University. His area of expertise is environment legislation.

Concrete

UltraTech Appoints Jayant Dua As MD-Designate For 2027

Executive named to succeed current managing director in 2027

Published

19 hours agoon

March 10, 2026By

admin

UltraTech Cement has appointed Jayant Dua as managing director (MD) designate who will take charge in 2027, the company announced. The appointment signals a planned leadership transition at one of the country’s largest cement manufacturers. The board has set a clear timeline for the handover and has framed the move as part of a structured succession plan.

Jayant Dua will be referred to as MD after assuming the role and will be responsible for overseeing operations, strategy and growth initiatives across the company’s network. The company said the designation follows established governance norms and aims to ensure continuity in executive leadership. The appointment is expected to allow a phased transfer of responsibilities ahead of the formal changeover.

The decision is intended to provide strategic stability as UltraTech Cement navigates domestic infrastructure demand and evolving market dynamics. Management will continue to focus on operational efficiency, capacity utilisation and cost management while aligning investments with long term objectives. The board will monitor the transition and provide further information on leadership responsibilities closer to the effective date.

Investors and market observers will have time to assess the implications of the announcement before the change is effected, and analysts will review the company’s outlook in the context of the succession. The company indicated that it will communicate any additional executive appointments or organisational changes as they are finalised. Shareholders were advised to refer to formal filings and company releases for definitive details on governance or remuneration.

The leadership change will be managed with attention to stakeholder interests and operational continuity, and the company reiterated its commitment to delivery on ongoing projects and customer obligations. Senior management will engage with employees and partners to ensure a smooth handover while maintaining focus on safety and compliance. Further updates will be provided through official investor communications in due course.

Concrete

Merlin Prime Spaces Acquires 13,185 Sq M Land Parcel In Pune

Rs 273 crore purchase broadens the developer’s Pune presence

Published

5 days agoon

March 6, 2026By

admin

Merlin Prime Spaces (MPS) has acquired a 13,185 sq m land parcel in Pune for Rs 273 crore, marking a notable expansion of its footprint in the city.

The transaction value converts to Rs 2,730 mn or Rs 2.73 bn.

The parcel is located in a strategic area of Pune and the firm described the acquisition as aligned with its growth objectives.

The deal follows recent activity in the region and will be watched by investors and developers.

MPS said the acquisition will support its planned development pipeline and enable delivery of commercial and residential space to meet local demand.

The company expects the site to provide flexibility in product design and phased development to respond to market conditions.

The move reflects an emphasis on land ownership in key suburban markets.

The emphasis on land acquisition reflects a strategy to secure inventory ahead of demand cycles.

The purchase follows a period of sustained investor interest in Pune real estate, driven by expanding office ecosystems and residential demand from professionals.

MPS will integrate the new holding into its existing portfolio and plans to engage with local authorities and stakeholders to progress approvals and infrastructure readiness.

No financial partners were disclosed in the announcement.

The firm indicated that timelines will depend on approvals and prevailing market conditions.

Analysts note that strategic land acquisitions at scale can help developers manage costs and timelines while preserving optionality for future projects.

MPS will now hold an enlarged land bank in the region as it pursues growth, and the acquisition underlines continued corporate appetite for measured expansion in second tier cities.

The company intends to move forward with detailed planning in the coming months.

Stakeholders will assess how the site is positioned relative to existing infrastructure and connectivity.

Concrete

Adani Cement and Naredco Partner to Promote Sustainable Construction

Collaboration to focus on skills, technology and greener practices

Published

5 days agoon

March 6, 2026By

admin

Adani Cement has entered a strategic partnership with the National Real Estate Development Council (Naredco) to support India’s construction needs with a focus on sustainability, workforce capability and modern building technologies. The collaboration brings together Adani Cement’s building materials portfolio, research and development strengths and technical expertise with Naredco’s nationwide network of more than 15,000 member organisations. The agreement aims to address evolving demand across housing, commercial and infrastructure sectors.

Under the partnership, the organisations will roll out skill development and certification programmes for masons, contractors and site supervisors, with training to emphasise contemporary construction techniques, safety practices and quality standards. The programmes are intended to improve project execution and on-site efficiency and to raise labour productivity through standardised competencies. Emphasis will be placed on practical training and certification pathways that can be scaled across regions.

The alliance will function as a platform for knowledge sharing and technology exchange, facilitating access to advanced concrete solutions, innovative construction practices and modern materials. The effort is intended to enhance structural durability, execution quality and environmental responsibility across developments while promoting adoption of low-carbon technologies and green cement alternatives. Companies expect these measures to contribute to longer term resilience of built assets.

Senior executives conveyed that the partnership reflects a shared commitment to strengthening quality and sustainability in construction and that closer engagement with developers will help integrate advanced materials and technical support throughout the project lifecycle. Leadership noted the need for responsible construction practices as urbanisation accelerates and indicated that the association should encourage wider adoption of green building norms and collaboration within the real estate and construction ecosystem.

The organisations said they will also explore integrated building solutions, including ready-mix concrete offerings, while supporting initiatives aligned with affordable and inclusive housing. The partnership will progress through engagements, conferences and joint training programmes targeting rapidly urbanising cities and growth centres where demand for efficient and environmentally responsible construction grows. Naredco, established under the aegis of the Ministry of Housing and Urban Affairs, will leverage its policy and advocacy role to support implementation.

UltraTech Appoints Jayant Dua As MD-Designate For 2027

Merlin Prime Spaces Acquires 13,185 Sq M Land Parcel In Pune

Adani Cement and Naredco Partner to Promote Sustainable Construction

Operational Excellence Redefined!

World Cement Association Annual Conference 2026 in Bangkok

UltraTech Appoints Jayant Dua As MD-Designate For 2027

Merlin Prime Spaces Acquires 13,185 Sq M Land Parcel In Pune

Adani Cement and Naredco Partner to Promote Sustainable Construction

Operational Excellence Redefined!