Concrete

Achieving Sustainability with LD Steel Slag

Published

4 years agoon

By

admin

The utilisation of Linz-Donawitz (LD) steel slag is a firm step towards achieving sustainability and players of the Indian cement industry need to focus on this to make a positive impact on the environment. Dr Asok K Dikshit, Dr Sanjeev Chaturvedi and Kirti Chugh from National Council for Cement and Building Materials (NCCBM) present a detailed study.

Slag is a by-product generated during the manufacturing of pig iron and steel. This is a solid industrial by-product of the iron and steel industry and mainly these wastes include blast furnace and steel melting slag. It can be categorised as carbon steel slag and stainless steel slag according to the type of steel, and as pre-treatment slag, Linz-Donawitz (LD) converter slag, electrical arc furnace slag (EAFS), ladle refining slag, and casting residue according to the steelmaking process. LD slag is generated by the Linz- Donawitz process from steel making process or pig iron refining process in oxygen converters [1-2]. One of the important wastes in all integrated steel plants is LD converter steelmaking slag. Worldwide generation of LD slag waste is about 47 MT per annum [3] and in India, the total generation rate of LD slag waste is (150-180) kg/t of crude steel [4] whereas, in SAIL, the generation per annum is 1.28 MT [5]. Steel melting slag generation is about 4 to 4.5 MT per annum. The amount of LD slag produced in Indian integrated steel plants is about 200 kg/t of hot metal. Out of this 70-100 per cent is being reused in other countries whereas only 25 per cent is being reused in India [6]. It has been observed that for the road project, for sintering and iron-making recycling in steel making plants, 50 per cent of slag has been used.

The generation of LD slag increases due to the rapid growth of industrialisation, the land available for disposal of large quantities of LD slag at a landfill site is deteriorating and disposal cost is increasing. Nowadays, the vital environmental topics are the issues on both the global warming effect and natural resource-saving. The significant source of pollution of air, water, and soil are land filled with waste materials, and hence human health, the growth of plants and vegetation, etc are adversely affected. From the viewpoint of conservation and protection of the global environment, steel slag recycling has attracted the attention of many scientists in recent years. Therefore, improving the utilisation rate of steel LD slag is an imperative way for the steel enterprise to realise sustainable development.

This by-product LD slag generated by Tata Steel BSL at present generates about 1 million tonnes of slag per annum. Tata Steel exports 9,000 tonnes of LD slag to the Bangladesh market through Dhamra Port Company Odisha state in 2021. As part of the quest for a sustainable future in the Cement Industry, LD slag is facing innovations by creating value out of its by-products. In collaboration with its cement industry, for applications in slag cement PSC, clinker making, and GGBS (Ground Granulated Blast Furnace Slag), (0-6) mm size slag range has been developed by steel major. LD slag is being supplied by Tata Steel BSL (as part of its sustainable operations of by-products) to brick makers near the plant for hard surfacing national highway work, and low land area filling, besides to cement companies also.

Basics of steel production and types of steel slag

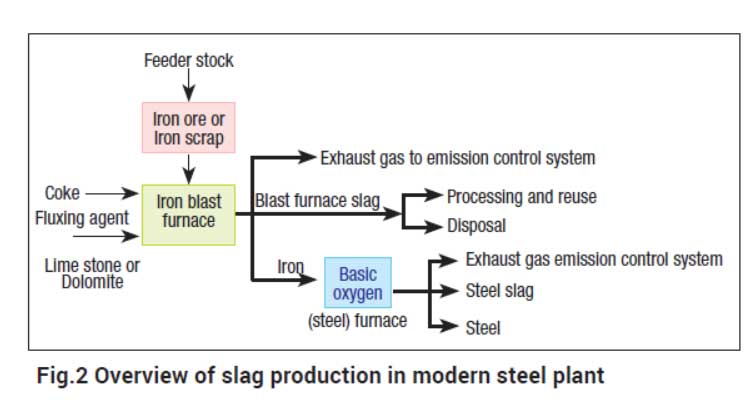

Electric arc furnaces (EAF) or in basic oxygen processes for steel production are being used in all steel integrated. Molten metal and dolomitic lime (CaO.MgO) or fluxes lime (CaO) is placed in the furnace in the basic oxygen and EAF processes. In the furnace, high-pressure oxygen is injected with a lance. Several oxidised compounds are formed when oxygen reacts with carbon and non-iron impurities. Slag is formed when these compounds react with the lime or dolomitic lime. The slag remains while liquid steel is poured from the furnace which is then poured into a separate vessel. In the steel-making process, different types of slag produced are furnace or tap slag, synthetic or ladle slags, raker slag. Fig. 1 shows the production of different slag in the general flow in a modern steel plant. The nonmetallic products from the furnace, raker and ladle slags are used for different applications including as construction aggregate, in agriculture, or reclamation of acidic lands following processing and metal recovery [7].

Fig 2 shows the flow process during steel production operation and generation of by-product slag. BOFS is produced in the steelmaking process by using the molten iron coming from the BF. The slag contains various heavy metal carriers such as chrome, lead, or zinc that produce various types of slag.

The macrograph about structural morphology is shown in Fig.3. Particles of various sizes are agglomerated.

Physical, chemical and mineralogical characteristics of LD steel slag

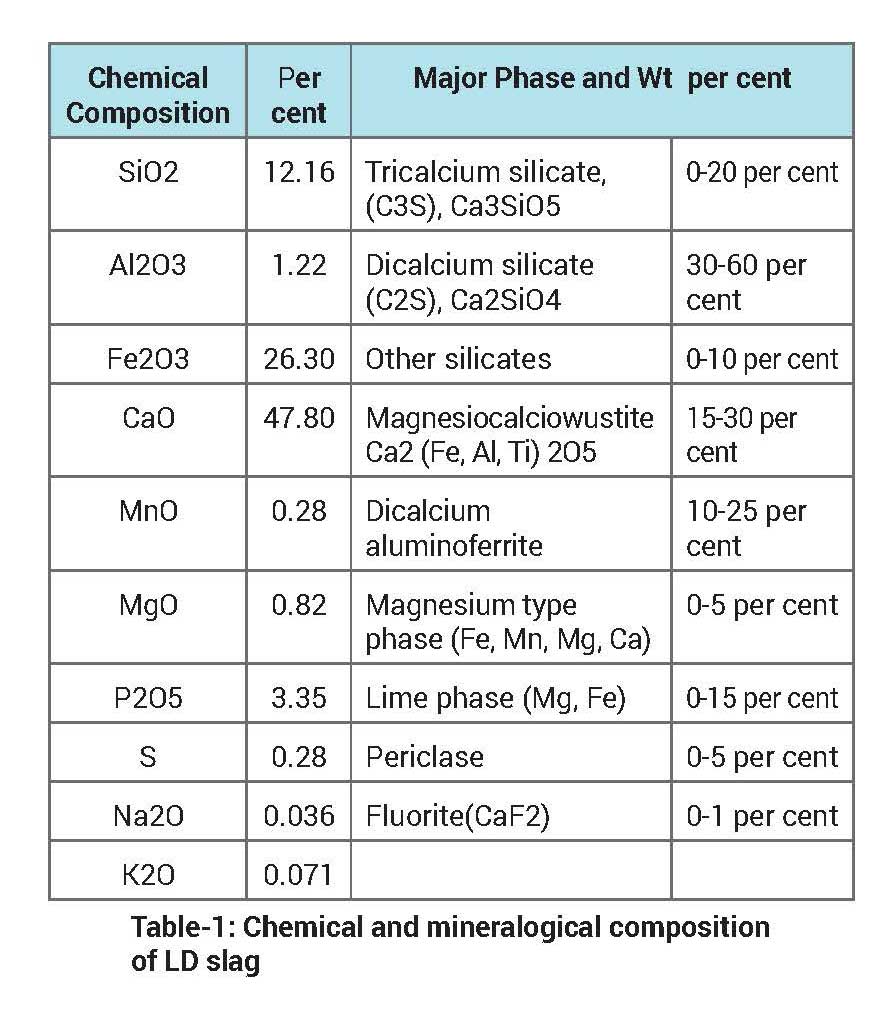

It was found that the LD slag density lies between 3.3-3.6g/cm.3 Due to high Fe content in slag, steel slag looks like a loose collection in appearance, and appears hard and wear resistant. The grindability index of steel slag is 0.7, in comparison with the value of 0.96 and 1.0 for blast furnace slag and standard sand respectively. SiO2, CaO, Fe2O3, FeO, Al2O3, MgO, MnO, P2O5 are major constituents of LD slag . The main mineral phases in steel slag are dicalcium silicate (C2S), tricalcium silicate (C3S), RO phase (CaO-FeO-MnO-MgO solid solution), tetra-calcium aluminoferrite (C4AF), olivine, merwinite and free-CaO [8]. The reuse and recycle of the steel slag is closely related to the slag’s chemical and physical characteristics. For chemical and mineralogical characteristics of LD slag, many studies were done. ICP-AES and C-H-N-S analyser were used for chemical characterisation of LD slags. CaO, Fe, SiO2 and Mn are the main desirable substances [9].

Table 1 summarises the major phases and chemical composition of steel slag generated at integrated steel plant in India [10].

Application of LD slag in cement industry and brick production

(a) Cement clinker using LD lag

The transformation of pig iron into liquid steel generates a significant quantity of LD slag in the steel-making process. The possibility of adding LD slag in the raw meal for the production of Portland clinker replacing iron ore. 0.6 mass per cent iron ore and 1.0, 2.0, and 3 mass per cent of iron ore being replaced by LD slag. The various components of LD slag were prepared in the different raw mixes in the laboratory and fired in a high-temperature muffle furnace at 1400°C, all raw mix samples were sintered. The ethylene glycol method is used to determine free lime to assess the comparative burnability of the raw mix samples. X-ray and X-ray fluorescence were employed to determine the chemical and mineralogical composition of the clinkers which showed that the mineralogical composition of the clinker was not altered on the addition of LD slag in the raw mix. The fluxing agent was the iron present in the LD slag and it replaced the iron ore requirement. Improvement in burnability and development of clinker mineral phases was shown by reduction in free lime and increase in C3S phase value with LD slag as shown in Fig 4. Under the optical microscope, homogeneously distributed and well-developed alite and belite phases were observed. A plant trial with 2 mass per cent LD slag as a raw mix component replacing iron ore was conducted, but no adverse impact in the pyro-processing system was observed, and operation of the kiln was found to be smooth and stable during the trial [11].

(b) Cement replacement with LD slag

A study on partial replacement of cement with LD slag was done and its impact on the mechanical, microstructural, and durability properties of concrete were studied. Grindability is of major importance in the manufacture of slag blended cement. In terms of grindability, the incorporation of LD slag with particle size below 5mm can benefit the grinding of OPC clinker. Other particle size materials should be used for other applications in road bases etc. The addition of LD slag, at content levels of up to 20 per cent of total solid material, is suggested as optimum for the stability, economy, and strength of the blended cements as shown in Fig 5. Steel slag contains a similar mineral composition to that of OPC clinker; the slag may become unstable due to excess free lime (f-CaO). GBFS possesses hydraulic properties that can only be activated in the presence of an existing basic or sulfate activator such as CaO or CaS. This excess CaO steel slag could constitute

this activator.

(c) LD slag in brick production

LD steel slag is used in commercial brick manufacturing as shown in Fig.6. The characterisation results of LD slag showed that the pH and electrical conductivity of the samples were very high indicating high percentage of lime presence and presence of ionic form of various salts, respectively. The specific gravity and bulk density of LD slag samples were found to be high in comparison to fly ash samples. The major elemental compositions of LD slag samples are shown by weight Ca and oxygen. The CaO, FeO and SiO2 are the major components in the LD slag. The compressive strength was found to be more than 100 kg/cm2 for brick samples type A as shown in Fig 6 (Fly ash – 35 per cent + LD slag – 30 per cent + Gypsum – 5 per cent + Quarry dust – 20 per cent + Lime – 9.75 per cent + CaCl2 – 0.25 per cent) after 14 days of curing which is greater than 50-70 kg/cm2, i.e., strength of normal red clay bricks and maybe it is a feasible replacement for commercial purposes in civil jobs.

Summary

The steel industry is nowadays focused to increase the way for recycling slags generated during steel production. The pressure for saving energy and natural resources has led the steel industry to improve and increase the recycling of steel slag since its use as landfill material has almost reached its limit. Steel slag in most cases, the valorisation, and use of these by-products prevent landfill, reduce energy consumption, reduce CO2 emissions and help preserve natural resources. To neutralise soil acidity in agricultural soils for many years, LD slag has been successfully used as a substitute for limestone, and slag use is comparable to or superior to limestone in some cases. In addition to its limiting benefits, slag contains Si which has been shown to increase yields of crops, like rice and sugarcane, and Si is also helpful in defending crops against crop diseases. Slag also contains plant nutrients that can enhance plant growth. Considerable cost advantages are offered by steel slag over commercial limestone. In recent years, significant volatility in the cost of agricultural limestone is attributable in part to energy costs of production. To cover the rising costs of fertiliser, limestone use has been deferred by Cultivators, even at the risk of lower yields. The application of LD slag as a cementitious component instead of aggregate in concrete would boost its reuse and will reduce the cost of construction and production of greenhouse gases significantly. The main constraint with the usability of LD slag is the high amount of free MgO and free CaO content, which leads to volumetric changes. At the same time, owing to calcined materials present in LD slag, its potential to be used as a partial substitution of OPC Granulated slag is used for the manufacture of hydraulic cement by mixing Portland cement clinker, gypsum, and granulated slag in suitable proportions and grinding the mixture to get a thorough and intimate mix between the constituents. There is IS code for GBFS, i.e., IS 12089:1987 but for LD slag utilisation in the construction industry for infrastructure development is in the interfacial stage, more research work is required for innovative solutions for its utilisation.

Acknowledgment

The authors are thankful to DPIIT, Ministry of Commerce and Industry (MoC&I), Government of India for supporting R&D funding to NCCBM in the favour of a circular economy.

References

- Alexandre, J., and Boudonnet, J.Y., Les laitiers d’aciérie LD et leurs utilisations routières. Laitier sidérurgiques., 75: 57–62 (1993).

- Shen, D. H., Wu, C. M., and Du, J. C., Laboratory investigation of basic oxygen furnace slag for substitution of aggregate in porous asphalt mixture. Constr Build Mater., 23: 453–61 (2009).

- Takano, Cyro et al., Recycling of Solid Waste From Integrated Steel Plant: A Sustainable Alternative. Materials Transactions., 42: 2560-2570 (2001).

- Yadav, U. S., Das, B. K., Kumar, A., and Sandhu, H. S., Solid waste recycling through sinter status at Tata Steel. In: Proceeding of Environment and Waste Management, NML, Jamshedpur, India, pp: 81-94 (2002).

- Basu, P., Alternative ironmaking technologies: an environmental impact analysis. In: Proceeding of Environment and Waste Management, NML, Jamshedpur, India, pp: 194-202 (2002).

- Umadevi, T., Rao, S. P., Roy, Pankaj., Mohapatra, P.C., Prabhu, M., and Ranjan, M., Influence of LD slag on iron ore sinter properties and productivity. In: 6th international seminar on mineral processing technology, NML, Jamshedpur, pp: 747-757 (2010).

- www.nationalslag.org

- Kourounis, S., Tsivilis, S., Tsakiridis, P.E. Papadimitriou, G. D., and Tsibouki, Z., Properties and hydration of blended cements with steelmaking slag. Cement Concrete Res., 37: 815-822 (2007).

- Waligora, J., Bulteel, D., Degrugilliers, P., Damidot, D., Potdevin, J. L., and Measson, M., Chemical and mineralogical characterisations of LD converter steel slag: A multi-analytical techniques approach. Mater Charact., 61: 39-48 (2010)

- Chand, S., Paul, B., & Kumar, M. (2015). An overview of use of Linz-Donawitz (LD) steel slag in agriculture. Current World Environment, 10(3), 975.

- Singh, A. K., Kukreti, N. C., Chandraker, V., Baury, M., Biswas, T., & Patil, K. D. (2015). Utilization of LD Slag for the production of Portland cement clinker. Cement International, 3, 70-76.

You may like

Concrete

ICRA Sees Steady Cement Demand Growth Ahead

Volumes seen rising 6–7 per cent in FY27 on infra push

Published

3 days agoon

January 2, 2026By

admin

India’s cement industry is expected to record steady growth over the coming years, with cement volumes projected to expand by 6–7 per cent in FY27, supported by sustained demand from the housing and infrastructure sectors, according to a report by rating agency ICRA.

The agency said the sector is likely to maintain healthy momentum after registering growth of 6.5–7.5 per cent in FY26, despite a higher base in the second half of FY25. Cement demand remained strong in the current financial year, with volumes increasing by 8.5 per cent during the first eight months of FY26, driven by robust construction activity across regions.

ICRA expects demand to strengthen further in the second half of FY26 as construction activity accelerates after the monsoon. Continued government focus on infrastructure spending and the possibility of a reduction in goods and services tax on cement are also expected to support demand through FY26 and FY27.

Against this favourable demand backdrop, cement manufacturers are continuing to expand capacity through both organic and inorganic routes to strengthen their market positions. The industry is estimated to add 85–90 million tonnes per annum of capacity during FY26–FY27, including around 43–45 million tonnes per annum in FY26 and a further 42–44 million tonnes per annum in FY27.

Commenting on the outlook, Anupama Reddy, Vice President and Co-Group Head, Corporate Ratings at ICRA, said sector profitability is expected to improve significantly in FY26, supported by better pricing and higher volumes. Operating profit before interest, depreciation, tax and amortisation per tonne is projected to rise to around Rs 900–950 per tonne in FY26, compared with Rs 810 per tonne in FY25.

However, ICRA expects some moderation in earnings in FY27 due to rising input costs. Operating profit per tonne is estimated at Rs 880–930 in FY27, as costs related to pet coke and freight are likely to increase and remain influenced by global crude oil prices and geopolitical developments.

On a regional basis, North and Central India are expected to report capacity utilisation levels above the national average, while the southern region may continue to see relatively moderate utilisation due to existing capacity overhang. ICRA noted that recent merger and acquisition activity in the southern market has helped large players strengthen their regional and pan-India presence.

Overall capacity utilisation for the cement industry is projected to remain stable at around 70–71 per cent in FY27, broadly in line with FY26 levels, albeit on an expanded capacity base.

Concrete

GCCA India–NCB Carbon Uptake Report Released at NCB Foundation Day

New report highlights CO? absorption by concrete in Indian conditions

Published

1 week agoon

December 29, 2025By

admin

The Global Cement and Concrete Association (GCCA) India–NCB Carbon Uptake Report was recently released during the 63rd Foundation Day celebrations of the National Council for Cement and Building Materials (NCB). On the occasion, a Gypsum Board Testing Laboratory and a Micro-Characterisation Laboratory were also inaugurated, strengthening India’s research and quality infrastructure for construction materials.

The laboratories were inaugurated by Urmila, Economic Advisor, Department for Promotion of Industry and Internal Trade (DPIIT), and Mohd. Kamal Ahmad, Special Director General, Central Public Works Department (CPWD), in the presence of L. P. Singh, Director General, NCB.

The newly established Gypsum Board Testing Laboratory will support quality assurance and standardisation requirements of the gypsum board industry, particularly in the context of the Gypsum-Based Building Materials (Quality Control) Order, 2024. The Micro-Characterisation Laboratory is equipped with advanced analytical tools for detailed investigation of cementitious and construction materials.

Addressing the gathering, Ms Urmila highlighted NCB’s sustained contributions to research, technology development, quality assurance and capacity building for the cement sector. Shri Mohd. Kamal Ahmad also commended NCB’s role in promoting sustainable construction practices through focused research and development.

The GCCA India–NCB report titled Carbon Uptake by Concrete assesses CO? uptake through carbonation in concrete under Indian conditions. Prepared in collaboration with the Global Cement and Concrete Association (GCCA) India, the study is based on the Tier-I methodology of IVL Swedish Environment Research Institute. It notes that while the cement industry contributes around seven per cent of global anthropogenic emissions, carbon uptake by concrete can partially offset process-related emissions.

The report outlines future actions to improve data robustness, refine estimation methodologies and support integration of carbon uptake into national sustainability and climate reporting frameworks. It will be submitted to the Ministry of Environment, Forest and Climate Change for consideration of inclusion as a carbon sink in India’s National Communications to the UNFCCC.

Concrete

Shree Cement To Invest Rs 20 Billion In Maharashtra Plant

New 2 mtpa unit to strengthen capacity expansion plans

Published

2 weeks agoon

December 24, 2025By

admin

Shree Cement Ltd has announced an investment of Rs 20 billion to set up a new cement plant in Maharashtra, the country’s third-largest cement maker said on Friday at the World Hindu Economic Forum (WHEF) 2025. The letter of intent for the proposed investment was signed in the presence of Maharashtra Chief Minister Devendra Fadnavis in Mumbai. Shree Cement chairman Hari Mohan Bangur said the company will establish a 2 million tonnes per annum plant in Chandrapur district, where land has already been acquired. He added that the project is awaiting environmental clearance and, once approved, is expected to be completed within two years. The expansion will be funded through internal cash reserves, with the company reporting a cash balance of Rs 65.41 billion at the end of FY25.

Shree Cement currently has an installed capacity of 62.8 million tonnes per annum. During the second quarter of FY26, the company commissioned a 3.65 mtpa clinker unit at Jaitaran in Rajasthan, while a 3 mtpa cement mill at the same location is expected to start operations shortly. A 3 mtpa integrated plant at Kodla in Karnataka is in the final stages of development and is scheduled to be commissioned within the third quarter of FY26. Following these ongoing expansions, the company’s total capacity is expected to rise to 68.8 mtpa, according to an ICICI Direct Research note dated 29 October.

Analysts estimate that Shree Cement’s capacity could reach between 72 and 75 mtpa by FY27E, with further potential to scale up to 80 mtpa by FY28E or FY29E, depending on demand trends. However, market observers have flagged medium-term risks, noting that industry-wide capacity additions may outpace demand growth through FY28-29, particularly in northern and western India where significant new capacity is expected. At the same time, cement prices declined sharply in the third quarter, especially in eastern and southern regions, though analysts expect some recovery from January, led by the South and East.

The announcement comes amid aggressive expansion plans by larger peers. UltraTech Cement recently raised its capacity target from 167 mtpa to 240 mtpa by FY28, while the Adani Group increased its cement capacity target by nearly 10 per cent to 155 mtpa by the same period. Shree Cement reported a 15 per cent year-on-year rise in revenue to Rs 43.03 billion in the September quarter, driven by higher volumes, premiumisation efforts and a value-over-volume strategy. The company’s chief financial officer Ashok Bhandari has guided for capital expenditure of around Rs 30 billion in FY26-27, with a similar level expected in FY27-28. Shares of Shree Cement ended 0.18 per cent lower on Friday, while the benchmark Sensex closed 0.53 per cent higher.

ICRA Sees Steady Cement Demand Growth Ahead

India Imposes Three-Year Tariff on Select Steel Imports

GCCA India–NCB Carbon Uptake Report Released at NCB Foundation Day

Global Crude Steel Output Falls 4.6% to 140.1 Mt in Nov 2025

Shree Cement To Invest Rs 20 Billion In Maharashtra Plant

ICRA Sees Steady Cement Demand Growth Ahead

India Imposes Three-Year Tariff on Select Steel Imports

GCCA India–NCB Carbon Uptake Report Released at NCB Foundation Day

Global Crude Steel Output Falls 4.6% to 140.1 Mt in Nov 2025

Shree Cement To Invest Rs 20 Billion In Maharashtra Plant

Trending News

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoNMDC Steel Posts Record Output And Efficiency Gains In November

-

Concrete4 weeks ago

Concrete4 weeks agoNiraj Cement JV Wins Railway and Metro Contracts

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoLloyds Metals, Tata Steel Sign MoU For Strategic Partnership

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoEnlight Metals Enters Chemical Trading With New Subsidiary