Economy & Market

Cement Machinery – Eyeing on the green potential

Published

4 years agoon

By

admin

Increasing focus on savings in energy consumption, stringent emission and pollution control norms, thinning bottom lines on one hand, and thanks to the Perform-Achieve-Trade Scheme, launched by Bureau of Energy Eficeny (BEE), most of the cement majors been inspired to innovate for ways and means, not only to reduce the energy consumption and the carbon footprint, but also to better cost efficiency. This has resulted in plant optimisation where energy and fuel efficient equipment and components play a pivotal role. INDIAN CEMENT REVIEW trains its thoughts on the latest developments.

EVEN THOUGH THE economic slowdown has adversely impacted the off take of cement, and to an extent, has dented the confidence of the equipment vendors, the long term growth potential is really tremendous. The per capita consumption of cement in India tells no other tale. Indian per capita consumption of cement is much less compared to the world average. As per reports, compared to the world average of over 350 kg, the Indian per capita consumption of cement was around 150 kg in 2011. The corresponding figure is 660 kg per capita in China, 631 kg per capita in Japan and 447 kg per capita in France. This very fact has been one of the main reasons that brought in global players into the Indian shore.

The Indian cement industry is globally competitive with lowest energy consumption and CO2 emissions. As per inputs from Cement Manufacturers Association during 2009-10, the Indian cement industry grew at a robust rate of 12.7 per cent. With the government promoting construction activities across the country through various stimulus packages for building roads, bridges, houses, etc., the Indian cement industry added a capacity of 37 million tonne in 2009-10, which is the highest capacity ever added in any single year so far. The government’s focus on building infrastructure is likely to continue in the near future and the Indian cement industry is expected to sustain an even higher growth rate of 15 per cent over the coming years.

According to G Jayaraman, Associate Director, Price Waterhouse, Chennai, the Indian cement industry has been very proactive in adopting various technological advancements taking place all over the world. This was particularly triggered by the partial decontrol of cement industry in 1982 followed by full decontrol in 1989 giving the resultant free market competition an opportunity for growth in production and productivity. Jayaraman points out, "The share of energy inefficient wet process plants had slowly decreased from 94.4 per cent in 1960 to 61.6 per cent in 1980. Thereafter, as a result of quantum jump in production capacities through installation of modern dry process plants as well as conversion of some of the wet process plants, the share of wet process has reduced to less than 5 per cent today. During the last two decades (80’s and 90’s), major technological advancements took place in design of cement plant equipment/systems basically in the following major areas – a) pre-calcination b) high pressure grinding c) automation in process control d) high efficiency particle separation and e) clinker cooling.

Technology Roadmap

These innovation resulted in sea change developments globally and the Indian cement industry followed the international trend."

Recently, a low-carbon technology roadmap for the Indian cement industry has been launched in response to the sector’s need to cut its carbon footprint whilst meeting the growing demand for building materials in the country. It follows the launch of the global cement technology roadmap published in 2009. Enhancing energy efficiency and investing in newer technologies is one of the major objectives in the India-specific roadmap that aims to reduce the industry’s carbon emissions by 45 per cent by 2050. In an exclusive interview with Indian Cement Review, Philip Fonta, Managing Director, World Business Council for Sustainable Development says, "The Indian cement industry’s efforts to reduce its carbon footprint by adopting the best available technologies and environmental practices are reflected in the achievement of reducing total CO2 emissions to an industrial average of 0.719 tonne COf per tonne cement in 2010 from a substantially higher level of 1.12 tonne CO2 per tonne cement in 1996. The Indian roadmap outlines a low-carbon growth pathway for the Indian cement industry that could lead to carbon intensity reductions of 45 per cent by 2050. It proposes that these reductions could come from increased clinker substitution and alternative fuel use; further improvements to energy efficiency, and the development and widespread implementation of newer technologies."

Fonta further adds, "The vision laid out in the roadmap is ambitious but achievable. Wide stakeholder consultation took place throughout the process to bring in varied perspectives, and to reiterate that decisive action by all stakeholders is critical to realise the vision laid out in the roadmap. To achieve the proposed levels of efficiency improvements and emissions reduction, government and industry must join hands to take decisive and collaborative actions in creating an investment climate that will stimulate the scale-up of financing required."

"Energy efficiency index of Indian cement industries is better than the world average. This has been achieved by judicious selection of plant/equipments for greenfield projects/plant upgradation and adopting outstanding processes/practices. Installing latest equipments has resulted into incremental saving in terms of energy consumption, innovative efforts that lead towards quantum jump in terms of energy saving to be pursued," says Ratan K Shaw, Group Executive President & Chief Manufacturing Officer, UltraTech Cement Limited. He further adds, "Enhancement of blended cement share and fly ash/slag absorption will contribute not only towards energy reduction but will also help in reducing carbon footprint and thus paving the road to green solution."

According to him, the criteria for selection of equipment for new plants are as follows: input material properties viz. grindability, abrasiveness, moisture, presence of free silica, minor constituents, versatility in terms of grinding viz. OPC/PPC/Slag, output material properties-product fineness, PSD etc, investment and operating cost, scope for capacity enhancement and layout constraints in application of the technology. The operative norms desired are specific fuel and power consumption, environmental considerations, equipment reliability-easy to maintain equipment/proven performance.

The focus on energy efficiency for upcoming new plants as well as operating plants will contribute towards reduced energy demand and CO2 abatement, and he stresses on the selection of state-of-art energy efficient equipments /auxiliaries, latest automation systems/optimal systems/layout, integrated design with WHR power plants.

SN Subrahmanyan, Member of the Board and Sr. EVP, L&T Construction says, "The current focus is on savings in energy consumption and emission control methods, with stringent pollution control norms which are tightened day by day and the introduction of the PAT (Perform, Achieve and Trade) scheme. Cement manufacturers are expected to operate their plant in optimised conditions all the time. Power availability is also a key factor that affects cement plant operations. Clients are looking for equipment which reduces energy, fuel consumption, and effective utilisation of waste heat. Due to this trend, waste heat recovery systems and alternate fuel firing systems have become common requirements in cement plant tenders."

"Fuel efficient technologies have been adopted by majority of cement manufacturers," says Jayesh Somwanshi, Proprietor, Shreeyash Engineering. He adds, "A lot of affordable technology is now coming into the market. Also, there is a shift in focus of the manufacturers on the fuel efficient products which are really important for our industry."

Talking about the latest trends in technology, B Seenaiah, National President, Builder’s Association of India and Managing Director, BSCPL says, "The cement machinery manufacturers are obviously now focusing more on fuel efficient equipment. The manufacturers are now more keen on complying this latest emmission norm which helps save fuel and increases durability of the machinery." Explaining the same further, Martin Gierse, Managing Director, KHD Humboldt Wedag India Pvt Limited "We see that the trend is towards environmentally friendly and energy efficient products and services. As such, KHD has established themselves as one of the industry leaders in low NOx calcining technology, power efficient grinding technology and highly efficient pyro processing equipment requiring less heat and energy consumption, and thus avoids producing additional unnecessary CO2."

According to R Bhargava, Chief Climate & Sustainability Officer Shree Cement, periodic review of performance of various parameters of equipment with operating condition of plant at time of commissioning, year on year basis, checking of all parts of equipment at suppliers site, evaluation of energy efficiency for new equipment, determination of measuring points for evaluating the performance of plant are important factors while selecting plant and machinery with an approach towards energy reduction. Training on energy policy to vendors/contractors to design and construct energy efficient plant, efficient purchasing strategies, and incorporating specific energy consumption for every equipment in purchase order/contract etc, will also help moving towards the higher goal making an energy-efficient plant.

K Karunakara Rao, Dalmia Cement (Bharat) says, "The life cycle cost is a very important factor while selecting equipment. Deployment of higher capacity equipment bring added advantages of higher reliability, and easier supervision of operation apart from lowering overall cost per tonne, and will also reduce manpower. The higher capacity equipment also helps reduce the traffic on the haul roads, reduce the exposure of humans to the safety risk, and minimise the fugitive emissions. He also stressed the use of Vehicle Health Monitoring System (VHMS) that could help avoid unexpected machine downtime by a prognostic look at data changes over time, helps faster troubleshooting due to readily identified situations and causes. Another advantage is the in-advance arrangement for certified rebuilt parts for replacement, resulting in downtime reduction, which also helps achieve extended service life of the machine through proper operating method and maintenance work."

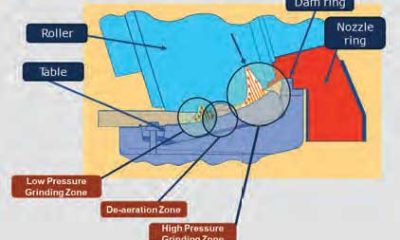

Highlighting the latest technologies in raw material grinding, Jayaraman says, "Selection of the type of grinding mill depends on the raw materials’ several physical characteristics, most important amongst them are hardness of the material and moisture content. Availability of the major grinding equipment in appropriate capacity decides complexity or otherwise of layout, auxiliary equipment sizing etc which ultimately decide the plant’s pyro-processing capacity. Vertical roller mills have been widely accepted for combined grinding and drying of moist raw materials in view of their excellent drying capacity and low energy consumption.

Although the principle of the vertical roller mill did not change over the years, many improvements have been made in design of the mill and other equipments in the grinding circuit resulting in less energy consumption and improved reliability. Introduction of external re-circulation of material, adjustable louvre ring and modification of mill body to improve the air and material trajectories are examples of such design changes." He further adds, "Apart from the main equipment viz. mill, classifier and fan, the efforts have been on improving the performance of internals e.g. table liners in case of vertical roller mills and classifying liners in case of ball mills. Use of mechanical conveying systems like bucket elevators are becoming more common in place of pneumatic conveying giving substantial savings in energy."

Market Trends

Gierse says, "The current situation is governed by the low utilisation of the cement production facilities on the one side and low speed in decision making and granting of permits on the other. This has made cement producers focus on reduction of operational cost and increasing efficiency. Some are working on optimisation of their product offerings to serve more specific needs of their respective clients. Only the very strategic players planned to expand their production base, following the good rule that makes you win market shares during low seasons. However, cement consumption grew in 2012 by 8 per cent, which is more than the GDP growth and proves the importance of this core sector."

However, KHD is not planning to launch any new equipment in the market but the focus remains on the further optimisation of, as well the systems for pyro and grinding sections with cost and performance. Talking about the requirements of the clients, Gierse said, "We do believe that our clients’ business cases can best be supported by offering services in achieving the maximum performance for their manufacturing plant."

Commenting on the situation, Gaurav Khanna, Managing Director, Ashoka Group says, "Currently the industry is going through a bad phase since the infrastructure projects are not happening and there is no business. However, we expect the industry to improve in the year 2014 due to elections otherwise to be honest; I do not expect much right now. The year 2013 will be similar to the previous year."

Somwanshi says, "Right now, our industry is not in a satisfactory phase. The projects have not been happening since a long time. Due to which, we are on the receiving end. Though, the announcement made by the government for the construction of 3,000 km road project has brought a huge relief, you actually do not know if they are implementing the same in six months time." Feeling the heat of slowness in the markets, Shreeyash Engineering, does not plan to launch any new equipment currently.

But Seenaiah was on a positive refrain. "I do agree that the cement equipment manufacturers are facing a tough time but by the end of the year, the cement companies will expand their capacity by 25 per cent, especially in the southern parts of India." He further adds, "The construction sector is divided into two parts, one is the building construction and the other is infrastructure projects. The building construction is picking up, but the infrastructure part is stagnant. The year 2013 will be marginal as the government is still taking a stock of the situation and change needs time." Manish Kumar, Head of Plant and Machinery, Supreme Infra, also supports the view. According to him, the industry is gradually coming back to the earlier pace. "I would say that the industry is going well, since there are projects that have been coming up which has reflected in the sale of equipment. We have recently purchased equipments, despite the government not doing enough for the industry."

The China Factor

Contributing nearly 15 per cent globally, Chinese equipment players have taken a significant share of Indian demand. But for some, the only advantage of the China brand is low price. Despite, the users combating several issues like bad quality and after sales services, the Chinese equipment continues to make inroads into the Indian markets.

"There are few plants in India which are running on equipment supplied by Chinese suppliers but the lifecycle of such plants are questionable. Some investors only see the initial cost of the project rather than the performance and efficiency of the plant. This trend is threatening the Indian suppliers who offer quality products at a moderate price. Dumping from China has affected not only the Indian market but industries globally. Most of the customers who purchased Chinese equipment for their plants are facing issues in operation as well as in maintenance areas like frequent breakdowns of core equipment, increased plant downtime and increased equipment replacement cost. This trend can only be arrested if our government takes concrete steps to curb dumping from China," says Subrahmanyan.

Seenaiah says, "The quality of machinery is cheap but it is fine for them, since their costs are low and ours are high. But the quality of our machinery is also much better as compared to theirs. For us quality matters and a lot of players have changed their preferences and have now shifted to Indian equipment."

Geirse begs to differ. He says, "I would not call this a threat. As western suppliers, the Chinese suppliers are today players in the global competition. The western suppliers have in the meantime opened up equivalent sourcing strategies to cater the clients’ need for the most favourable balance between technology and cost. India itself offers good opportunities for such sourcing, which lead to the fact that Chinese plant equipment manufacturers have yet to establish a significant presence in the Indian cement industry." Explaining the situation further, he said, "For India as an import destination, equipment manufactured in China loses its competitive edge when pitched against equipment manufactured domestically.

Duties, inadequate transport/handling infrastructure and freight costs are, possibly, the principal deterrents. In addition, the Engineering, Procurement and Construction (EPC) mode of project execution, at which the Chinese are particularly proficient, is yet to establish itself in the Indian context."

According to Somwanshi, the Chinese equipment cannot be labeled as æcheap quality ones’. Admitting the fact that a few players in the market have been known for its cheap price and substandard quality, he says, "Some companies are really good and their range of products are as competitive as ours. Now, that the Chinese manufacturers know that the customer opts for quality and not price, the companies have now been quality conscious and are adhering to the quality standards." But he quickly adds, "In fact, I suggest that our government should make policies that protect our economy from the Chinese."

Priority List

Voicing their concern over some of the major challenges Khanna, says, "Commencement of the projects which have been pending since long is the one thing that we would like to have. The other would be the reduction in import duty. Since long we have been demanding all this, but even during the budget the government didn’t announce any good policies. So we are stuck where we are and we are not able to move ahead."

According to Seenaiah, the projects worth Rs 40, 000 crore have been pending for a while which need to be cleared quickly.

He says, "The banking policies need to be in place since the companies are now cash-strapped to invest in any of these projects." Says Gierse, "On the policy level, government needs to push investment in infrastructure projects, and with regard to equipment and plant and machinery industry, the government should bring in similar kind of sops given during the 2009 budget, i.e reduction in excise duty for capital equipment. Further, if some changes could be done for abolition of entry tax, and implementation of GST, and bringing in uniform tax structure would lead to positive growth sentiments. According to Kumar, one of the biggest challenges for the industry today is the price rise. He also pointed out that the pending projects are worth crore of rupees resulting in cost escalation. He further adds, "The import duty has also been very high and even the budget hasn’t spelt out any reduction in the same." Valued at US$ 360 billion, India’s construction market accounted for five per cent of the US$ 7.2 trillion global construction market in 2010, and is expected to replace Japan as the third largest, after China and the US, by 2020.

As per India’s 12th Five-Year Plan (2012-17) document, the two segments most important to construction activity are infrastructure and housing. Since, infrastructure spending is expected to go up to nine per cent of gross domestic product (GDP) or US$ 1 trillion for the Plan period (2012-17), this will translate into double-digit growth for the demand of cement.

You may like

-

Double Tap to Go Green

-

15th Cement EXPO to be held in March 2025 in Hyderabad

-

14th Cement EXPO

-

Vinita Singhania receives Lifetime Achievement Award at the 7th Indian Cement Review Awards

-

Increasing Use of Supplementary Cementitious Materials

-

Indian Cement Review Touts Decarbonisation Mantra & Awards Growth

SEEPEX introduces BN pumps with Smart Joint Access (SJA) to improve efficiency, reliability, and inspection speed in demanding rock blasting operations.

Designed for abrasive and chemical media, the solution supports precise dosing, reduced downtime, and enhanced operational safety.

SEEPEX has introduced BN pumps with Smart Joint Access (SJA), engineered for the reliable and precise transfer of abrasive, corrosive, and chemical media in mining and construction. Designed for rock blasting, the pump features a large inspection opening for quick joint checks, a compact footprint for mobile or skid-mounted installations, and flexible drive and material options for consistent performance and uptime.

“Operators can inspect joints quickly and rely on precise pumping of shear-sensitive and abrasive emulsions,” said Magalie Levray, Global Business Development Manager Mining at SEEPEX. “This is particularly critical in rock blasting, where every borehole counts for productivity.” Industry Context

Rock blasting is essential for extracting hard rock and shaping safe excavation profiles in mining and construction. Accurate and consistent loading of explosive emulsions ensures controlled fragmentation, protects personnel, and maximizes productivity. Even minor deviations in pumping can cause delays or reduce product quality. BN pumps with SJA support routine maintenance and pre-operation checks by allowing fast verification of joint integrity, enabling more efficient operations.

Always Inspection Ready

Smart Joint Access is designed for inspection-friendly operations. The large inspection opening in the suction housing provides direct access to both joints, enabling rapid pre-operation checks while maintaining high operational reliability. Technicians can assess joint condition quickly, supporting continuous, reliable operation.

Key Features

- Compact Footprint: Fits truck-mounted mobile units, skid-mounted systems, and factory installations.

- Flexible Drive Options: Compact hydraulic drive or electric drive configurations.

- Hydraulic Efficiency: Low-displacement design reduces oil requirements and supports low total cost of ownership.

- Equal Wall Stator Design: Ensures high-pressure performance in a compact footprint.

- Material Flexibility: Stainless steel or steel housings, chrome-plated rotors, and stators in NBR, EPDM, or FKM.

Operators benefit from shorter inspection cycles, reliable dosing, seamless integration, and fast delivery through framework agreements, helping to maintain uptime in critical rock blasting processes.

Applications – Optimized for Rock Blasting

BN pumps with SJA are designed for mining, tunneling, quarrying, civil works, dam construction, and other sectors requiring precise handling of abrasive or chemical media. They provide robust performance while enabling fast, reliable inspection and maintenance.With SJA, operators can quickly access both joints without disassembly, ensuring emulsions are transferred accurately and consistently. This reduces downtime, preserves product integrity, and supports uniform dosing across multiple bore holes.

With the Smart Joint Access inspection opening, operators can quickly access and assess the condition of both joints without disassembly, enabling immediate verification of pump readiness prior to blast hole loading. This allows operators to confirm that emulsions are transferred accurately and consistently, protecting personnel, minimizing product degradation, and maintaining uniform dosing across multiple bore holes.

The combination of equal wall stator design, compact integration, flexible drives, and progressive cavity pump technology ensures continuous, reliable operation even in space-limited, high-pressure environments.

From Inspection to Operation

A leading explosives provider implemented BN pumps with SJA in open pit and underground operations. By replacing legacy pumps, inspection cycles were significantly shortened, allowing crews to complete pre-operation checks and return mobile units to productive work faster. Direct joint access through SJA enabled immediate verification, consistent emulsion dosing, and reduced downtime caused by joint-related deviations.

“The inspection opening gives immediate confidence that each joint is secure before proceeding to bore holes,” said a site technician. “It allows us to act quickly, keeping blasting schedules on track.”

Framework agreements ensured rapid pump supply and minimal downtime, supporting multi-site operations across continents

Concrete

Digital process control is transforming grinding

Published

3 weeks agoon

February 20, 2026By

admin

Satish Maheshwari, Chief Manufacturing Officer, Shree Cement, delves into how digital intelligence is transforming cement grinding into a predictive, stable, and energy-efficient operation.

Grinding sits at the heart of cement manufacturing, accounting for the largest share of electrical energy consumption. In this interview, Satish Maheshwari, Chief Manufacturing Officer, Shree Cement, explains how advanced grinding technologies, data-driven optimisation and process intelligence are transforming mill performance, reducing power consumption and supporting the industry’s decarbonisation goals.

How has the grinding process evolved in Indian cement plants to meet rising efficiency and sustainability expectations?

Over the past decade, Indian cement plants have seen a clear evolution in grinding technology, moving from conventional open-circuit ball mills to high-efficiency closed-circuit systems, Roller Press–Ball Mill combinations and Vertical Roller Mills (VRMs). This shift has been supported by advances in separator design, improved wear-resistant materials, and the growing use of digital process automation. As a result, grinding units today operate as highly controlled manufacturing systems where real-time data, process intelligence and efficient separation work together to deliver stable and predictable performance.

From a sustainability perspective, these developments directly reduce specific power consumption, improve equipment reliability and lower the carbon footprint per tonne of cement produced.

How critical is grinding optimisation in reducing specific power consumption across ball mills and VRMs?

Grinding is the largest consumer of electrical energy in a cement plant, which makes optimisation one of the most effective levers for improving energy efficiency. In ball mill systems, optimisation through correct media selection, charge design, diaphragm configuration, ventilation management and separator tuning can typically deliver power savings of 5 per cent to 8 per cent. In VRMs, fine-tuning airflow balance, grinding pressure, nozzle ring settings, and circulating load can unlock energy reductions in the range of 8 per cent to 12 per cent. Across both systems, sustained operation under stable conditions is critical. Consistency in mill loading and operating parameters improves quality control, reduces wear, and enables long-term energy efficiency, making stability a key operational KPI.

What challenges arise in maintaining consistent cement quality when using alternative raw materials and blended compositions?

The increased use of alternative raw materials and supplementary cementitious materials (SCM) introduces variability in chemistry, moisture, hardness, and loss on ignition. This variability makes it more challenging to maintain consistent fineness, particle size distribution, throughput and downstream performance parameters such as setting time, strength development and workability.

As clinker substitution levels rise, grinding precision becomes increasingly important. Even small improvements in consistency enable higher SCM utilisation without compromising cement performance.

Addressing these challenges requires stronger feed homogenisation, real-time quality monitoring and dynamic adjustment of grinding parameters so that output quality remains stable despite changing input characteristics.

How is digital process control changing the way grinding performance is optimised?

Digital process control is transforming grinding from an operator-dependent activity into a predictive, model-driven operation. Technologies such as online particle size and residue analysers, AI-based optimisation platforms, digital twins for VRMs and Roller Press systems, and advanced process control solutions are redefining how performance is managed.

At the same time, workforce roles are evolving. Operators are increasingly focused on interpreting data trends through digital dashboards and responding proactively rather than relying on manual interventions. Together, these tools improve mill stability, enable faster response to disturbances, maintain consistent fineness, and reduce specific energy consumption while minimising manual effort.

How do you see grinding technologies supporting the industry’s low-clinker and decarbonisation goals?

Modern grinding technologies are central to the industry’s decarbonisation efforts. They enable higher incorporation of SCMs such as fly ash, slag, and limestone, improve particle fineness and reactivity, and reduce overall power consumption. Efficient grinding makes it possible to maintain consistent cement quality at lower clinker factors. Every improvement in energy intensity and particle engineering directly contributes to lower CO2 emissions.

As India moves toward low-carbon construction, precision grinding will remain a foundational capability for delivering sustainable, high-performance cement aligned with national and global climate objectives.

How much potential does grinding optimisation hold for immediate energy

and cost savings?

The potential for near-term savings is substantial. Without major capital investment, most plants can achieve 5 per cent to 15 per cent power reduction through measures such as improving separator efficiency, optimising ventilation, refining media grading, and fine-tuning operating parameters.

With continued capacity expansion across India, advanced optimisation tools will help ensure that productivity gains are not matched by proportional increases in energy demand. Given current power costs, this translates into direct and measurable financial benefits, making grinding optimisation one of the fastest-payback operational initiatives available to cement manufacturers today.

Concrete

Refractory demands in our kiln have changed

Published

3 weeks agoon

February 20, 2026By

admin

Radha Singh, Senior Manager (P&Q), Shree Digvijay Cement, points out why performance, predictability and life-cycle value now matter more than routine replacement in cement kilns.

As Indian cement plants push for higher throughput, increased alternative fuel usage and tighter shutdown cycles, refractory performance in kilns and pyro-processing systems is under growing pressure. In this interview, Radha Singh, Senior Manager (P&Q), Shree Digvijay Cement, shares how refractory demands have evolved on the ground and how smarter digital monitoring is improving kiln stability, uptime and clinker quality.

How have refractory demands changed in your kiln and pyro-processing line over the last five years?

Over the last five years, refractory demands in our kiln and pyro line have changed. Earlier, the focus was mostly on standard grades and routine shutdown-based replacement. But now, because of higher production loads, more alternative fuels and raw materials (AFR) usage and greater temperature variation, the expectation from refractory has increased.

In our own case, the current kiln refractory has already completed around 1.5 years, which itself shows how much more we now rely on materials that can handle thermal shock, alkali attack and coating fluctuations. We have moved towards more stable, high-performance linings so that we don’t have to enter the kiln frequently for repairs.

Overall, the shift has been from just ‘installation and run’ to selecting refractories that give longer life, better coating behaviour and more predictable performance under tougher operating conditions.

What are the biggest refractory challenges in the preheater, calciner and cooler zones?

• Preheater: Coating instability, chloride/sulphur cycles and brick erosion.

• Calciner: AFR firing, thermal shock and alkali infiltration.

• Cooler: Severe abrasion, red-river formation and mechanical stress on linings.

Overall, the biggest challenge is maintaining lining stability under highly variable operating conditions.

How do you evaluate and select refractory partners for long-term performance?

In real plant conditions, we don’t select a refractory partner just by looking at price. First, we see their past performance in similar kilns and whether their material has actually survived our operating conditions. We also check how strong their technical support is during shutdowns, because installation quality matters as much as the material itself.

Another key point is how quickly they respond during breakdowns or hot spots. A good partner should be available on short notice. We also look at their failure analysis capability, whether they can explain why a lining failed and suggest improvements.

On top of this, we review the life they delivered in the last few campaigns, their supply reliability and their willingness to offer plant-specific custom solutions instead of generic grades. Only a partner who supports us throughout the life cycle, which includes selection, installation, monitoring and post-failure analysis, fits our long-term requirement.

Can you share a recent example where better refractory selection improved uptime or clinker quality?

Recently, we upgraded to a high-abrasion basic brick at the kiln outlet. Earlier we had frequent chipping and coating loss. With the new lining, thermal stability improved and the coating became much more stable. As a result, our shutdown interval increased and clinker quality remained more consistent. It had a direct impact on our uptime.

How is increased AFR use affecting refractory behaviour?

Increased AFR use is definitely putting more stress on the refractory. The biggest issue we see daily is the rise in chlorine, alkalis and volatiles, which directly attack the lining, especially in the calciner and kiln inlet. AFR firing is also not as stable as conventional fuel, so we face frequent temperature fluctuations, which cause more thermal shock and small cracks in the lining.

Another real problem is coating instability. Some days the coating builds too fast, other days it suddenly drops, and both conditions impact refractory life. We also notice more dust circulation and buildup inside the calciner whenever the AFR mix changes, which again increases erosion.

Because of these practical issues, we have started relying more on alkali-resistant, low-porosity and better thermal shock–resistant materials to handle the additional stress coming from AFR.

What role does digital monitoring or thermal profiling play in your refractory strategy?

Digital tools like kiln shell scanners, IR imaging and thermal profiling help us detect weakening areas much earlier. This reduces unplanned shutdowns, helps identify hotspots accurately and allows us to replace only the critical sections. Overall, our maintenance has shifted from reactive to predictive, improving lining life significantly.

How do you balance cost, durability and installation speed during refractory shutdowns?

We focus on three points:

• Material quality that suits our thermal profile and chemistry.

• Installation speed, in fast turnarounds, we prefer monolithic.

• Life-cycle cost—the cheapest material is not the most economical. We look at durability, future downtime and total cost of ownership.

This balance ensures reliable performance without unnecessary expenditure.

What refractory or pyro-processing innovations could transform Indian cement operations?

Some promising developments include:

• High-performance, low-porosity and nano-bonded refractories

• Precast modular linings to drastically reduce shutdown time

• AI-driven kiln thermal analytics

• Advanced coating management solutions

• More AFR-compatible refractory mixes

These innovations can significantly improve kiln stability, efficiency and maintenance planning across the industry.

UltraTech Appoints Jayant Dua As MD-Designate For 2027

Merlin Prime Spaces Acquires 13,185 Sq M Land Parcel In Pune

Adani Cement and Naredco Partner to Promote Sustainable Construction

Operational Excellence Redefined!

World Cement Association Annual Conference 2026 in Bangkok

UltraTech Appoints Jayant Dua As MD-Designate For 2027

Merlin Prime Spaces Acquires 13,185 Sq M Land Parcel In Pune

Adani Cement and Naredco Partner to Promote Sustainable Construction

Operational Excellence Redefined!