Product development

Multi-fuel kilns come of age

Published

7 years agoon

By

admin

Fluctuations in prices of various fuels and regulatory pressures are making manufacturers to choose machines that can be adapted to various fuels based on cost and other advantages.

Coal has the special distinction of being at the same time the fuel and a raw material for production of clinker, the cement intermediate. As much as 25 per cent of the manufacturing cost of cement could be coal. Coal is also used as fuel for power plants by the captive power producers in the cement industry.

Petcoke is a key raw material for producing clinker (primary raw material for manufacturing cement). Clinker production accounts for a majority of fuel consumption in cement industry. Petcoke, which is also a feedstock, has a larger overall share and coal as a key fuel for power plants accounts for the remaining fuel consumption. "Both coal and petcoke together account for an average 85-90 per cent of the total fuel requirement of the cement industry," says Ashish K Nainan of CARE Ratings. As such, fluctuation in the prices of these fuels has the potential to affect the cost and profitability of cement companies.

Renewable energy, power from waste and other non-conventional power sources account for almost 10 per cent of the fuel and power requirement of the industry. Coal plays dual role because, in the cement kiln, when pulverised coal is fired through the burners, it provides energy needed for the chemical calcinations reactions, and then the combustion residue of coal with all its silica, iron oxides, and other compounds, add to the cementatious properties of the end-product. To this, if we were to add that most cement plants in India run coal-fired captive power plants for much of their power needs, the role of coal in cement industry gets further enlarged.

Precautions

The fuel mix depends on the kilns technological acceptability towards a particular fuel source – either a coal based kiln or a multi fuel kiln. Most of the cement manufacturers are taking several factors into consideration in order to take advantage of price fluctuations of various fuels they can use in their kilns. That is where adoption of multi fuel technologies coming in handy.

"Nowadays most of the cement manufacturers have a multi fuel facility, cement manufacturers benefit from having a multi fuel kiln for the simple reason they have a flexibility to switch between different fuel sources depending on the cost (INR/Kcal) dynamics. For example from 1HFY17 to 1HFY18, the delta between pet coke prices and coal prices were as high as 30-40 paise, thus it made sense to use pet coke, however this narrowed out from 1HFY18 to 5-10 paise, and in some cases coal were cheaper source thus making coal more lucrative," says Shochis Natrajan, Analyst (Corporate Ratings), India Ratings and Research (Fitch Group).

Besides, the manufacturers have to take precautions towards ensuring regulatory compliance relating to environmental protection, while adopting a particular fuel.

On environmental consideration, regulatory or judicial interventions could be very disruptive, like petcoke ban implemented in the past which had a major impact on large number of players in the sector. "Fuels like coal and petcoke have this major drawback wherein restrictions especially judicial interventions pose a major challenge for the sector. The industry has to work towards finding alternatives or substitute some of these fuels used for manufacturing as well as improve the overall efficiency in usage and minimize wastage," says Nainan.

"The other key challenge is prices of commodity and currency movements. Cement is more of a commodity and thus, passing on costs, especially in competitive market conditions is quite difficult," Nainan adds citing how prices of crude and coal globally have impacted the margins of the industry in FY19 (2018-19). Additionally, it is the availability of these fuels as in case of domestic coal and their transportation costs or availability of rakes too impacts its users.

The petcoke dilemma

The major environmental concern of the traditional fuels like coal and pet coke is the high carbon emission during the manufacturing process. The sector contributes considerably towards carbon emission among manufacturing industries (approximately 3-4 per cent globally). Since emissions are highly regulated, there are enough measures and safeguards already implemented by cement manufacturers in the industry, but there is always scope to improve by following the highest global standards like in some European nations.

Petcoke is preferred due to its high carbon content, with higher calorific value (over approximately 7,500 Kcal/kg), which makes it a much more economical fuel for the cement manufacturers and they also blend it with coal to improve energy production.

However, the major downside is sulphur content in low quality petcoke (approximately 8-25 per cent), which is highly-polluting and also causes formation of a layer of sulphur, which leads to higher maintenance/downtime of cement plants.

Over the last few years, consumption of pet coke has spiked in India, driven particularly by the cement industry, and also by some of the power generating stations, and imports have sharply increased as well. Many cement factories have been spending considerable amount of time and money to learn how to use more and more pet coke in their kilns without destabilising their chemical processes.

In the wake of its adverse impact on environment, the focus of regulators on high-sulphur petcoke increased, resulting in the state of Delhi and the National Green Tribunal banning use of furnace oil and pet coke in states neighbouring the capital region, a couple of years’ back. After hectic lobbying, there was a relaxation for cement kilns, given its capacity to burn pet coke in an environment-friendly manner.

But the relaxation came with a suggestion to nudge the government to discourage pet coke use, including considering a ban on its imports, which were equal to the then domestic production of 12 million tonnes. The import ban has resulted in domestic supplier jacking up prices.

"Considering the coal and pet coke price inflation, renewable and waste heat energy is preferred over traditional thermal captive power plant or grid purchase. Amongst renewable and waste heat, it depends on the waste heat generated by the cement plant if waste heat generation is higher then waste heat recovery system is preferred else renewable," says Natrajan.

The way forward

Coal India reached extremely close to its production target of 610 million tonne (MT) for 2018-19 and posting a 7 per cent growth in production to 606.9 MT of coal. Thus, it posted a three-fold growth in production compared to 2017-18 output growth of 2.4 per cent. The Ministry of Coal has set a production target of 655 MT for Coal India for the current fiscal.

Singareni Collieries Company’s (SCCL) production stood at 57.94 MT in the 11 months to February 2019 against the target of 65 MT for 2018-2019. The coal production of captive mines during the 11 months period was 44.41 MT compared to a target of 40 MT for the fiscal, achieving a growth rate of 31.6 per cent year-on-year. Commissioning of three crucial railway tracks – Jharsuguda-Sardega railway line, Tori-Shivpur line in Jharkhand and Connector in Chhattisgarh – the East Corridor and East-West Corridor – this year will increase the CIL’

India’s coal imports are still high at 233.56 million tonnes in 2018-19, up nearly 9 per cent, according to a mjunction report. Despite having reserves that are equal to 43 years of current consumption as part of the natural endowments, India still remains import dependent for this crucial fuel, mainly due to slow growth in production in available mines. With coal import trend expected to continue as power, cement and steel industries are expected to create more demand for coal, the government has to evolve strategies to improve energy security by tapping domestic coal reserves. CIL earmarks 10 per cent of its production for e-auction and though e-auction has proved to be a mutually beneficial option for both CIL and the end users initially, e-auction prices rose about 53 per cent in the December quarter of FY19, when the company offered only half the quantity it did a year ago, after diverting supplies to power plants. That kind of ad-hoc paring of supplies have to be avoided as they are expected to hurt the industry in general and cement manufacturers in particular, as they are not part of the priority sector for coal supplies.

– BS SRINIVASALU REDDY

You may like

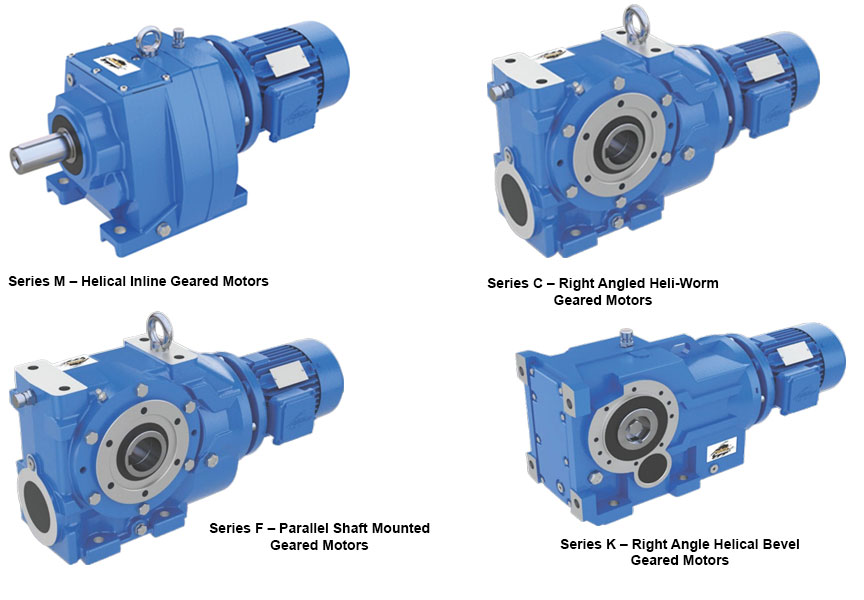

A deep dive into Core Gear Series of products M, C, F and K, by Power Build, and how they represent precision in motion.

At the heart of every high-performance industrial system lies the need for robust, reliable, and efficient power transmission. Power Build answers this need with its flagship geared motor series: M, C, F and K. Each series is meticulously engineered to serve specific operational demands while maintaining the universal promise of durability, efficiency, and performance.

Series M – Helical Inline Geared Motors

Compact and powerful, the Series M delivers exceptional drive solutions for a broad range of applications. With power handling up to 160kW and torque capacity reaching 20,000 Nm, it is the trusted solution for industries requiring quiet operation, high efficiency, and space-saving design. Series M is available with multiple mounting and motor options, making it a versatile choice for manufacturers and OEMs globally.

Series C – Right Angled Heli-Worm Geared Motors

Combining the benefits of helical and worm gearing, the Series C is designed for right-angled power transmission. With gear ratios of up to 16,000:1 and torque capacities of up to 10,000 Nm, this series is optimal for applications demanding precision in compact spaces. Industries looking for a smooth, low-noise operation with maximum torque efficiency rely on Series C for dependable performance.

Series F – Parallel Shaft Mounted Geared Motors

Built for endurance in the most demanding environments, Series F is widely adopted in steel plants, hoists, cranes and heavy-duty conveyors. Offering torque up to 10,000 Nm and high gear ratios up to 20,000:1, this product features an integral torque arm and diverse output configurations to meet industry-specific challenges head-on.

Series K – Right Angle Helical Bevel Geared Motors

For industries seeking high efficiency and torque-heavy performance, Series K is the answer. This right-angled geared motor series delivers torque up to 50,000 Nm, making it a preferred choice in core infrastructure sectors such as cement, power, mining and material handling. Its flexibility in mounting and broad motor options offer engineers the freedom in design and reliability in execution.

Together, these four series reflect Power Build’s commitment to excellence in mechanical power transmission. From compact inline designs to robust right-angle drives, each geared motor is a result of decades of engineering innovation, customer-focused design and field-tested reliability. Whether the requirement is speed control, torque multiplication or space efficiency, Radicon’s Series M, C, F and K stand as trusted powerhouses for global industries.

http://www.powerbuild.in

Call: +919727719344

Economy & Market

Conveyor belts are a vital link in the supply chain

Published

8 months agoon

June 16, 2025By

admin

Kamlesh Jain, Managing Director, Elastocon, discusses how the brand delivers high-performance, customised conveyor belt solutions for demanding industries like cement, mining, and logistics, while embracing innovation, automation, and sustainability.

In today’s rapidly evolving industrial landscape, efficient material handling isn’t just a necessity—it’s a competitive advantage. As industries such as mining, cement, steel and logistics push for higher productivity, automation, and sustainability, the humble conveyor belt has taken on a mission-critical role. In this exclusive interview, Kamlesh Jain, Managing Director, Elastocon, discusses how the company is innovating for tougher terrains, smarter systems and a greener tomorrow.

Brief us about your company – in terms of its offerings, manufacturing facilities, and the key end-user industries it serves.

Elastocon, a flagship brand of the Royal Group, is a trusted name in the conveyor belt manufacturing industry. Under the brand name ELASTOCON, the company produces both open-end and endless belts, offering tailor-made solutions to some of the most demanding sectors such as cement, steel, power, mining, fertiliser, and logistics. Every belt is meticulously engineered—from fabric selection to material composition—to ensure optimal performance in tough working conditions. With advanced manufacturing facilities and strict quality protocols, Elastocon continues to deliver high-performance conveyor solutions designed for durability, safety, and efficiency.

How is the group addressing the needs for efficient material handling?

Efficient material handling is the backbone of any industrial operation. At Elastocon, our engineering philosophy revolves around creating belts that deliver consistent performance, long operational life, and minimal maintenance. We focus on key performance parameters such as tensile strength, abrasion resistance, tear strength, and low elongation at working tension. Our belts are designed to offer superior bonding between plies and covers, which directly impacts their life and reliability. We also support clients

with maintenance manuals and technical advice, helping them improve their system’s productivity and reduce downtime.

How critical are conveyor belts in ensuring seamless material handling?

Conveyor belts are a vital link in the supply chain across industries. In sectors like mining, cement, steel, and logistics, they facilitate the efficient movement of materials and help maintain uninterrupted production flows. At Elastocon, we recognise the crucial role of belts in minimising breakdowns and increasing plant uptime. Our belts are built to endure abrasive, high-temperature, or high-load environments. We also advocate proper system maintenance, including correct belt storage, jointing, roller alignment, and idler checks, to ensure smooth and centered belt movement, reducing operational interruptions.

What are the key market and demand drivers for the conveyor belt industry?

The growth of the conveyor belt industry is closely tied to infrastructure development, increased automation, and the push for higher operational efficiency. As industries strive to reduce labor dependency and improve productivity, there is a growing demand for advanced material handling systems. Customers today seek not just reliability, but also cost-effectiveness and technical superiority in the belts they choose. Enhanced product aesthetics and innovation in design are also becoming significant differentiators. These trends are pushing manufacturers to evolve continuously, and Elastocon is leading the way with customer-centric product development.

How does Elastocon address the diverse and evolving requirements of these sectors?

Our strength lies in offering a broad and technically advanced product portfolio that serves various industries. For general-purpose applications, our M24 and DINX/W grade belts offer excellent abrasion resistance, especially for RMHS and cement plants. For high-temperature operations, we provide HR and SHR T2 grade belts, as well as our flagship PYROCON and PYROKING belts, which can withstand extreme heat—up to 250°C continuous and even 400°C peak—thanks to advanced EPM polymers.

We also cater to sectors with specialised needs. For fire-prone environments like underground mining, we offer fire-resistant belts certified to IS 1891 Part V, ISO 340, and MSHA standards. Our OR-grade belts are designed for oil and chemical resistance, making them ideal for fertiliser and chemical industries. In high-moisture applications like food and agriculture, our MR-grade belts ensure optimal performance. This diverse range enables us to meet customer-specific challenges with precision and efficiency.

What core advantages does Elastocon offer that differentiate it from competitors?

Elastocon stands out due to its deep commitment to quality, innovation, and customer satisfaction. Every belt is customised to the client’s requirements, supported by a strong R&D foundation that keeps us aligned with global standards and trends. Our customer support doesn’t end at product delivery—we provide ongoing technical assistance and after-sales service that help clients maximise the value of their investments. Moreover, our focus on compliance and certifications ensures our belts meet stringent national and international safety and performance standards, giving customers added confidence.

How is Elastocon gearing up to meet its customers’ evolving needs?

We are conscious of the shift towards greener and smarter manufacturing practices. Elastocon is embracing sustainability by incorporating eco-friendly materials and energy-efficient manufacturing techniques. In parallel, we are developing belts that seamlessly integrate with automated systems and smart industrial platforms. Our vision is to make our products not just high-performing but also future-ready—aligned with global sustainability goals and compatible with emerging technologies in industrial automation and predictive maintenance.

What trends do you foresee shaping the future of the conveyor belt industry?

The conveyor belt industry is undergoing a significant transformation. As Industry 4.0 principles gain traction, we expect to see widespread adoption of smart belts equipped with sensors for real-time monitoring, diagnostics, and predictive maintenance. The demand for recyclable materials and sustainable designs will continue to grow. Furthermore, industry-specific customisation will increasingly replace standardisation, and belts will be expected to do more than just transport material—they will be integrated into intelligent production systems. Elastocon is already investing in these future-focused areas to stay ahead of the curve.

Advertising or branding is never about driving sales. It’s about creating brand awareness and recall. It’s about conveying the core values of your brand to your consumers. In this context, why is branding important for cement companies? As far as the customers are concerned cement is simply cement. It is precisely for this reason that branding, marketing and advertising of cement becomes crucial. Since the customer is unable to differentiate between the shades of grey, the onus of creating this awareness is carried by the brands. That explains the heavy marketing budgets, celebrity-centric commercials, emotion-invoking taglines and campaigns enunciating the many benefits of their offerings.

Marketing strategies of cement companies have undergone gradual transformation owing to the change in consumer behaviour. While TV commercials are high on humour and emotions to establish a fast connect with the customer, social media campaigns are focussed more on capturing the consumer’s attention in an over-crowded virtual world. Branding for cement companies has become a holistic growth strategy with quantifiable results. This has made brands opt for a mix package of traditional and new-age tools, such as social media. However, the hero of every marketing communication is the message, which encapsulates the unique selling points of the product. That after all is crux of the matter here.

While cement companies are effectively using marketing tools to reach out to the consumers, they need to strengthen the four Cs of the branding process – Consumer, Cost, Communication and Convenience. Putting up the right message, at the right time and at the right place for the right kind of customer demographic is of utmost importance in the long run. It is precisely for this reason that regional players are likely to have an upper hand as they rely on local language and cultural references to drive home the point. But modern marketing and branding domain is exponentially growing and it would be an interesting exercise to tabulate and analyse its impact on branding for cement.

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence

FORNNAX Appoints Dieter Jerschl as Sales Partner for Central Europe

Our strategy is to establish reliable local partnerships

Power Build’s Core Gear Series

Compliance and growth go hand in h and

Turning Downtime into Actionable Intelligence