Process

Limestone scenario in India

Published

4 years agoon

By

admin

The basic raw material for cement manufacturing is limestone. Indian limestone, which is used in cement manufacturing, and Indian coal, which is used for burning, makes the job of cement producers difficult, says Madhav Damle.

The Indian cement industry occupies a pride of place in the cement universe. The annual cement manufacturing capacity is now close to 500 million tonne per annum (MTPA) and thus has the distinction of being the second biggest producer in the world. Broadly speaking, cement is termed as a binder, a substance used for construction that sets, hardens and adheres to other materials. Cement mixed with fine aggregate produces mortar for masonry, or with sand and gravel, produces concrete. Cement is the most widely used material in existence and is only behind water as the planet’s most-consumed resource.

Any cement raw material investigator needs to keep a few important points in mind starting from the fact that this industry is very capital intensive, large gestations time, varied raw materials in large quantities are handled in the plant involving different processes such as mining, crushing, grinding, pyro-processing and finished grinding, to name a few. Perhaps, because of these reasons, there is always a need to build inventory at every stage of processing to ensure uninterrupted operations. Cement manufacturing process could itself be divided into clinkering and grinding processes, where clinker becomes an intermediate product involving calcination of limestone.

Limestone is used in clinkering process by finely grinding it into powder along with admixture of either/or clay, sand, bauxite, iron, etc. is calcined (heated up) at a very high temperature approximately 140 degree Celsius resulting into limestone (CaCO3) dissociated into CaO and CO2. Lime (CaO) then chemically reacts with available silica (SiO2), alumina (Al2O3) and iron (Fe2O3) to form silicates, aluminates and ferrites of lime.

From the point of economy of size, currently, clinkering units of 6,000 tonnes per day (TPD) to 10,000 (TPD) capacity are preferred that on an annualised basis works out to nearly 2 to 3.5 (MTPA) of clinker entailing huge capital cost in the range of Rs 1,500 to Rs 3,500 crore. Such large upfront capital investment calls for assured life of more than 30 years of plant for any investor to get economically viable returns. When such large quantity of limestone is processed day in and day out, the tolerance/fluctuations in terms of quality and quantity needs to be minimised for a very smooth and therefore economical operation of the clinkering unit.

As a rule of thumb, in order to produce a tonne of clinker about 1.6 tonnes of limestone is processed, i.e., around 3.5 to 5.5 MTPA of limestone is required and assuming a minimum plant life of 30 years each modern clinkering unit would need an assured limestone deposit of more than 100 to 150 MT. Such large quantity of limestone handling on an annual basis necessitates that the cement plants (at least the clinkering unit) should preferably be located in proximity to the cement grade limestone deposit.

This is perhaps the main reason as to why in India cement plants occur in clusters. A cursory glance of map of India with cement plant locations would show clusters like, for example: Kadapah in Andhra Pradesh/Telangana; Ariyalur in Tamil Nadu; Wadi and Gulbarga in Karnataka; Damoh, Katni, Satna and Rewa in Madhya Pradesh; Raipur and Bilaspur in Chattisgarh; Bhavnagar, Amreli and Junagadh in Gujarat, so on a so forth.

Further compared to other parts of world, the Indian limestone deposits are considered to be of inferior grade meaning marginal or sub-marginal in quality and therefore need additional processing step/s to enrich lime content alternately it may call for adding high grade limestone to enhance overall lime content before it is ground and fired in the kiln. The problem of low grade in limestone gets further compounded by the fact that the Indian coal, which is used as a source of heat, is also poor grade meaning low in heat value and high in ash.

Limestone classification generally adopted in the Indian cement industry is two folds: one based on its origin such as igneous (Carbonetite), metamorphic (Marble) and sedimentary and other being based on its geological age. Like Achaean (>2,500 million years), i.e., those limestone deposits that were formed much before any life form existed, Proterozoic (between 2,500 and 600 MY) Palaeozoic (600 to 250 MY), Mesozoic (250 to 65 MY) and Cenozoic (65 to Present).

In India, occurrences of igneous type limestone deposits are very rare and none of the cement plant is exclusively relying on this type of limestone.

The metamorphic limestone deposits, generally in India, are of Archaean Age and are located in Coimbatore, Salem and Madurai regions of Tamil Nadu, Dharwar region of Karnataka and Aravalli region of Rajasthan. Such occurrences exhibit complex type of limestone deposits meaning non-uniformity in terms of shape and size, intricately mixed with waste material and inconsistency in quality. Because of these complexities, such deposits are relatively lower grade and thus invariably calls for additional processing ‘ be it selective mining, screening either before or after crushing, magnetic separation, adding higher/better quality stone that is generally termed as "Sweetener" to in some rare cases going all the way to froth floatation.

From the above, it may be obvious that such deposits are not preferred because of high mining/manufacturing cost, but still we do find some cement plants in India derive their limestone deposit because of its proximity to the consumption centres. So from this description it is evident that the selection of plant site is not solely dependent on limestone deposit but it is a complex interplay of many other criteria chief among them being "total logistical cost" of input materials as well as finished product.

One would not be wrong in making a statement that the backbone of the Indian cement industry is Proterozoic limestone deposits starting from dense cluster around Cuddapah and Kornool region, Bhima basin in Gulbarga, Katni, Satna and Damoh regions of Vindhya Range, etc. are considered to be the ideal source of limestone. They are sedimentary type; therefore predictable in shape and size, fine grained therefore easy to burn/react in chemical process, large to very large size that could support modern mega cement plants and are near or about uniform cement grade limestone.

These features make such limestone deposits as mainstay of the Indian cement industry. The paleozoic age sedimentary rock formations in India are known for extensive coal deposits in Bihar, Bengal, Chhattisgarh, Odisha and Maharashtra; unfortunately however barring a few small limestone deposits no major limestone deposits are found in Indian Peninsular region. Though economically insignificant, a few limestone deposits are reported in the Himalayan region.

Similar is the situation in Mesozoic Period except sedimentary limestone deposits occur in Tiruchirappalli, Tamil Nadu. The limestone deposits are though patchy but its aerial extent is large and hence many large cement plants are situated in Tiruchirappalli, Perambular and Cuddalore districts of Southeastern Tamil Nadu. These limestone deposits are banded and inter-bedded with marl and other clayey formations. Limestone deposits of this region exhibits better quality in terms of CaO content however at times it gets contaminated with marl and thus brings down the overall quality of limestone.

In addition of above limestone deposits, extensive limestone deposits in Himachal Pradesh and Uttarakhand are said to be of Mesozoic age indicating that their age is doubtful. As mentioned above, these limestone deposits are large, mostly occur in hilly areas, sedimentary type. From the quality perspective, they are invariably high in CaO content at times, however some minor oxides are at elevated levels. These limestone deposits support almost all major cement plants in Himachal Pradesh and a plant in Uttarakhand (CCI Poanta Sahib).

One of the youngest formations belonging to Cenozoic Period, in India is found along the periphery of continental margins. Extensive limestone occurrences in Kachchh district of Gujarat is one such example. This deposit currently supports many recently constructed large cement plants. The limestone deposits of this region is considered to be high grade as far as CaO content is concerned however, minor oxides especially SO3, Na2O and K2O are high and therefore in some cases alkali and/or sulphur bypass arrangement is required.

Another extensive occurrence of limestone of this period is in Northeastern State of Meghalaya and in that also the large limestone deposits in Jaintia district are notable. Such large deposits have tremendous potential of supporting large cement plant and in fact a few are already in operations. These limestone deposits are high to very high in CaO content with a little less problem of minor oxides as compared to Kachchh District.

Finally, the limestone deposits that occur along and almost parallel to the Saurashtra coast and support many cement plants belongs to almost recent age, i.e., these deposits were formed at about two million years back. These limestone deposits are very soft that could be cut even with an axe and because of this reason many houses in Saurashtra region cut and dress into brick like blocks and used as a primary building material. Like above, quality of limestone is very good and easy to mine. However being close to sea coast, certain restrictions are imposed due to environmental considerations.

Summarising above discussion, it could be said that in-spite of many challenges, raw material situation is reasonably good to support not only current cement capacity in India, but also are confident that future expansions are well supported till the middle of this century.

ABOUT THE AUTHOR:

MG Damle did his post graduation from the Department of Geology, University of Rajasthan and joined ACC as a Junior Geologist. After nearly four decades of active service with the company, he retired as Director ‘ Raw Materials and Mine Planning. He was associated with many exploration campaigns ‘ for ACC and other external clients. He has led to establishing many modern cement plants in India. In addition, he was also associated with iron ore, chromite, talc, and other mineral explorations in India and abroad.

Process

Price hikes, drop in input costs help cement industry to post positive margins: Care Ratings

Published

2 years agoon

October 21, 2021By

admin

Region-wise,the southern region comprises 35% of the total cement capacity, followed by thenorthern, eastern, western and central region comprising 20%, 18%, 14% and 13%of the capacity, respectively.

The cement industry is expected to post positive margins on decent price hikes over the months, falling raw material prices and marked drop in overall production costs, said an analysis of Care Ratings.

Wholesale and retail prices of cement have increased 11.9% and 12.4%, respectively, in the current financial year. As whole prices have remained elevated in most of the markets in the months of FY20, against the corresponding period of the previous year.

Similarly, electricity and fuel cost have declined 11.9% during 9M FY20 due to drop in crude oil prices. Logistics costs, the biggest cost for cement industry, has also dropped 7.7% (selling and distribution) as the Railways extended the benefit of exemption from busy season surcharge. Moreover, the cost of raw materials, too, declined 5.1% given the price of limestone had fallen 11.3% in the same aforementioned period, the analysis said.

According to Care Ratings, though the overall sales revenue has increased only 1.3%, against 16% growth in the year-ago period, the overall expenditure has declined 3.2% which has benefited the industry largely given the moderation in sales.

Even though FY20 has been subdued in terms of production and demand, the fall in cost of production has still supported the cement industry by clocking in positive margins, the rating agency said.

Cement demand is closely linked to the overall economic growth, particularly the housing and infrastructure sector. The cement sector will be seeing a sharp growth in volumes mainly due to increasing demand from affordable housing and other government infrastructure projects like roads, metros, airports, irrigation.

The government’s newly introduced National Infrastructure Pipeline (NIP), with its target of becoming a $5-trillion economy by 2025, is a detailed road map focused on economic revival through infrastructure development.

The NIP covers a gamut of sectors; rural and urban infrastructure and entails investments of Rs.102 lakh crore to be undertaken by the central government, state governments and the private sector. Of the total projects of the NIP, 42% are under implementation while 19% are under development, 31% are at the conceptual stage and 8% are yet to be classified.

The sectors that will be of focus will be roads, railways, power (renewable and conventional), irrigation and urban infrastructure. These sectors together account for 79% of the proposed investments in six years to 2025. Given the government’s thrust on infrastructure creation, it is likely to benefit the cement industry going forward.

Similarly, the Pradhan Mantri Awaas Yojana, aimed at providing affordable housing, will be a strong driver to lift cement demand. Prices have started correcting Q4 FY20 onwards due to revival in demand of the commodity, the agency said in its analysis.

Industry’s sales revenue has grown at a CAGR of 7.3% during FY15-19 but has grown only 1.3% in the current financial year. Tepid demand throughout the country in the first half of the year has led to the contraction of sales revenue. Fall in the total expenditure of cement firms had aided in improving the operating profit and net profit margins of the industry (OPM was 15.2 during 9M FY19 and NPM was 3.1 during 9M FY19). Interest coverage ratio, too, has improved on an overall basis (ICR was 3.3 during 9M FY19).

According to Cement Manufacturers Association, India accounts for over 8% of the overall global installed capacity. Region-wise, the southern region comprises 35% of the total cement capacity, followed by the northern, eastern, western and central region comprising 20%, 18%, 14% and 13% of the capacity, respectively.

Installed capacity of domestic cement makers has increased at a CAGR of 4.9% during FY16-20. Manufacturers have been able to maintain a capacity utilisation rate above 65% in the past quinquennium. In the current financial year due to the prolonged rains in many parts of the country, the capacity utilisation rate has fallen from 70% during FY19 to 66% currently (YTD).

Source:moneycontrol.com

Process

Wonder Cement shows journey of cement with new campaign

Published

2 years agoon

October 21, 2021By

admin

The campaign also marks Wonder Cement being the first ever cement brand to enter the world of IGTV…

ETBrandEquity

Cement manufacturing company Wonder Cement, has announced the launch of a digital campaign ‘Har Raah Mein Wonder Hai’. The campaign has been designed specifically to run on platforms such as Instagram, Facebook and YouTube.

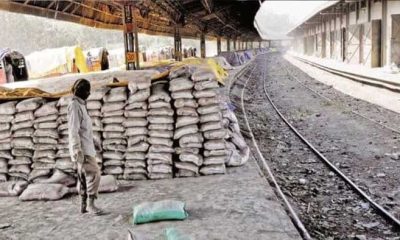

#HarRaahMeinWonderHai is a one-minute video, designed and conceptualised by its digital media partner Triature Digital Marketing and Technologies Pvt Ltd. The entire journey of the cement brand from leaving the factory, going through various weather conditions and witnessing the beauty of nature and wonders through the way until it reaches the destination i.e., to the consumer is very intriguing and the brand has tried to showcase the same with the film.

Sanjay Joshi, executive director, Wonder Cement, said, "Cement as a product poses a unique marketing challenge. Most consumers will build their homes once and therefore buy cement once in a lifetime. It is critical for a cement company to connect with their consumers emotionally. As a part of our communication strategy, it is our endeavor to reach out to a large audience of this country through digital. Wonder Cement always a pioneer in digital, with the launch of our IGTV campaign #HarRahMeinWonderHai, is the first brand in the cement category to venture into this space. Through this campaign, we have captured the emotional journey of a cement bag through its own perspective and depicted what it takes to lay the foundation of one’s dreams and turn them into reality."

The story begins with a family performing the bhoomi poojan of their new plot. It is the place where they are investing their life-long earnings; and planning to build a dream house for the family and children. The family believes in the tradition of having a ‘perfect shuruaat’ (perfect beginning) for their future dream house. The video later highlights the process of construction and in sequence it is emphasising the value of ‘Perfect Shuruaat’ through the eyes of a cement bag.

Tarun Singh Chauhan, management advisor and brand consultant, Wonder Cement, said, "Our objective with this campaign was to show that the cement produced at the Wonder Cement plant speaks for itself, its quality, trust and most of all perfection. The only way this was possible was to take the perspective of a cement bag and showing its journey of perfection from beginning till the end."

According to the company, the campaign also marks Wonder Cement being the first ever cement brand to enter the world of IGTV. No other brand in this category has created content specific to the platform.

Process

In spite of company’s optimism, demand weakness in cement is seen in the 4% y-o-y drop in sales volume. (Reuters)

Published

2 years agoon

October 21, 2021By

admin

Cost cuts and better realizations save? the ?day ?for ?UltraTech Cement, Updated: 27 Jan 2020, Vatsala Kamat from Live Mint

Lower cost of energy and logistics helped Ebitda per tonne rise by about 29% in Q3

Premiumization of acquired brands, synergistic?operations hold promise for future profit growth Topics

UltraTech Cement

India’s largest cement producer UltraTech Cement Ltd turned out a bittersweet show in the December quarter. A sharp drop in fuel costs and higher realizations helped drive profit growth. But the inherent demand weakness was evident in the sales volumes drop during the quarter.

Better realizations during the December quarter, in spite of the 4% year-on-year volume decline, minimized the pain. Net stand-alone revenue fell by 2.6% to ?9,981.8 crore.

But as pointed out earlier, lower costs on most fronts helped profitability. The chart alongside shows the sharp drop in energy costs led by lower petcoke prices, lower fuel consumption and higher use of green power. Logistics costs, too, fell due to lower railway freight charges and synergies from the acquired assets. These savings helped offset the increase in raw material costs.

The upshot: Q3 Ebitda (earnings before interest, tax, depreciation and amortization) of about ?990 per tonne was 29% higher from a year ago. The jump in profit on a per tonne basis was more or less along expected lines, given the increase in realizations. "Besides, the reduction in net debt by about ?2,000 crore is a key positive," said Binod Modi, analyst at Reliance Securities Ltd.

Graphic by Santosh Sharma/Mint

What also impressed analysts is the nimble-footed integration of the recently merged cement assets of Nathdwara and Century, which was a concern on the Street.

Kunal Shah, analyst (institutional equities) at Yes Securities (India) Ltd, said: "The company has proved its ability of asset integration. Century’s cement assets were ramped up to 79% capacity utilization in December, even as they operated Nathdwara generating an Ebitda of ?1,500 per tonne."

Looks like the demand weakness mirrored in weak sales during the quarter was masked by the deft integration and synergies derived from these acquired assets. This drove UltraTech’s stock up by 2.6% to ?4,643 after the Q3 results were declared on Friday.

Brand transition from Century to UltraTech, which is 55% complete, is likely to touch 80% by September 2020. A report by Jefferies India Pvt. Ltd highlights that the Ebitda per tonne for premium brands is about ?5-10 higher per bag than the average (A cement bag weighs 50kg). Of course, with competition increasing in the arena, it remains to be seen how brand premiumization in the cement industry will pan out. UltraTech Cement scores well among peers here.

However, there are road bumps ahead for the cement sector and for UltraTech. Falling gross domestic product growth, fiscal slippages and lower budgetary allocation to infrastructure sector are making industry houses jittery on growth. Although UltraTech’s management is confident that cement demand is looking up, sustainability and pricing power remains a worry for the near term.

RAHSTA to showcase cutting-edge road construction tech, says NCC Director

RAHSTA will drive road construction innovation: Sundaresan

New appointment at TMEIC

Social Impact Award for Ambuja Cements

UCWL unveils new plant in Dabok, Udaipur

Environment Ministry revises rules of solid waste management

M-sand boards new terrain

Process and quality optimization in cement plant.

Concrete: A Highly Sustainable Building Material